US Consumer Confidence Rebounds Sharply in May

If you need more evidence that consumer sentiment is easily swayed by headlines, look no further than the latest US consumer survey report. Consumer sentiment rebounded 12.3 points in May according to the Conference Board, which is its most aggressive month-over-month rise in more than four years.

Does that mean the economy is saved? Not really. But if consumers are confident about the future then it greatly improves the odds of them spending into that future and supporting the economy to some degree. It won’t fend off any black swan event of course, but for now Wall Street traders are satisfied that the worst of Trump’s trade war is behind us.

View related analysis:

- If Consumers Don’t Consume, a Recession Could be Presumed

- Wall Street Futures, ASX 200 Hint at Swing Lows

- USD/JPY Outlook: US Dollar Rises on Trade News, Yen Ignores Hawkish BOJ

- US Dollar Shorts Trimmed, Gold Bulls Return: COT report

Tariffs and Inflation Concerns Remain Key Drivers for Markets

Looking through the report reveals that tariffs remain a top concern, though there is some hope that trade deals will support the economy. Naturally, inflation and high prices are a major concern but with some acknowledgement that some price pressures are easing. And the internal indices show a general improvement overall, even if it is from a four-year and one-month low. And with Trump delaying his 50% tariffs to the EU until July, that leaves plenty of time for deals to be struck and for sentiment to remain support (unless we’re hit with another slew of unexpected policy changes).

- A slight improvement of current business conditions: 21.9% said ‘good’ (up from 19.2% in April), 14% said ‘bad’ (down from 16.3% in April)

- Views of current labour market conditions weakened in May: 18.6% said jobs were ‘hard to get’ (up from 17.5%) though 31.8% said ‘plentiful’ (up from 31.2%)

- Consumers were less pessimistic about future business conditions: 19.7% expect them to improve (up from 15.9%), 36.7% expect conditions to worsen (down from 34.9%)

- The outlook for the labour market was less negative: 19.2% expect more jobs to become available (up from 13.9%) and fewer anticipated jobs fell to 26.6% from 32.4%

- Income prospects brightened: 18% expect incomes to rise (up from 15.9%), 13.8% expect them to decrease (down from 17.7%)

Focus Shifts to US GDP and PCE Inflation Data

Attention now shifts to US GDP and the PCE price index report later this week. Though it will be the monthly inflation data that is the main event. Keep a close eye on 'super core' PCE inflation in this week's report. Because it spikes higher like it in April, it will exacerbate fears of stagflation which could spell more trouble for the dollar.

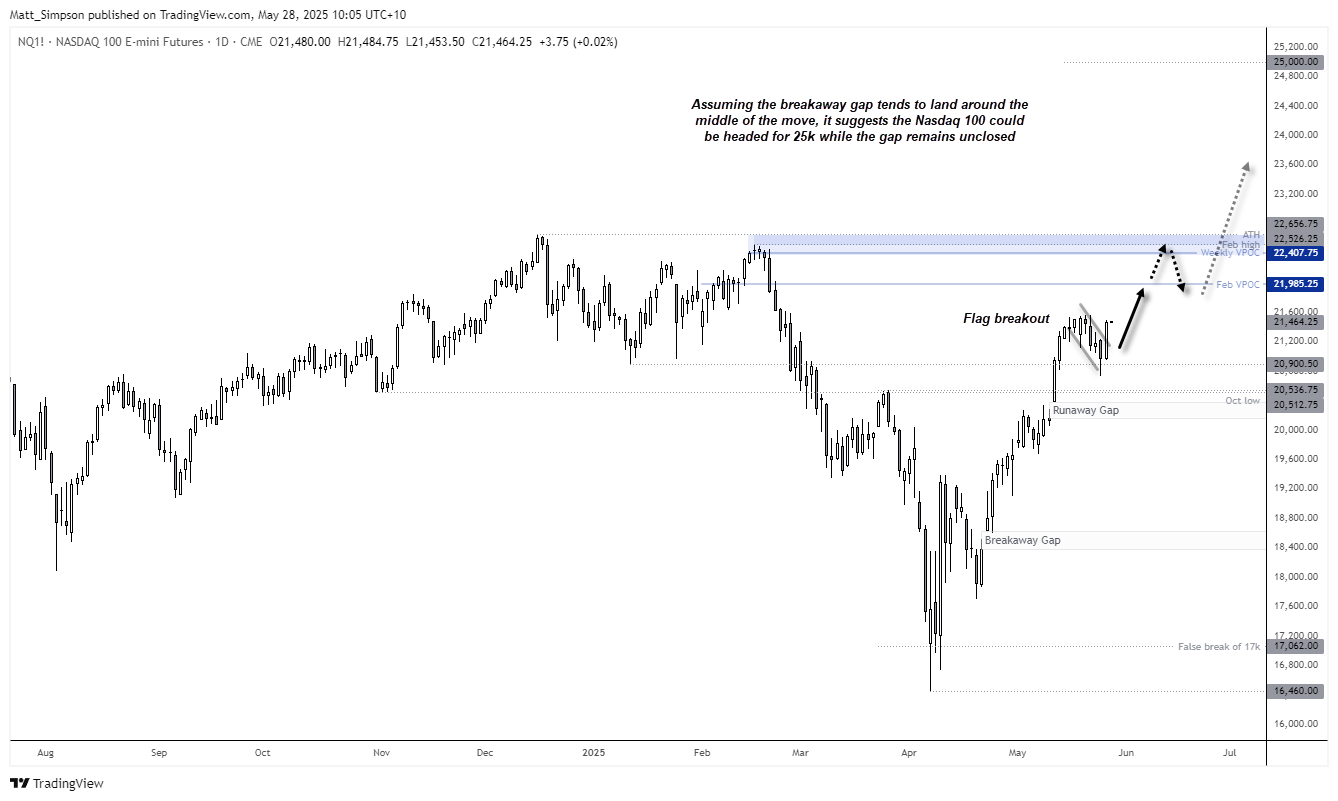

Nasdaq 100 Futures (NQ) Technical Analysis

It seems Friday’s has produced an important swing low after all, despite President Trump’s attempt to topple sentiment with EU tariffs. The Nasdaq 100 future chart shows a strong bullish trend from the 16,460 low, with a ‘breakaway gap’ and ‘runaway gap’ showing further signs of strength from bulls.

On the assumption that runaway gaps tend to land around the halfway point of a move, it could suggest the Nasdaq 100 is headed for the 25k region. Still, resistance if of course nearby to mix things up along the way, so for now bulls could set their sights on 22km bear the February VPOC (volume point of control) and all-time high (ATH) just above 2,500.

But until we see a clear momentum shift lower on the Nasdaq 100, bulls are likely to favour dips.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge