Gold Talking Points:

- Last weekend the fear on social media was a ‘Black Monday’ event at the weekly open after Jerome Powell failed to reiterate the Fed put at his speech. But stocks stabilized last week as a few other items started to show in a concerning manner.

- U.S. Treasury yields spiked aggressively, with the 10-year running from 4% to 4.5%, and the 30-year briefly touching 5%. Gold’s parabolic-like move showed a 9.76% gain at its peak from the weekly low to the weekly high. And the US Dollar put in a nasty bearish move. These are major shifts in some important global markets, and it suggests that we may not yet be out of the woods.

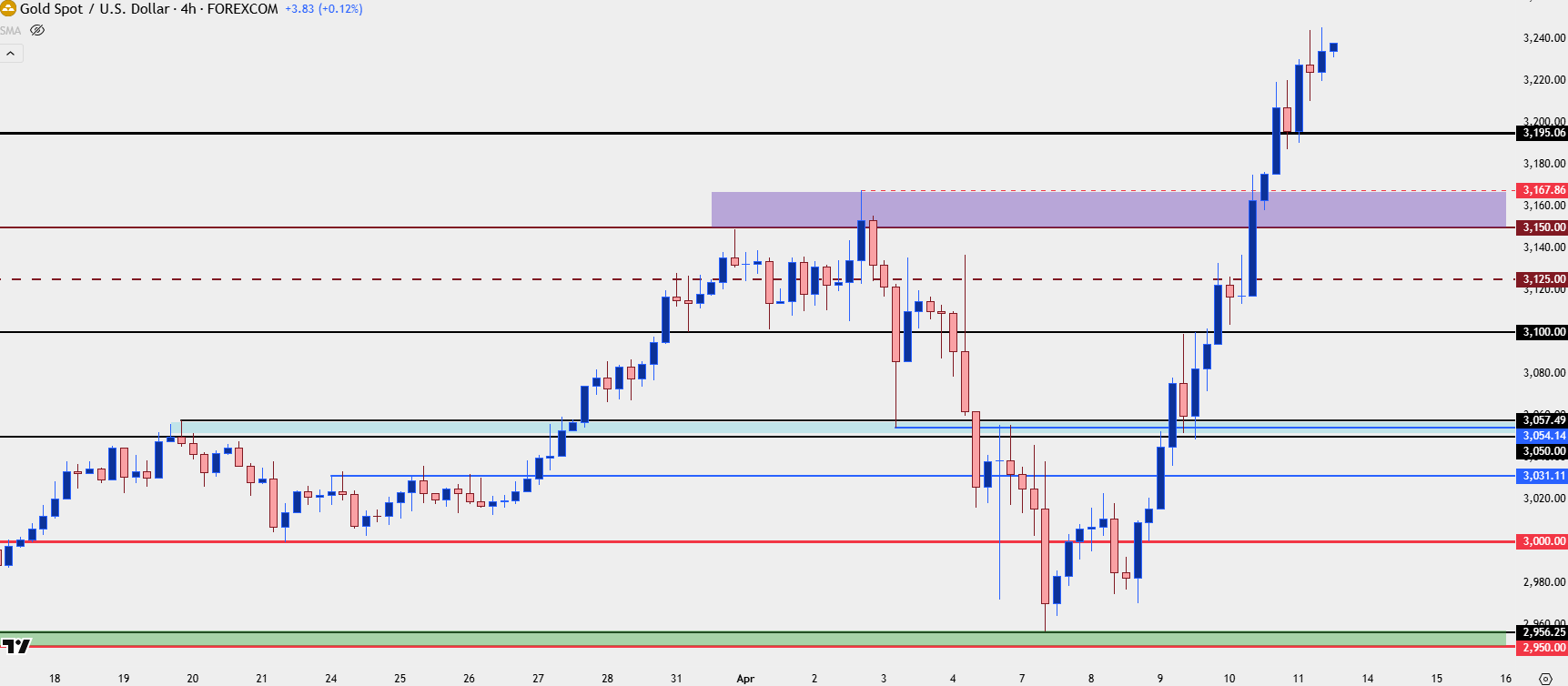

Well, gold’s test below the $3k handle has been short-lived so far. The metal has been on an outlandish run since resolving the bull pennant at the start of the year, and while last Friday’s pullback was sizable, bulls returned earlier this week at a very key spot to continue the trend.

It was the same 2956 level that marked the highs back in February, producing a bit of stall before the first ever test of the $3k marker.

The Monday pullback suddenly stopped at that level and then on Tuesday, sellers were stopped in their tracks as a doji developed on the daily chart, coupled with a higher-low above the Monday swing. It was the rally on Wednesday which was helped along by the Trump twist on tariffs that really started to drive the reversal, and gold continued to gain steam over the next two days until another fresh all-time-high was firmly in-place at 3245.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

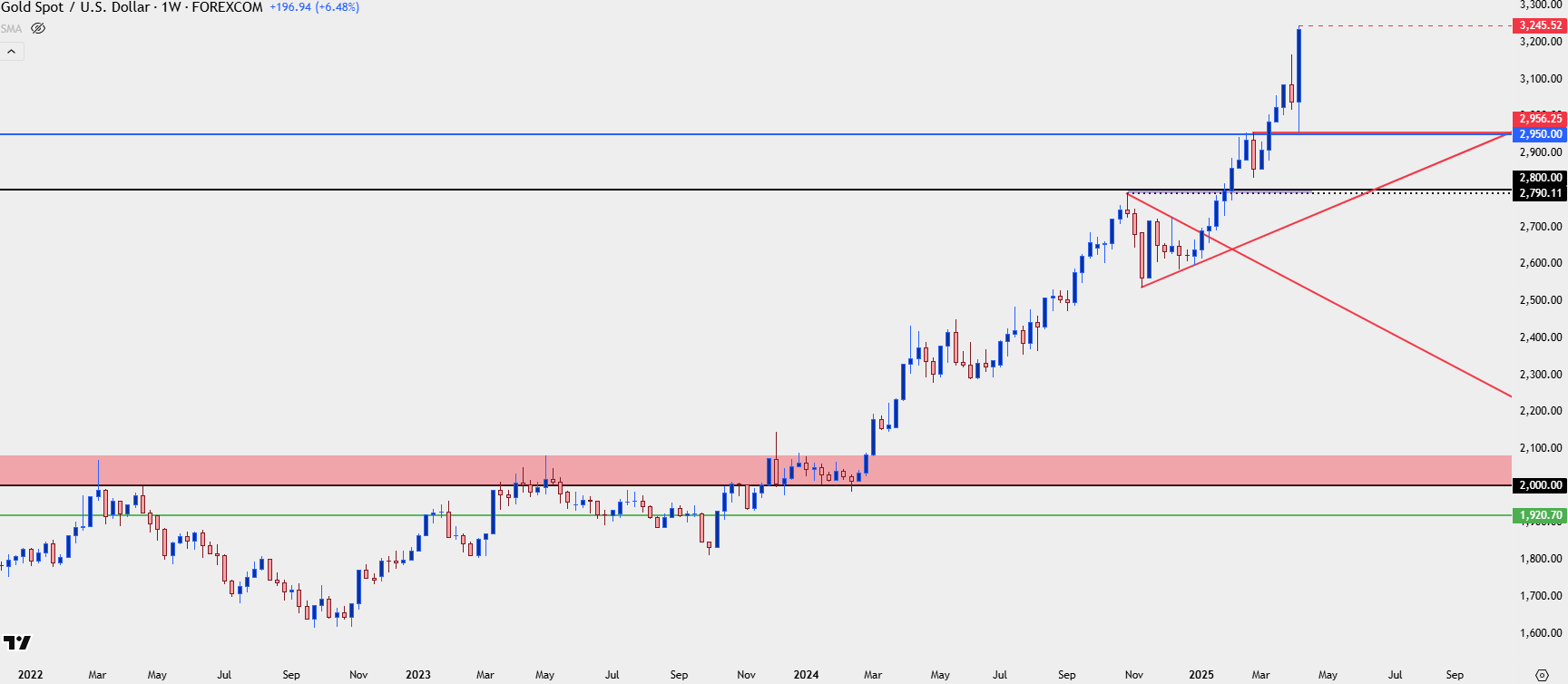

Gold Bigger Picture

The current trend in gold started just over a year ago, and it was the catalyst to that move that I think remains important today. After resistance at the $2k level for the prior three and a half years, gold spent the first month and a half of 2024 trade holding above the psychological level.

But, the CPI report in February came out above expected and quickly rate cut expectations around the Fed were in question, leading to the first daily close below $2k in gold for the year. A day later, Austan Goolsbee of the Chicago Fed implored market participants to avoid getting ‘flipped out’ about a single inflation print. The day after gold climbed above $2k and never looked back, starting on a 40% rally that ran into late-October.

The move started to stall around the U.S. Presidential election and that’s when a rather clean symmetrical triangle had built, which when taken with the prevailing trend, makes for a bull pennant formation. That formation started to give way as we came into 2025; and just as we had seen in the prior year, bulls took over in a very big way.

At this point there has been only two red weekly candles in gold this year: From the stalled test at 2950 and then again in the prior week. But bulls have continued to push and as I’ve been saying in webinar, there’s little attraction on the bearish side here to me, even if the move is overbought from several different vantage points.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold: Managing Emotions in a Bubbling Market

I think that psychology is probably one of the most important aspects of a trader’s approach and nothing puts that psychology in the spotlight like a massive one-sided move. The fear of missing out can run high and that innate desire to try to predict price can become quite loud given how aggressively we’ve seen a directional bias price in.

This can make patience an even more difficult premise as price has peeled further and further away from any recent swing lows.

But, interestingly, with moves such as we have in gold the most opportune times are when the desire for trend continuation is at its least attractive, such as what appeared on Tuesday. At that point, there was a clean doji on the daily chart with a higher-low above a key area of support. That indecision followed some pretty aggressive selling, and the trend soon turned as gold bulls piled back in. This doesn’t mean every spot of support will turn into fresh highs, but it does illustrate how patience in waiting for support in bullish trends can be a calculated way of looking to work with the move, especially given the ability to manage risk in a more palatable manner.

At this point, there’s another spot of prior resistance around the 3150 level, which stalled the move around the April open. This was the zone that invariably led to that pullback that ran into last week’s open, and this now becomes the next key spot for bulls to hold on pullback attempts. For more aggressive stances, 3200 is also of interest as this is a rounded level, and if buyers remain quick to respond then a test of 3199 or 3195 would show as a form of relative value, so if there is defense that that could also play as higher-low support potential.

If we see a pullback dig a bit deeper such as what showed in the prior instance, then both 3100 and 3050-3057 both remain in working order for higher-low support potential. Theoretically, price could even spill all the way down to $3k and as long as it holds above that prior swing low of 2956, there could be a bullish argument on the basis of a higher-low support hold.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist