- Trump’s tariff move hits risk sentiment

- China responds with reciprocal tariffs from April 10

- Nikkei and Hang Seng hammered on open

- Momentum signals favour selling rallies and bearish breaks

Summary

Both the Nikkei 225 and Hang Seng are under pressure, grappling with heavy technical selling and renewed macro headwinds stemming from Donald Trump's tariff announcement. The Hang Seng appears particularly vulnerable following China's decision to impose reciprocal tariffs on U.S. imports starting April 10, a move that threatens to reignite trade tensions and weigh further on risk sentiment across the region. With momentum signals firmly bearish in both markets and key support levels at risk, any escalation in the tariff standoff could deepen the downside in the days ahead.

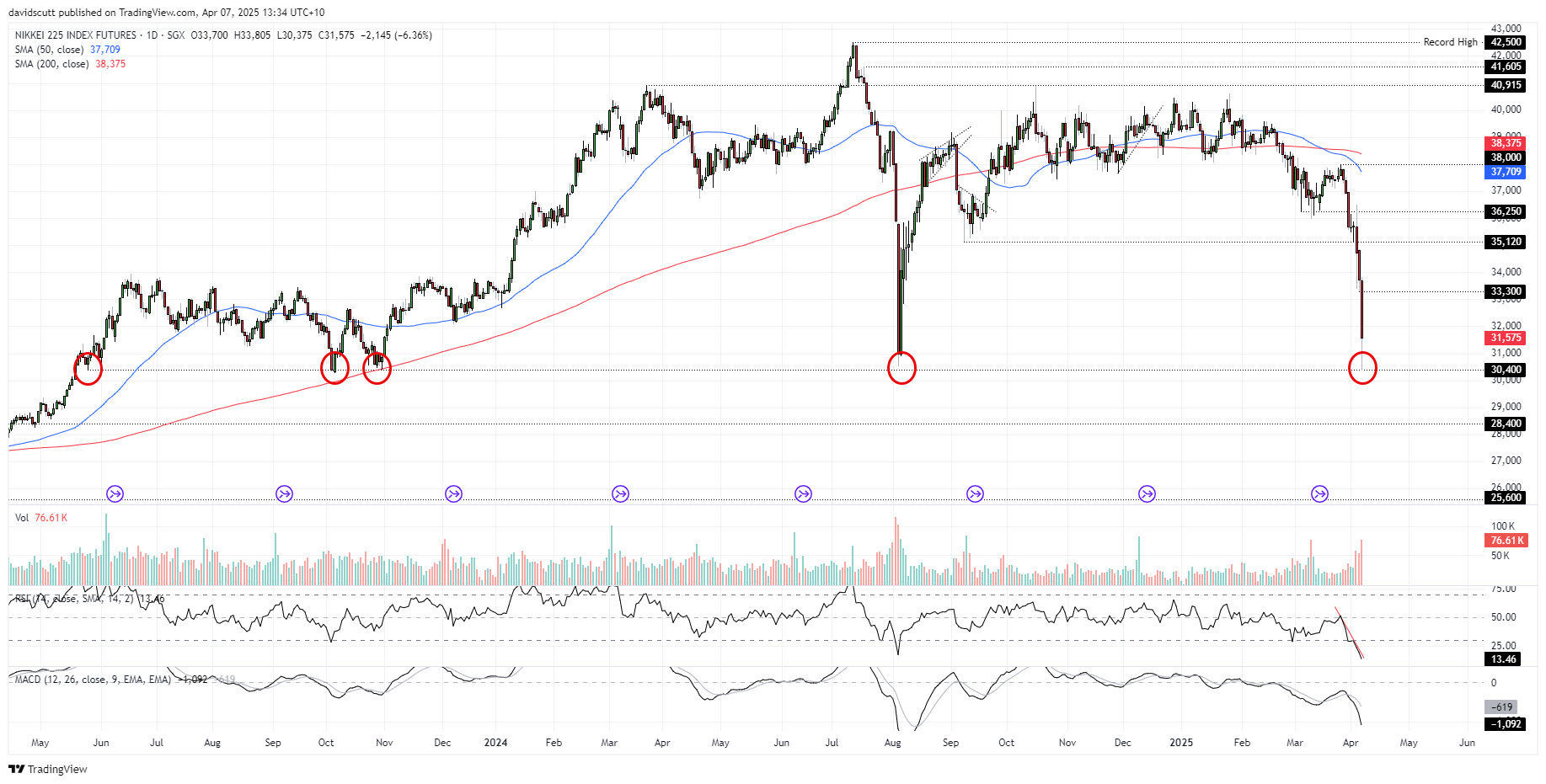

Nikkei 225 Bounce Zone Holds Again

Traders should pay close attention to Nikkei 225 futures if the price returns towards 30,400. We’ve now seen decent bounces from around that level five times, including earlier today upon the resumption of trade after the weekend.

Source: TradingView

While momentum signals are firmly bearish, with RSI (14) and MACD both trending lower, the former now sits at its most oversold level since the pandemic plunge in early 2020. That means the market may be vulnerable to even a minor shift in the prevailing bearish sentiment. For now, the preference remains to sell rallies over buying dips.

A clean break of 30,400 would open the door for a run towards 28,400 or 25,600 — the latter a key technical level given how often it thwarted bearish moves in 2022. On the topside, resistance may be encountered around 33,300, marking where the price rout stalled last Friday. A break of that would put 35,120 on the radar.

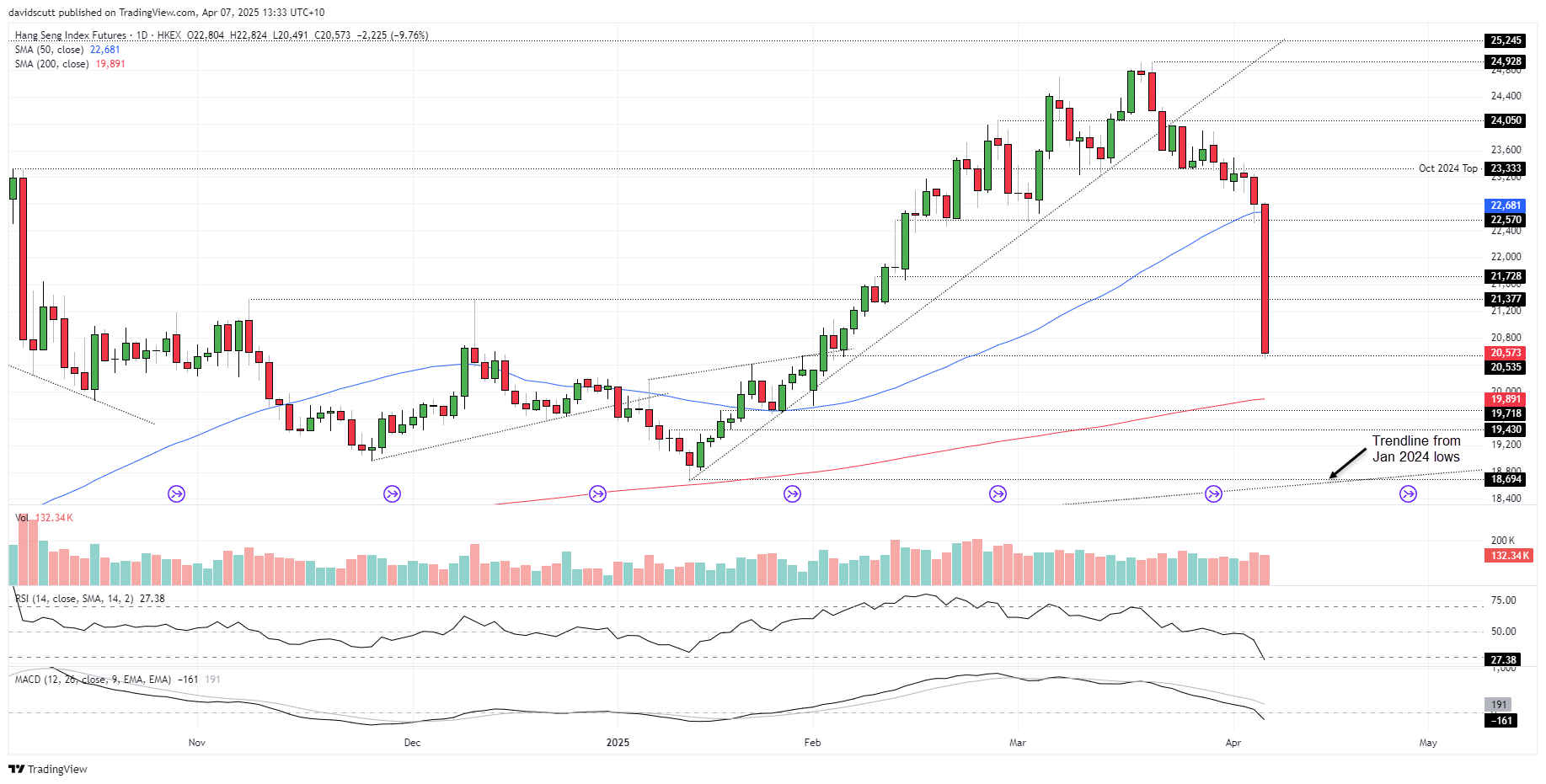

Hang Seng Bull Market Implodes

Source: TradingView

Hong Kong’s Hang Seng opened in similar fashion to Japan’s Nikkei earlier in the session, with the price cascading lower after breaking support at 22,570. The subsequent unwind saw 21,728 and 21,377 melt like a hot knife through butter before the price eventually bounced at 20,535 — another minor level that acted as both support and resistance earlier this year. That makes it an initial level of interest for those contemplating setups involving Hang Seng futures.

A clean break of 20,535 would put a retest of minor levels such as 19,718 and 19,430 on the table. The 200-day moving average is also found at 19,891, although one glance at how price has interacted with it previously suggests it may be entirely ignored in this environment. Beyond that, the uptrend dating back to the early 2024 low is another level to watch, although it hasn’t been tested enough to declare it meaningful downside support. It’s located around 18,550 today, just beneath the January 2025 swing low of 18,694.

While they provided no support earlier today, 21,377 and 21,728 may still be of interest if bears choose to set up shop above either. Watch the price interaction at these levels if the Hang Seng gets back there.

Momentum signals remain firmly with the bears, with MACD and RSI (14) both negative and trending strongly lower. While RSI is now oversold, it was also extremely overbought earlier this year — and that didn’t stop further gains at the time. The same could easily apply on the downside. The overall momentum signal favours selling rips and downside breaks near term.

-- Written by David Scutt

Follow David on Twitter @scutty