- USD/JPY held firm despite bearish signals as short-covering lifted the dollar

- Correlations with risk proxies remain strong, especially S&P 500 and gold

- Treasury calm and steady U.S. data flow underpinned appetite for risk

- May non-farm payrolls and unemployment rate in focus this week

- USD/JPY Range trade favoured with mild bearish bias

Summary

The sell signals may have been stacking up for USD/JPY last week but the headlines didn’t oblige, with a sustained bid in U.S. Treasuries combining with buoyant risk appetite to deliver a powerful—yet fleeting—short-covering rally in the dollar. Looking ahead, while trade headlines remain a constant challenge, U.S. economic data will take centre stage late next week with the release of May non-farm payrolls. So far, U.S. activity appears to be holding up despite uncertainty created by rapidly shifting trade policy. Should that continue in the payrolls update, it favours range trade for USD/JPY as we enter June.

USD/JPY Remains a Risk Proxy

USD/JPY maintained a strong relationship with broader risk sentiment last week. That was reflected in its five-day correlation of 0.84 with S&P 500 futures, and inverse correlations of -0.86 and -0.92 respectively with gold and VIX futures.

Source: TradingView

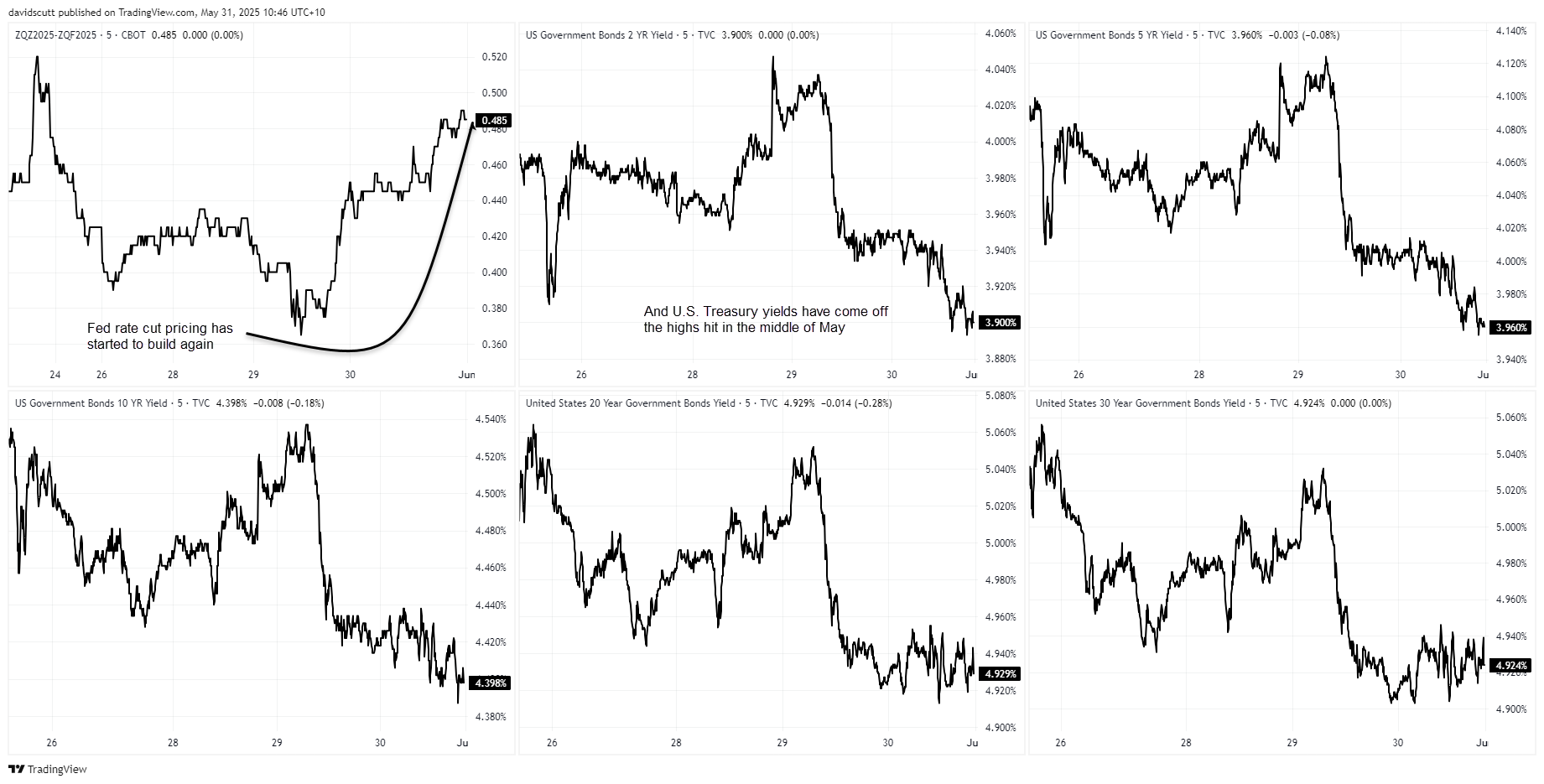

While the direct relationship with U.S. and Japanese bond yields and interest rate spreads remained negligible to non-existent, indirectly, a sustained decline in long-dated Treasury yields—driven by a rally in Japanese bonds, strong auctions of two, five, and seven-year U.S. debt, and a soft core PCE deflator—was a key factor underpinning risk appetite during the week.

Intense focus on U.S. Treasuries will likely persist this week. However, with no major auctions scheduled, trade uncertainty unlikely to be resolved as markets await court rulings, and the Fed unlikely to deviate meaningfully from its message of patience, the immediate threat of a Treasury-driven risk swoon doesn’t appear as elevated as in prior weeks—especially with expectations for Fed rate cuts building again.

Source: TradingView

U.S. Data Resilience on Display

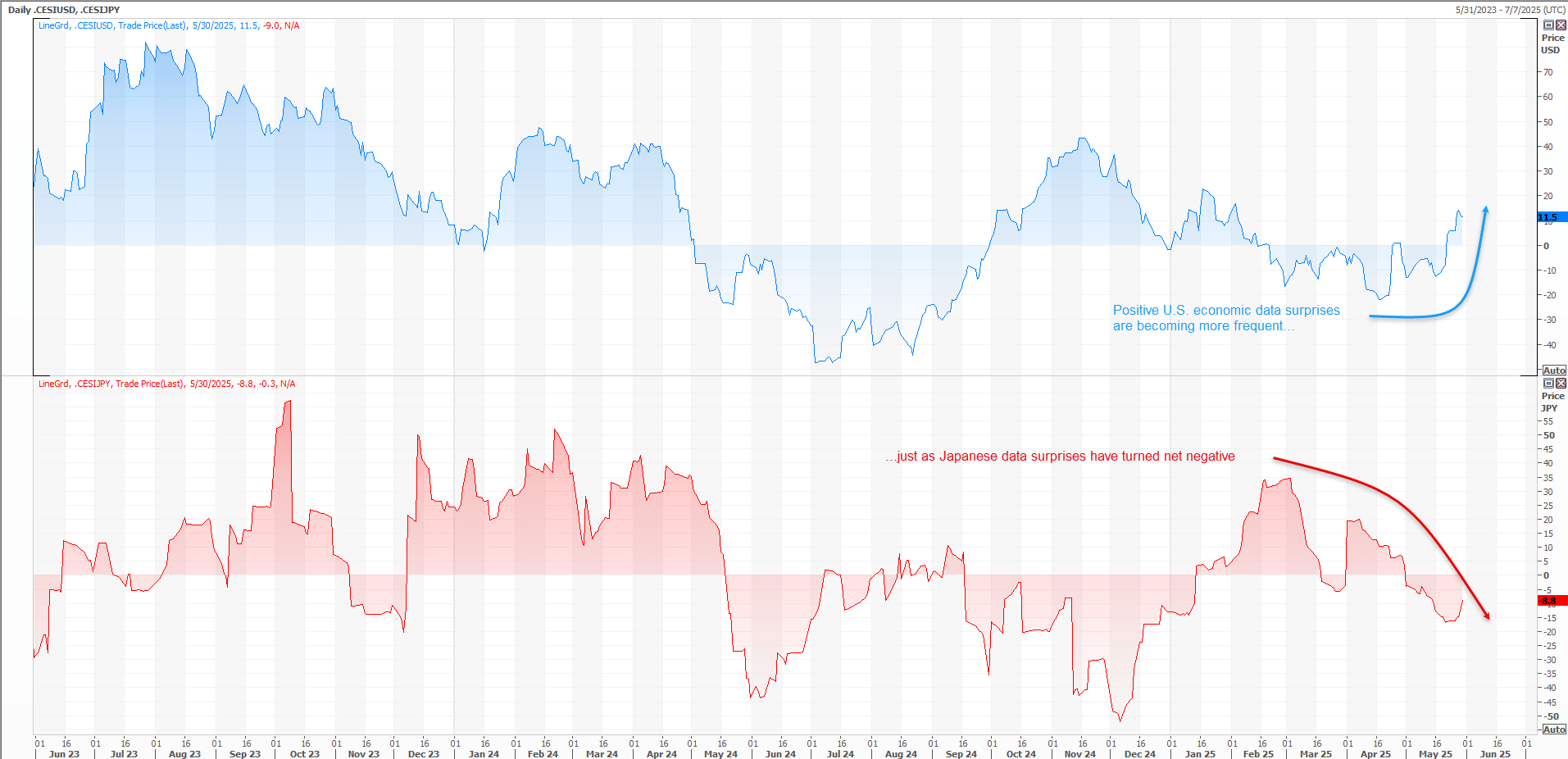

Along with risk appetite holding up, another factor that’s helped to stabilise USD/JPY recently has been the continued resilience of the U.S. economy despite tariff-driven uncertainty. That’s evident in Citi’s Economic Surprise Index (CESI)—a gauge of how data prints relative to market expectations.

Source: Refinitiv

After a prolonged stint in negative territory through Q1, the U.S. CESI has recently flipped positive, indicating a slim majority of releases are topping expectations. In contrast, Japan’s CESI has shifted the other way, turning negative over the past month.

While recent Japanese inflation prints have surprised on the upside—including Tokyo CPI for May released last Friday—sputtering activity data elsewhere hasn’t convinced Bank of Japan officials of an imminent need to lift overnight rates, particularly with trade uncertainty still elevated. Even if a U.S.–Japan trade agreement is reached, unless similar deals are struck with Japan’s other major partners, the overall impact may be limited.

Payrolls Headline Busy Calendar

Source: Refinitiv

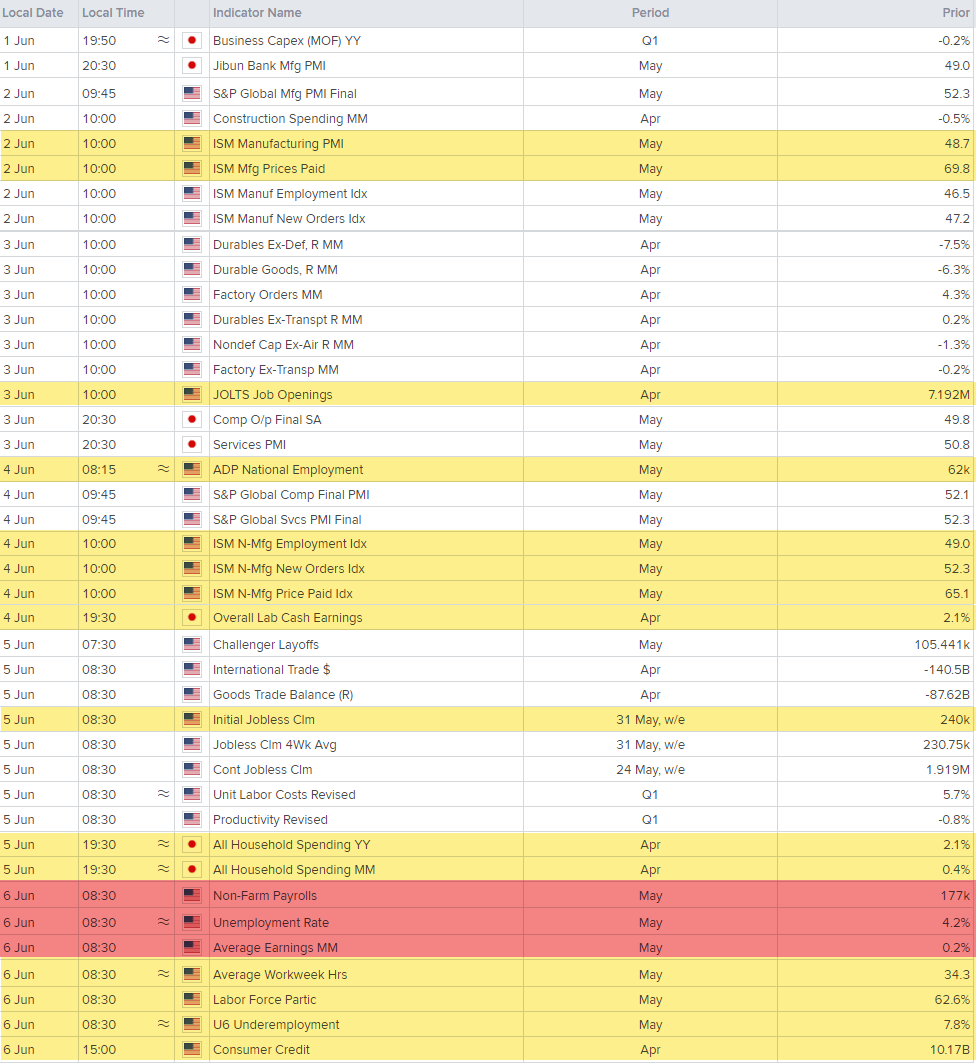

Traders will get further insight into the health of the U.S. economy this week with a swathe of major data releases, headlined by Friday’s non-farm payrolls. Markets tend to react initially to the payrolls figure, but it’s the unemployment rate that matters most for the Fed and U.S. rate outlook. If the two send different signals, markets will likely gravitate eventually toward the latter. The jobless rate is expected to hold at 4.2%, with payrolls—before revisions—seen slowing to 130,000.

Outside of payrolls, lead-up employment data like JOLTS, ADP, and jobless claims could generate volatility. The Memorial Day holiday may temporarily impact jobless claims if past patterns are any guide, so be cautious if the number prints well away from expectation. While ISM manufacturing and services PMIs haven’t been great indicators of real activity lately, they still move markets, so keep an eye on the headline prints along with prices paid and new orders for signs of tariff effects.

In Japan, wages data out midweek may show the impact of spring wage negotiations, though it could take time for chunky increases to flow through to the numbers. With the BoJ looking for wage pressure to boost domestic demand, household spending will also be closely watched.

Weak U.S. data may drag USD/JPY lower, and vice versa if strong. The opposite applies to Japanese data, though the U.S. calendar is likely to be far more influential.

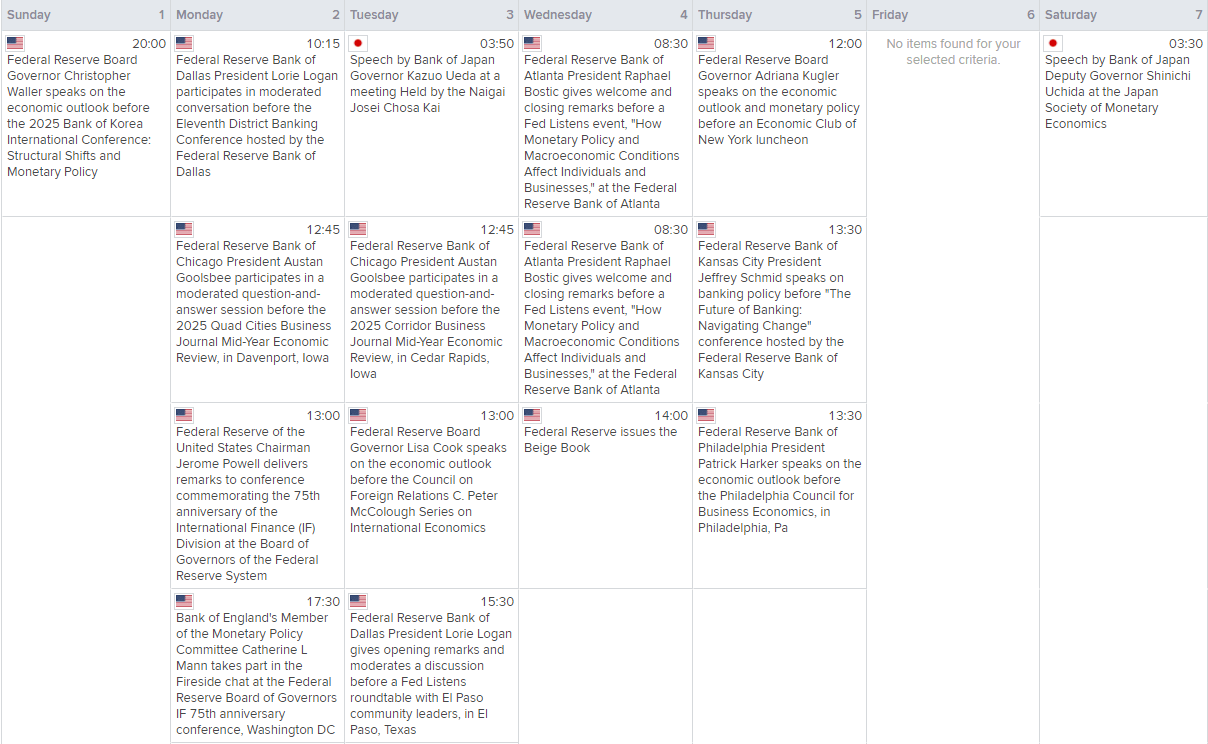

Fedspeak Picks Up Ahead of Blackout

Source: Refinitiv

With the June FOMC meeting approaching, this week is the last chance for Fed speakers to shape expectations before their media blackout kicks in from Thursday. It’s a busy line-up, but whether we see a coordinated move away from the 'patience on policy' stance is debatable—especially with the big data prints coming after the blackout begins. The Fed, like the rest of us, is waiting for clarity on trade policy and fiscal settings.

BoJ Governor Ueda and Deputy Governor Uchida are also scheduled to speak, but with uncertainty still elevated, they too are unlikely to provide firm policy signals.

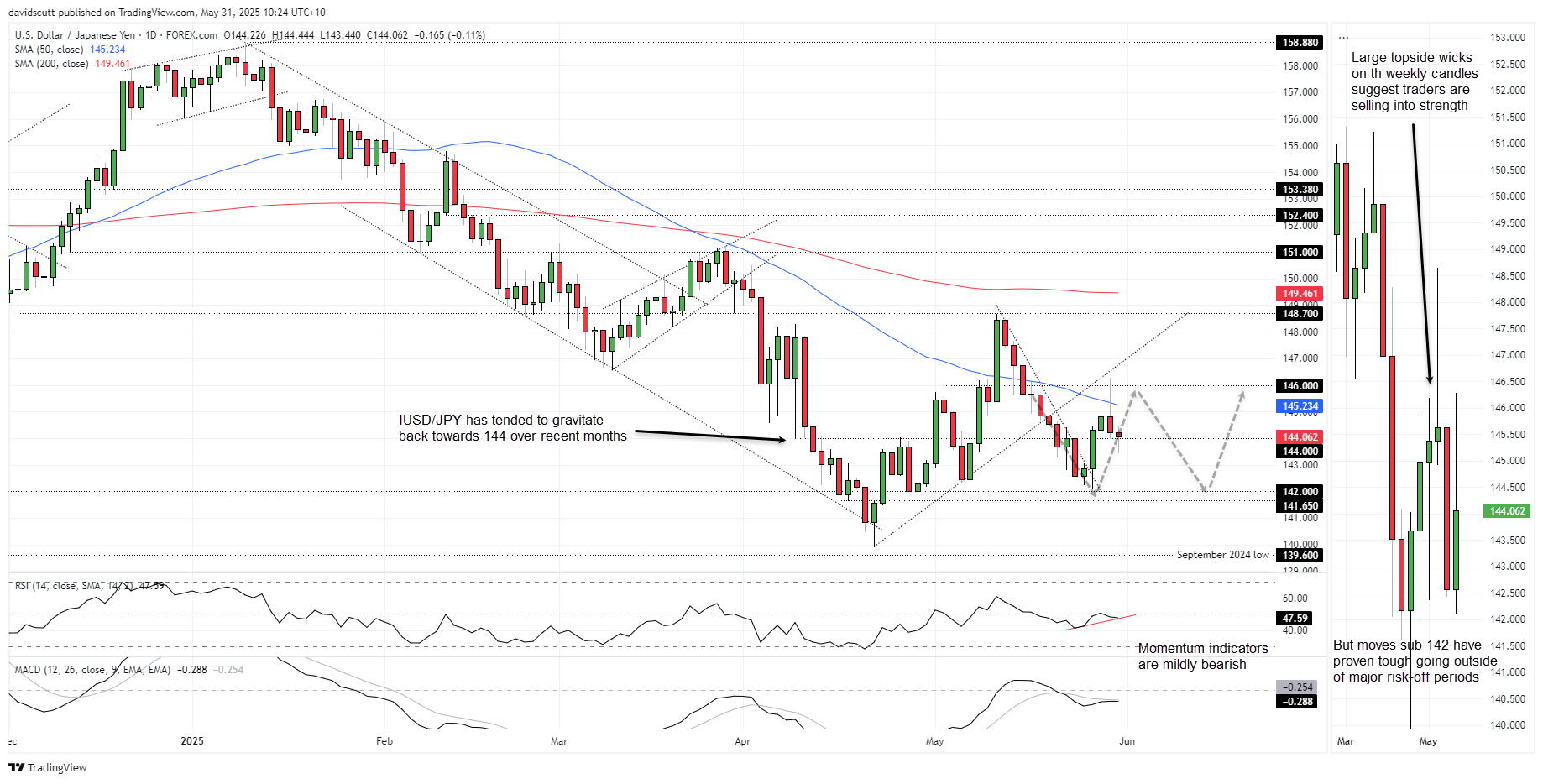

USD/JPY Range Trade Favoured, Mild Bearish Bias

Source: TradingView

Range trade in USD/JPY is favoured ahead of payrolls with bids likely to emerge around 142 with offers kicking in around 146. 144 remains a key level when assessing setups given the sheer amount of work the price has done either side of it in recent months.

Momentum indicators marginally favour downside over upside near-term, with RSI (14) below 50 despite sitting in an uptrend while MACD remains in negative territory.

With the price beneath both the 50 and 200-day moving averages, with the former sloping downwards, the overall bias remains bearish but not massively so. Price signals take precent in this environment.

-- Written by David Scutt

Follow David on Twitter @scutty