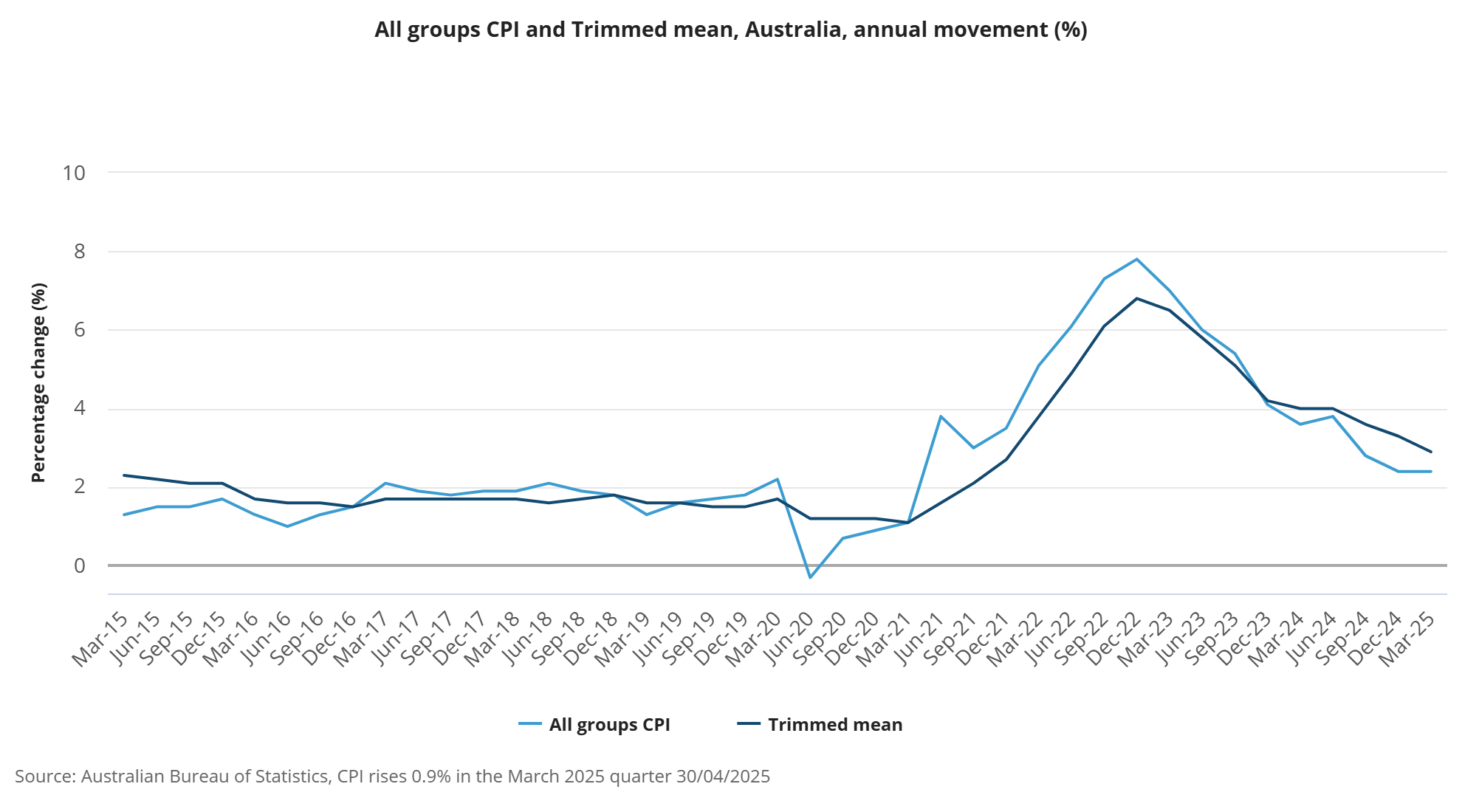

- CPI rose 0.9% in Q1, keeping annual inflation steady at 2.4%.

- Trimmed mean inflation rose 0.68%, in line with RBA projections

- Weak market-based inflation: goods up just 0.145%, services down 0.149%

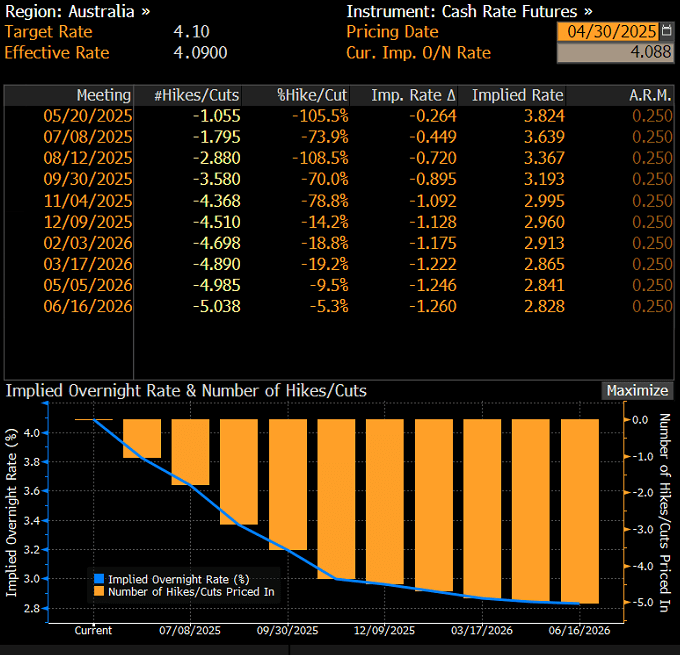

- Traders pricing in at least four RBA rate cuts by end-2025, with risks tied to global factors

Summary

Australia’s inflation pulse picked up in Q1, with CPI rising 0.9% leaving the annual rate steady. The RBA’s preferred trimmed mean inflation measure rose 0.68%, slightly above forecasts but in line with its own projections. Market-based inflation, however, was weak, with goods prices up 0.15% and services down 0.15%, indicating fading demand pressures. Traders expect the RBA to cut rates in May, with at least four expected by end-2025.

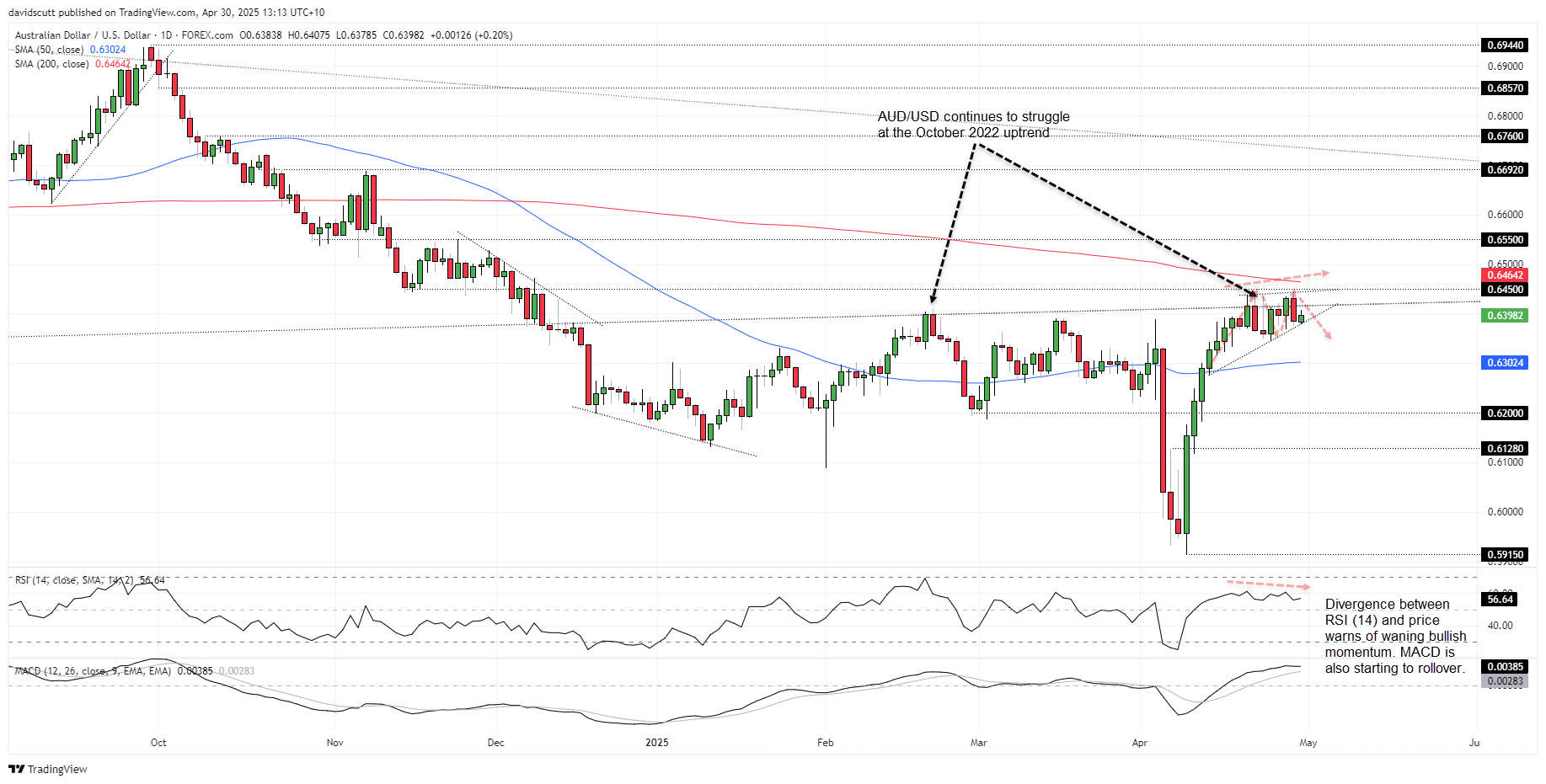

The Aussie dollar responded to the inflation print by pushing higher, though domestic data remains less relevant amid global risk sentiment. AUD/USD continues to face resistance at the October 2022 trendline, with downside risks building as momentum wanes.

CPI Report Masks Private-Sector Weakness

Source: ABS

Australia’s inflation pulse picked up in Q1, with headline CPI rising 0.9% and annual inflation steady at 2.4%. While that keeps the annual rate within the RBA’s 2–3% target band, underlying pressures remain in focus. Trimmed mean inflation—the RBA’s preferred gauge—rose 0.68% for the quarter, just above the 0.6% median economist forecast but bang in line with the RBA’s own projections. The annual trimmed mean slowed to 2.9%, the lowest since 2021 and edging closer to the 2.5% midpoint the RBA is targeting over time.

Beneath the surface, signs of disinflation are building. Market-based prices excluding volatile and administered items—like electricity, education and childcare—came in very soft, with goods up just 0.145% and services down 0.149%. That’s the first quarterly fall in market-based services since Q2 2020, pointing to fading demand-led inflation. It also suggests that most of the current price pressures are coming from non-market forces, not broad-based strength.

Including all items, goods inflation picked up to 1.3% annually, largely due to electricity, while services inflation eased again to 3.7%—its lowest since mid-2022.

Markets Price Modest RBA Rate Cut Cycle

With trimmed mean outcomes aligning with its own forecasts and market-based indicators turning soft, the RBA is likely to resume its easing cycle when its next interest rate decision arrives on May 20.

Source: Bloomberg

The Q1 inflation print has traders pricing in 26.4bps of RBA cuts for the May meeting, implying a 25bp move is fully priced with a small chance of 50. That probability dipped slightly following the hotter-than-expected trimmed mean reading. Looking further out, at least four cuts remain priced by end-2025, with a fifth seen as a coin toss.

Despite the dovish rates outlook, RBA officials—including Governor Michele Bullock—may be reluctant to adopt an explicit easing bias given ongoing uncertainty around U.S. trade policy and potential spillovers into domestic activity and key trading partners like China. That’s one potential hawkish surprise for traders to watch for on May 20.

AUD/USD Risks Skewed Lower

The Australian dollar pushed higher in the wake of the CPI report, partially reversing Tuesday’s decline. But even with the upside surprise in the RBA’s preferred core measure, inflation data from months ago carries less weight in an environment like this. AUD/USD is rarely driven by domestic factors outside of brief bursts—global risk sentiment and the outlook for China remain far more influential. That hasn’t changed.

Source: TradingView

The rebound in AUD/USD from the April 9 lows looks increasingly mature. Directional risks now appear skewed to the downside given the size of the recent move. The pair continues to stall at the October 2022 trendline despite repeated attempts to break higher, echoing the pattern seen in February. It hasn’t been fully rejected, but with price sitting in a rising wedge and horizontal resistance at .6450 still intact, bears remain in control for now.

Bearish divergence between RSI (14) and price is flashing a warning for bulls. MACD is still above the signal line and zero but appears to be rolling over. It’s not an outright bearish picture just yet—but momentum is starting to turn.

If downside emerges, the 50-day moving average will be the first level to watch, having been respected consistently in recent months. A break below would bring .6200 and .6128 into focus for those looking at short setups. On the upside, a clean break of .6450—and with it, the October 2022 trendline—would open the door to the 200-day moving average and resistance around .6550.

-- Written by David Scutt

Follow David on Twitter @scutty