View related analysis:

- If Consumers Don’t Consume, a Recession Could be Presumed

- AUD/USD forecast: GBP/AUD Eyes 2020 High, Inflation Reports on Tap

- EUR/USD bears short-covered at fastest pace in 5 years - COT Report

The relative calm seen on Wall Street these past two weeks came to an abrupt end on Wednesday when President Trump announced that auto tariffs are set to be announced on Wednesday night. And they have just been announced. A 25% levy will be added to all auto vehicle imports not made in the US, which he expects will result in over $100 billion of annual revenue. He is also to sign an executive order to enhance auto growth in the US.

Another round of tariffs is set to be announced on April 2nd, and that there will also be tariffs on pharmaceuticals.

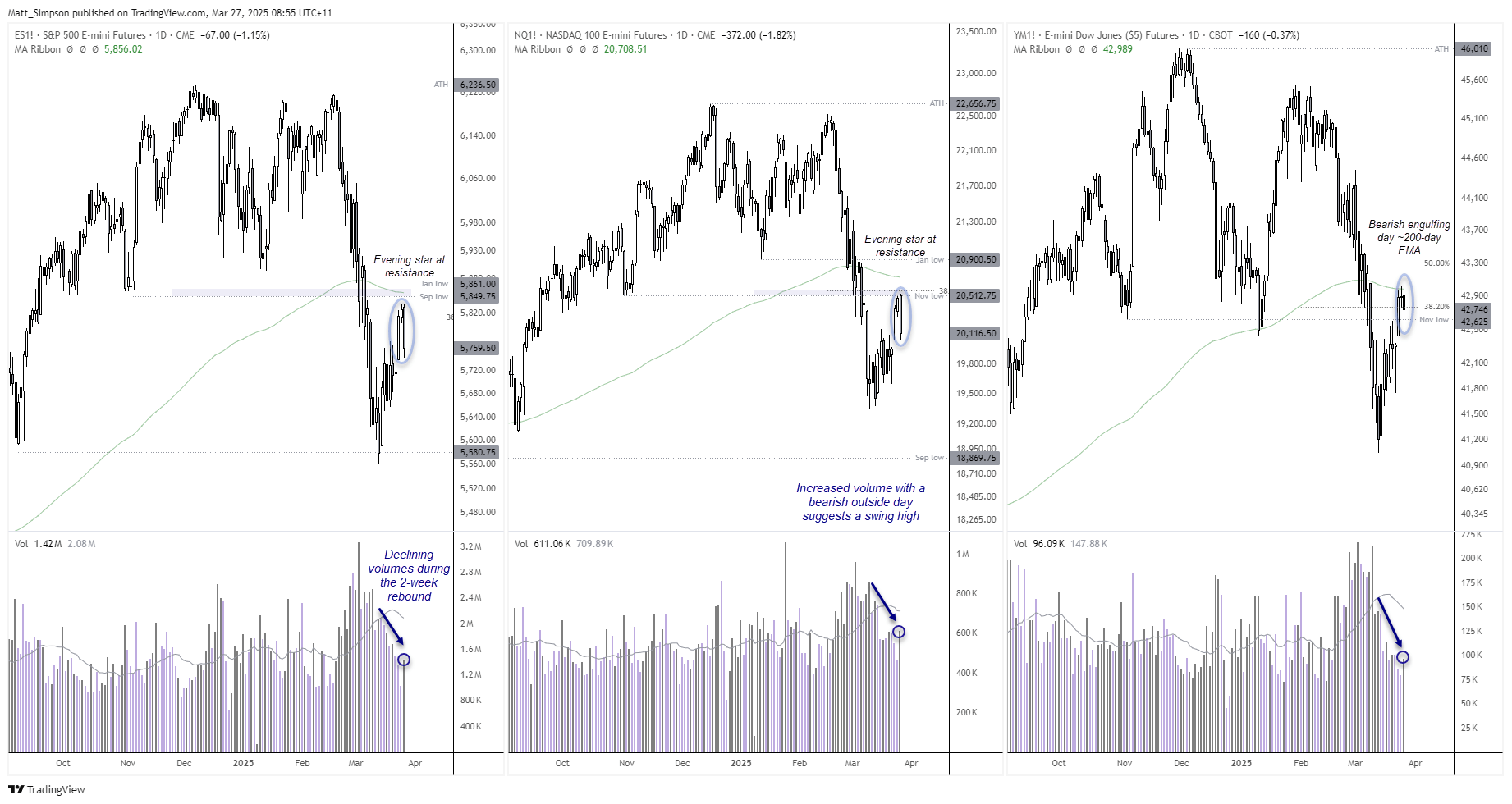

- Nasdaq 100 futures led Wall Street lower ahead of the official announcement, falling -1.8% by the close after hitting resistance around the November low and 38.2% Fibonacci ratio, and formed a bearish outside day.

- S&P 500 futures formed a bearish engulfing day to close firmly back beneath its 38.2% Fibonacci ratio.

- Dow Jones futures closed beneath its 200-day EMA after an intraday break above it, and formed a smaller bearish engulfing day just above the November low

- All three indices saw higher volume on the day, which suggests bearish initiation and a potential swing high

- The fact that volumes were declining through much of the rally of the past two weeks could suggest the bounce was corrective, which implies new lows

ASX 200 at a glance

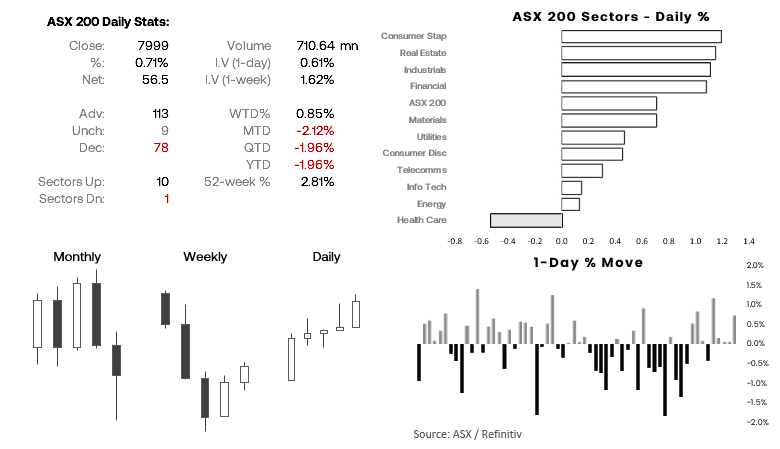

- The ASX 200 closed higher for a fifth day, although missed the 8,000 milestone by a single point by the end of the day

- 10 of its 11 sectors advanced (led by Consumer Staples and Real Estate ETFs), Healthcare was the only sector to decline

- Implied volatility continues to trend lower, allowing the ASX to extend its bounce alongside Wall Street indices in light of Trump’s tariffs not being severe as once feared

ASX 200 futures (SPI 200) technical analysis

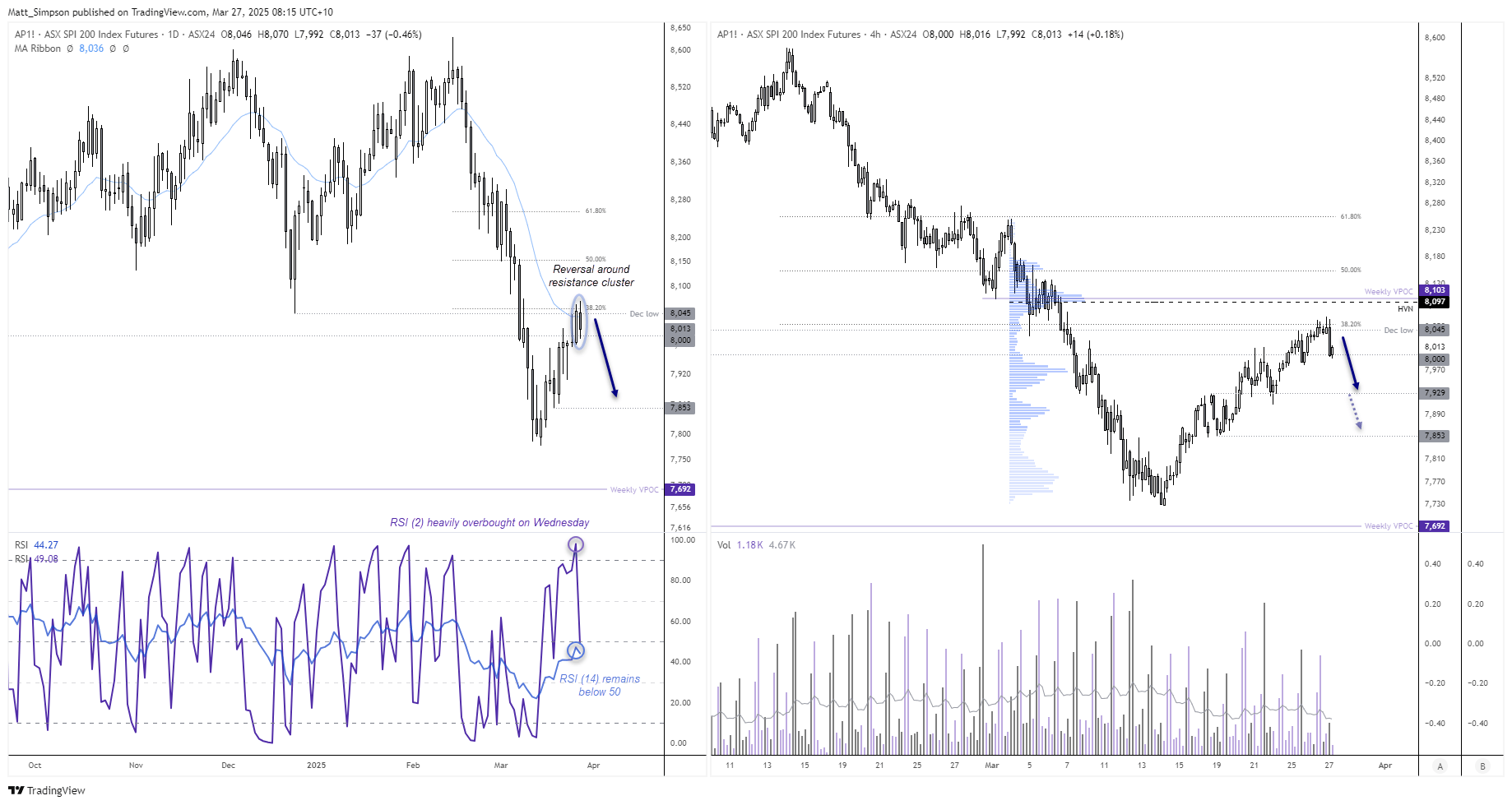

The ASX tracked Wall Street indices higher over the past two weeks, although its 3.75% gain trailed behind its US counterparts. This could suggest that the ASX has further to fall should sentiment truly sour for risk appetite.

The ASX rally stalled around a resistance cluster including the December low, 38.2% Fibonacci level and 20-da EMA. The daily RSI (2) reached the highly overbought level of 98.9 on Wednesday and now sits back beneath 50. The daily RSI (14) remains beneath 50 to show negative momentum overall.

A large bearish engulfing candle formed on the 4-hour chart before the US close. Bears could seek to fade within retracements within the engulfing candle, and using a break above Wednesday’s highs or above the 8100 handle to invalidate the bearish bias.

An initial downside target could be the swing highs and lows ~7930, a break beneath which opens up a run for 7850.

Economic events in focus (AEDT)

- 10:50 – Japanese Foreigner Bond and Stock Purchases

- 12:30 – Chinese Industrial Profits YTD

- 19:30 – BoE MPC Member Dhingra Speaks

- 23:30 – US Q4 GDP, Corporate Profits, PC Prices, Goods Trade Balance (Final), Jobless Claims

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge