Key Market Highlights

- Silver nears 2012 peaks at $37.40/oz

- Geopolitics and tariffs stall Nasdaq just below its 22,000-peak

- U.S. Dollar Index (DXY) holds near three-year lows ahead of FOMC

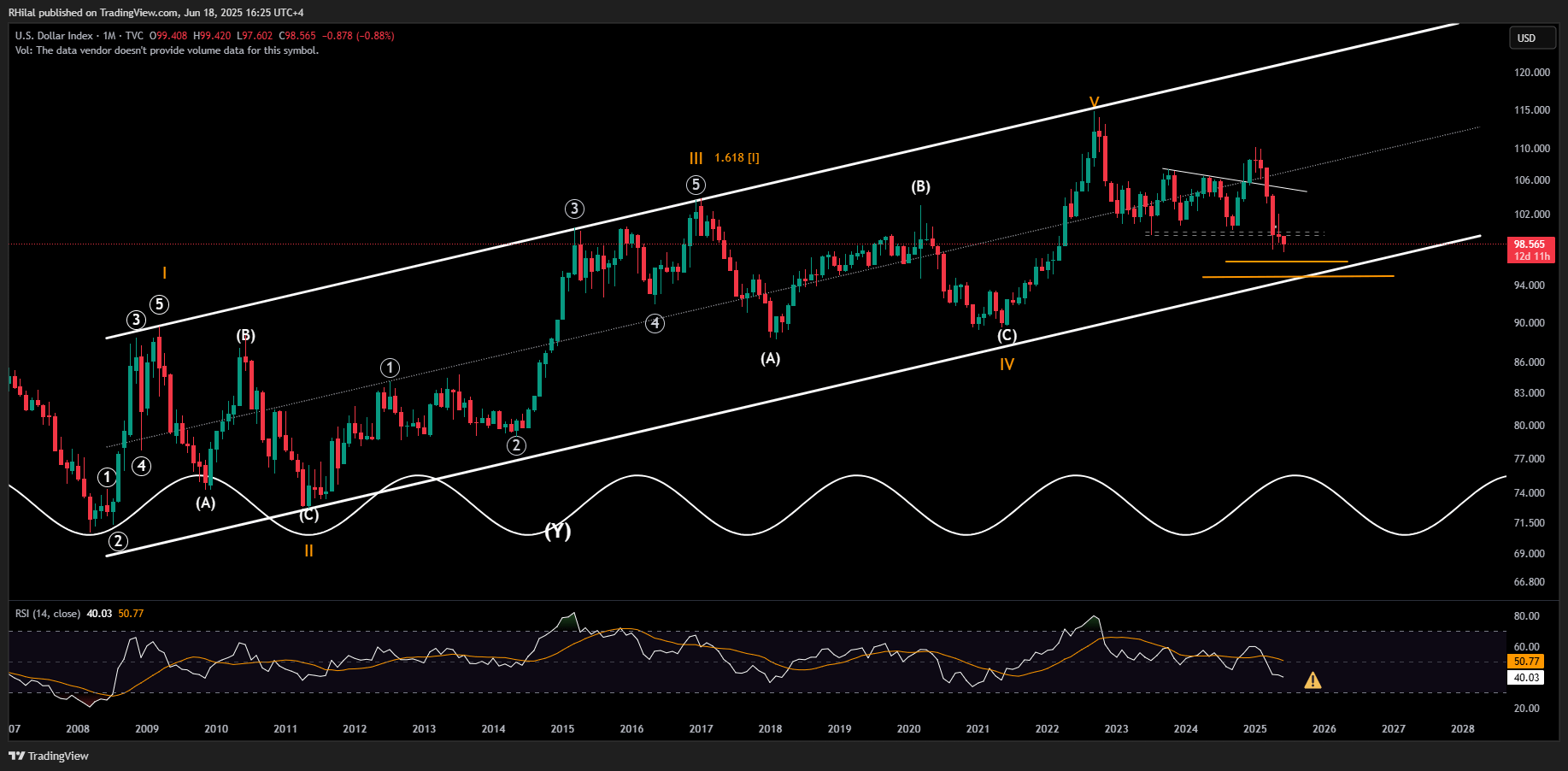

DXY Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

The U.S. Dollar Index (DXY) is currently trading near three-year lows, reflecting concerns over economic fragility and heightened geopolitical tensions. If the Federal Reserve adopts a dovish tone in tonight’s FOMC meeting, the DXY could face additional pressure, potentially descending toward the lower boundary of a long-term channel that has held since the 2008 lows.

Key support levels at 96 and 94 may offer potential rebound zones. Monthly RSI reflects more downside potential towards oversold conditions last seen in 2021. To reverse the current bearish momentum, the index would need to regain and hold above the 100-mark, which could shift sentiment back toward a bullish rebound outlook against the markets.

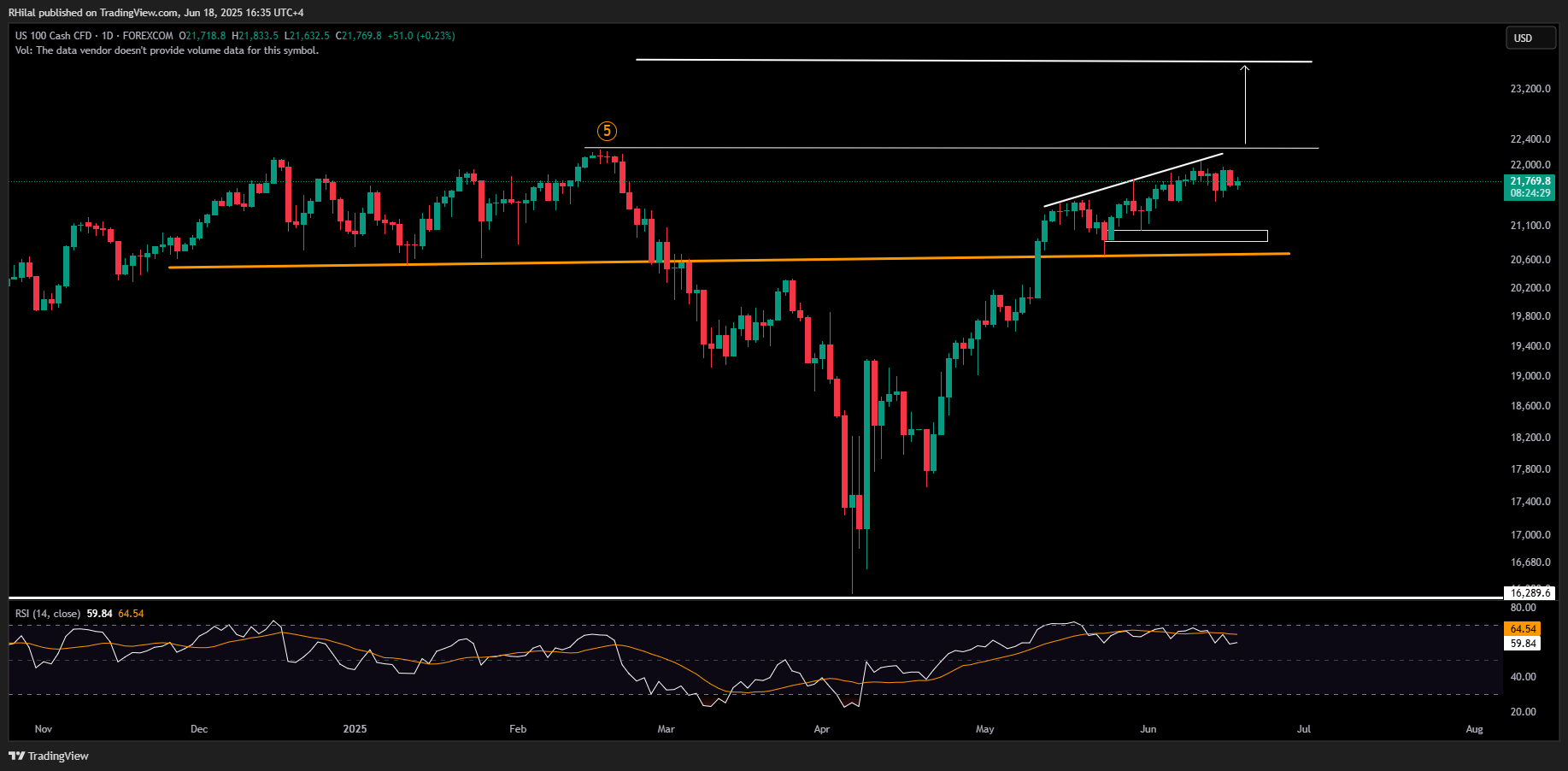

Nasdaq Outlook: Daily Time Frame – Log Scale

Source: Tradingview

Despite persistent geopolitical risks, U.S. economic uncertainty, and the usual summer slowdown, the Nasdaq remains near record territory. Meanwhile, silver's breakout further supports the resilience of the tech sector, which continues to align with long-term global growth and innovation trends.

Technically:

- Price action is testing a resistance trendline formed by consecutive higher highs between May and June 2025.

- A clear breakout above 22,200 could trigger bullish momentum toward 23,700, which aligns with the 0.618 Fibonacci extension drawn from the 2022 lows, 2025 highs, and 2025 retracement lows.

- Downside risks include a pullback toward the neckline of a December–February double top pattern, with support near 21,000 and 20,600, which could trigger a deeper bearish scenario if broken.

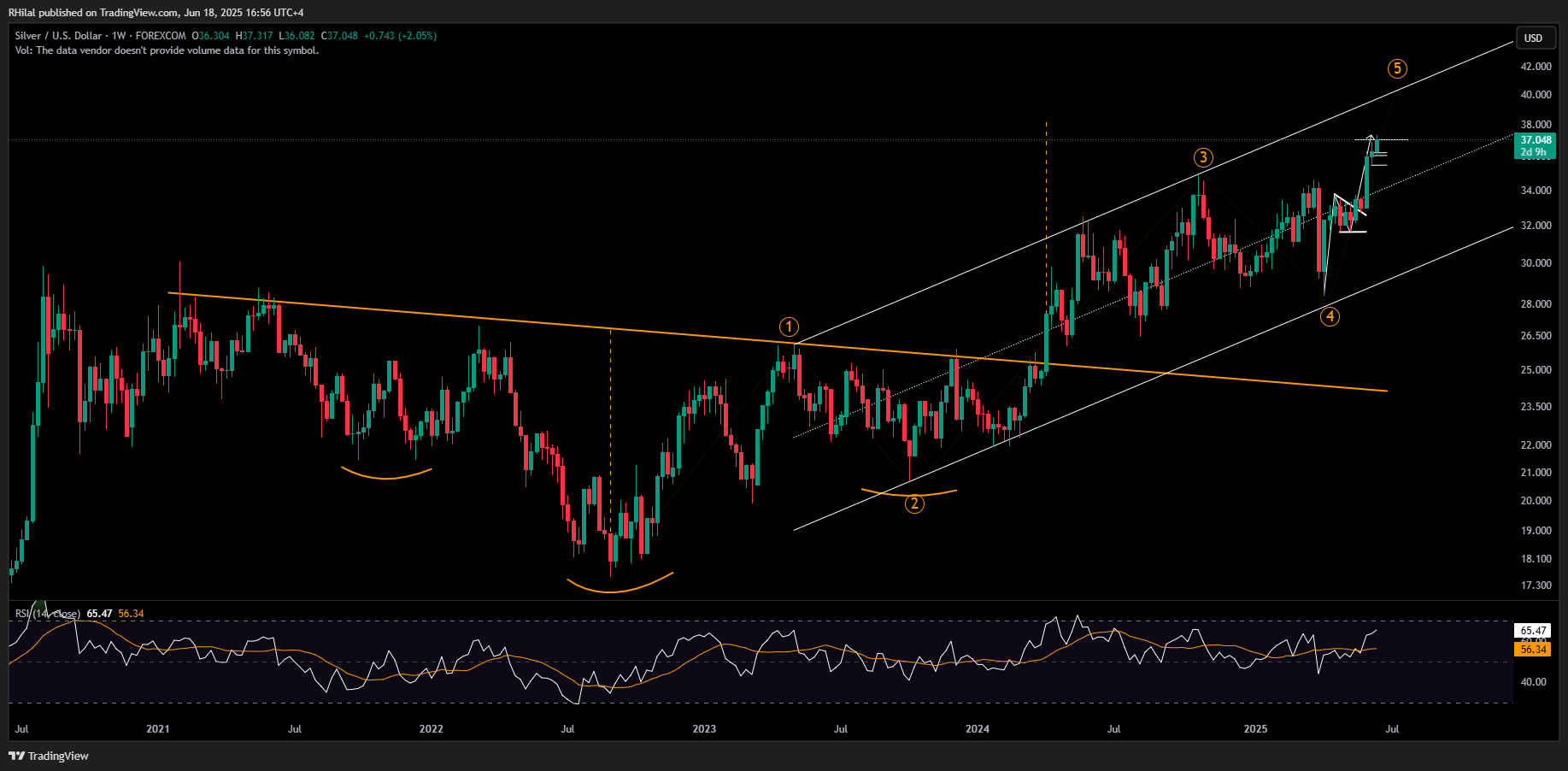

Silver Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

Amid a broadly risk-averse market, silver has emerged as a standout performer—tracking higher alongside Middle East supply risks and technical strength. The metal is now testing levels near its 2012 peak around $37.40, marking new decade highs.

- Silver appears to be completing an inverted head and shoulders breakout, nearing its projected target.

- A clean hold above $38 could pave the way for a breakout toward $40 and beyond.

- On the downside, support zones at $36 and $35 could contain short-term pullbacks.

Tonight’s FOMC decision may serve as a key catalyst in determining whether the U.S. Dollar resumes a longer-term downtrend—or stages a surprise rebound—while influencing the near-term direction for both Nasdaq and precious metals.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves