Gold Price Outlook: XAU/USD

The price of gold pulls back ahead of the record high ($3500) to keep the Relative Strength Index (RSI) out of overbought territory.

Gold Price Weakness Keeps RSI Out of Overbought Territory

Bullion struggles to retain the advance from the start of the week as US President Donald Trump announces that ‘together with our strong ally, the United Kingdom, we have reached the first, historic trade deal since Liberation Day,’ and the waning threat of a trade war may curb the appeal of gold as President Trump insists that there’s ‘many more to come.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the price of gold may may continue to give back the rebound from the monthly low ($3202) as there appears to be a shift in investor confidence, but the recent weakness in bullion may turn out to be temporary as it remains an alternative to fiat-currencies.

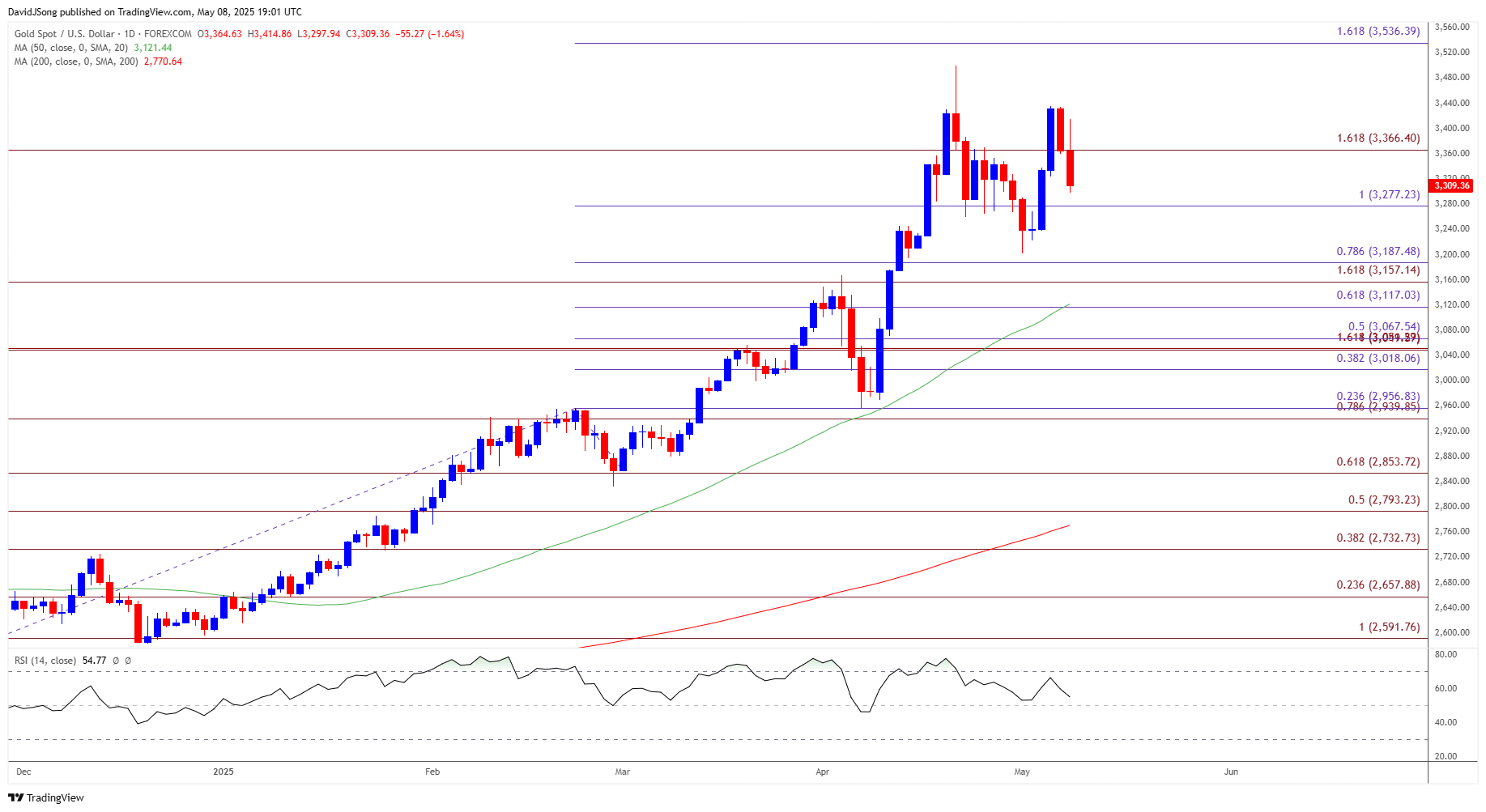

With that said, the price of gold may continue to track the positive slope in the 50-Day SMA ($3121) as it still holds above the moving average, but failure to hold above the indicator may signal a potential change in trend.

XAU/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; XAU/USD on TradingView

- The price of gold pulls back ahead of the record high ($3500) to snap the recent series of higher highs and lows, with a move below $3280 (100% Fibonacci extension) raising the scope for a test of the weekly low ($3238).

- Failure to defend the monthly low ($3202) may push the price of gold towards the $3160 (161.8% Fibonacci extension) to $3190 (78.6% Fibonacci extension) region, with the next area of interest coming in around $3120 (61.8% Fibonacci extension).

- At the same time, a move back above $3370 (161.8% Fibonacci extension) brings the April high ($3500) on the radar, with the next area of interest coming in around $3540 (161.8% Fibonacci extension).

Additional Market Outlooks

GBP/USD Post-BoE Rebound Unravels amid US-UK Trade Deal

Australian Dollar Forecast: AUD/USD Threatens December High

Canadian Dollar Forecast: USD/CAD Reverses Ahead of Monthly High

EUR/USD Defends Rebound from Monthly Low Ahead of Fed Rate Decision

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong