US futures

Dow futures -0.26% at 42,100

S&P futures -0.36% at 5880

Nasdaq futures -0.56% at 21204

In Europe

FTSE 0.13% at 8776

DAX -0.4% at 23897

- US futures on US-China trade war concerns

- Fed officials, including Powell, are due to speak

- US ISM manufacturing is expected to remain in contraction

- Oil rises as Russia-Ukraine tensions overshadow OPEC+ meeting

Stocks fall as US-China trade war worries return

U.S. stocks are pointing to a lower open as renewed tensions between China and the US raise the likelihood of a costly trade war.

Wall Street indices are set to start the new month and week on a softer note, giving back some of last month's gains as tensions between the US and China ramp up.

At the end of last week, U.S. Treasury Secretary Scott Bessent warned that trade talks with Beijing had stalled, and Trump accused China of violating the consensus it reached in the Geneva trade talks. China is pushing back against these accusations, as relations deteriorate once again.

The US and China agreed to pause triple-digit tariffs for 90 days in mid-May. China also promised to remove trade measures restricting exports of critical metals needed for US semiconductor electronics and defence production.

However, Trump has said he plans to hike tariffs on steel imports to 50% from 25%, as the erratic and coherent trade policies impact market sentiment, reviving the “sell America trade.

Today, a slew of Federal Reserve officials, including Chair Jerome Powell, are due to speak at a conference in Washington, DC. Attention will also be on manufacturing PMI figures, which are expected to show that activity remained in contraction in May at 49.5, up from 48.7 in April.

Looking out across the week, US non-farm payrolls on Friday will be the main focus, with expectations of job creation slowing to 130k from 177k. Weak job growth could fuel concerns over the health of the labour market in light of Trump’s trade tariffs.

Corporate news

Steel stocks rose after President Trump hiked tariffs on the metal. Cleveland-Cliffs jumped 25%, while Steel Dynamics rose 10%.

Chip stocks slide lower on reports that Trump is preparing to tighten restrictions on China’s tech sector by expanding existing rules to include subsidiaries of sanctioned firms. Nvidia falls 1%, Marvell Technologies falls 1.9%, and AVGO falls 0.9%.

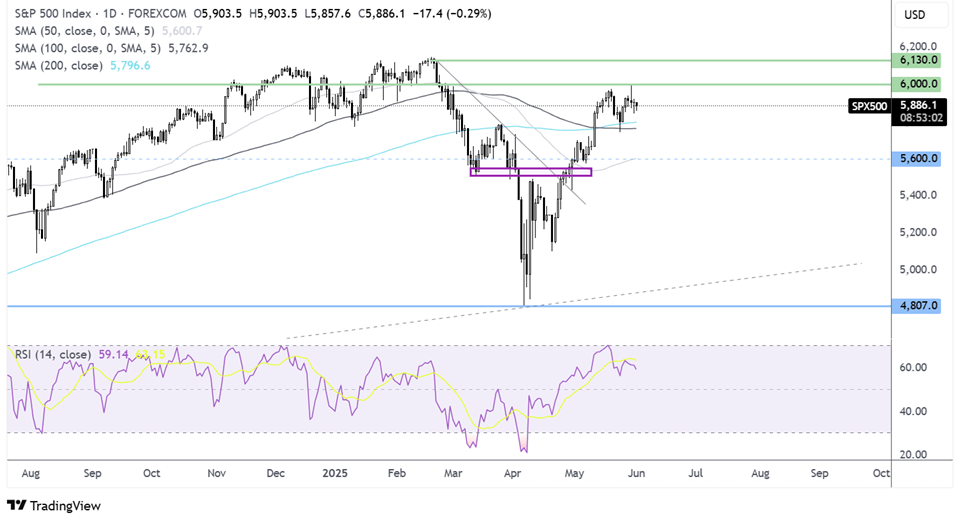

S&P 500 forecast – technical analysis.

The S&P 500’s recovery has stalled below the 6000 key psychological level—the price trades in a holding pattern below 600 but above the 200 SMA at 5800. A breakout above 6000 is needed to create a higher high and bring 6130 the ATH into play. Sellers will need to take out 5800 to gain traction towards 5600.

FX markets – USD falls, GBP/USD rises

The USD is falling amid re-escalating US-China trade war worries and after Trump announced 50% trade tariffs on aluminium and steel. His chaotic tariff policies hurt confidence towards the USD.

The EUR/USD is rising, pushing above 1.14 on broad-based USD weakness. Eurozone manufacturing PMI figures showed the sector contracted modestly at 49.4 in May. This marks the fifth straight monthly improvement and its best reading in 3 years.

GBP/USD is rising, breaking above 1.35, capitalising on the weaker USD. The pound has been supported by expectations that the BoE could be more cautious in cutting rates further from here. This week, the BoE Treasury Select hearing will shed more light on the BoE’s plans for rate cuts this year. Two more 25 bps cuts are expected.

Oil rises as Russia-Ukraine tensions rise & despite OPEC+ output increase

Oil prices rose 3% at the start of the week after Ukraine's drone attacks deep in Russia raised concerns over an escalating war and supply. This overshadows OPEC+ lifting oil output this weekend.

OPEC+ agreed to increase output by 411,000 barrels per day in July, marking the third straight month of the same increase. However, this mood was widely priced in.

As a result, markets are reacting to Ukraine's drone strikes on Russia's military airports over the weekend, which have brought a new element of supply risk into the market.

Meanwhile, lower US food inventory ease, combined with a surge in gasoline demand ahead of peak summer driving season, adds further support.

Meanwhile, on the demand side, Asian crude imports, particularly from China, have softened, pointing to some caution in the face of the economic uncertainty stemming from Trump's trade tariffs.