View related analysis:

- AUD/USD Weekly Outlook: Trimmed Mean Inflation in Focus

- USD/JPY, USD/CHF Rise for 2nd Day, Market Forces Lend SNB a Hand

- Japanese Yen Analysis: USD/JPY, CAD/JPY, AUD/JPY Price Action Setups

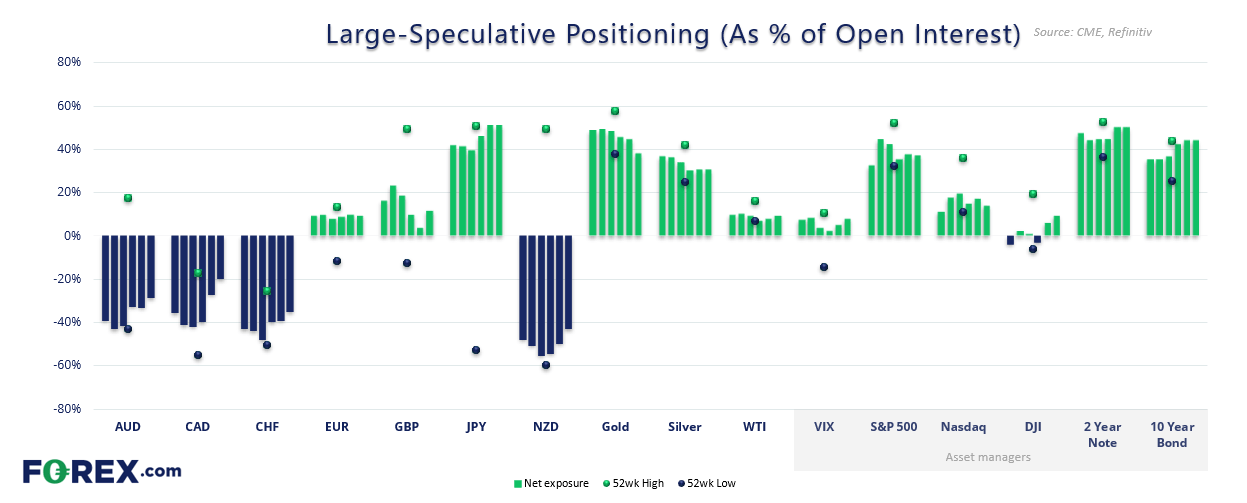

Market positioning from the COT report – 22 April 2025:

- Traders were effectively short US dollar (USD) futures by -$14.8 billion according to data from IMM

- Large speculators flipped to net-short exposure to the USD index futures for the first time since December

- They increased their net-long exposure to Japanese yen (JPY) futures to a new record high

- They also reduced their net-short exposure to Canadian dollar (CAD) futures to a 51-week low

- Net-short exposure to Swiss franc (CHF) futures fell to an 18-week low

- Asset managers increased their net-long exposure to euro dollar (EUR) futures to a 30-week high

- Asset managers were on the cusp of flipping to net-long Australian dollar (AUD) futures, with an exposure of just -5k net short

- Net-long exposure to gold futures (GC) fell to a 13-month low among large speculators and managed funds

- Large speculators and managed funds increased net-long exposure to WTI crude oil futures by a combined 76.4k contracts

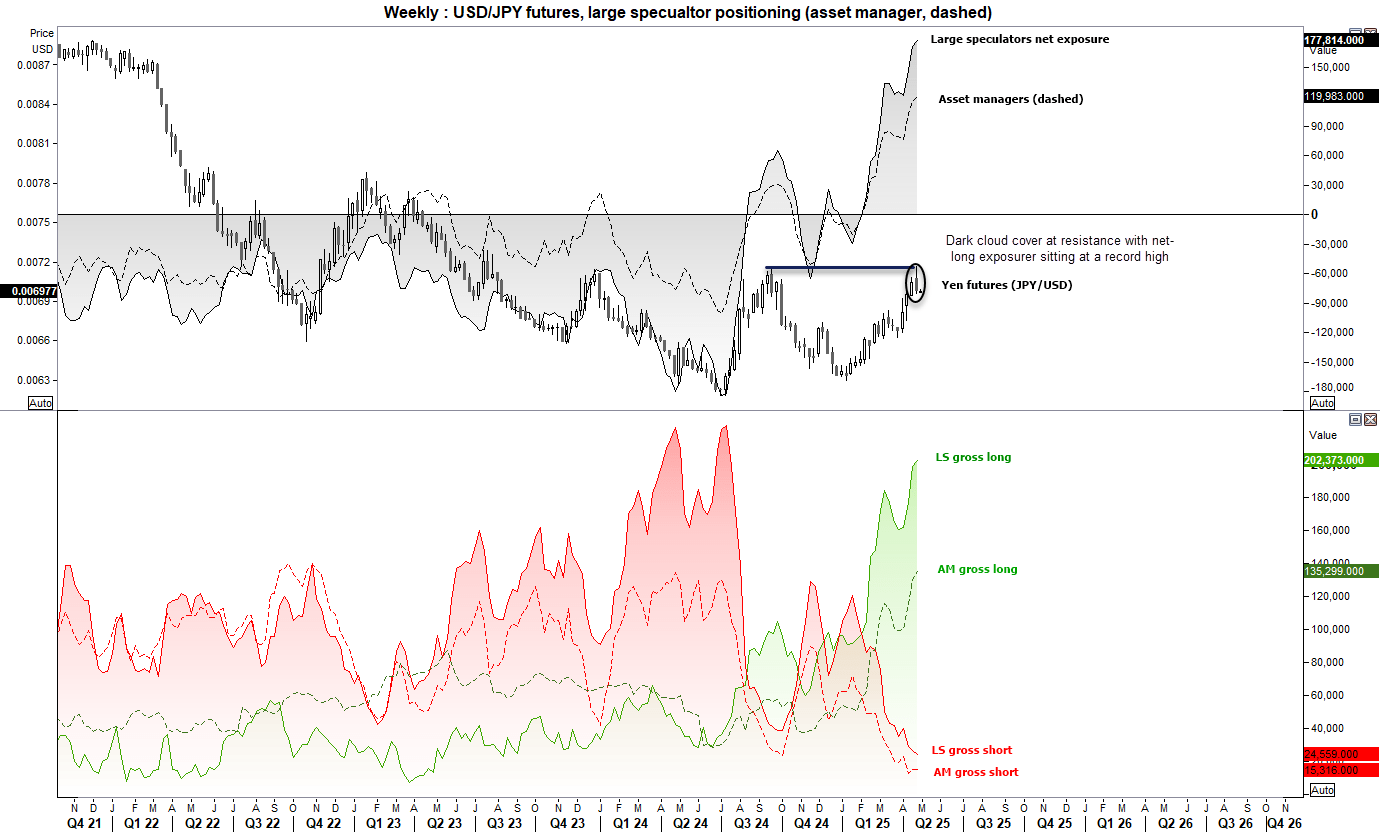

Japanese Yen (JPY/USD) Futures Positioning – COT report:

Both large speculators and asset managers have pushed their net-long exposure to Japanese yen futures to a record high for a third straight week. In both cases, gross longs are rising sharply while shorts are being closed, leaving these traders with a combined net-long exposure of 298k contracts.

With positioning stretched to such an extreme, the risk of a sentiment reversal is growing. Notably, a two-week bearish reversal pattern — a dark cloud cover — has formed on JPY futures. That it appeared near the September high, with exposure at record levels, strengthens the case for a turn lower in the Japanese yen, which in turn favours further gains for USD/JPY.

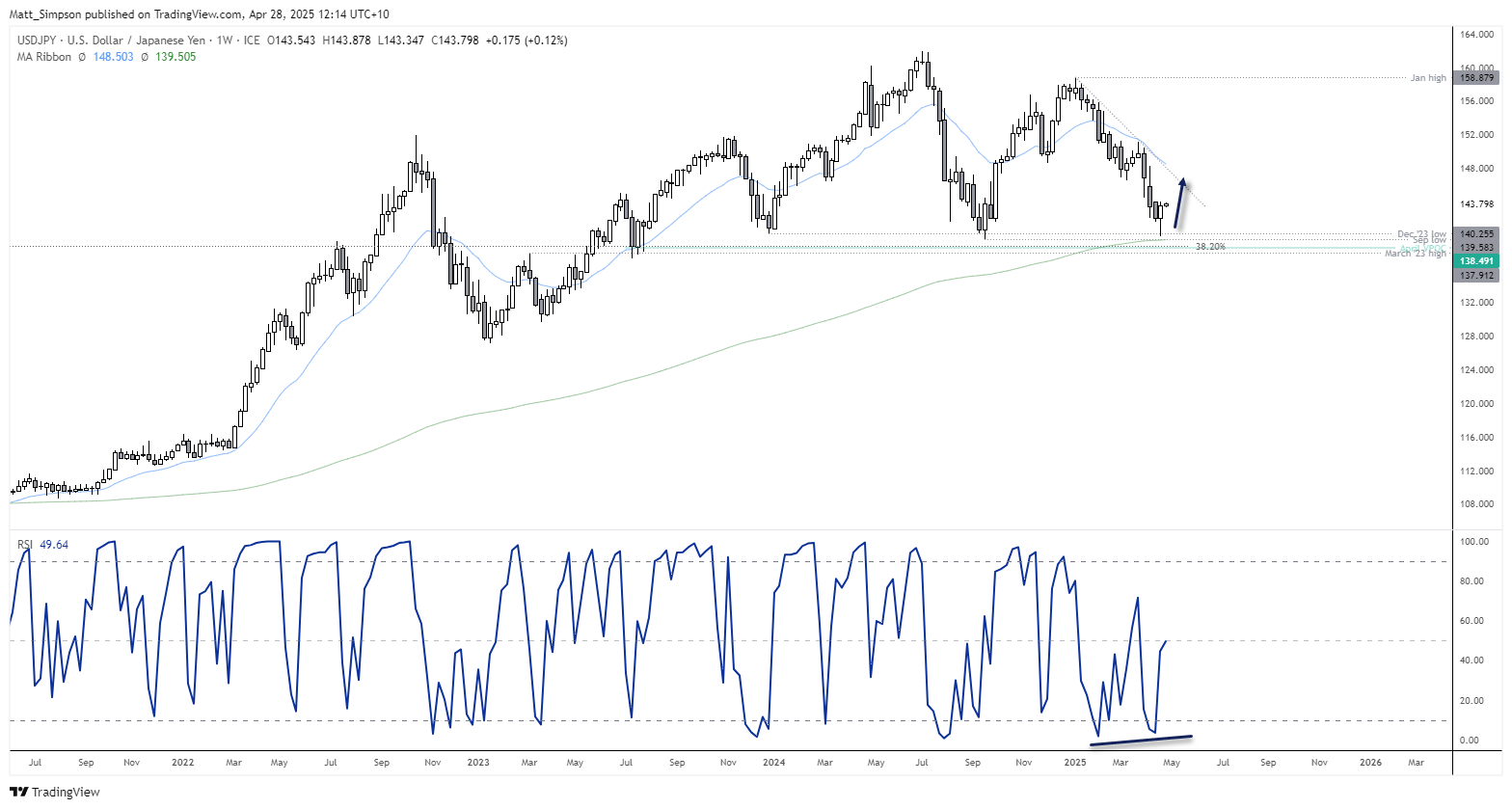

Japanese Yen Technical Analysis (USD/JPY): Daily Chart

The daily chart shows a bullish divergence has formed on the RSI (2) within the oversold level. Last week’s low also held above the 200-day EMA, with a 2-bar bullish reversal pattern (bullish piercing line). It6 also suggest a double bottom around the 140 handle. Bulls could seek dips within last week’s range in anticipation of a move up to 148, near trend resistance and the 20-day EMA.

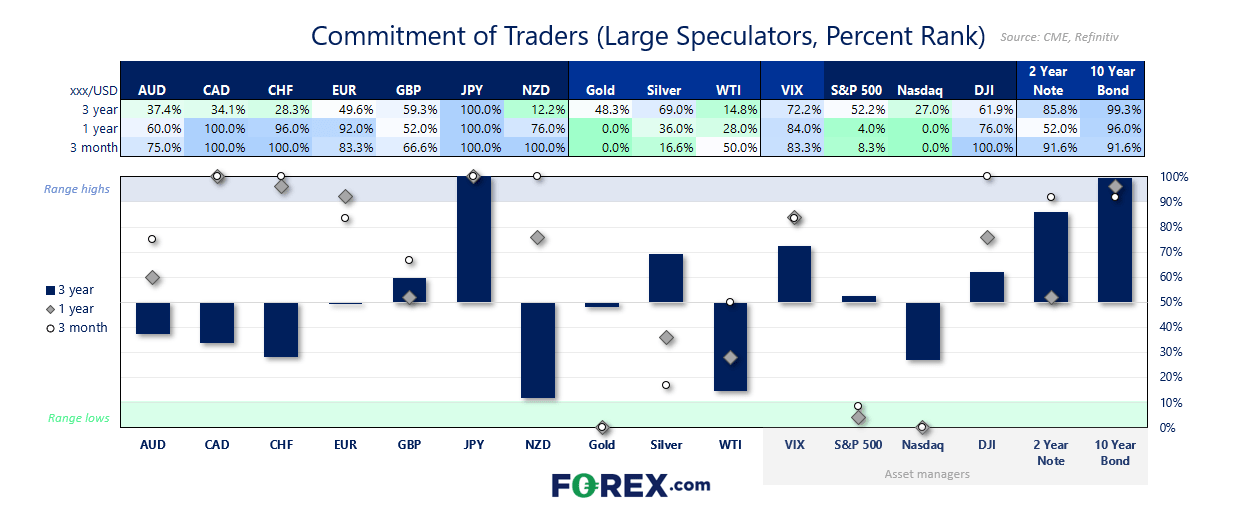

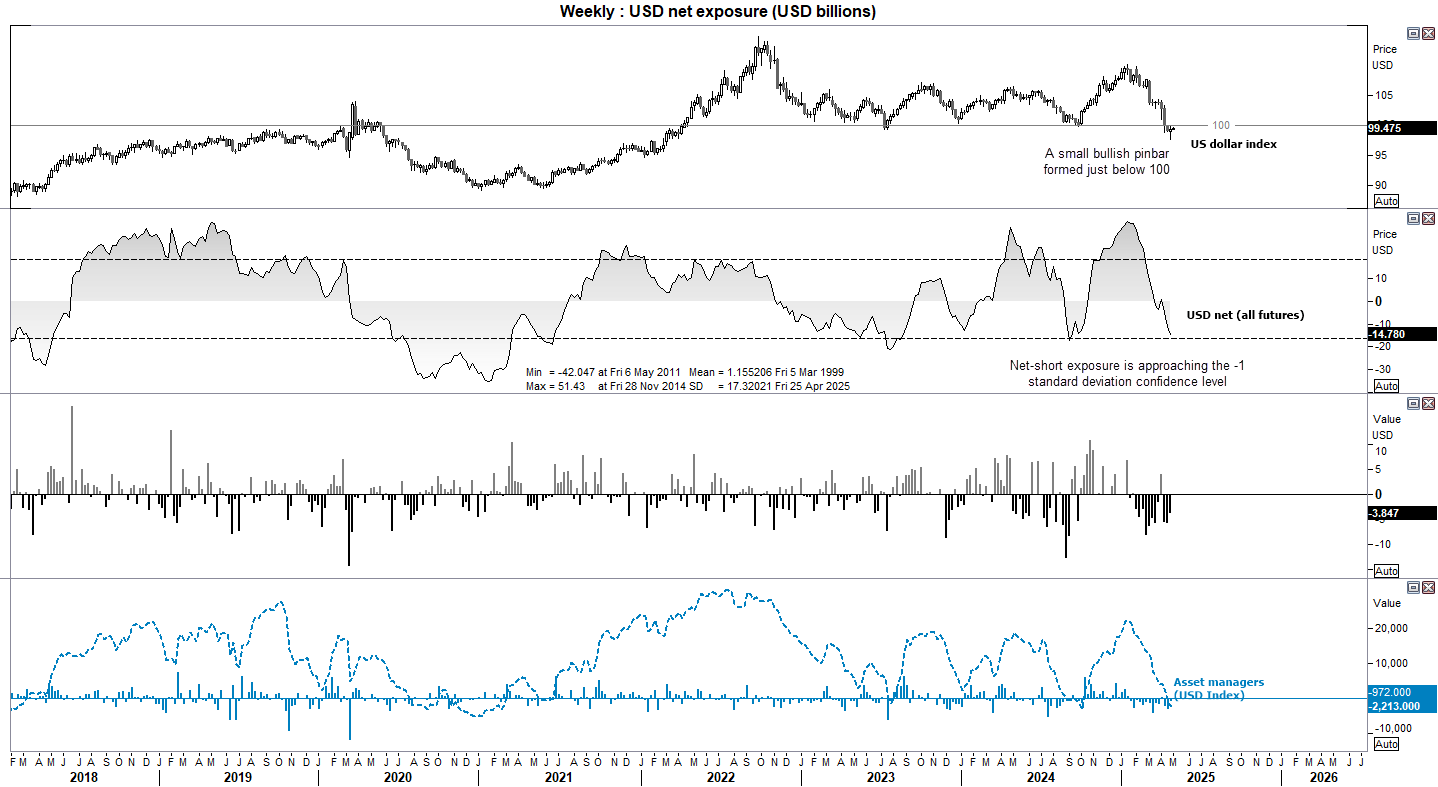

US dollar positioning (IMM data) – COT report:

Traders were effectively net-short USD futures by -$14.8 billion last week, their most bearish level of exposure since September. However, net-short exposure is also near its lower 1-standard deviation confidence level, and a small bullish hammer last week warns of trend exhaustion for bears.

Still, asset managers remain net-short- and not by an extreme amount. Unless we see them flip to net-long, any bounce on the US seems likely to fail and eventually see the dollar continue lower.

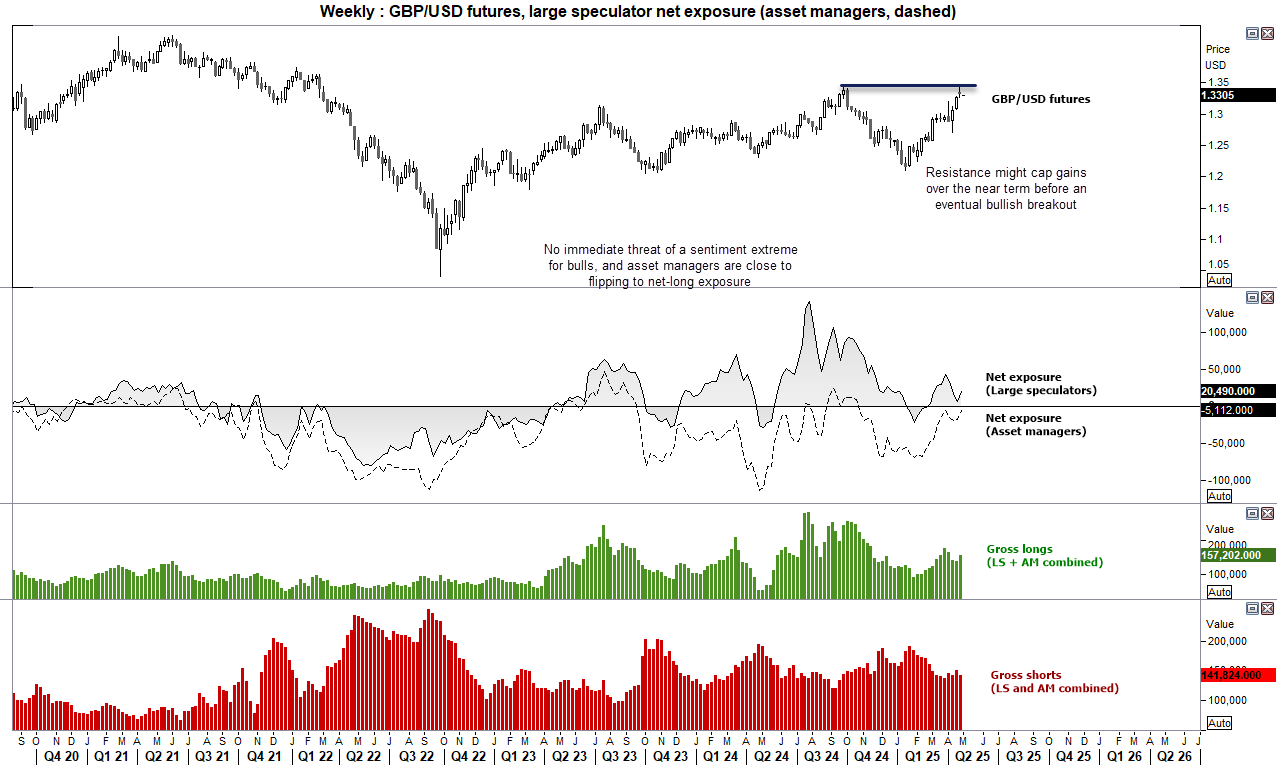

British Pound (GBP/USD) Futures Positioning – COT Report

Asset managers have reduced their net-short exposure to British pound futures (GBP/USD) to their lowest level since October. Woth net-short exposure at -5k contracts, its possible we’ll see them flip to net-long exposure soon. However, if the US dollar does perform a corrective bounce as I suspect, it could cap gains for GBP/USD over the near term and potentially prompt a pullback ahead of an anticipated breakout. And with large speculators net-long by 20.5k contracts, there’s no immediate sentiment extreme to be wary of.

Commodity FX (AUD, CAD, NZD) futures – COT report:

Australian dollar (AUD/USD) futures

Asset managers reduced their net-short exposure to Australian dollar futures to just -5k contracts, their least bearish level since October. However, this is mostly a function of short covering over the past six weeks, with gross-longs moving sideways. This is not overly bullish, but it does at least show a lack of appetite to short AUD/USD back down to 59c.

Canadian dollar (CAD/USD) futures

There’s also less appetite to short Canadian dollar futures, with net-short exposure among large speculators falling to a 51-week low, and asset managers dropping to a 46-week low. However, unlike AUD/USD, gross-longs have been rising gently higher among asset managers for the past few weeks.

New Zealand dollar (NZD/USD) futures

While net-short exposure is also declining on NZD/USD, gross-longs are moving sideways among asset managers, though they ticked higher by 1.1k contracts among large specs. Out of the three, the Canadian dollar seems to hold the most promise for commodify FX bulls.