Gold Price Outlook: XAU/USD

The price of gold seems to be coiling within the April range as it’s little changed from the start of the month, but the range bound price action may turn out to be temporary should bullion continue to track the positive slope in the 50-Day SMA ($3228).

Gold Price Coils as Trump Warns of China Violation

The price of gold holds above the moving average as it defends the rebound from the weekly low ($3246), and the ongoing transition in US trade policy may keep the precious metal afloat as US President Donald Trump warns that ‘China, perhaps not surprisingly to some, has totally violated its agreement with us.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, gold may attempt to retrace the decline from the May high ($3435) as it continues to offer an alternative to fiat currencies, but the range bound price action may persist should the precious metal close below 50-Day SMA ($3228) for the first time since January.

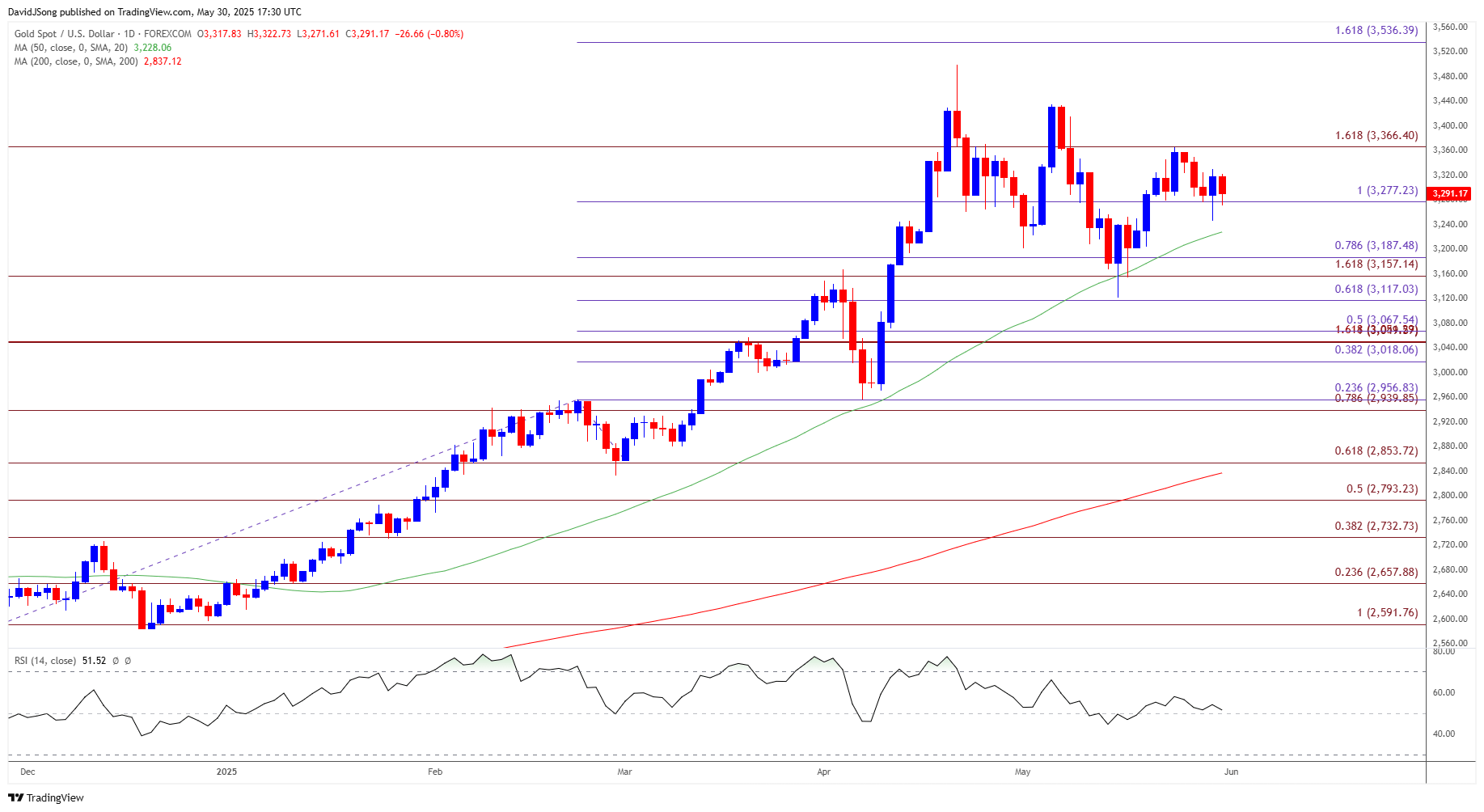

XAU/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; XAU/USD on TradingView

- The price of gold is little changed from the start of the month as it bounces back ahead of the 50-Day SMA ($3228), and bullion may continue to track the positive slope in the moving average amid the failed attempts to close below $3280 (100% Fibonacci extension).

- Need a break/close above $3370 (161.8% Fibonacci extension) to bring the monthly high ($3435) on the radar, with a breach above the April high ($3500) opening up $3540 (161.8% Fibonacci extension).

- At the same time, a close below $3280 (100% Fibonacci extension) may push the price of gold toward the $3160 (161.8% Fibonacci extension) to $3190 (78.6% Fibonacci extension) zone, with the next area of interest coming in around the $3120 (61.8% Fibonacci extension).

Additional Market Outlooks

EUR/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

Australian Dollar Forecast: AUD/USD Halts Bearish Price Series

Canadian Dollar Forecast: USD/CAD Snaps Rebound from May Low

GBP/USD Holds Below February 2022 High for Now

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong