Wall Street futures have had an uncharacteristically strong start to the Asian session on Thursday, after President Trump’s tariffs have come to a screeching halt.

A US Federal Court has ruled that President Trump does not have the authority to set global tariffs under the ‘economic emergency legislation’. The U.S. Court of International Trade ruled that President Trump overstepped his constitutional authority by using the IEEPA to impose sweeping tariffs without congressional approval. The court held that such broad executive action infringes upon Congress's exclusive power to regulate foreign commerce.

Naturally this has been seen as good news by investors who remain concerned of the detrimental impact of the US economy from the tariffs. And while it could be argued that the tariffs stoked new trades deal which could go on to benefit the economy, the blocked tariffs removes a lot of uncertainty – something investors love to loathe.

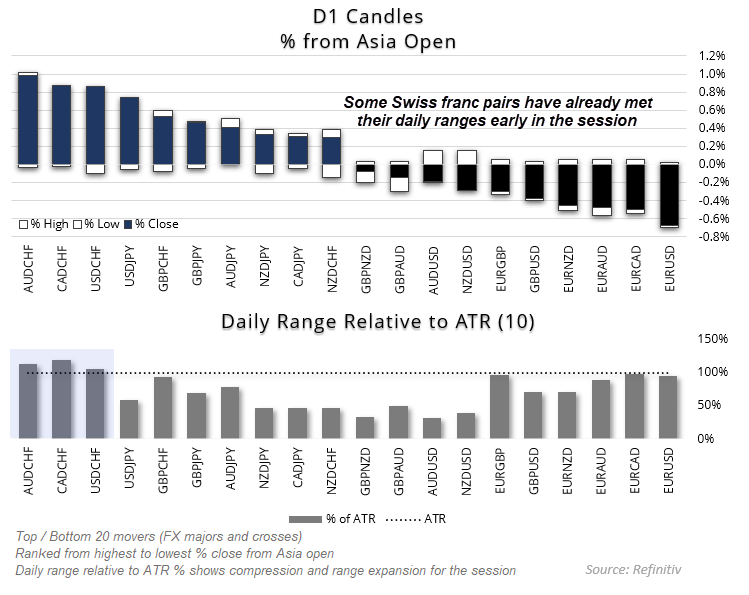

Still, it also seems highly likely that the Supreme court will with in on this one, which makes today’s decision more of a speed bump than a full drawn conclusion. But for now, appetite for risk has perked up and that is sending gold and the Japanese yen lower.

View related analysis:

- Gold at Technical Crossroads Ahead of GDP, PCE; ASX 200 Stalls at Resistance

- Wall Street Futures, ASX 200 Hint at Swing Lows

- Nasdaq 100 Leads Wall Street Higher on Consumer Sentiment Rebound

- USD/JPY Outlook: US Dollar Rises on Trade News, Yen Ignores Hawkish BOJ

Japanese Yen Retreats as Risk Appetite Returns

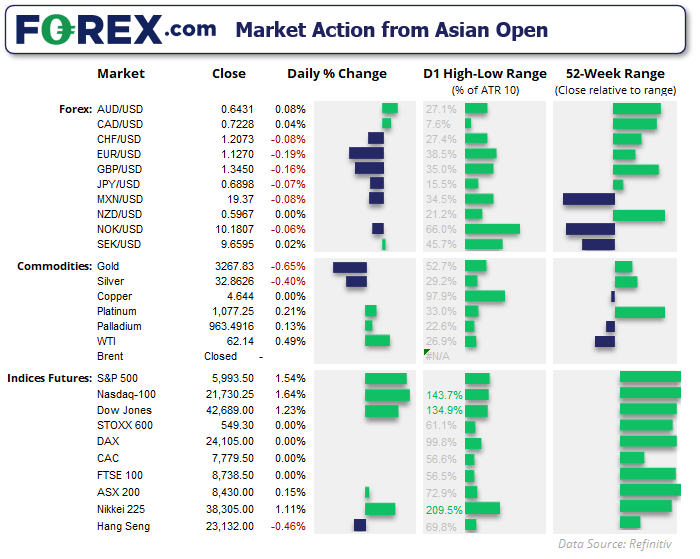

The US dollar is currently the strongest forex major of the session, as bears continue to cover. As noted in my weekly COT report, traders effectively reduced their net short USD futures exposure by $5 billion, and after an extended move lower, it seems there’s more short covering to go.

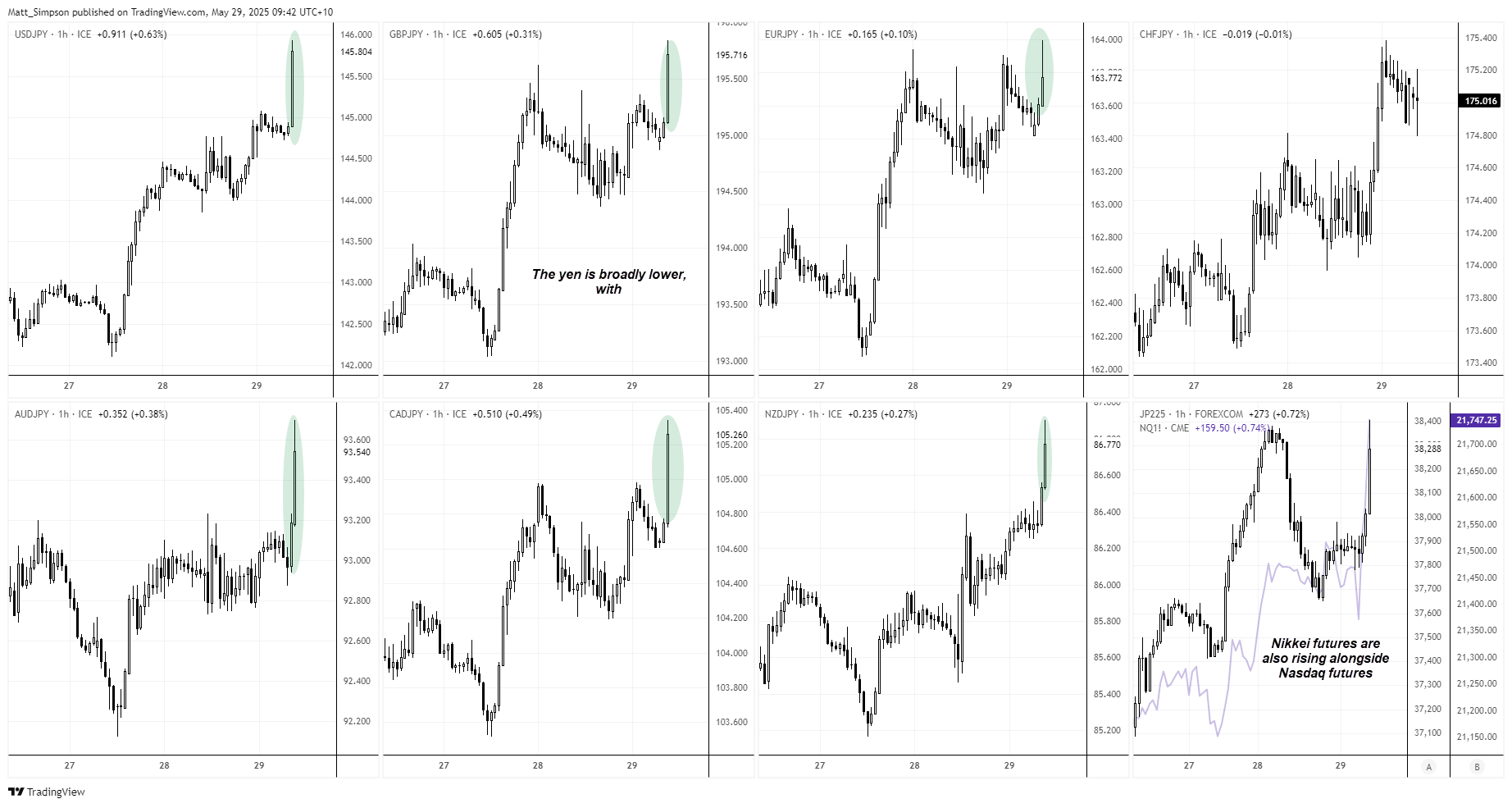

- The Japanese yen is broadly lower, with USD/JPY rising close to 100 pips after the news dropped.

- Nikkei 225 futures are rising, driven by a combination of higher Nasdaq 100 futures and a weaker Japanese yen.

- Commodity FX are also tracking Wall Street higher, with CAD/JPY up 0.5% and AUD/JPY up 0.4%.

- NZD/JPY has gained the most ground since Tuesday’s low, thanks to bets that the Reserve Bank of New Zealand (RBNZ) is nearing the end of its easing cycle.

- GBP/JPY has broken to a new cycle high.

Wall Street Futures Surge as US Court Blocks Trump's Tariffs

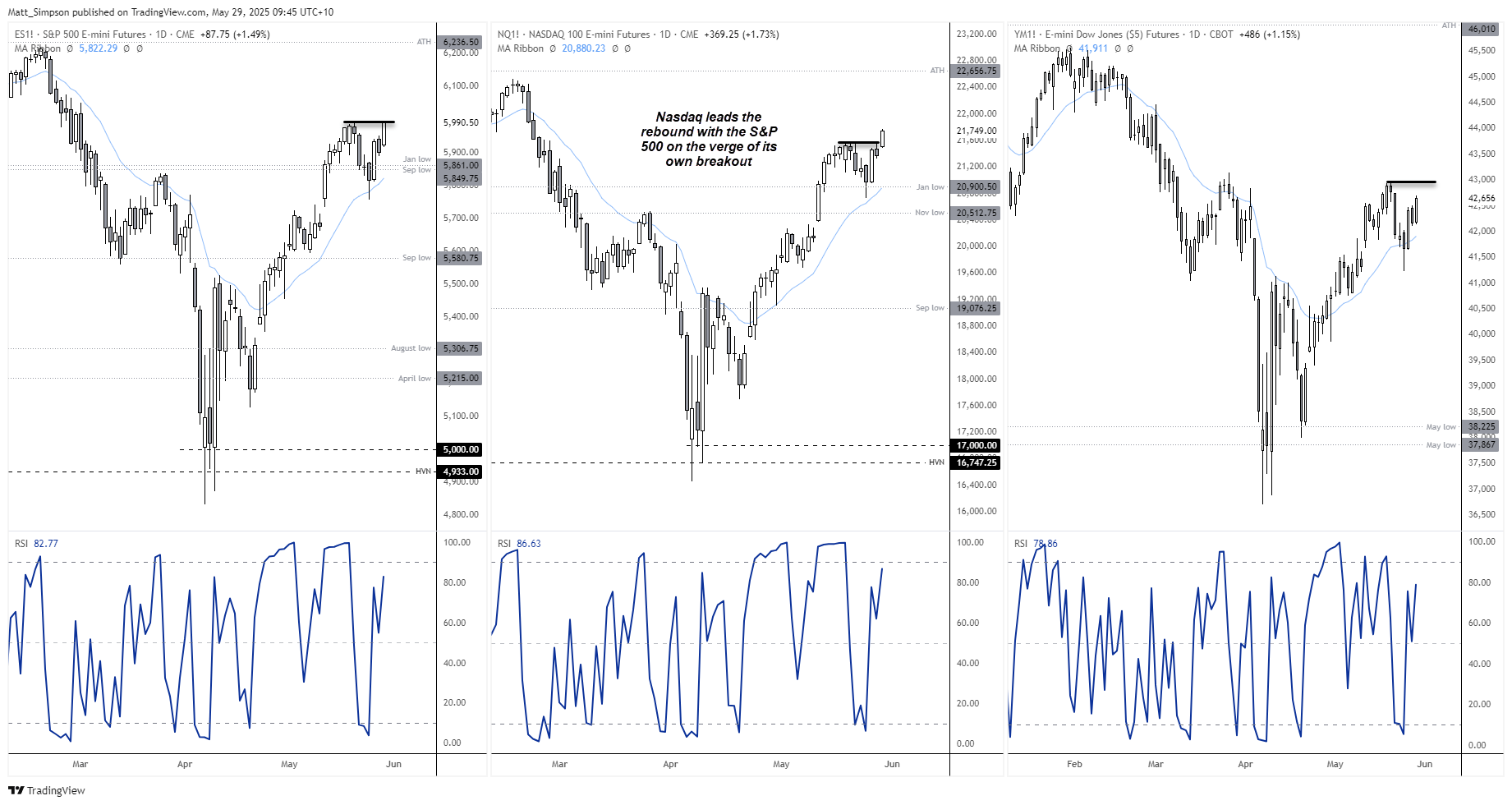

The Nasdaq 100 has led Wall Street futures higher, with the Nasdaq 100 breaking above last week’s high and S&P 500 futures on the cusp of its own breakout. The Dow Jones is also higher but continues to lag its Wall Street peers

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge