Japanese Yen Talking Points:

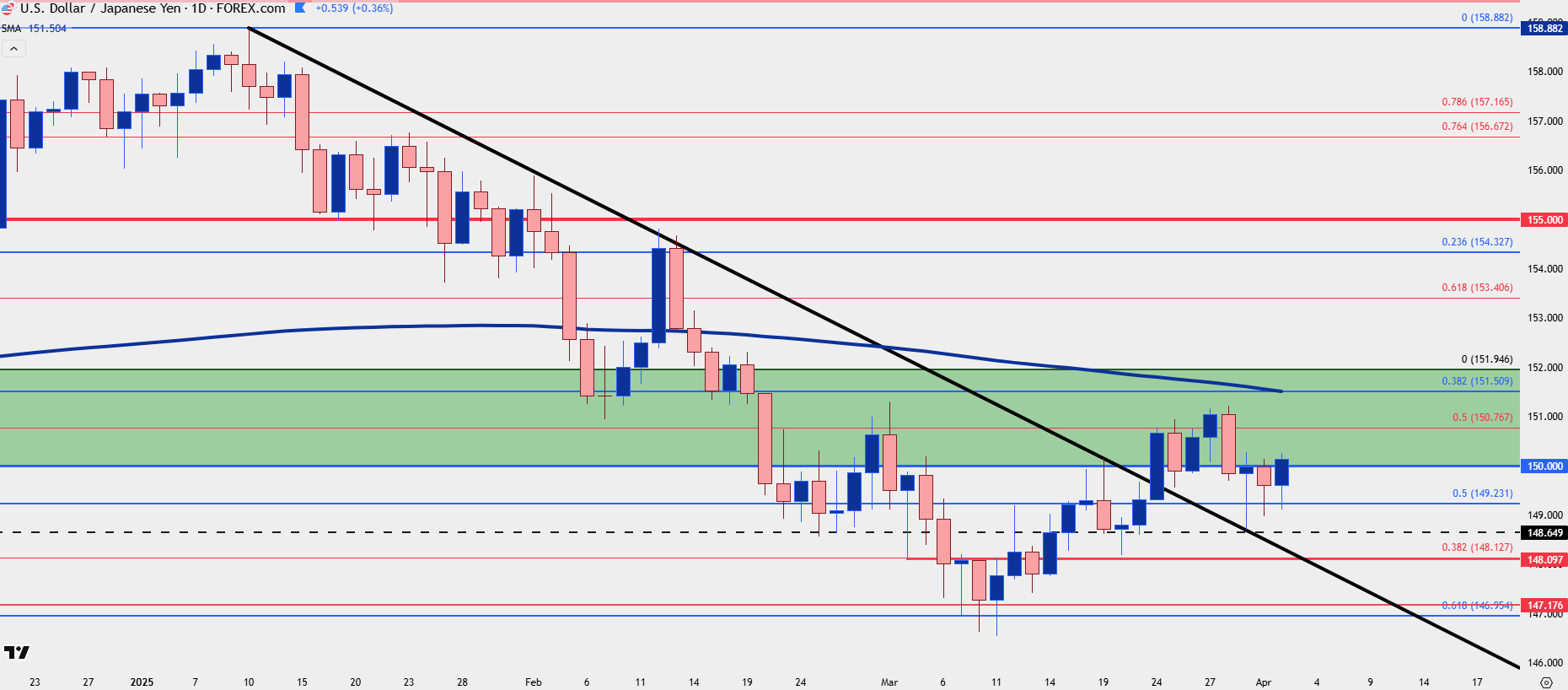

- USD/JPY bears had an open door on Monday of this week, but they failed to walk through it, now bulls are threatening a stronger push after higher-lows have developed over the past two days going along with defense of the 149.23 Fibonacci level.

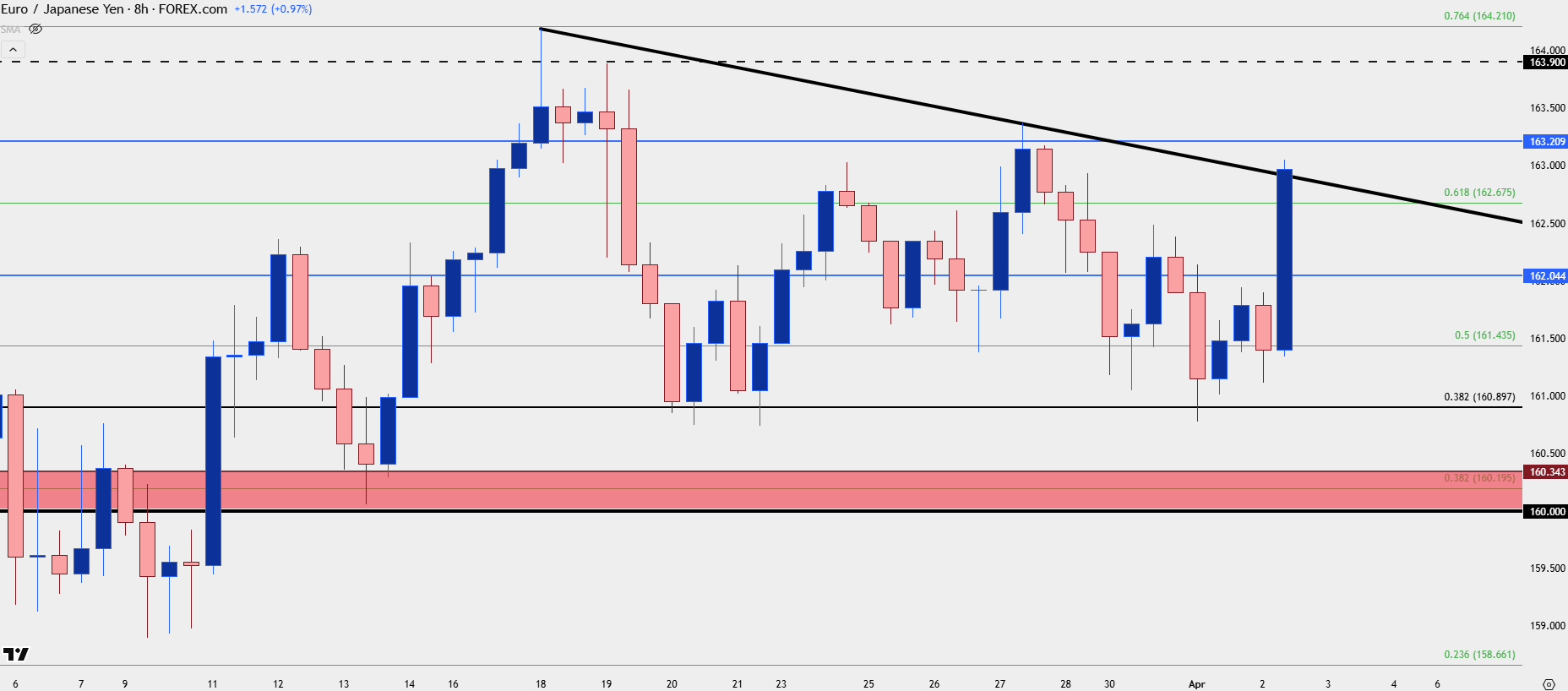

- EUR/JPY could be more attractive for Yen-bulls or those looking for Yen-strength to come into play, as the pair is currently testing a trendline taken from recent higher-lows.

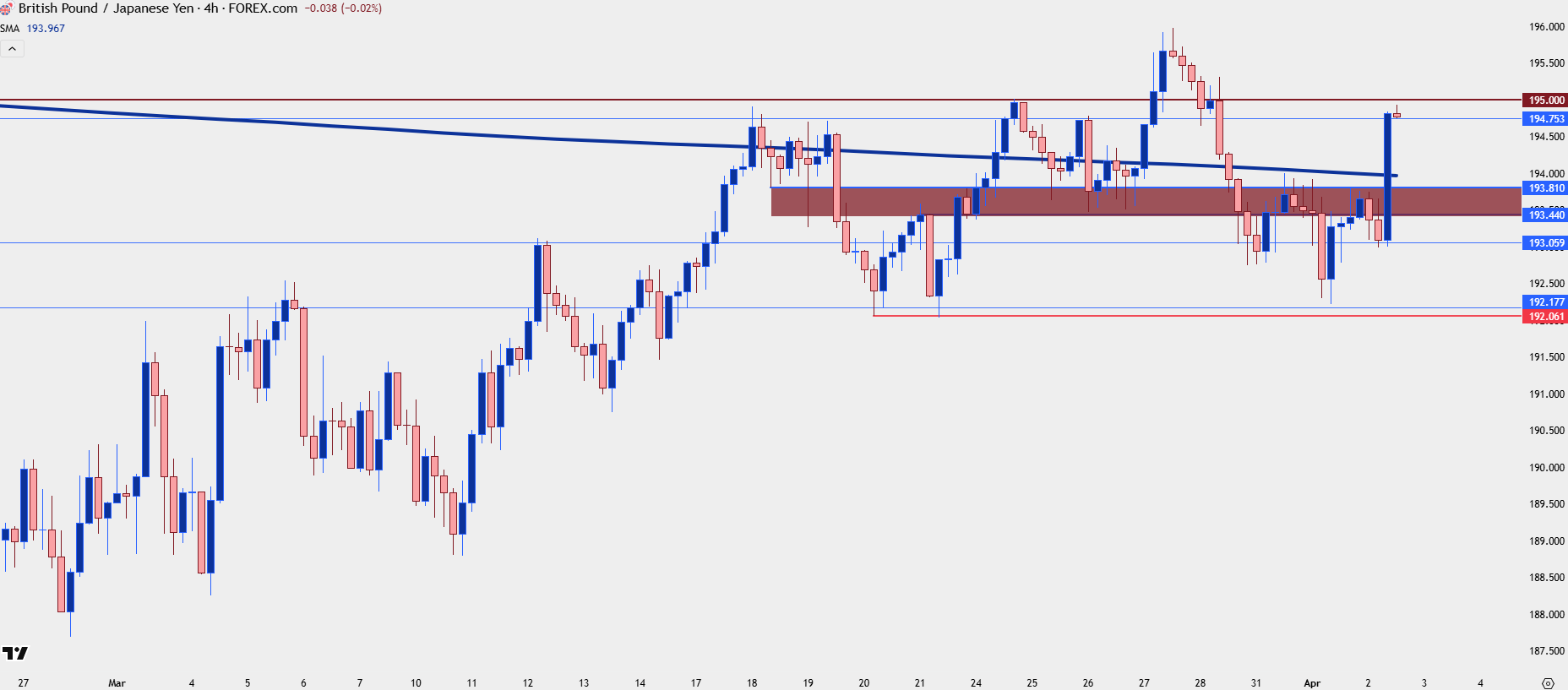

- I’m still of the mind that GBP/JPY is more attractive for Yen-weakness setups. The challenge there is chasing near the 195.00 level that bulls haven’t yet been able to break, and that opens the door for pullback potential to a familiar area on the chart.

USD/JPY has continued to brew bear traps after sellers failed to run with another open door to fresh lows to start this week. Last Friday showed a bearish engulfing formation in USD/JPY and initially, sellers were able to run with that after the weekly open, pushing back-below the 150.00 level. The pair bottomed around the Euro open on Monday morning and by the time the U.S. opened for business USD/JPY had already pushed back-above the 149.23 level.

From the daily chart, the importance of that 150.00 level shows prominently as that price helped to hold the highs over the past two days, with today showing a breach of that price following a second-higher low off of 149.23. The next resistance level above is the same that was in-play for all five days of last week at 150.77, after which 151.51 comes into the picture.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

EUR/JPY

For Yen-strength, EUR/JPY could still remain as a more enticing venue. There was a hold of support at 160.90 earlier this week, the same support that set the lows in the second-half of March. Like the Yen weakness showing elsewhere EUR/JPY has bounced from that test and is now testing a trendline as taken from the lower-highs that developed last month, and above that is another spot of possible resistance at the familiar 163.21 level that held the highs last week.

For supports, 162.04 sets up before the 160.90 level, and the 160 big figure remains a key spot, which I’ve spanned up to 160.34 to create a deeper support zone.

EUR/JPY Eight-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

GBP/JPY

As covered in the webinar yesterday I still prefer GBP strength to bullish potential in the Euro, and that can show against the Yen as well as the USD. In GBP/JPY, the pair hasn’t yet been able to show much above the 195.00 level. From the four-hour chart below, there’s a zone of interest that plots from around 193.44 to 193.81, and this is the area that could be tracked for higher-low support potential in bullish continuation approaches.

GBP/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

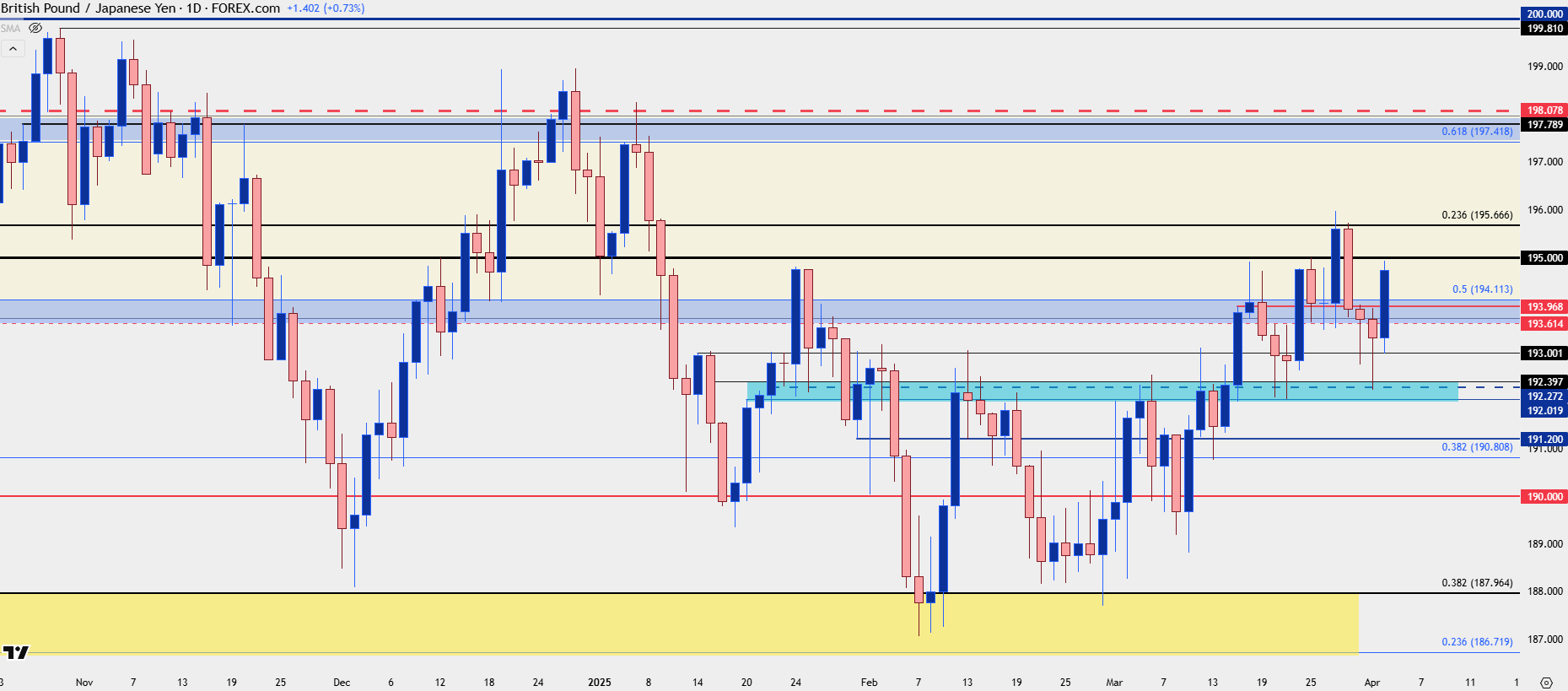

Chart prepared by James Stanley; data derived from Tradingview

The daily chart below was shared in my last Yen Technical Analysis article as the four-hour version, and I wanted to highlight this as there’s some confluence for support with the above zone marked in red. Notably, the same support from 192.02-192.40 held the lows after the recent pullback. The longer-term gap that I spoke of last week remains in-play and 193.61 is the bottom of that zone, which remains key support potential in GBP/JPY.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist