US futures

Dow future -0.4% at 40210

S&P futures -0.8% at 5346

Nasdaq futures -1.6% at 18525

In Europe

FTSE -0.3% at 8225

Dax -0.17.% at 21194

- Stocks indices fall as heavyweight Nvidia drops 7%

- Trump applies curbs on AI chip exports to China

- Bank of America rises after earnings beat

- Oil rises on US- China talk rumours

Nvidia leads a broader decline in tech stocks

U.S. stock indices are falling on Wednesday, with Nvidia acting as a drag after US controls on chip exports to China, in the latest development of the U.S.-China trade war.

Later on Tuesday, the US Commerce Department issued new export licensing requirements for Nvidia & AMD’s AI chip exports to China. The H20 chip which was expected to generate $12-15 billion in revenue is now unsellable in China. The selloff sparked a broad tech decline.

The risk off mood is driving safe haven demand sending Gold to $3300 a record high.

Uncertainties surrounding trade tariffs and the US-China trade war overshadowed stronger-than-expected US retail sales data. US retail sales were higher than expected in March, jumping by 1.4% ahead of the 1.3% expected. This was up from 0.2% in February. Delving deeper into the figures, sales of motor vehicles and parts dealers jumped 8.8% from last year.

These figures covered the period before Trump unveiled steep reciprocal tariffs on host countries on April 2nd. However, the strong data was likely due to consumers trying to buy products ahead of Trump’s “Liberation Day”.

Looking ahead, attention will turn to Federal Reserve Chair Jerome Powell, who is due to speak later today and provide an update on the economic outlook. Powell could disappoint as the Fed is unlikely to cut rates for now, although the Fed could implement liquidity tools.

The market is currently pricing in 20% probability that the Fed will cut rates by 25 basis points at the May meeting. Trump’s trade tariffs could keep inflation sticky but slow growth.

Corporate news

Nvidia has fallen over 6% after the semiconductor giant said it would be hit by a $5.5 billion charge following the Trump administration's decision to limit exports of its H20 AI chip to the Chinese market.

Sector peers such as AMD, Broadcom, and Super Micro Computer are falling on expectations that they could also face hefty charges.

Tesla is dropping over 2% on reports that the EV manufacturer has suspended plans to import components from China for its Cyber Cab and semi-electric trucks in the US. This is due to the ramping up of the US-China trade war.

United Airlines is rising 6.8% after confirming that forward bookings were stable so far in the current quarter despite economic uncertainty due to tariffs.

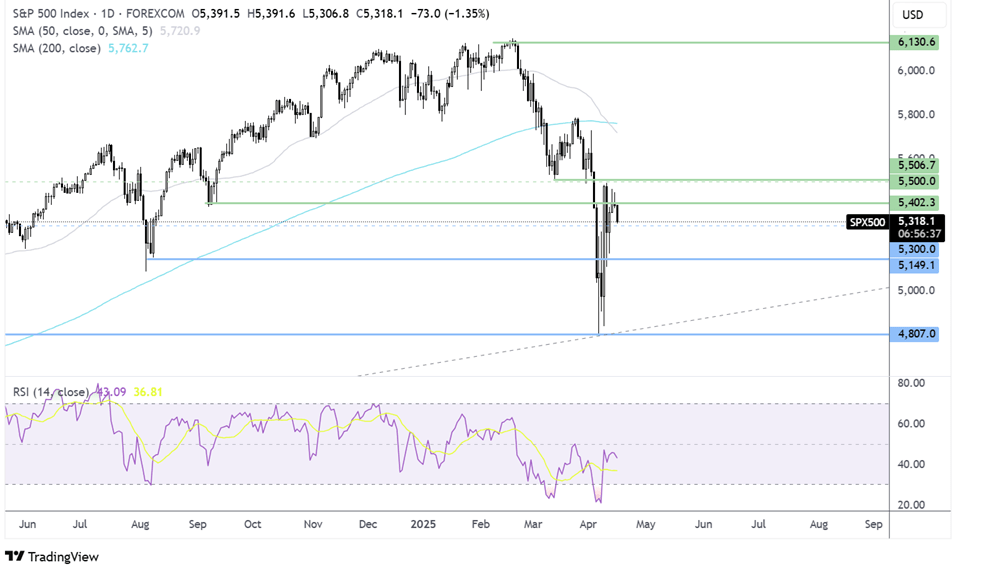

S&P 500 forecast – technical analysis.

The S&P500 recovered from 4800 the 2025 April low, running into resistance at 5500 before correcting lower. Buyers will need to rise above 5500 to gain conviction and break the falling trendline that could confirm a bullish trend. The 50 SMA is crossing below the 200 SMA in a death cross signal. Sellers will look to extend losses towards 5300 and then towards 5150.

FX markets – USD steadies, EUR/USD falls

The USD is falling as it struggles to attract bids at around a 3-year low. Worries over the outlook of the economy amid Trump’s tariffs are overshadowing stronger-than-forecast US retail sales/

The EUR/USD is rising, snapping a two-day losing run amid renewed USD weakness. The EUR has benefited from USD weakness even though the EU sees most trade tariffs going ahead and ahead of tomorrow’s ECB rare decision where the central bank is expected to cut rates by 25 basis points.

GBP/USD is rising towards 1.33 and trades at a six-month high amid USD weakness and despite cooler-than-expected UK inflation data. UK CPI eased to 2.6% YoY from 2.8% in February. This was cooler than the 2.7% forecasts and supports the view that the BoE will cut rates in the May meeting.

Oil rises on US–China trade talk optimism.

After a flat finish yesterday, oil prices are rising around 1%, boosted by speculation that the US and China could start trade talks. However, gains were limited by ongoing fears that energy demand could be curbed.

The de-escalation of the trade war between the US and China has reduced the downside risk for now. However, there is still much uncertainty.

Global oil demand is expected to grow at its slowest pace in five years in 2025, and oil production is also expected to slow because of Trump’s tariffs. Both the IEA and OPEC have downwardly revised oil demand growth forecasts.