USD/JPY Outlook Summary

A solid May payrolls report did just enough to keep the U.S. recessionistas quiet, trimming expectations for Federal Reserve rate cuts and sparking a bullish breakout in USD/JPY. With fresh U.S.-China trade talks scheduled in London, the move may have legs into early next week. However, with key U.S. inflation data looming, the details may well determine whether the rally sinks or swims.

Rate Differentials Reasserting Influence?

For the first time in a while, USD/JPY is beginning to show a positive relationship with interest rate differentials, suggesting its once-primary driver may be reasserting influence. Granted, the correlations—0.43 for two-year yield spreads (blue line) and 0.52 for 10-year differentials (red line) between the U.S. and Japan over the past month—are still well below pre-U.S. Liberation Day levels, but they are strengthening. Interestingly, in outright terms, USD/JPY has shown no meaningful relationship with U.S. 10-year Treasury yields (purple line) over the same period—only with yield spreads.

Source: TradingView

The strengthening link with rate differentials suggests risk appetite’s grip on USD/JPY may be loosening — a view supported by its weakening correlation with risk proxies like the VIX (grey line) and S&P 500 futures (yellow line). However, its safe haven status remains intact, as evidenced by its ongoing strong relationship with the Swiss franc (black line) and gold (green line).

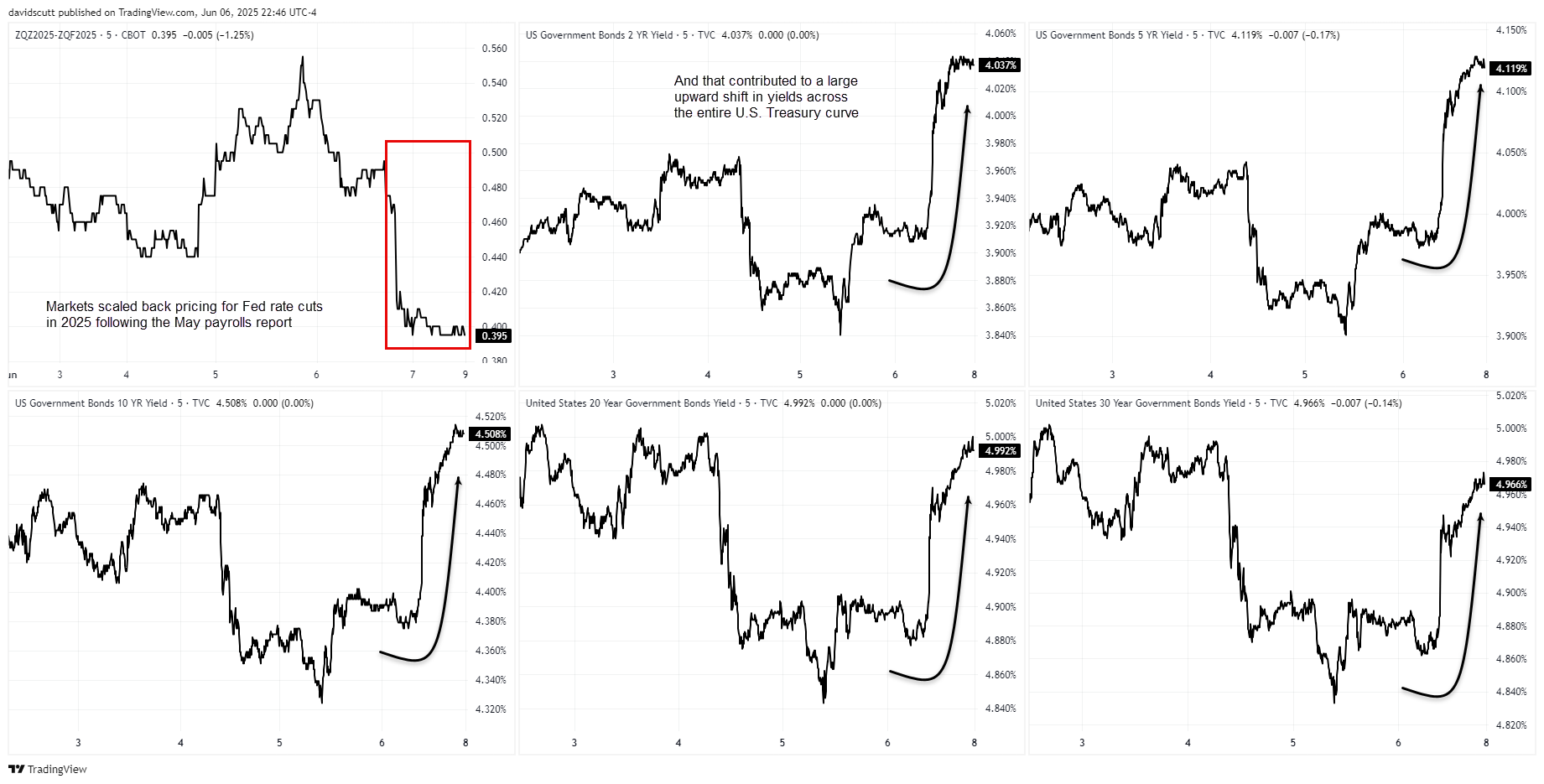

With yield differentials regaining importance, economic data from the U.S. and Japan will carry more weight in assessing USD/JPY directional risks—especially with Fed officials entering a media blackout ahead of the mid-June FOMC meeting. This is evident in the next chart, which shows shifts in the U.S. yield curve over the past week, with the defining move arriving Friday after the May non-farm payrolls report.

Source: TradingView

A slight beat on payrolls growth and an unchanged unemployment rate triggered double-digit yield moves across much of the U.S. curve, including the short end, as markets scaled back expectations for a second Fed rate cut this year. The scale of the moves suggests traders were bracing for a much weaker report. Notably, USD/JPY mirrored the yield rebound and rallied—a departure from earlier in May when the historic yield-dollar relationship broke down. The takeaway: while concerns about the U.S. fiscal outlook persist, near-term considerations for interest rates still influence the dollar—an important nuance.

U.S. Inflation Data Looms Large

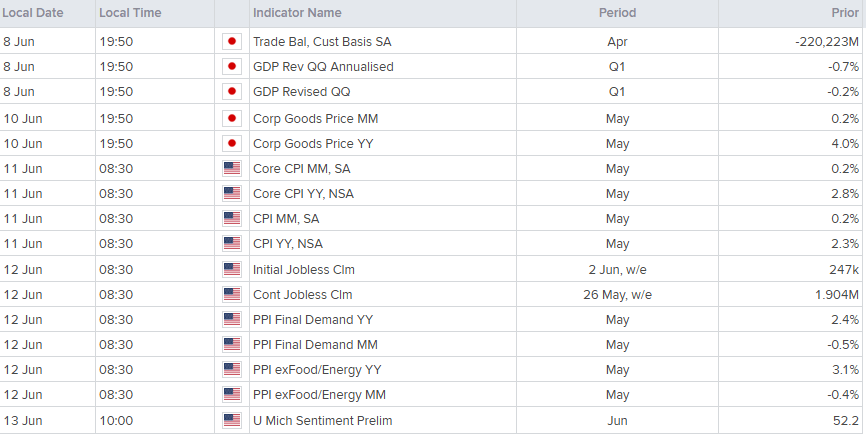

With no Fed speakers until Jerome Powell’s post-FOMC press conference Wednesday week, inflation data and Treasury auctions will join trade headlines as key near-term drivers for USD/JPY.

Source: Refinitiv

Despite suggestions that labor market outcomes now matter more to the Fed than inflation, U.S. CPI days have delivered larger average daily swings in USD/JPY than payrolls reports over the past year—putting CPI front and center for traders this week.

The key core measure is expected to accelerate to 0.3% in May, with higher tariffs beginning to filter through, lifting the year-on-year rate to 2.9%. Unusually, the focus may fall on goods prices rather than services—a departure from recent years.

Beyond CPI, Thursday’s PPI and initial jobless claims reports also have market-moving potential—the former for its influence on the Fed’s preferred inflation gauge, and the latter due to its recent upward trend, hinting at softening labor conditions.

In Japan, Monday’s trade data will dominate headlines, but Wednesday’s producer price inflation report is the only release likely to move markets meaningfully.

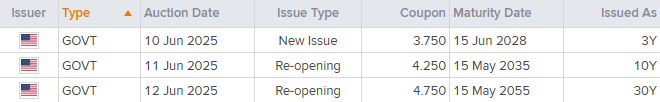

U.S. Treasury Auctions in Focus

Source: Refinitiv

While U.S. fiscal concerns have eased for now, upcoming Treasury auctions of three-, 10-, and 30-year debt could still generate volatility. Recent auctions have been well-supported—including by foreign buyers—but there’s no guarantee that trend will continue. Any signs of weakening demand, especially for long-dated debt, could spark risk aversion and weigh on the dollar.

As for other known risk events, U.S.-China trade talks are set for June 9 in London—another key event for traders. These meetings typically end with upbeat headlines, so a negative outcome would likely deliver the largest market impact. The same applies to any other trade-related developments in the coming week.

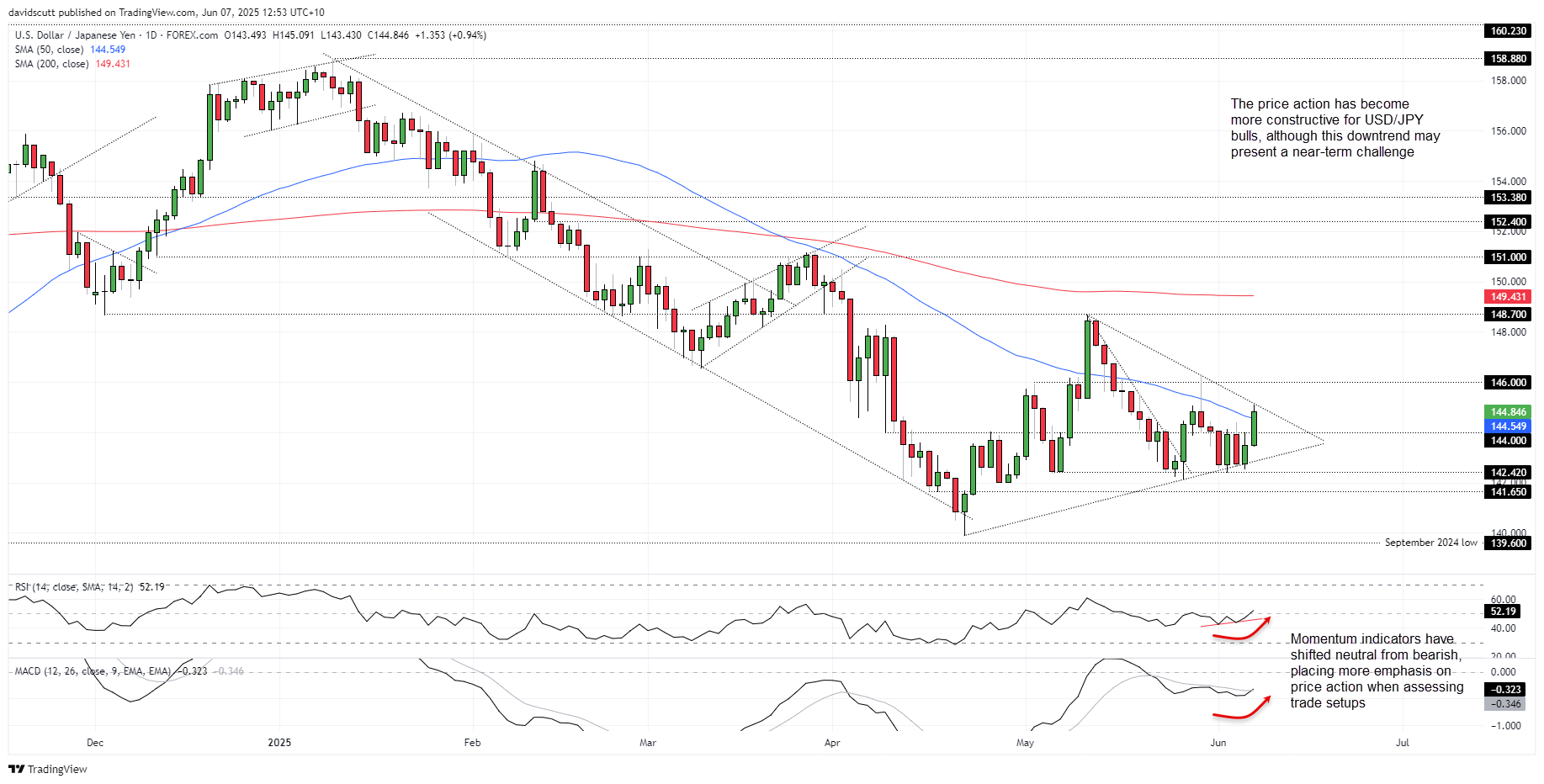

USD/JPY Triangle Test Awaits

Source: TradingView

USD/JPY ended last week on a high, breaking out above resistance at 144.00 after the payrolls report and closing above the 50-day moving average. While both are bullish signals, the rally stalled at trendline resistance from the May swing high. A sustained break above this level may be needed to entice more bulls off the sidelines, potentially setting up a retest of resistance above 146.00. A move beyond that would bring 148.70 into play.

Having been broken on Friday, 144.00 may now act as support. Below that, the uptrend from the April swing lows and the support zone between 142.42 and 141.65 are key levels to watch. With price action forming a symmetrical triangle, any breakout this week could be significant.

Momentum has also shifted from bearish to neutral, with RSI (14) trending higher and back above 50, and MACD crossing the signal line from below—albeit in negative territory. This places greater emphasis on price signals rather than leaning into a fixed bullish or bearish bias when trading the pair.

-- Written by David Scutt

Follow David on Twitter @scutty