- Nasdaq 100 forecast remains modestly bullish amid renewed trade optimism

- Chipmakers rally as Nvidia surges on easing AI export restrictions

- Technical signals suggest this remains a “buy-the-dip” market

The Nasdaq 100 jumped sharply in early Thursday trading, with futures up more than 1% as trade optimism roared back into the spotlight. Much of the cheer came after Nvidia spiked 3.1% late in the day yesterday before adding 1.70% more in pre-market, dragging the rest of the chip sector higher. It wasn’t just a tech party — Europe’s DAX flirted with its all-time high, Bitcoin sprinted towards the $100K milestone, and safe havens like gold and the yen took a backseat. Even the dollar found some footing, logging a third straight week of modest gains. What’s fuelling the recovery in risk? Trade optimism and a well-timed post from Donald Trump, hinting at a “major” trade deal — most likely with the UK — that could be the first of many. Meanwhile, US-China trade talks are back on the calendar this weekend, sparking hope that negotiations are finally gaining traction. Something big now has to happen, you’d feel, for the Nasdaq 100 forecast to turn bearish again. Otherwise, continued grind higher, with shallow dips is what I envisage will happen in the days and weeks ahead.

Market cheers ‘major’ trade deal hype, but is it just smoke?

Let’s be honest: UK-US trade news isn’t usually a market mover — but this time could be different. Some traders are speculating on whether the US might scrap the 10% baseline tariffs, which have been lingering since the so-called "pause" in trade tensions. Most believe those tariffs will stick, partly because Washington might need the revenue to fund upcoming tax cuts. But if the tariffs do come off? That’s a clear upside surprise for risk assets and a fresh bullish twist in the Nasdaq 100 forecast. That said, the real game-changer would be progress with China. And that’s where it gets murky.

US-China talks: hopeful but likely to drag

It is clear the market is already pricing in some level of trade optimism. Sure, headlines say “substantial tariff reductions” are on the table — but without actual deals (outside of the US-UK) inked, it’s hard to justify further upside. The weekend meeting between the US and China feels more like a diplomatic icebreaker than a breakthrough moment. We could be in for a long, drawn-out negotiation season, which may limit the upside potential for risk assets.

Nvidia leads chipmaker charge – but regulation still lurks

Chip stocks got a boost yesterday thanks to chatter that Trump’s team plans to roll back parts of the Biden-era AI chip restrictions. Nvidia surged over 3%, with traders betting on more upside if these rules are eased further. However, the celebration may be premature. The US is also reportedly drafting new restrictions on overseas chip exports — a sign that regulatory uncertainty hasn’t gone away. For now, the Nvidia stock looks like it wants to head back towards the $1.20s range. Let’s see if it gets there and how it performs.

Technical Nasdaq 100 forecast: Key levels to watch

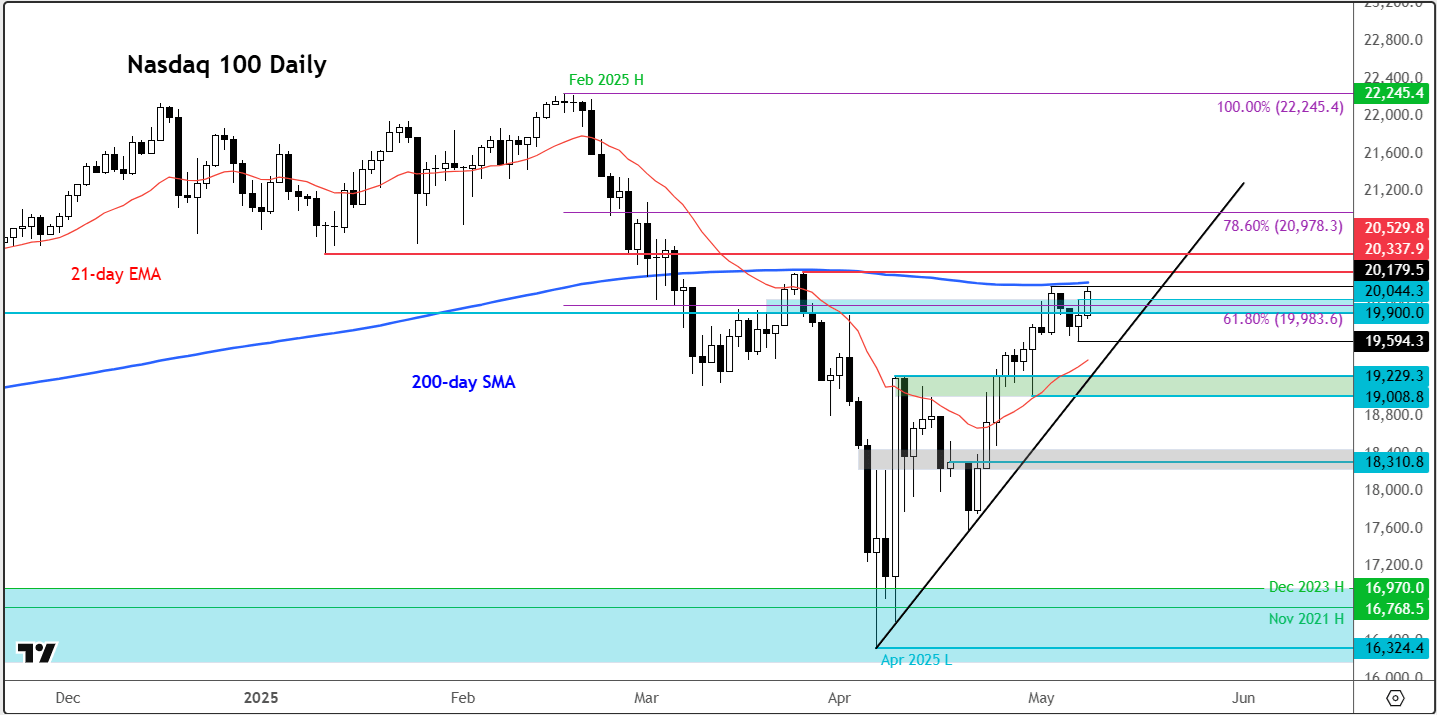

Source: TradingView.com

Technically, the Nasdaq 100 remains in bullish territory. The index has reclaimed its 21-day exponential moving average and continues to build a series of interim higher highs and higher lows. As long as we don’t see a convincing bearish reversal pattern, the dip-buying thesis is intact.

Short-term support Levels

- 20,044 – Yesterday’s high; key short-term support

- 19,000 – former support and resistance level

- 19,594 – Yesterday’s low; a break below here might flag a shift in momentum

Short-term resistance levels

- 20,179 – Most recent high, sitting just below the 200-day average

- 20,338 – Resistance from pre-tariff headlines in April

- 20,529 – Old support; now could act as potential cap

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R