View related analysis:

- USD/JPY Drops Before FOMC as Taiwan Dollar Surge Lifts Haven Flows

- ASX 200 Slips Amid Cautious Sentiment Ahead of Key US Data

- AUD/USD Weekly Outlook: Yuan Correlation Supports Aussie Strength

- Gold Rebounds, Crude Oil Tests Support as Markets Eye Fed, Trade Talks

No sooner had my early-morning article gone to press risk appetite received a healthy bump, thanks to headlines that US and Chinese officials are set to hold talks on Saturday and China are to release fresh stimulus.

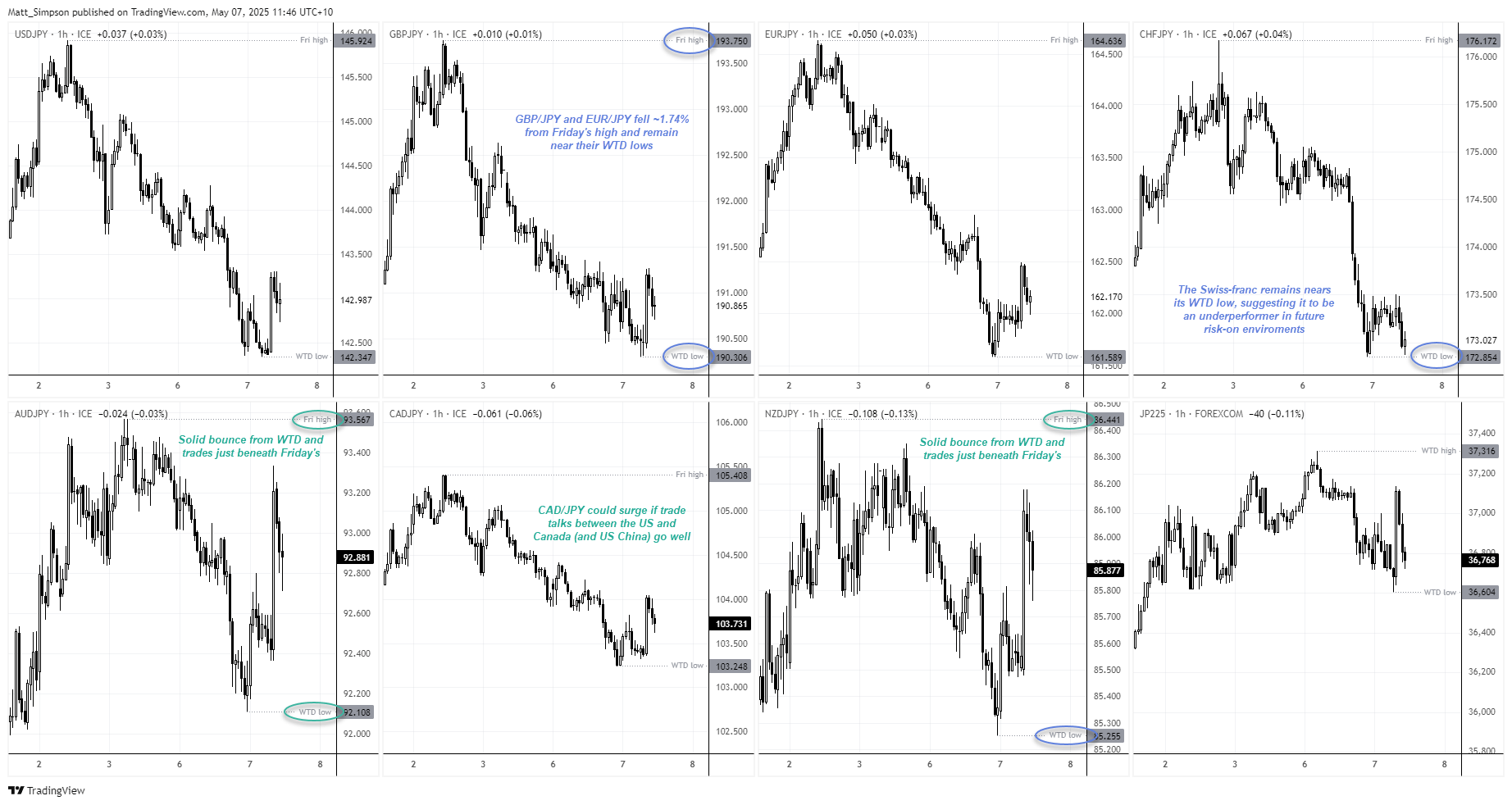

Wall Street futures rose around 0.8–0.9% in early Asian trade—an unusually high level of volatility for the S&P 500 and Nasdaq during these hours. The Japanese yen (JPY) weakened across the board, with the Australian dollar taking the most advantage with AUD/JPY rising nearly 0.9% in the first hours trade. And that provides a strong clue to the potential outperformer, should US -China trade talks end well.

Fed Likely to Stay Quiet Ahead of Trade Talks; Weekend Gap Risks Build

Trade negotiations between the US and China are the clear focal point this weekend, and they likely give the Federal Reserve even more reason to avoid offering forward guidance when it inevitably holds interest rates later today.

With sentiment hanging in the balance, markets are increasingly vulnerable to weekend gaps. Even the slightest hint of constructive dialogue between the US and China could boost risk appetite—pushing Wall Street indices and the Australian dollar higher, while weighing on safe havens like the Japanese yen (JPY) and Swiss franc (CHF).

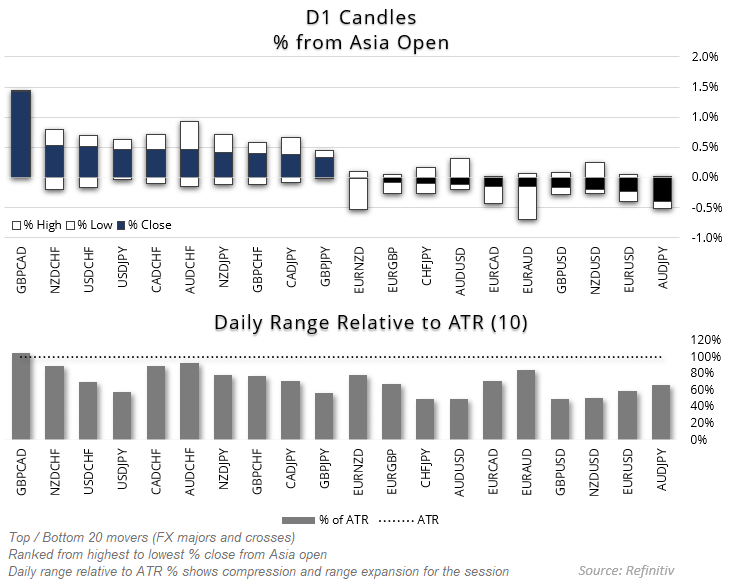

Japanese Yen Pairs: 1-hour Chart

The 1-hour chart clearly highlights the surge in volatility following headlines surrounding US-China trade talks, offering a useful road map for how markets might respond to further constructive developments this week or over the weekend.

AUD/JPY, NZD/JPY: Risk Currencies Lead the Charge

Among the major risk-sensitive currencies, the Australian dollar (AUD) took the lead, with AUD/JPY rising 0.85% in the first hour of trade. This move outpaced NZD/JPY (+0.64%) and CAD/JPY (+0.62%), underscoring AUD’s heightened sensitivity to trade optimism.

Technically, AUD/JPY and NZD/JPY also display more bullish trend structures compared to CAD/JPY. However, the Canadian dollar (CAD) could gain momentum if dialogue between Canada’s Prime Minister Carney and US President Trump turns more constructive, potentially positioning CAD/JPY to play catch-up.

GBP/JPY and EUR/JPY Lag as Yen Strengthens

In contrast, the British pound (GBP) and euro (EUR) have underperformed against a resurgent Japanese yen (JPY) this week. Both GBP/JPY and EUR/JPY have fallen approximately -1.7% from Friday’s highs and remain near their week-to-date lows. This reflects yen strength as risk appetite remains uneven, with safe-haven flows favouring JPY over lower-yielding European currencies.

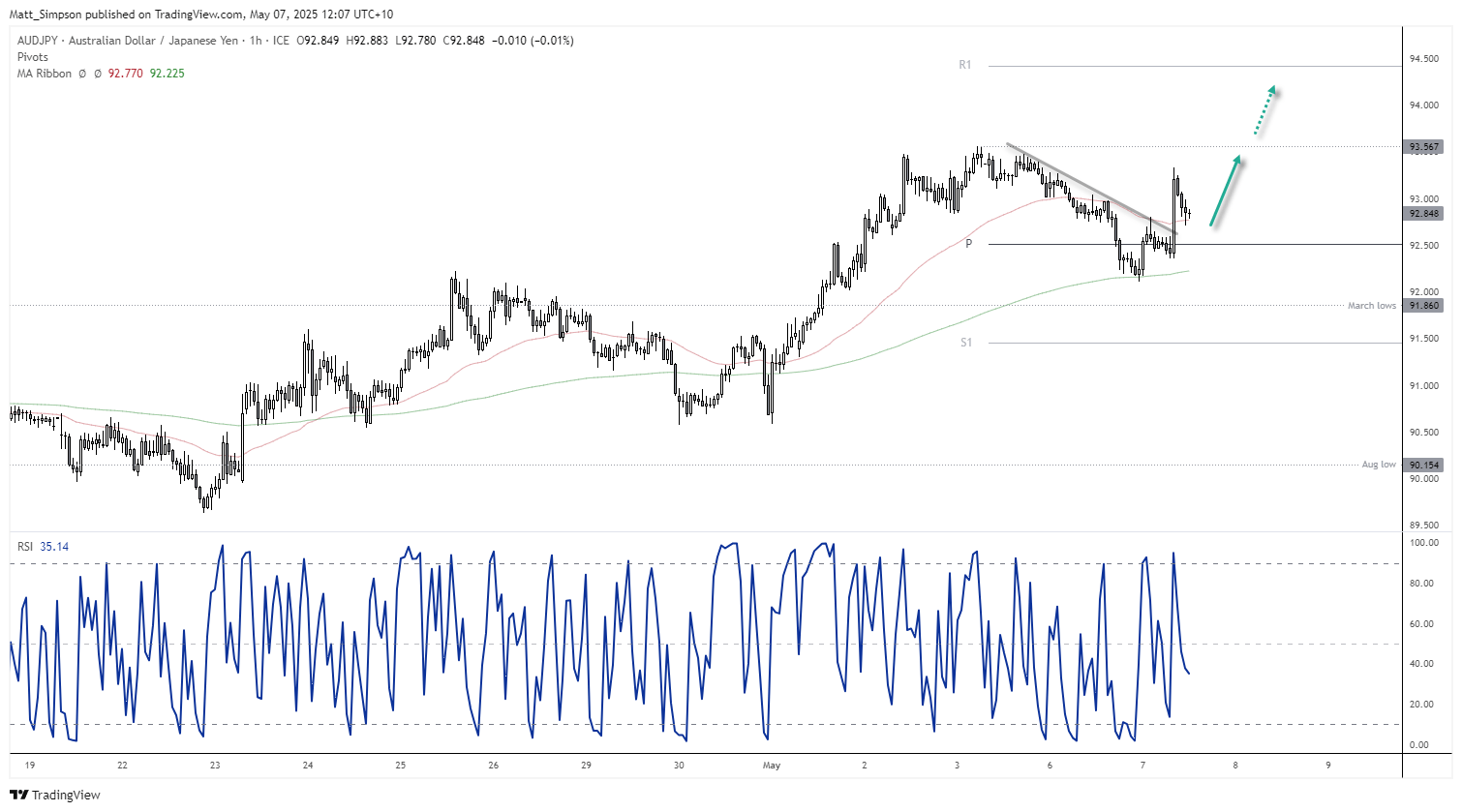

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

The Australian dollar has posted a near 9% rally from its April low to last week’s high, and bullish momentum has perked up on US-China headlines. And it is reasonable to expect a continuation higher should talks bear fruit. There is no obvious resistance until we approach the March and April highs, just below the 96 handle. And the daily RSI (14) is trending higher to confirm the move.

The 50-day SMA is supporting today’s trade, though should AUD/JPY dip beneath it then bulls may reconsider long setups around the March low (91.86) or monthly pivot point near the 91 handle.

AUD/JPY Technical Analysis: 1-Hour Chart

The 200-hour average is providing support for AUD/USD. And while prices have retraced against their early-Asia rally, the move lower appears to be corrective. And that suggests another crack at the highs around 93.50, a break above which brings the 94 handle and weekly R1 pivot into focus (94.40).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge