Gold Talking Points:

- Spot gold is currently up approximately 15% so far in Q1 with a little more than a week left to go.

- That would be the largest quarterly gain for gold since Q1 of 2016, and that move happened after a prolonged sell-off over the prior four-and-a-half years.

- The $3k level is in-play and while that price held the highs in the prior week, it’s so far held short-term support after a pullback on Friday. I dig deeper into the matter in this article and I discussed this topic in the video linked below.

Perhaps one of the more vexing phenomena for traders is when a massive trend is taking place, it’s difficult to imagine anything else happening other than that trend continuing. While may retail traders will fight moves initially, once a large trend is in-place, it can become difficult to avoid chasing it higher. I remember this well back in 2020, when gold first mounted above the $2k level. It felt almost blasphemous to be anything but bullish, but as the next three-and-a-half years showed, that first test over $2k in spot gold was around the optimal time to start looking for change.

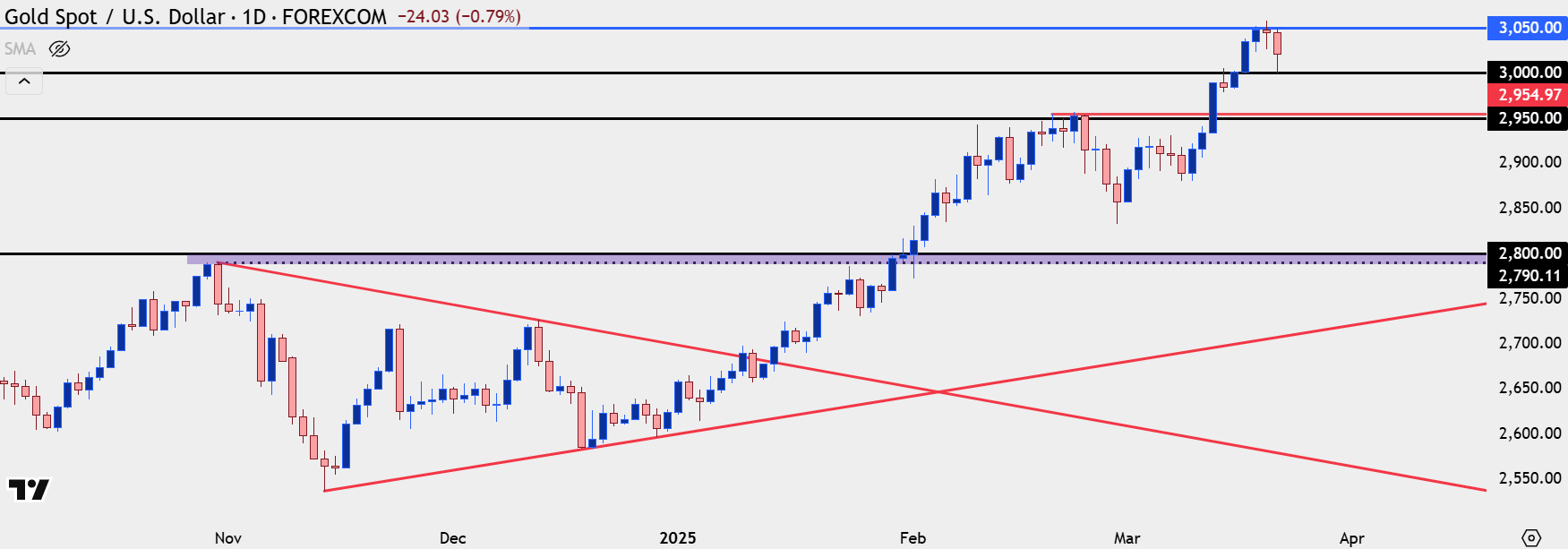

The $3k level in gold has been perhaps even more dramatic. A prolonged bullish run in gold saw the metal near the $2800 level in October, at which point a strong pullback appeared around the U.S. election. This took place even as the Fed remained dovish and talked up rate cuts, and ultimately, gold built an attractive bull pennant formation with that pullback in the final two months of the year.

It was in early 2025 that gold bulls forced the breakout from that formation in a big way, and that’s already led to a push up to and a test of the next major psychological level at the $3,000/oz level. And like the first test above $2k, it seems that there are few bears in sight.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

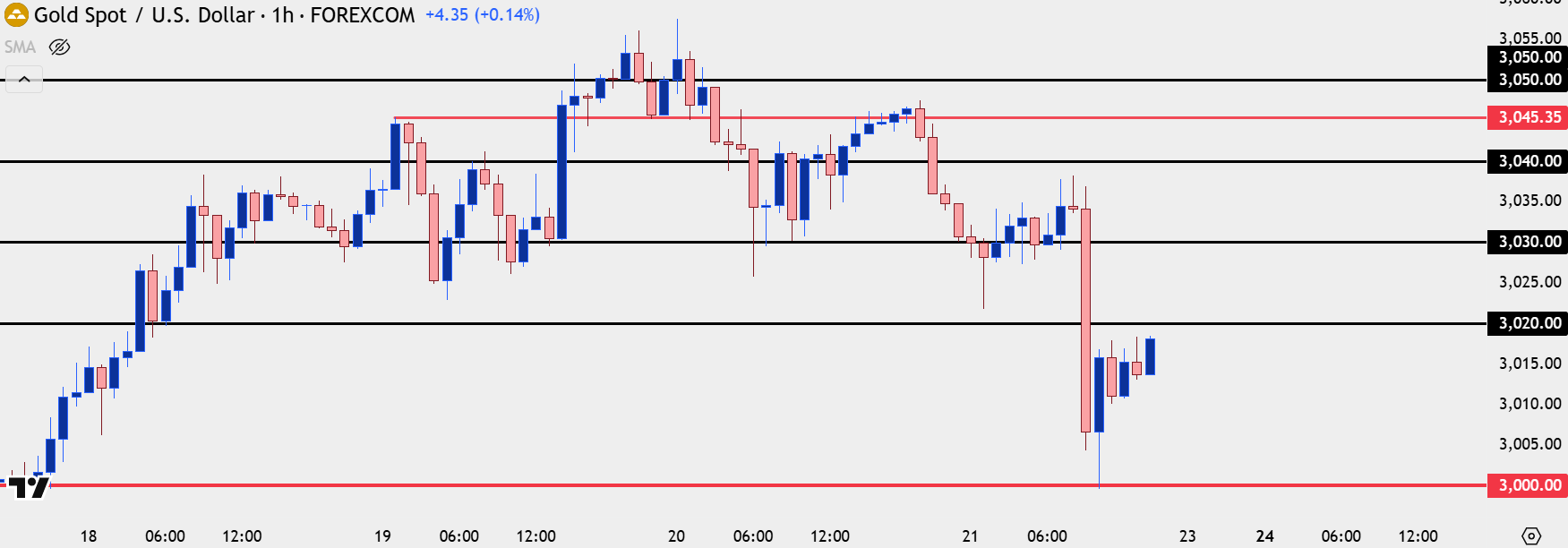

Gold $3k Test

I had written about this in February before the first $3k test started to take place and it was just a week ago, on Friday, when gold was finally able to tag that level.

It held last week’s highs but bulls continued to grind through early-week trade, eventually pushing a fresh ATH through the FOMC rate decision. And as we wind down this week, that level has so far shown as support. But it’s still too early to say that this will hold the lows on the way to a continued rally, and at this point, there could be scope for a deeper pullback as there’s been a development of short-term lower-lows and highs.

Gold Hourly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold and the Risks of Chasing

While the trend has been clear, strategy can be complicated by a move such as we’ve seen in gold. For traders that aren’t long, the option set isn’t great, as it’s either running a risk of buying near a top – or running the risk of missing out on the trade.

Perhaps more to the point, given how fast bulls have pressed the trend there’s a couple of different spots that can prove interesting for support, if price does in fact produce a deeper pullback.

The $2,950 area was resistance in February, producing a double top formation after two holds around the level. The pullback and filling in of that double top is what led to the trend that eventually pushed through $3k. But, so far, there hasn’t been a pullback to backtest support at that prior resistance.

And on a bigger picture basis, it was the $2,790-$2,800 that held bulls at bay back in October, and through the election. But, to date, there hasn’t really been much for support there, so if we do see a broader pullback pushed along by profit taking from long-term bulls after the first ever $3k test, that becomes an area of longer-term support to look to.

Gold Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist