US futures

Dow futures 0.13% at 42,150

S&P futures 0.73% at 5931

Nasdaq futures 1.05% at 21540

In Europe

FTSE -0.03% at 8719

DAX -0.54% at 23983

- US futures pare earlier gains

- The US trade court blocks Trump’s trade tariffs

- US GDP & jobless claims raise concerns

- Nvidia jumps after upbeat earnings

- Oil steady after Trump trade developments & OPEC+ supply

Stocks rise after Trump’s tariffs are blocked by court

U.S. stocks are set to open higher, although futures trade down from session highs after the U.S. trade court blocks Trump's trade tariffs. Meanwhile, Nvidia’s earnings impress.

Sentiment has been supported by a ruling from the US Court of International Trade, which found that President Trump had overstepped his authority in imposing reciprocal tariffs through emergency law.

While the White House has appealed the ruling, and the conclusion may be determined by higher courts, this development has offered some relief regarding trade war worries.

On the economic front, higher-than-expected jobless claims have unnerved traders. Initial jobless claims were raised by 240,000 the previous week.

The second reading of the US GDP for the first quarter showed that the economy contracted 0.2% annualised compared to the initial report of a 0.3% decline. The data showed that consumer spending, which is the economy's primary growth engine, advanced 1.2%, down from the initial estimate of 1.8%, marking the weakest pace in almost two years. Corporate profits also fell 3.6%, marking the steepest fall since late 2020 raising concerns over the economic momentum.

Economic growth was slowed at the start of the year by a surge in imports, which US businesses were trying to offset Trump's trade tariffs. However, moderating consumer spending and the decline in federal spending are also weighing on the figure.

Investors were also digesting the minutes from the Federal Reserve's most recent monthly policy meeting, which reiterated policymakers' concerns over the economic impact of tariffs. Federal Reserve policymakers said that tariff-induced upside risks to inflation could complicate the Fed's macro policy, especially if labour market conditions weaken.

Corporate news

Nvidia is set to open over 5% higher after the AI chipmaker posted stronger than expected Q1 earnings and revenue. NVIDIA posted an almost 70% increase in revenue to 46.1 billion despite a big hit to Chinese sales amid the US restriction on exports to the key market. Guidance was also strong, with revenue expected to be $45 billion in the current quarter, and gross margins are set to rise to 72%. Despite the challenging environment, the upbeat guidance eased fears over the impact of China restrictions..

Tesla is rising 2.2% after CEO Elon Musk confirmed he was leaving his role in the Trump administration to focus on running the EV giant.

Kohl's is rising over 3%. The department store chain posted a smaller quarterly loss than forecast and maintained its annual targets as it focused on turnaround efforts and cost-cutting.

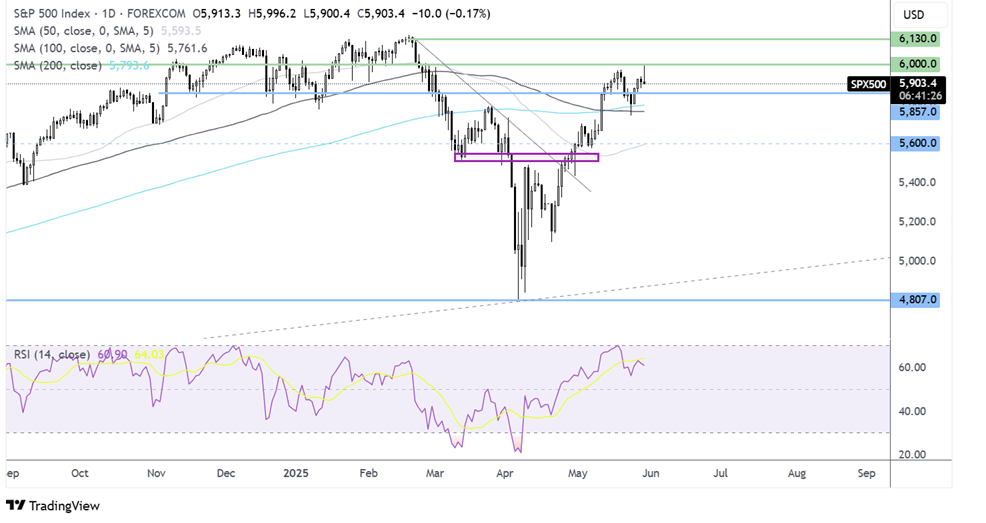

S&P 500 forecast – technical analysis

.

The S&P 500 rebounded higher from the 200 SMA rising to a peak of 5996 before falling lower. The inverted hammer candle could point to a reversal. Signs of slowing momentum could also favour sellers, with support seen at 5850. It would take a break below the 200 SMA at 5800 for sellers to gain traction. Buyers look to rise above 6000 to create a higher high before bringing 6130 and record highs into play.

FX markets – USD rises, EUR/USD falls

The USD is falling after weak jobless claims unnerve investors, raising concerns over the labour market as trade tariff uncertainty starts to show up in the jobs data.

The EUR/USD is rising amid USD weakness. The EUR rises as a liquid and stable alternative to the USD despite dovish ECB expectations. The central bank is expected to cut rates next week by 25 bps to 2%.

GBP/USD is rising amid USD weakness. The UK economic calendar is quiet. However, strong data last week supported the view that the BoE will only cut rates cautiously, keeping GBP underpinned.

Oil flat on Trump trade developments & OPEC expectations

Oil prices are holding steady as the market weighs up news that Trump’s trade tariffs are unlawful, along with the possibility of an OPEC+ supply hike in July.

Trump's sweeping tariff agenda blocked by the US court of international trade has helped ease fears of a potential economic slowdown. This initially helped boost oil prices in a new European session; however, those gains have since been given back as the White House appeals the decision.

Separately, OPEC+ is expected to make a decision on Saturday over July output levels, with another supply increase of 411K barrels per day expected.