US futures

Dow future 0.7% at 38420

S&P futures 0.71% at 5190

Nasdaq futures 0.75% at 17938

In Europe

FTSE 1.5% at 8275

Dax 1.47.% at 21076

- Stocks indices rise after yesterday’s steep selloff

- The mood is cautious after Trump attacked Powell

- Tesla reports after the close

- Oil rises recovering after losses yesterday

The mood remains cautious after Trump attacked Powell

U.S. stock indices are pointing to a stronger open, rebounding from yesterday's steep sell-off, which was caused by President Trump's escalated criticism of Federal Reserve chair Jerome Powell, which hit market sentiment.

All three major indices closed Monday over 2% lower after Trump redoubled attacks on the Federal Reserve chief Powell for not cutting interest rates. This raised concerns over the central bank's autonomy regarding its future path for rates.

Still, the market remains cautious as investors await Trump's next steps, further clarity on U.S. trade policy, and the outcome of negotiations with individual countries.

While the sell-off has steadied today, the market is pricing in a political risk premium for US assets, which is weighing on equities and risk sentiment, while boosting Gold to record highs.

Meanwhile, attention will turn to corporate results, with Tesla kicking off earnings to the Magnificent 7 later today.

Mega-caps have been among the hardest hit by yesterday's selloff and are recovering today, with Apple up 1% and NVIDIA gaining 1.2% premarket.

US stocks is remaining sharply lower from record highs reached earlier this year amid Trump's incoherent trade policies,, with the S&P 16% down from its February 19 high

Corporate news

Tesla is edging higher on Tuesday after dropping almost 6% yesterday, ahead of the Q1 earnings report after the close today. The share price trades 44% lower across the year amid the worst quarter since 2022 as the market frets over ongoing brand erosion. CEO Elon Musk has many distractions outside of Tesla, particularly with his role with the Trump administration. The long delay on robo-taxis and self-driving technology for existing cars will also be in focus. Tesla reported 336,681 vehicle deliveries in the first quarter down 13% from the same period a year earlier. Expectations are for revenue of 21.24 billion an EPS of $0.40.

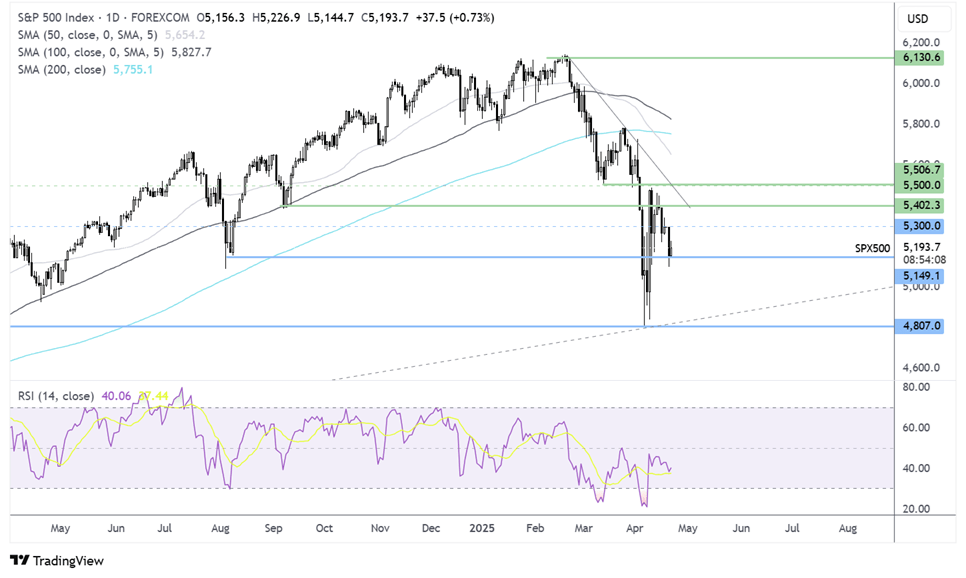

S&P 500 forecast – technical analysis.

The S&P500’s recovery from 4800 ran into resistance at 5500 and rebounded lower, creating a lower high. The price closed above 5150 support,, which is the next level sellers will need to break down to bring 5100 and 5000 into focus. Resistance can be seen at 5300 and 5400,, with a rise above 5500 needed to create a higher high.

FX markets – USD steadies, EUR/USD falls

The USD is steadying at fresh 3-year lows after a selloff of everything American on Monday. The USD has fallen over 9% so far this year amid growing fears of a recession in the US.

The EUR/USD is easing back from yesterday's multi-year high of 1.1570. Eurozone consumer confidence data is due later and is expected to deteriorate to -15.6 from -14.8 amid concerns over what trade tariffs could mean for the economic outlook.

GBP/USD is easing back from 1.34, reached earlier in the session, a level last seen in September 2024. The pound is at a seven-month high as it benefits from USD weakness. UK PMI data and retail sales figures are due this week.

Oil rises, recovering some of yesterday’s losses

Oil prices are edging higher amid short coveringS after yesterday’s selloff. However, economic headwinds persist, which could limit the upside.

Both WTI and Brent fell more than 2% on Monday amid signs of progress in a nuclear deal in talks between the US and Iran which eased supply concerns.

The US and Iran agreed to begin drawing up a framework for a potential nuclear deal, which could result in Trump easing restrictions on Iranian oil.

Still, concerns over the impact of Trump's trade tariffs on global growth could limit the upside. The IMF growth outlook is released later today.