US futures

Dow futures 0.02% at 42,310

S&P futures 0.26% at 5840

Nasdaq futures 0.26% at 21545

In Europe

FTSE 0.03% at 8776

DAX 0.24% at 23897

- US stocks are muted, waiting for the next catalyst

- Factory orders & JOLTS job openings are due

- US ISM manufacturing is expected to remain in contraction

- Oil rises despite weak China data

Stocks are muted ahead of Factory orders, job openings data

U.S. stocks are muted as investors continue to weigh up the global impact of President Trump's trade policies

The OECD lowered its global growth forecast for a second time this year, warning over a deteriorating outlook due to rising trade barriers and waning business confidence.

President Trump ramped up rhetorical attacks against China at the end of last week, raising concerns of increased tensions between the world's two largest economies. President Trump and President Xi will probably speak later in the week.

Attention is on economic data with US factory orders and jolts jobs openings due to be released these figures will provide more insight into the health of the US economy as trade tariffs were implemented.

Job openings are expected to ease to 7.1 million from 7.2 million, and factory orders are expected to fall 3%. The date comes after the US manufacturing PMI unexpectedly contracted for a third straight month.

Weak data could raise concerns of a slowing outlook, particularly ahead of Friday's nonfarm payroll report.

Corporate news

Ford is falling despite posting a 16% increase in US car sales to May, aided by demand for pickup trucks and crossover SUVs.

Dollar General gained more than 10% after lifting its annual sales outlook, saying the updated guidance assumes current tariffs remain through mid-August. The firm beat on top and bottom lines, posting EPS of 1.78 on revenue of 10.44 billion, which was ahead of estimates of 1.48 and 10.38 billion.

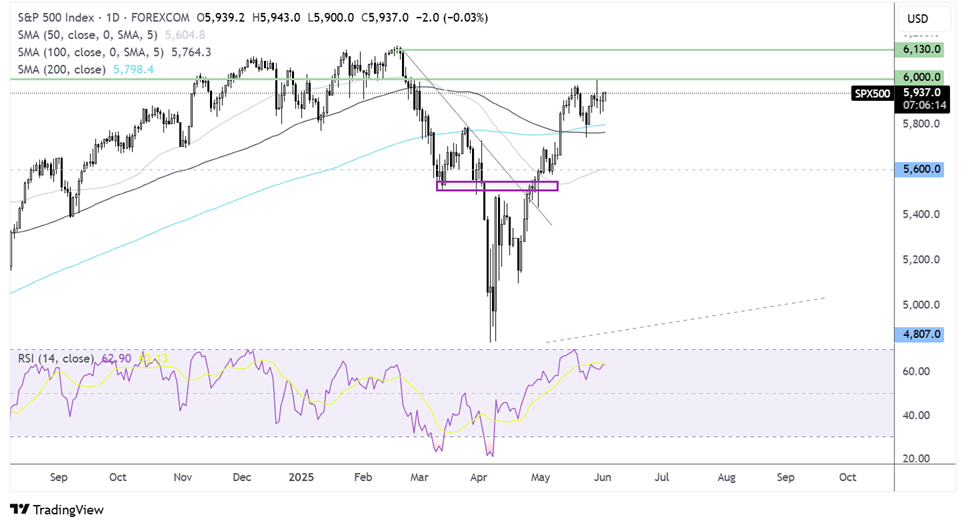

S&P 500 forecast – technical analysis.

The S&P 500’s recovery has stalled below the 6000 key psychological level—the price trades in a holding pattern below 6000 but above the 200 SMA at 5800. A breakout above 6000 is needed to create a higher high and bring 6130 the ATH into play. Sellers will need to take out 5800 to gain traction towards 5600.

FX markets – USD rises, EUR/USD falls

The USD is rising ahead of data and as risk aversion eases. Attention turns to factory orders and JOLTS job opening data. Still, the upside to the USD appears limited given the deteriorating outlook for the economy.

The EUR/USD is falling after Eurozone CPI eased to 1,9% YoY, falling below the ECB’s 2% target and making a 25 basis point rate cut on Thursday as good as a done deal.

GBP/USD is falling amid a rebound in the USD. However, losses could be limited after BoE governor said that he would cut rates gradually and carefully, citing uncertainty about the outlook due to the trade tariff turmoil.

Oil rises despite weak Chinese data

Oil prices are rising amid increased geopolitical tensions as the war in Ukraine ramps up despite peace talks in Turkey and as the talks between Iran and / a nuclear deal proposal make little progress.

Oil's recent gains come despite OPEC+ agreeing to hike output by 411,000 barrels per day in July, as the risk premium has filtered back into oil prices.

Data from China shows that manufacturing activity contracted for the first time in eight months, suggesting a slowdown in the world’s largest importer of oil that may