Japanese Yen Talking Points:

- The FOMC rate decision on Wednesday is a big item for the Yen, as USD/JPY has continued to digest following buyer support at 140.00 and then 142.50.

- EUR/JPY is in the midst of a strong breakout and it looks like there’s little fear of carry unwind there, driven by lower long-term Japanese rates.

- The big question now is whether the Fed begins to lay the groundwork for rate cuts later this year. Inflation can justify that argument, as both PCE and Core PCE have been below the Fed’s projections. But the unemployment rate has held up better than they expected, and given the possible inflationary impact of tariffs, there could be rationale for a more-hawkish Fed at this quarterly meeting.

- I’ll be looking at these pairs in the pre-FOMC webinar tomorrow, and you’re welcome to join. Click here to register.

The Fed leaned into rate cuts aggressively last year and that had a large impact on global markets. Ahead of the cuts, USD/JPY began to unwind as traders removed hedges that were driven by the rate differentials between Japan and the U.S. The Fed cut rates by 50 bps in September but interestingly, USD/JPY held a higher-low above the 140.00 level in what appeared to be an oversold short-side theme, at the time.

The Fed cut twice more that year but USD continued to rally anyways, bringing USD/JPY along for the ride. The drive at that point was more forward-looking in nature, as the Trump election ushered in another wave of USD and US equity strength, but there was another component at work as USD/JPY sellers took a step back from the ledge as carry unwind themes quieted.

Given that USD/JPY remains about 40% above early-2021 values, I think it’s reasonable to expect that there are still some hedges in-place from that carry trade. As Japanese rates shot higher earlier in the year and as expectations remained for the Fed to cut, both USD/JPY and stocks hurried lower. More recently, the sell-off in Japanese bonds has slowed, allowing for long-term Japanese yields to soften and that’s helped JPY bears to get back in the driver’s seat in EUR/JPY and GBP/JPY.

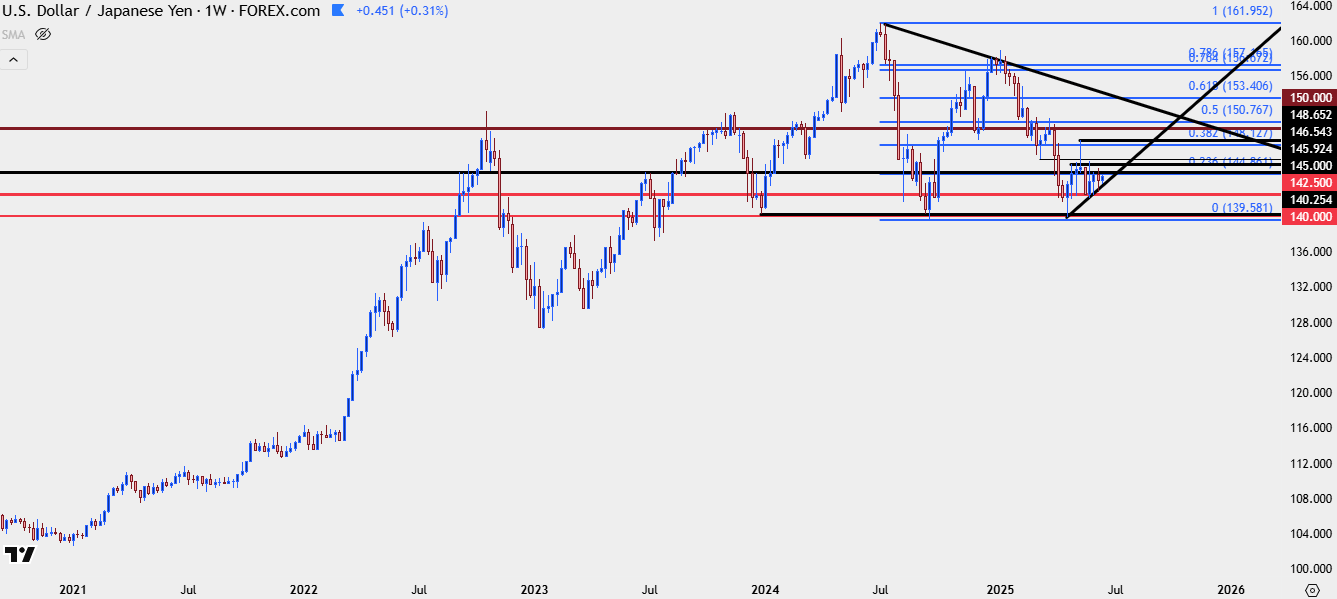

USD/JPY Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

In USD/JPY, however, an impasse remains as markets are still expecting the Fed to cut by 50 bps or more into the end of the year. And the reason for that draws back to the FOMC’s last update of projections and guidance at the March meeting, when they forecasted a finish to the year between 3.75 and 4.0%.

Since then, inflation has deteriorated and PCE and Core PCE are printing below what the Fed was looking for. This would normally justify weaker policy from the FOMC and we saw another illustration of this expectation last week when USD sold off on the back of softer-than-expected CPI numbers.

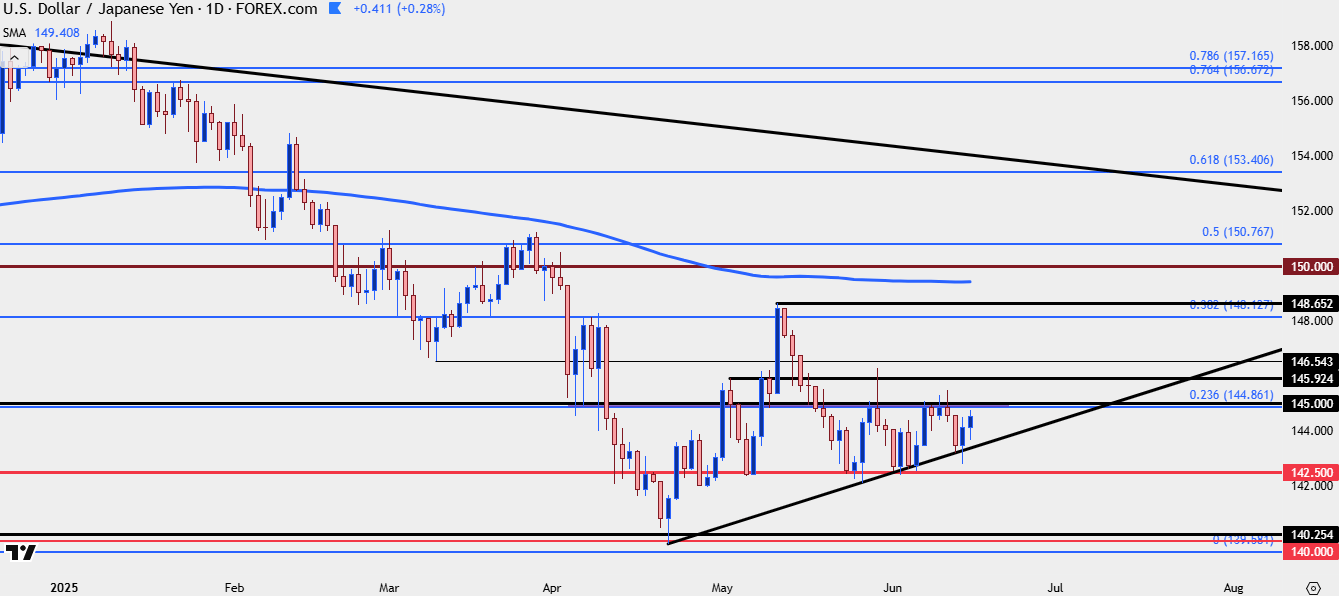

USD/JPY has held up relatively well as higher-lows remain from the 140.00 test in April and the 142.50 test in May. This sets up a short-term ascending triangle with resistance at the 145.00 handle.

If we do see the Fed push expectations for rate cuts this year towards the 4.00-4.25% range, then there could be justification for USD shorts to close and that can add upward pressure on USD/JPY. From the daily chart, the support structure is fairly clear with 140.00 and 142.50 both standing out as key levels.

The 145.00 level is the price that bulls haven’t been able to leave behind of late with multiple intra-day reversals around that level, and if they can finally push above, it’s 145.92 and 146.54 sitting overhead, followed by the 148.13-148.65 zone that turned around the rally in May.

USD/JPY Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

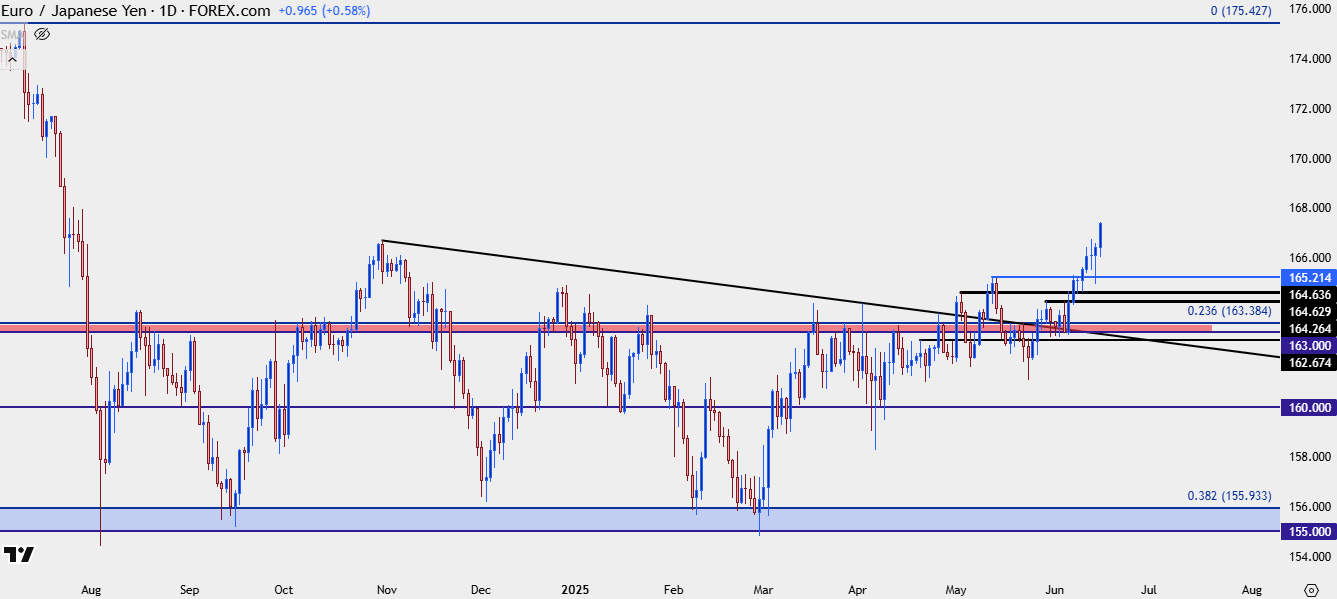

EUR/JPY

There seems to be little fear of carry unwind in EUR/JPY as the pair continues to jump to fresh nine-month highs. I had looked at the pair in an inverse head and shoulders-like formation last week, and that’s led to breakout in a big way. Previously, I was looking to EUR/JPY for Yen-strength scenarios but given the pace of price, that no longer seems prudent. Instead, this is a bullish momentum story although I do think there still could be a case made for similar themes of Yen-weakness in GBP/JPY.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

GBP/JPY

At the time of production of the above video, GBP/JPY was in the process of testing above resistance in an ascending triangle formation. Since then bulls have made a larger push and price is now sitting at a fresh six-month high.

Last week saw defense of a key zone from 193.61-193.75, and the door remains open for bullish continuation scenarios. The next resistance zone on my radar is the 198.08 level that makes up the top of the gap from back in 2008.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist