Gold Talking Points:

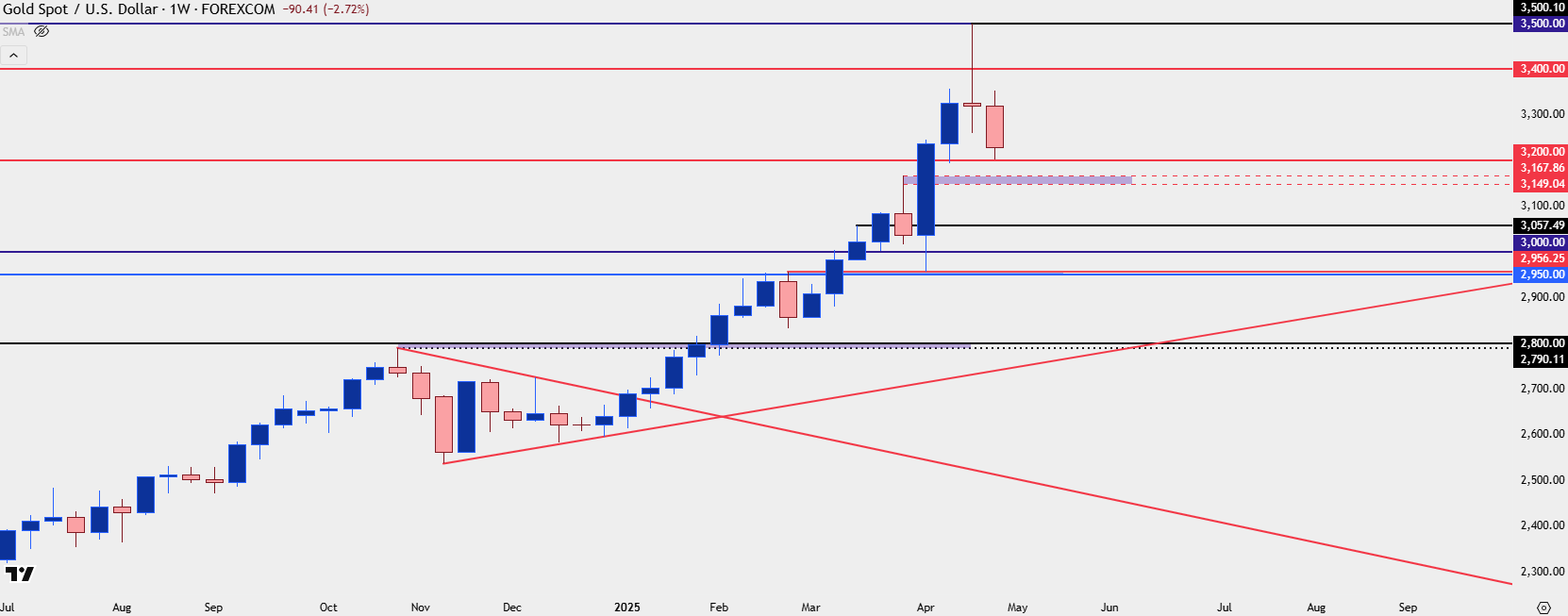

- After only two red weeks in the first 16 of 2025, bears have finally strung together two consecutive weeks of losses with price taking on an evening star pattern following the $3500 test.

- The FOMC rate decision looms large for next week but also of interest is the USD and the possibility of a near-term low being in-place. If we do see bulls continue to push in DXY that could further support the backdrop for a larger pullback in gold.

Gold is posting its second consecutive weekly loss for the first time in 2025 trade and this stands in stark contrast to the trend that developed around the start of the year. Gold prices had spent two months digesting in late-2024 trade but after buyers pushed the breakout, there was a strong directional move that held through the first four months of the year.

While the $3k level was a mere speedbump in March and April, so far, it’s been the $3500 level that’s drawn a line-in-the-sand. Bulls pushed that test the week before last but it didn’t hold for long, as profit taking took over shortly thereafter.

Bulls weren’t deterred, at least initially, as supports continued to hold even through early-trade last week. It was the continued sell-off on Thursday and Friday, after the May open, that started to open the door for deeper pullback potential. At this point, the weekly chart is showing an evening star pattern, often approached with aim of bearish reversal.

The pattern is a three-bar sequence, with a bullish candle followed by a show of indecision, often a doji, and that’s followed by a bearish candle that erases at least half of candle body one. With the $3500 level marking the high it becomes clear why, and how, such a formation comes to life.

Immediate support is at the $3200 level, which I’ll look at deeper below.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

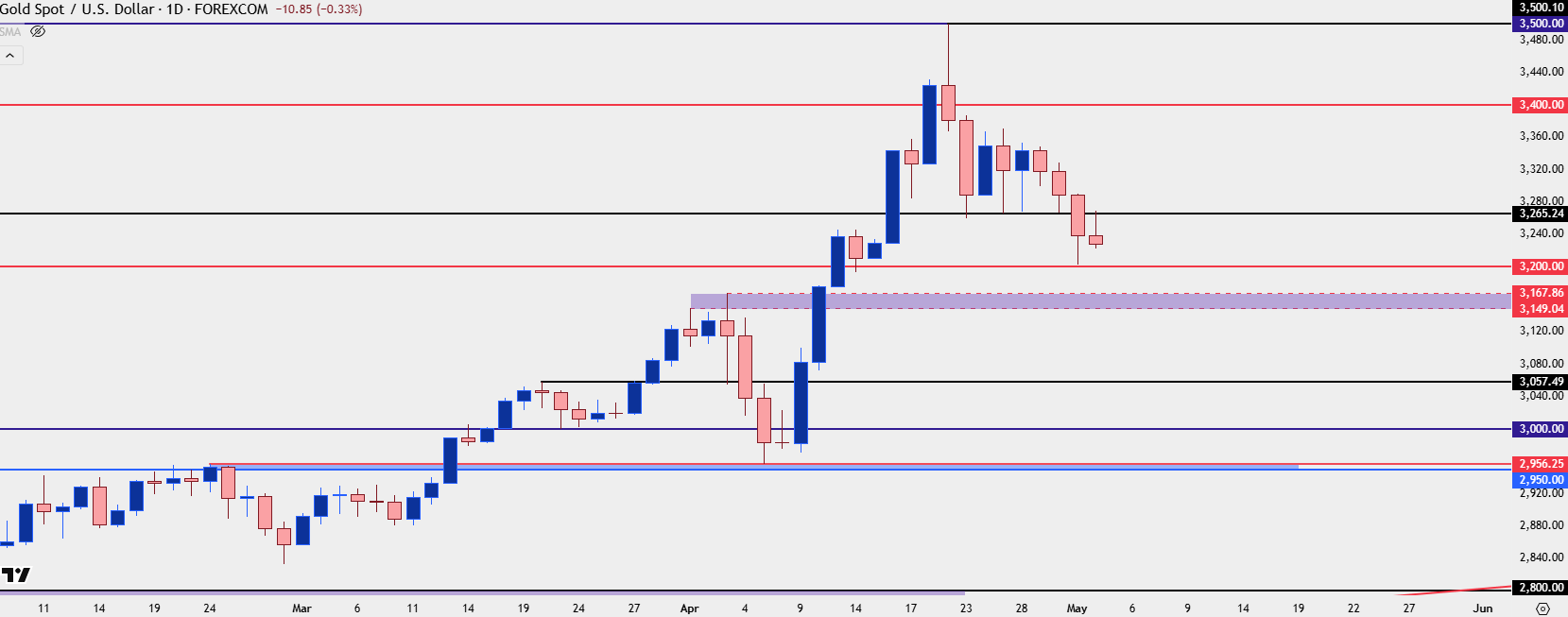

Gold Daily: Cash Crunch

It was the massive sell-off in USD that was driving so much interest behind the long side of gold. The tariff drama brought upon questions of ‘de-dollarization’ and it’s perhaps no coincidence that the high in gold at $3500 printed right around the time that DXY ran into a major level of long-term support.

The Dollar has since bounced and as of this writing appears to be trying to string together another higher-low to go along with the prior higher-high. This sets up for the FOMC rate decision on Wednesday and naturally that has some interest for gold.

From the daily chart of gold we can see a similar development in a short-term trend with Thursday and Friday’s lower-low to go along with the prior lower-high. So far, the $3200 level has been defended and that’s the next major level in the sand for gold. Below that, there’s a support zone as derived from prior resistance, around 3149-3167.

Gold Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

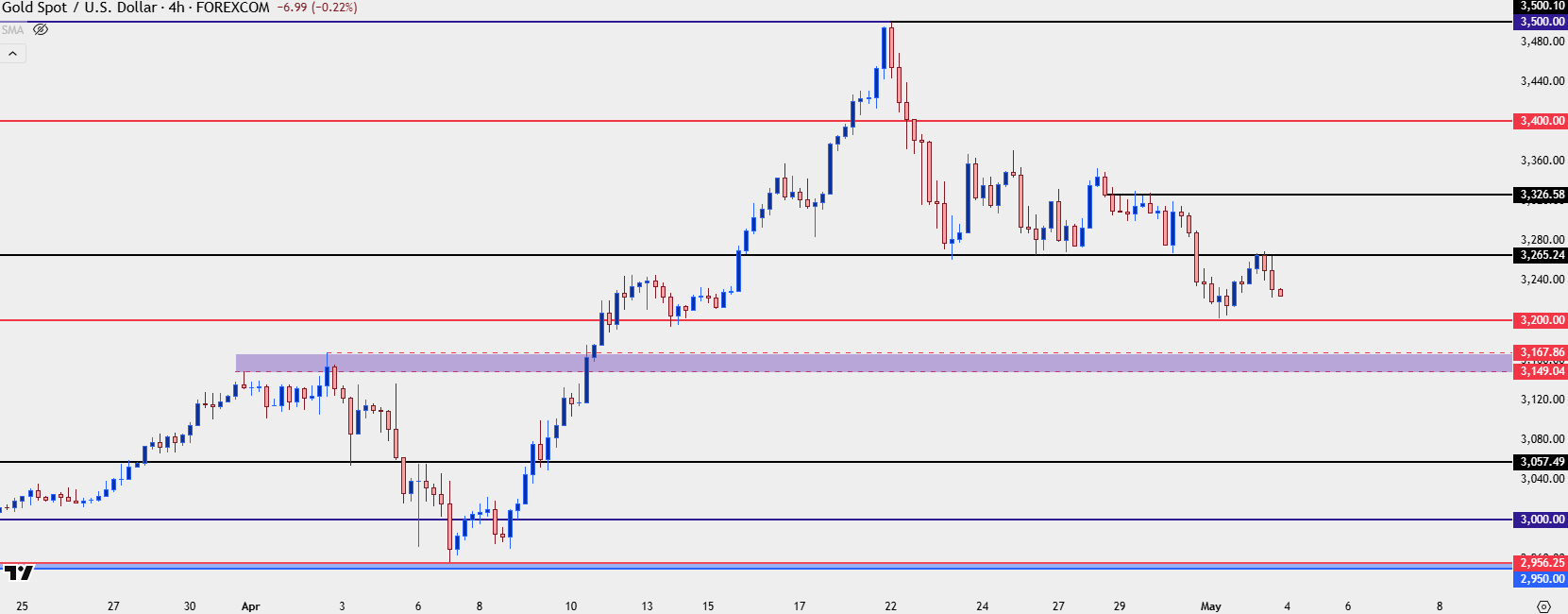

Gold: The Bearish Scenario

Given the early nature of this recent sell-off, I wanted to look at a bearish scenario in gold as what would likely be needed to bring it to fruition. USD strength would probably be a necessity, and this would likely need some element of hawkishness at the FOMC rate decision on Wednesday. This doesn’t sound all too outlandish, to me, especially given the Fed’s prior reticence to lean dovish in consideration of inflationary potential from tariffs.

For gold, the bigger question in my mind is whether we see bulls stage a defense from a deeper support level, perhaps the 3057 prior swing-high, or maybe even the $3k level which, technically, could still constitute a higher-lower above the early April swing low.

At this point from the four-hour chart, there’s now a sequence of lower-lows and lower-highs to work with and that provides some structure to work with for pullback scenarios into next week.

Gold Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold: The Bullish Scenario

This side is a little more difficult to entertain and I think that’s simply because it goes against the grain of the past couple of weeks. But we would probably also want to define what success for bulls would mean, as in are we talking about a break of the $3500 level or simply a green bar for next week? The former would equate to a failure of the evening star while the latter could remain in the context of that formation.

For a break of $3500 we’re likely going to need an extremely weak US Dollar and for that, I’d imagine that the Fed would need to sound very dovish at next week’s meeting. That’s something I have a difficult time expecting given how they’ve refrained from a dovish tilt given their fears of inflation over tariffs.

For a green weekly bar, we would simply need to see bulls put up a fight at support which seems a more reasonable prospect, but it would probably also need to be accompanied by some element of weakness in the USD.

At this stage, between the two scenarios above, the bearish backdrop in gold appears more attractive to me but I’d still hesitate from trying to get too bearish just yet, as the possibility of bulls putting up a push at support remains a key risk. Looking to or for lower-high resistance at 3265 or 3326 could remain attractive prospects, and if we do see prices slide below 3200, that becomes a spot for lower-high resistance, as well.

--- written by James Stanley, Senior Strategist