New Zealand Dollar Outlook: NZD/USD

NZD/USD may consolidate over the remainder of the month as it struggles to test the November high (0.6038), but the Reserve Bank of New Zealand (RBNZ) meeting may drag on the exchange rate as the central bank is anticipated to deliver a 25bp rate cut.

NZD/USD Struggles to Test November High Ahead of RBNZ Rate Decision

NZD/USD gives back the advance from the start of the week as it falls from a fresh yearly high (0.6032), and the exchange rate may struggle to retain the rebound from the monthly low (0.5847) as it snaps the recent series of higher highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

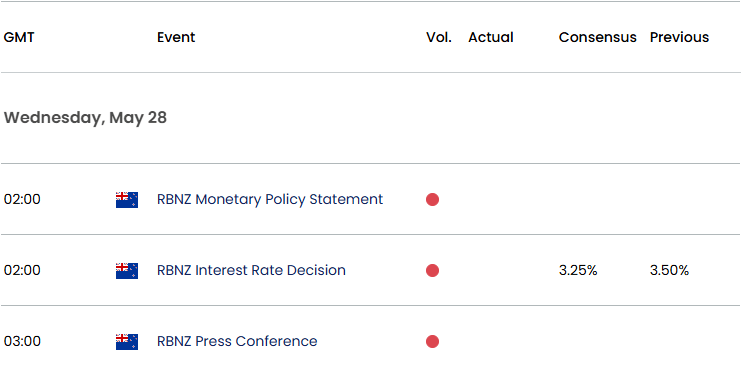

New Zealand Economic Calendar

At the same time, developments coming out of the RBNZ meeting may sway NZD/USD as the central bank is expected to cut the official cash rate (OCR) to 3.25% from 3.50%, and more of the same from the Monetary Policy Committee (MPC) may produce headwinds for the New Zealand Dollar should Governor Christian Hawkesby and Co. reiterate that ‘the Committee has scope to lower the OCR further as appropriate.’

With that said, NZD/USD may depreciate over the remainder of the month if the RBNZ maintains a dovish forward guidance for monetary policy, but a hawkish rate cut may generate a bullish reaction in the New Zealand Dollar as the central bank appears to be at or nearing the end of its rate-cutting cycle.

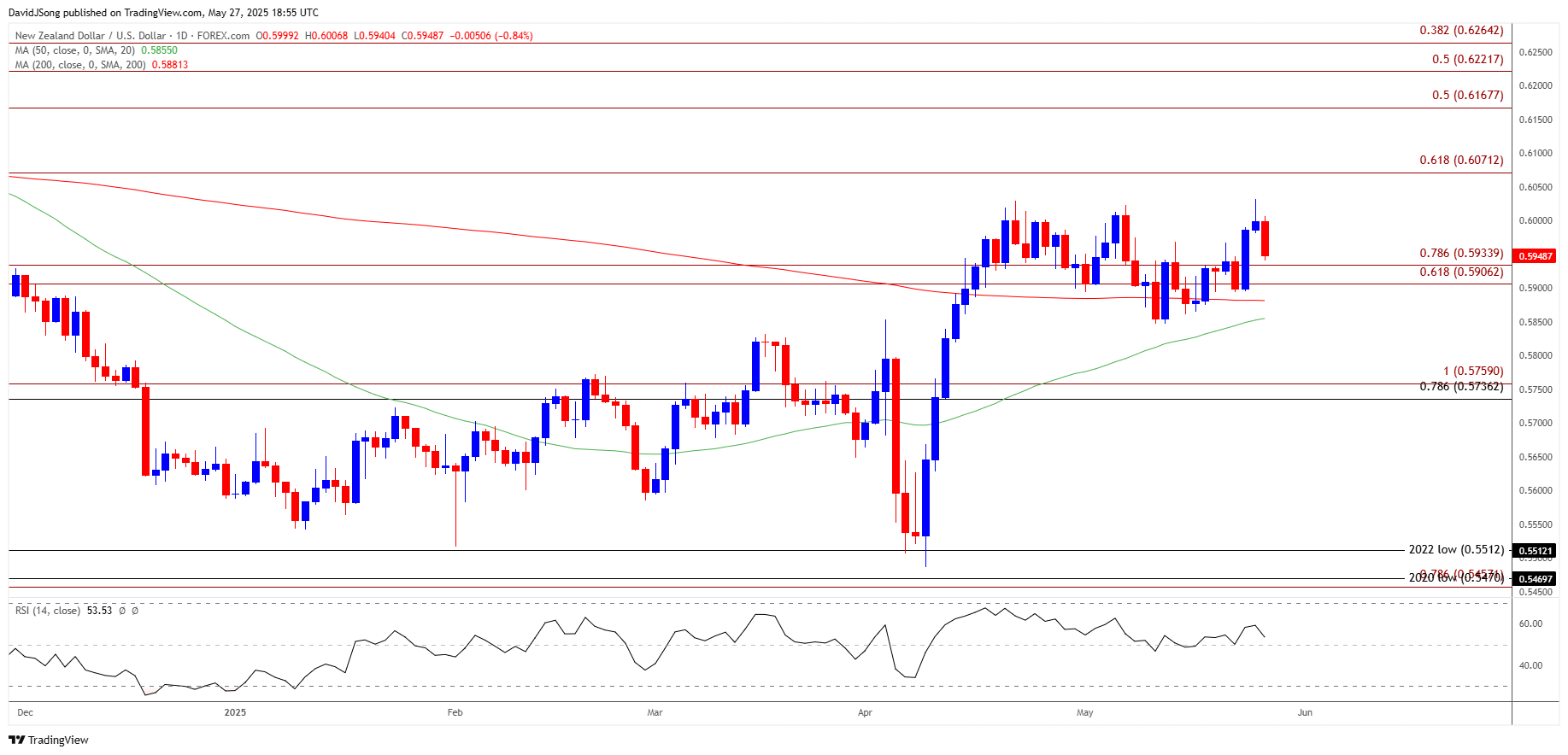

NZD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; NZD/USD on TradingView

- NZD/USD pulls back ahead of the November high (0.6038) to register a fresh weekly low (0.5940), and lack of momentum to hold above the 0.5910 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region may push the exchange rate toward the monthly low (0.5847).

- Next area of interest comes in around 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension), but NZD/USD may stage further attempts to test the November high (0.6038) should it defend the rebound from the monthly low (0.5847).

- Need a break/close above 0.6070 (61.8% Fibonacci extension) to bring 0.6170 (50% Fibonacci extension) on the radar, with the next area of interest coming in around 0.6220 (50% Fibonacci extension) to 0.06260 (38.2% Fibonacci extension).

Additional Market Outlooks

Gold Price Falls as Trump Delays EU Tariff

USD/JPY Approaches Monthly Low as Trump Plans 50% Tariff for Europe

Australian Dollar Forecast: AUD/USD Struggles Following RBA Rate Cut

Canadian Dollar Forecast: USD/CAD Bounces Back Ahead of Monthly Low

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong