View related analysis:

- If Consumers Don’t Consume, a Recession Could be Presumed

- Nasdaq 100, S&P 500 Feel the Force of Trump’s Tariffs, ASX to Open Lower

- Japanese yen broadly lower, USD, risk bounces amid Trump-tariff relief

- EUR/USD bears short-covered at fastest pace in 5 years - COT Report

- AUD/USD Weekly Outlook: AU inflation, US Core PCE on Tap

The Japanese yen was the weakest currency on Thursday, which saw GBP/JPY breakout and tap 196 for the first time since January, AUD/JPY rise to a 7-day high and EUR/JPY a 6-day high. Yet this was not a risk-on move. Instead, traders are lowering their expectations of a hawkish Bank of Japan (BOJ) in light of Trump’s tariffs, on bets it will weaken their economy.

- CHF/JPY closed above its 200-day EMA and a double top pattern to suggest bullish trend continuation.

- EUR/JPY rallied from its 200-day EMA to suggest it wants another crack at breaking above 164

- GBP/JPY was the outperformer as traders are also lowering their expectations of BOE cuts

- Whether USD/JPY can break out above its 200-day EMA and the 152 handle likely requires a soft set of inflation figures from Tokyo and a stronger-than-expected US PCE report today

Economic events in focus (AEDT)

- 10:30 – Tokyo CPI

- 10:50 – BOJ summary of opinions

- 18:00 – UK Q4 GDP, Retail Sales, Trade Balance, Business Investment

- 21:00 – European Sentiment Indicator

- 23:30 – US Core PCE

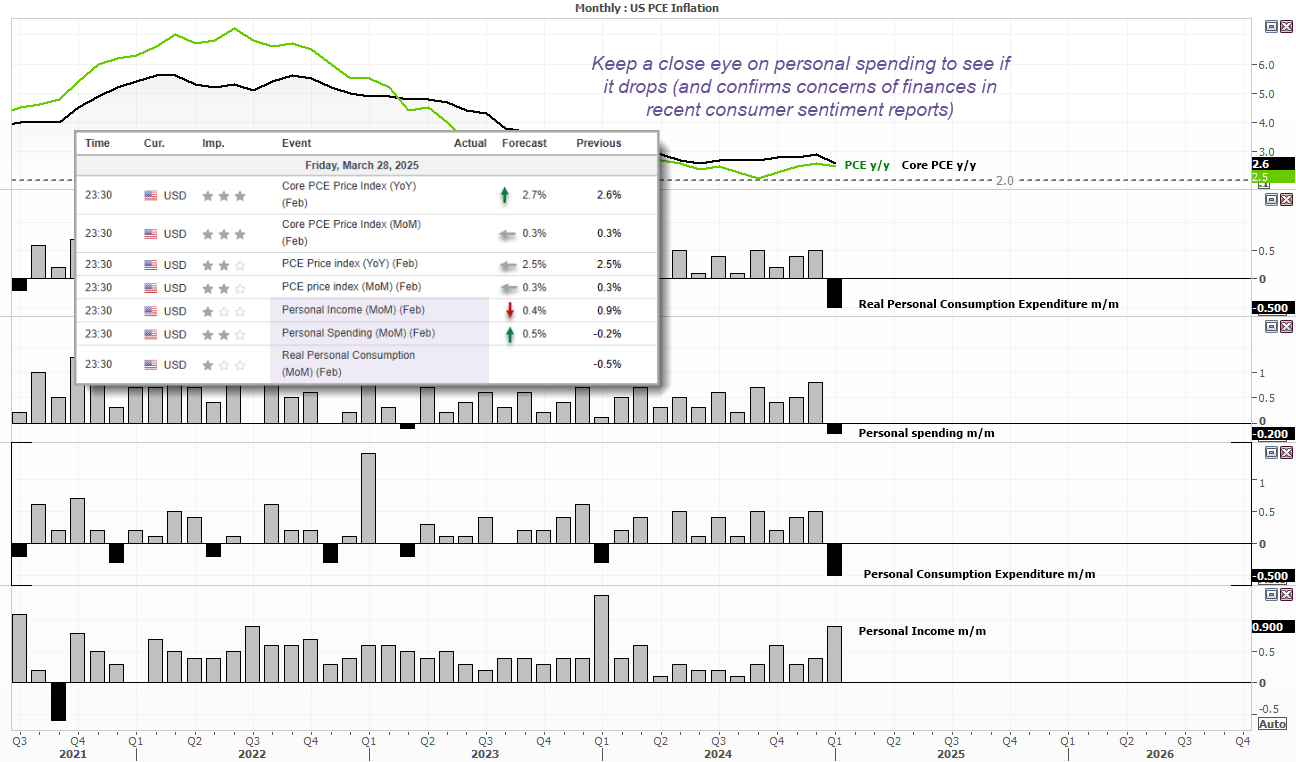

Watch personal spending, income in today’s US PCE report

While today’s PCE inflation report for the US is today’s big calendar event, it remains debatable as to how important the headline figures are, given all attention is firmly on Trump’s tariffs. Unless, of course, we get a large deviation from forecasts and prior readings, in either direction. Yet PCE data is by design less volatile than other inflation readings, and the estimates are also not overly exciting.

Core PCE is expected to rise to 2.7% y/y from 2.6% and remain stable at 0.3%. PCE is expected to remain unchanged at 2.7% y/y and 0.3% m/m.

Personal income and spending could be metrics to watch closely, given the dire US consumer reports. In particular, I noted concerns over future finances, which could put a cap on future spending and therefore growth. Today’s PCE report is an ideal place to look for such cutbacks.

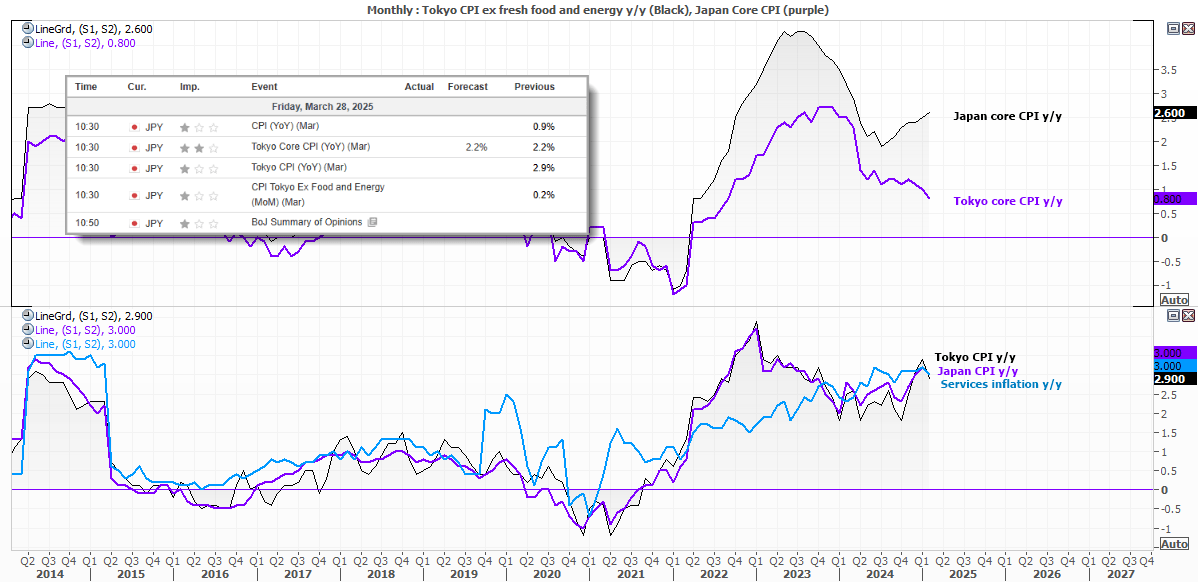

Tokyo’s inflation report up next

There was a close, positive correlation between Tokyo and Japan’s core CPI readings up until Q3 2024, but since then we have seen Japan’s core CPI rise and Tokyo’s decelerate. This is unfortunate because Tokyo’s data is released three weeks prior and was thus a useful leading indicator for the nationwide counterpart.

All is not lost, however, because there is still a strong correlation between Tokyo’s broad CPI, Japan’s nationwide CPI and (as an added bonus) Japan’s services CPI. Given traders are trimming their bets on a hawkish BOJ due to Trump’s tariffs, a weak set of inflation figures today could further weaken the yen and allow EUR/JPY, GBP/JPY, and the like to continue higher. USD/JPY could finally break out if bulls are treated to soft data from Tokyo and a stronger-than-expected PCE report later today.

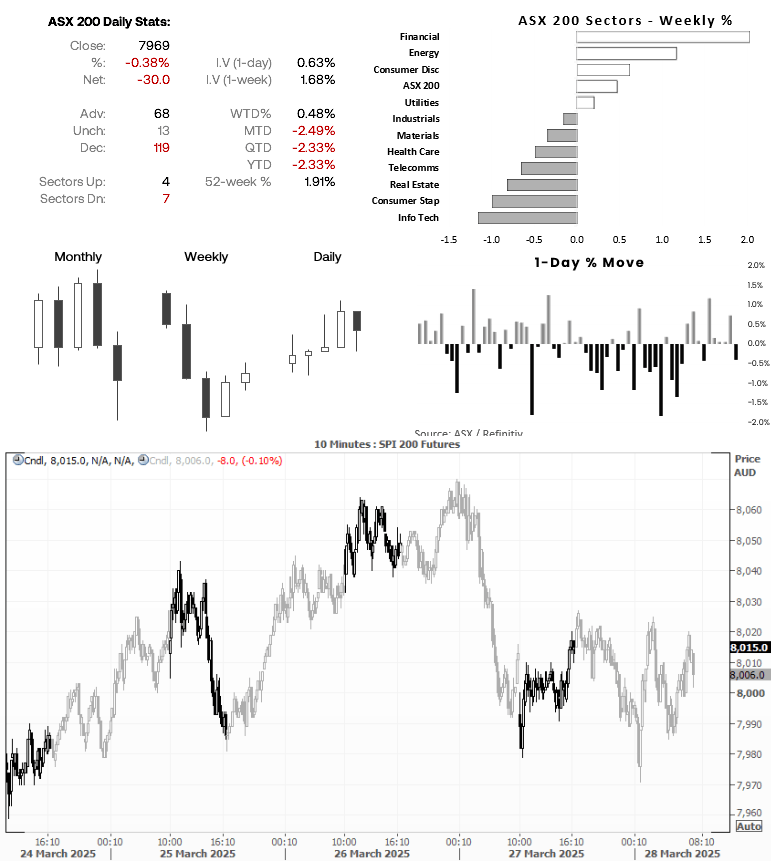

ASX 200 at a glance

- The ASX 200 snapped a 5-day winning streak on Thursday and closed -40 points on the day, after failing to close above 8,000 on Wednesday

- 7 of the ASX 200 sectors declined (led by info tech and consumer staples), 4 advanced (led by financial and energy)

- Wall Street was a touch lower and ASX 200 futures (SPI 200) were down -0.1% overnight, pointing to a flat open for the ASX cash market today.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge