View related analysis:

- AUD/USD Analysis: Eyes on China and the yuan Amid Trump’s 104% Tariff

- AUD/USD weekly outlook: Bears Eye Sustainable Move to the 50s Amid Tariff Turmoil

- The RBNZ deliver another 50bp cut, AUD/NZD eyes breakout

The RBNZ cut its Official Cash Rate (OCR) by 25bp as expected to 3.5%, marking the fifth cut of the cycle and bringing the total reduction to 200bp. This also sees the central bank slow its pace of easing, following three prior cuts of 50bp each. There was some speculation that they could opt for a full 50bp cut today, but that may have caused more panic than necessary—especially as Trump’s tariffs are not technically in place yet, and world leaders are reportedly “queuing up” to strike a deal (according to the Trump officials…)

- RBNZ cut their cash rate by 25bp to 2.5%

- Firms’ inflation expectations and core inflation are consistent with CPI remaining at target over the medium term.

- Economic activity in New Zealand has evolved largely as expected since the February MPS

- Tariffs weaken the outlook for the global economy and create downside risks for NZ economy and inflation

- Having consumer price inflation close to the middle of its target band puts the Committee in the best position to respond to developments

- The Committee has scope to lower the OCR further as appropriate

Implications of Trump’s tariffs remain unclear

This also marks the first meeting with interim Governor Christian Hawkesby. If he felt any pressure to go ‘all in’ with a 50bp cut, he clearly played it safe. The statement and minutes highlight the uncertainty surrounding the severity of the incoming levies, though expectations are clearly for them to weigh on growth and inflation. That should keep the RBNZ on an easing path, even if the speed and timing of future cuts remain unclear.

As the RBNZ hinted at 25bp cuts in April and May, they are on track for the cash rate to fall to a minimum of 3.25% next month. However, as we've seen, trade headlines move fast and tensions are escalating—so we should not rule out the potential for a 50bp cut next month.

Tariffs over rate differentials

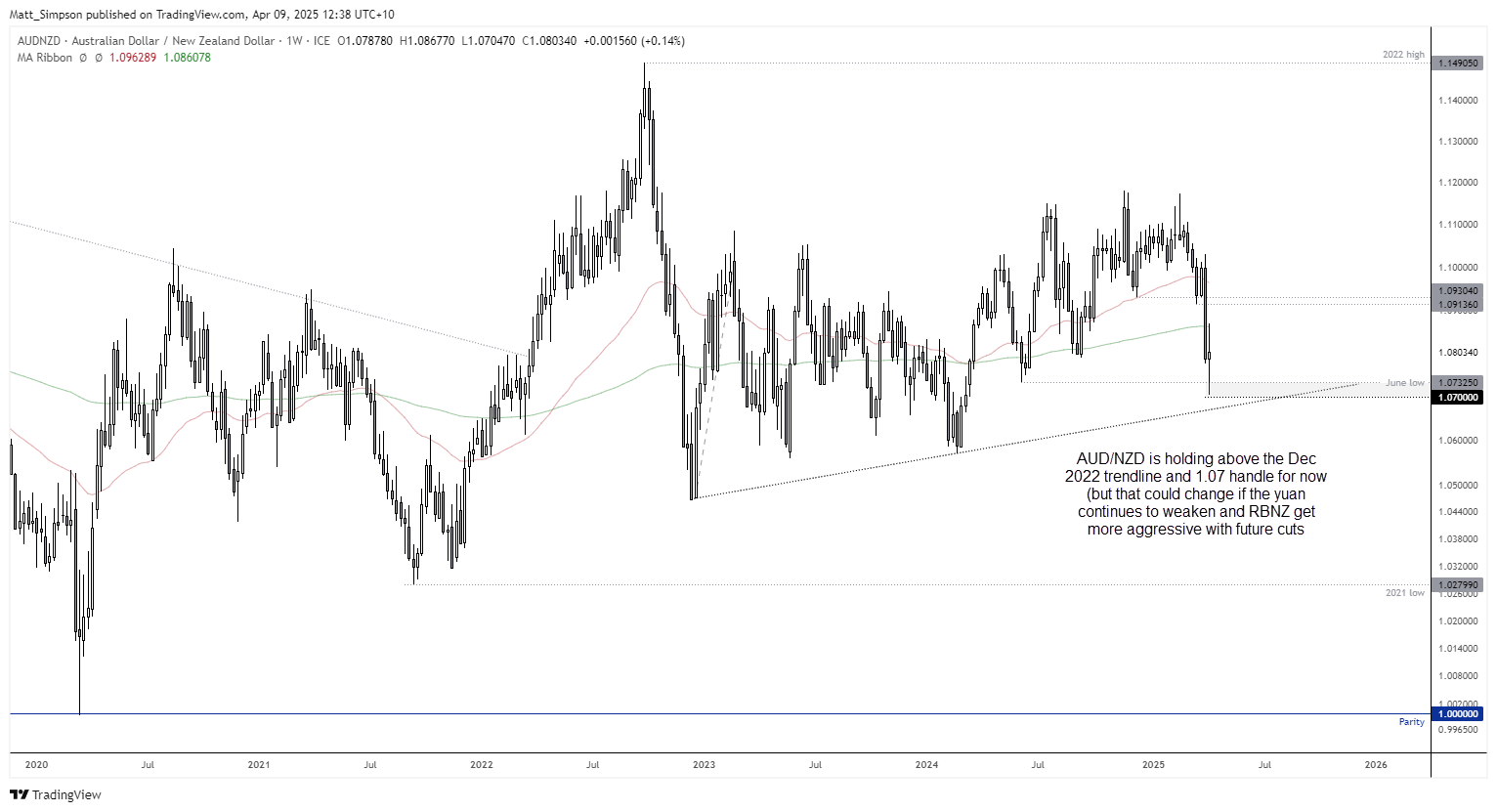

Today’s RBNZ cut sees the RBA–RBNZ interest rate differential rise to 60bp. Bloomberg pricing estimates both central banks will cut rates a further 3.5 times. In theory, this should support a rise in AUD/NZD, but as I’ve discussed in other articles, the close relationship between the Chinese yuan and Australian dollar has seen AUD/USD lead the bearish stampede—ahead of the New Zealand and Canadian dollars.

Still, AUD/NZD has been falling since the RBNZ’s February meeting. With the pair having found support just above the December 2022 trendline and demand around 1.07, perhaps we’re nearing the end of the move lower. Time will tell, but if the Chinese yuan continues to depreciate, AUD/USD could fall alongside AUD/NZD—regardless of interest rate expectations between the RBA and RBNZ.

AUD/USD, NZD/USD technical analysis

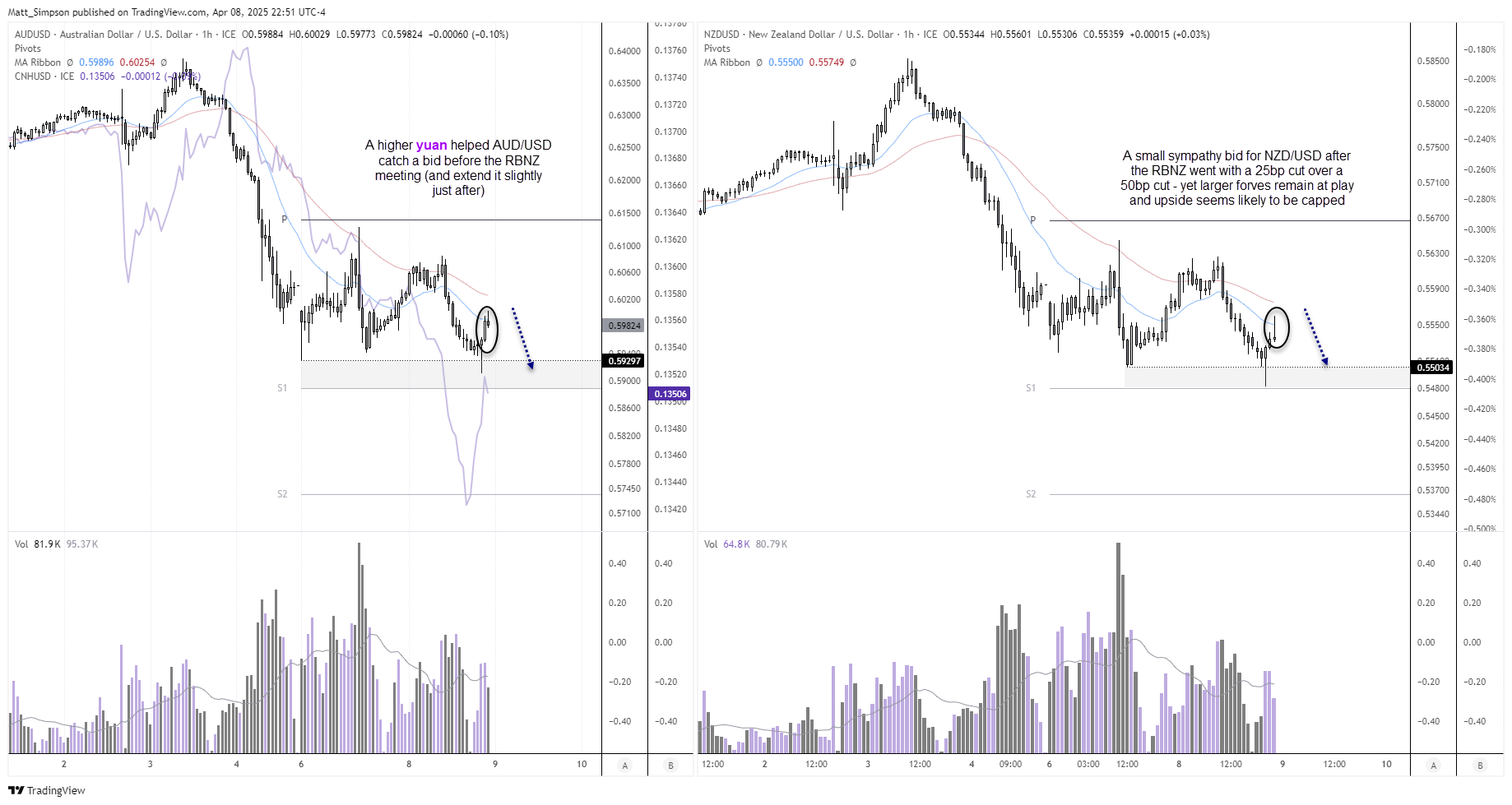

We saw a slight sympathy bid for the Australian and New Zealand dollars after the rate decision, yet their upside potential seems likely to be capped with larger forces at play.

Both AUD/USD and NZD/USD printed bullish hammers on the 1-hour chart, signalling a false break of Monday’s low ahead of the meeting. Both caught a sympathy bid after the rate decision. Yet in both cases, upside potential appears limited by broader market dynamics.

The 1-hour 20-bar EMA is currently acting as resistance, and both AUD/USD and NZD/USD already appear to be forming swing highs. Should bears regain control—potentially triggered by further yuan weakness—they could target the weekly S1 pivots near today’s lows. A break beneath those levels would suggest bearish continuation.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge