NZD/USD Rally Stalls at Key Level

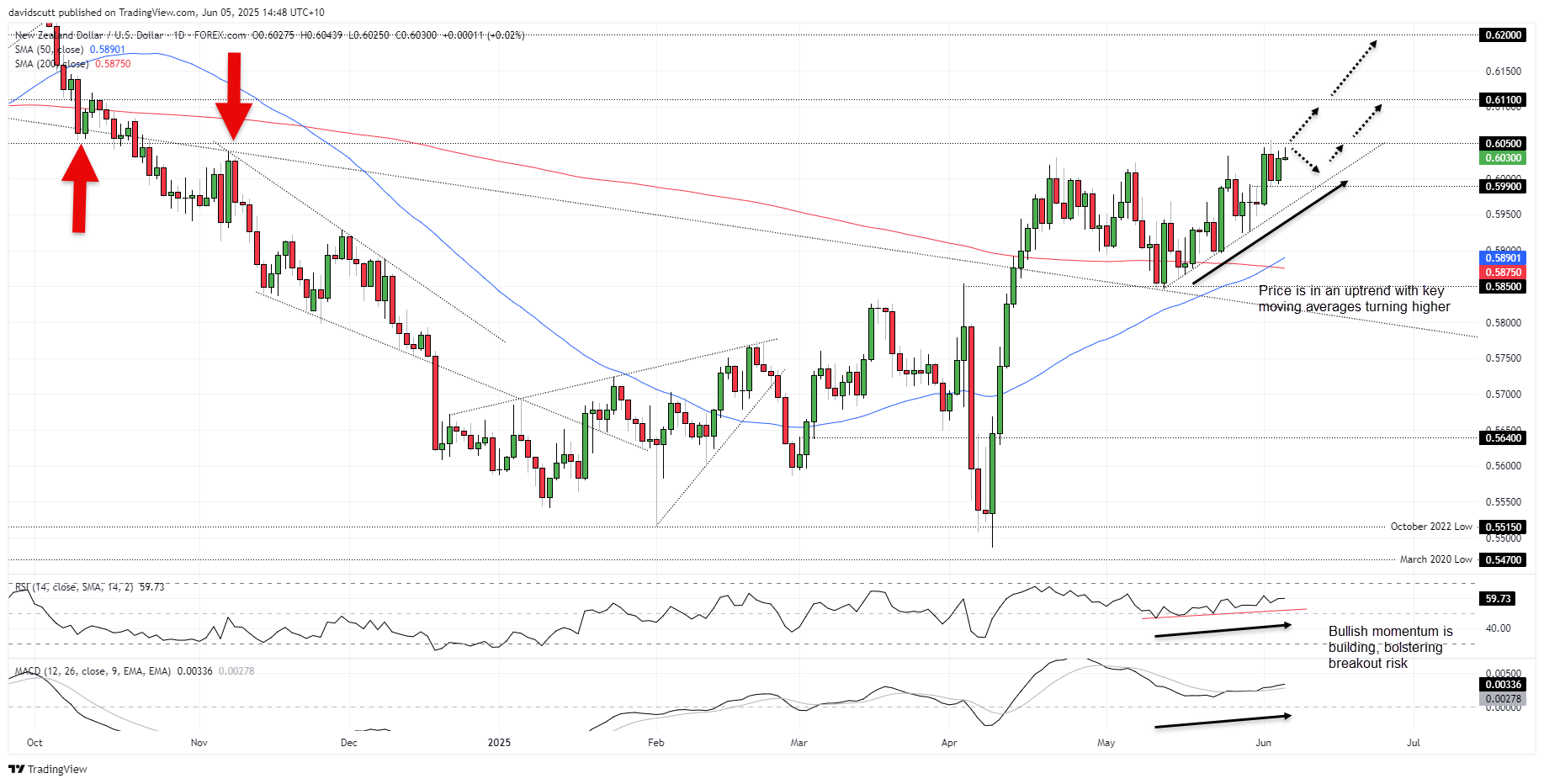

Sitting in an uptrend and with bullish momentum building, there’s not a lot not to like about the Kiwi right now. However, before it tries to prove it can fly unlike its namesake, NZD/USD bulls face one major hurdle in the form of resistance at .6050. To say the Kiwi has done a little bit of work around this level over the years is an understatement, often testing it from both directions but rarely crossing over.

Source: TradingView

You can see the first attempt from bulls to reclaim the level earlier this week ended in failure, with sellers moving in as soon as it ventured over. However, you get the feeling it won’t be the last attempt, with the price sitting in an established uptrend after bouncing off horizontal support at .5850 in May, reclaiming the important 200-day moving average in the process.

With RSI (14) grinding higher above 50 and MACD flicking higher after crossing the signal line in positive territory, the momentum picture is also shifting more definitively in favour of the bulls. The golden cross of the 50-day moving average over its 200-day equivalent earlier this week only adds to the bullish backdrop.

If the price can break and close above .6050, it could generate a bullish setup where longs could be established above the level with a stop beneath for protection. .6110 is a minor resistance level overhead, with an advance beyond that opening the door for a run to .6200—another level the Kiwi has done ample work either side of in recent years.

On the downside, .5990 acted as resistance last week before flipping to support in recent days, putting it on the radar should NZD/USD fail to extend its bull run. If that were to give way, uptrend support, the 200-day moving average and .5850 are the levels to watch.

There’s no major data on the docket in New Zealand over the next week, putting emphasis on U.S. nonfarm payrolls, CPI and PPI to drive NZD/USD direction—they’re the key known risk events to watch. Outside of short-term data impacts, NZD/USD has essentially been a play on U.S. dollar sentiment over the past month, running with strong to extremely strong correlations with other major currencies, along with metals such as gold and silver against the USD.

For now, it suggests the Kiwi’s standing as a China-centric risk play has been put on ice.

-- Written by David Scutt

Follow David on Twitter @scutty