S&P 500 analysis: After a bright start, the S&P 500 and Nasdaq 100 were coming off their highs, while the Dow and Russell lost their earlier gains. The loss of momentum comes after the S&P enjoyed one of its strongest days so far this year in the previous session. Clearly, investors are fearful about further volatility ahead and are happy to book profit, as the major indices test key resistance areas. With consumer and business sentiment sinking, as Trump’s tariffs fuel inflation worries, dampen demand, and heighten recession risks, you can understand why.

Sentiment remains cagey

There are fears that the rebound may have run a bit too high given ongoing trade war risks, signs of economic slowdown, and sticky inflation. Today, we saw the CB consumer confidence slumped to a four-year low, tempering optimism over a potential end of the conflict in Ukraine, where Russia and Ukraine have agreed to truce in the Black Sea. Clearly some investors remain unconvinced that the worst is over and are happy to book profit after a decent rally in recent days.

S&P 500 analysis: key resistance levels to watch after recent rally

Source: TradingView.com

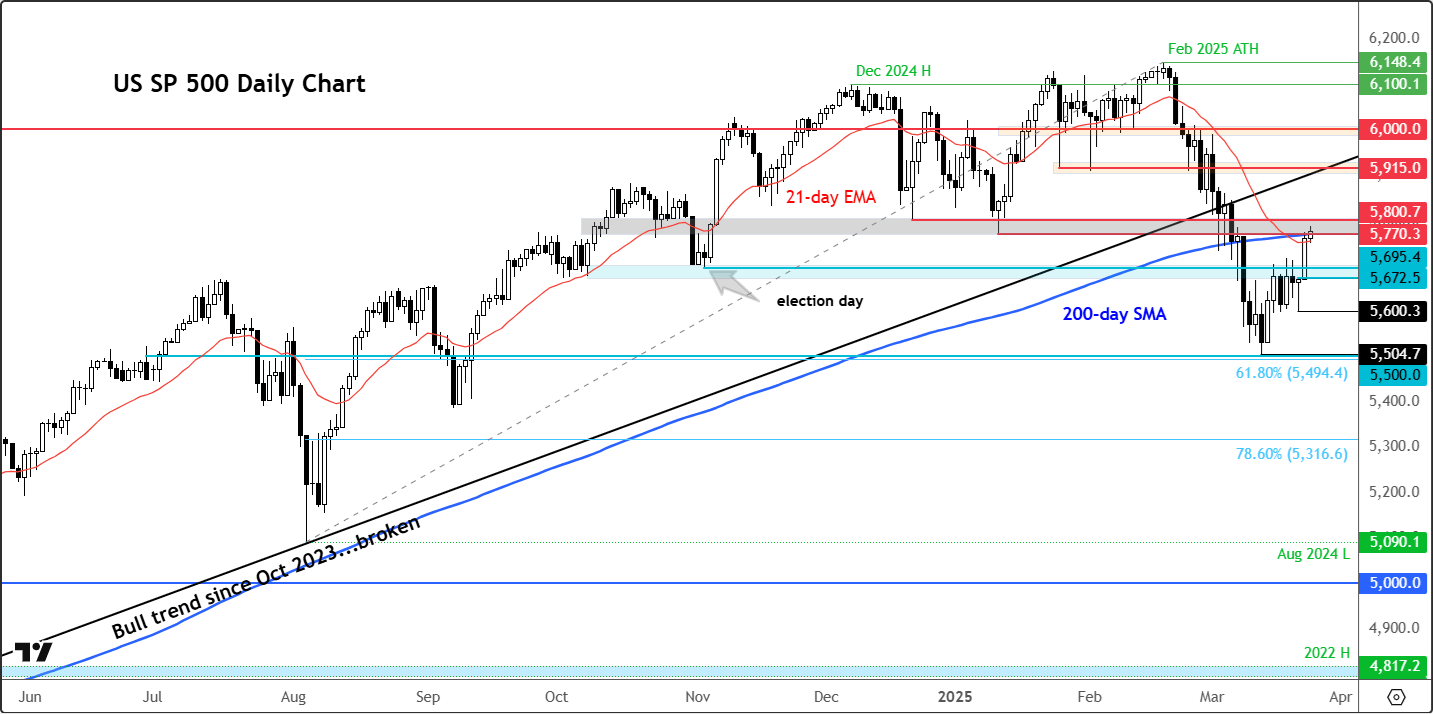

The S&P 500 has been on a strong two-week rally, but now finds itself at a critical resistance zone. The index is currently testing resistance around the 200-day moving average and a prior support level in the 5770-5800 region. This key area, shaded in grey on the chart, could determine whether the recent bullish momentum continues.

Key support levels to watch

Support for the index comes in between 5672 and 5695, an area shaded in blue on the chart. This zone is also significant because it marked the beginning of the post-election rally (which eventually faltered). While the fact the index has reclaimed this level is a bullish sign, the S&P 500 must remain above this range for the rest of the week to sustain the upward bias.

However, if the support at 5672-5695 fails, the bulls could face significant challenges. A breakdown here might increase the risk of renewed selling pressure, similar to what was seen a few weeks ago. The situation could worsen if the index goes on to drop below 5600, marking Friday’s low when a hammer candle was formed.

Downside and upside scenarios

If the 5600 level breaks, the S&P 500 could decline further to retest the 5500 area, which aligns with the 61.8% Fibonacci retracement level of the August-February rally. This would represent a critical test for the broader market.

On the upside, if resistance in the 5770-5800 range is broken, the index could see further gains toward the underside of the broken trendline and the next resistance level around 5915. A breakout here would reinforce the bullish case and potentially lead to a more extended rally.

In a nutshell

The S&P 500 is at a pivotal technical juncture, with support at 5672-5695 and resistance at 5770-5800 defining the near-term outlook. Traders should closely monitor these levels to gauge the next move. A break above resistance could trigger a continuation higher, while a loss of key support might put bulls under pressure and open the door for further declines.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R