View recent analysis:

- Japanese yen broadly lower, USD, risk bounces amid Trump-tariff relief

- EUR/USD bears short-covered at fastest pace in 5 years - COT Report

- AUD/USD Weekly Outlook: AU inflation, US Core PCE on Tap

- ASX 200 Set to Snap 4-Week Losing Streak With 8k Now in Bullish Sights

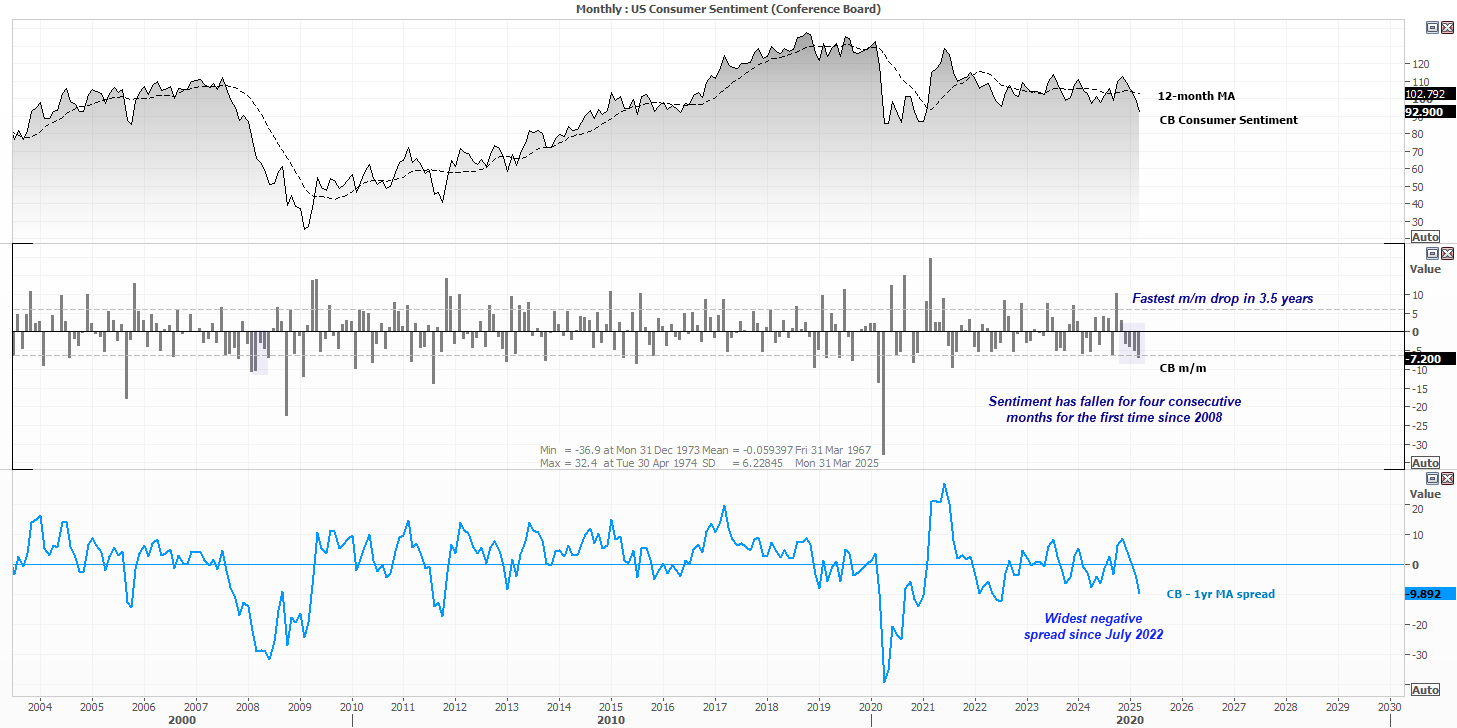

Consumer sentiment fell at its fastest pace in three years, and to its lowest level since January 2021 according to the Conference Board. And chances, weak figures are likely to appear in Friday’s University of Michigan’s (UOM) report.

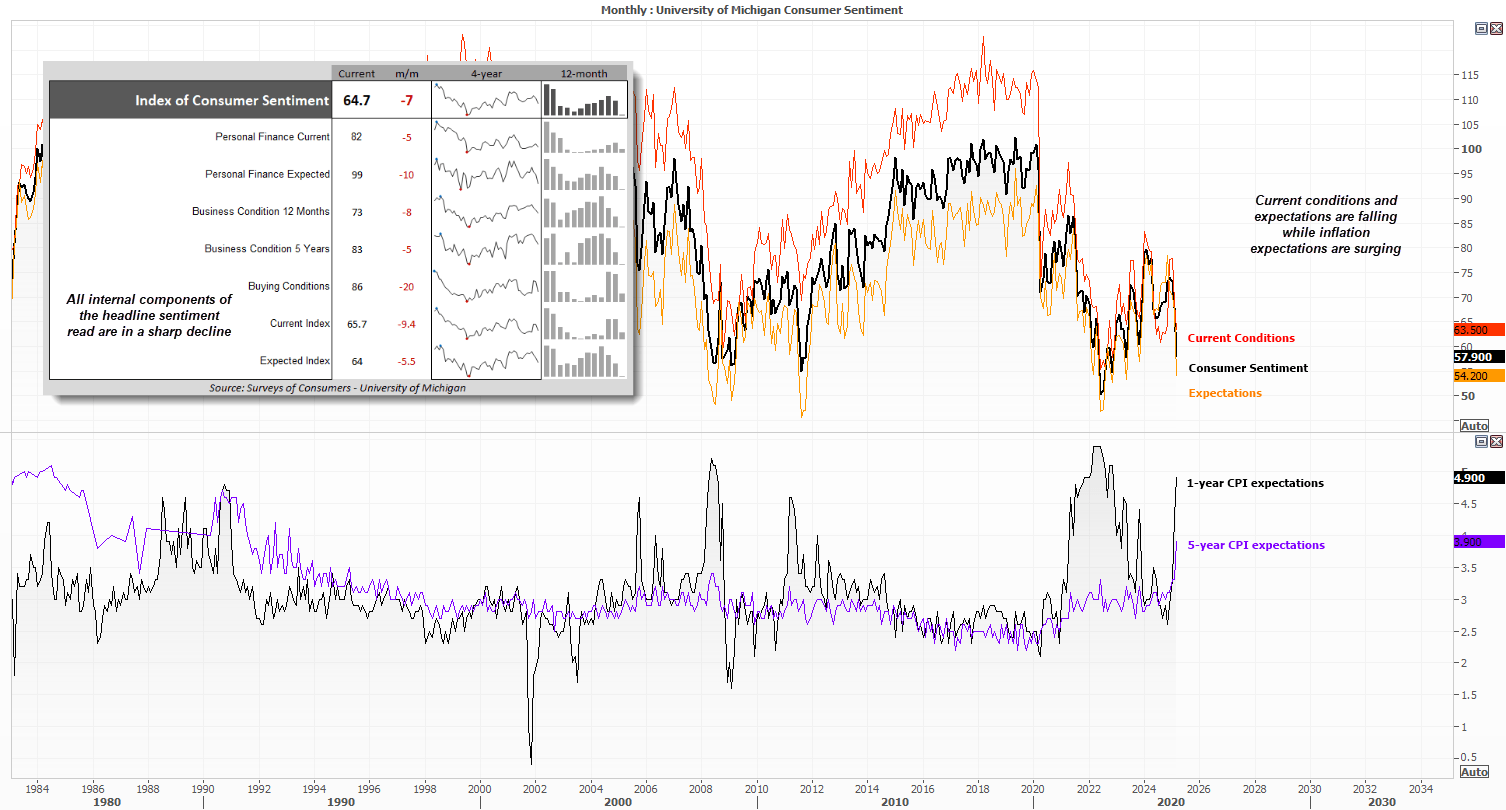

The two main consumer sentiment reports for the US are released each month by the Conference Board (CB) and the University of Michigan. They generally tracked one another quite well up until the pandemic, but since 2020 the CB read has been elevated relative UOM’s. While a sizable spread remains in place between the two, there has been a noteworthy deterioration for both since Trump took office.

Concerns over inflation and low growth have likely been hammered across most news channel, adding to concerns that Wall Street investors raised back in Q4. The question now is where consumers are concerned enough to stop consuming and tip the recession they seem to be worried over.

Summary of CB consumer sentiment:

- Down for a fourth consecutive month, consumer sentiment fell to its lowest point since January 2021

- The -7.2 m/m decline was its fastest in 3.5 years

- The expectations index fell to a 12-year low of 65.2, well below the ‘recessionary threshold’ of 80

- Optimism of future income was flat, breaking the trend of clear optimism in recent months

- The fall in confidence was driven mostly by consumers aged 55 and over, and to a lesser extent, those ages between 35-55 years

- The decline in confidence was also driven mainly by those earning less than $125k per year

All eyes are now on the University of Michigan Consumer Survey

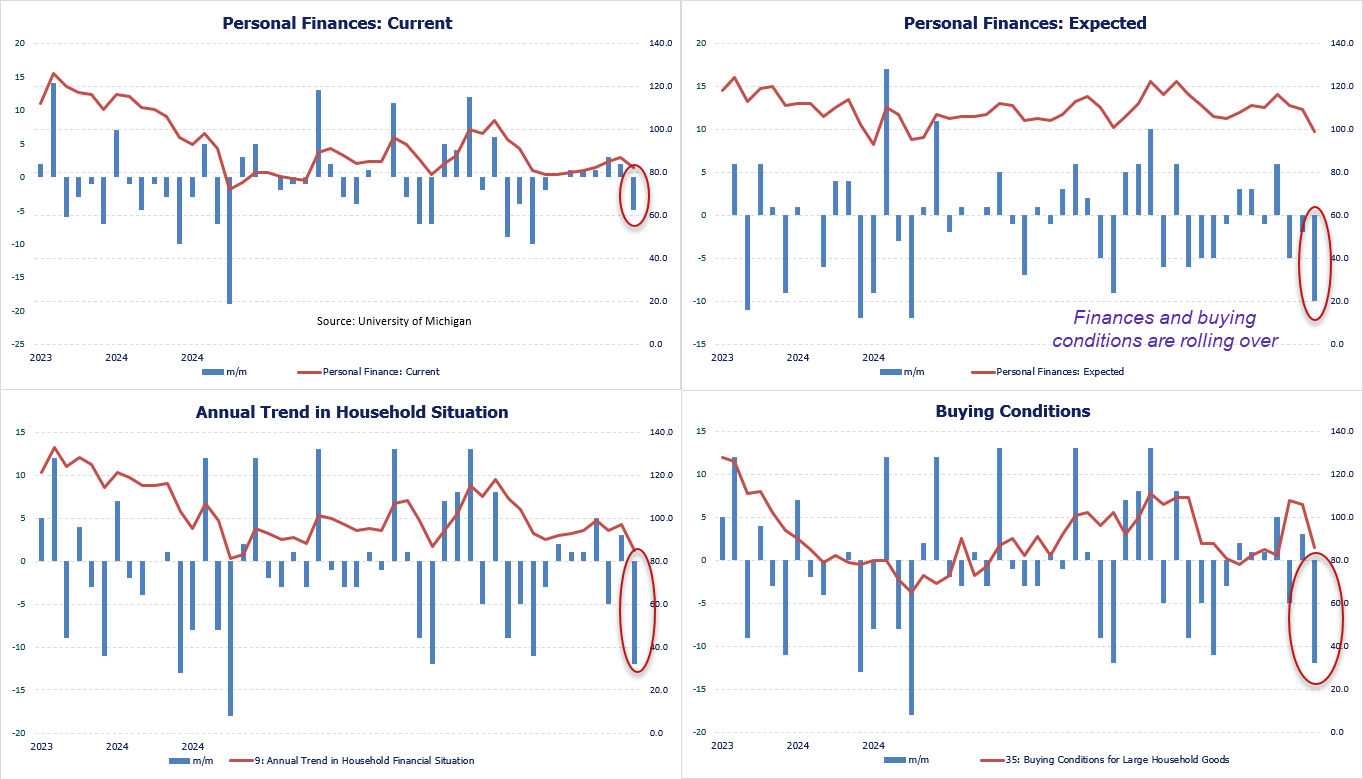

The final revision of the UOM consumer sentiment survey is released on Friday, and it provides much greater detail over the headline preliminary figures. But looking through February’s data reveals plenty of concern among US consumers. Particularly over personal finances.

- Expected personal finances contracted by -10 points, its fastest monthly decline in 32-months

- Current personal finances contracted for the first month in seven (and fastest pace in eight)

- The annual trend in the household financial situation contracted -12 points m/m, its fastest pace in 16 months

- Buying conditions fell -20 points, its fastest decline in nine months

If concerns over personal finances continue to decline, it seems highly likely that consumption and therefore economic growth will dry up. And while that will turn out to be deflationary, the economy may need to endure a recession to get there. Trump did warn that there may be some near-term pain to suffer while he balances the books, and it’s already showing up in the data before tariffs have even been implemented.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge