- S&P 500 forecast: trade concerns and global slowdown threaten recent gains

- Data watch: job openings and payrolls in focus this week

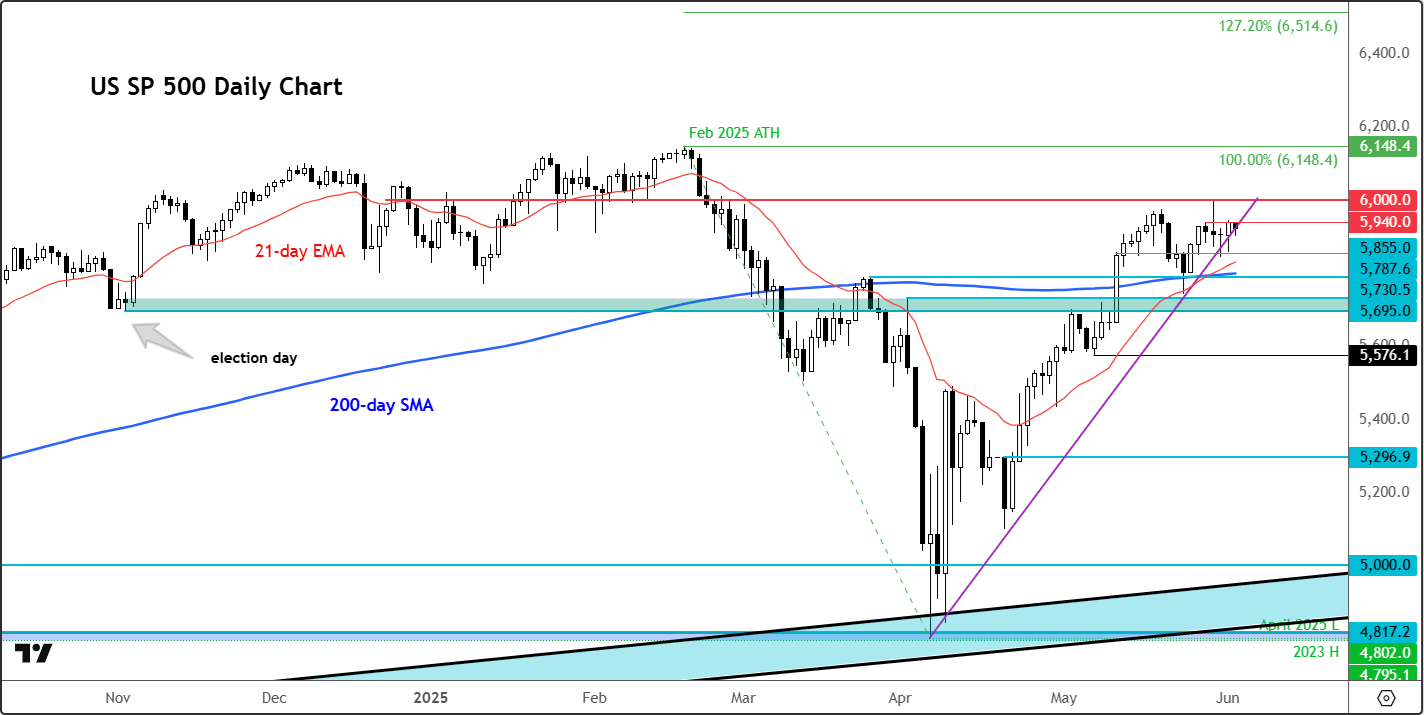

- Key levels: 6,000 remains the ceiling; 5,785 support

The markets haven’t gone anywhere fast in the past week or so, stuck in a tight range with traders sitting on their hands, awaiting fresh stimulus. The start of June contrasts sharply with how markets were trading for much of May and the second half April, when we saw a big upsurge on the back of optimism that we had seen the worse of the trade war and that deals would soon be struck between the US and other nations. Well, that hasn’t quite happened yet. Markets are now caught in a fresh bind of geopolitical risk and economic caution. Investors are contending with renewed trade war rhetoric, signs of cooling in the US economy, and a chorus of warnings from global institutions. Meanwhile, the bond markets are still waring investors of bigger troubles ahead. Yet, equity investors are not panicking yet. But if the trade uncertainty drags on, this will negatively impact the S&P 500 forecast, especially if leaders of the US and China don’t start trade talks again this week.

Tariffs, Trade, and Trouble Ahead?

Donald Trump’s decision to double tariffs on Chinese steel and aluminium to 50% after accusing Beijing of violating trade agreements caused a bit of volatility in recent day, though not the type we saw in early April, with traders now used to the idea of buying into any trade-related weakness with expectations that Trump would later walk back on his threats Could it be different this time, remains to be seen. But the cheerfulness of May’s rally has given way to some unease for sure.

It’s not just tariffs spooking the markets. The OECD has now chimed in with a warning on the state of global growth, casting a shadow over investor sentiment. Bond markets are already flashing signs of worry, with US and Japan long-term yields climbing sharply higher in recent weeks. But today, Treasuries have caught a bid, aided in part by strong demand at a Japanese 10-year auction.

Meanwhile, the data drumbeat is starting to sound more like a warning. Today’s JOLTS report is expected to reveal a drop in job openings to levels not seen since 2020 — a reflection of more cautious corporate hiring as consumers tighten their belts. With Friday’s non-farm payrolls also expected to show slowing job creation, it’s becoming harder to maintain the “soft landing” narrative with a straight face.

The trade uncertainty and softness in the economy means earnings have been revised down, which may prevent the markets from rising too much further in the near-term outlook without a major improvement in data or trade talks.

Technical S&P 500 forecast: Treading Carefully

Source: TradingView.com

From a technical point of view, the S&P 500 chart is showing signs of hesitation, yet no major reversal sign is observed yet. There were a couple of doji candles from the end of last week – a classic sign of indecision. So far, those indecisive candles were not bearish enough to bring out the sellers. The index continues to hover below the psychologically important 6,000 level, an area that acted as strong support before the Q1 wobble and now serves as stiff resistance. Ahead of it, 5940 is also a resistance level to watch, which has kept the gains in check on a daily closing basis in recent times.

Support is seen around 5900, where a bullish trend line comes into play. This trend line has held firm on a closing basis despite a couple of breakdown attempts. If it breaks down more decisively in the coming days then it could unleash a bout of stop-driven selling, pushing the index toward its 200-day moving average around 5,785/90 next. That’s not just a moving average — it also aligns with a key prior high, offering potential support. Should that level give way, traders will be eyeing the 5695–5730 range as the next defence zone — a region that’s repeatedly seen price interaction this year.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R