US futures

Dow futures -0.74% at 40932

S&P futures -0.9% at 5601

Nasdaq futures -1.27% at 19722

In Europe

FTSE -0.28% at 8600

DAX -0.52% at 23213

- Stocks drop as tariff uncertainty weighs

- The 2-day FOMC meeting begins

- Ford falls after suspending guidance

- Oil rebounds from a 4-year low

Stocks fall on tariff concerns as the FOMC meeting begins

U.S. stocks are set to open lower on Tuesday after President Trump's plan to impose further trade tariffs dampened investor sentiment. The Federal Reserve's two-day meeting also kicks off today ahead of tomorrow's rate decision.

Trump said on Monday he would announce farmer tariffs over the next two weeks. His latest announcement follows his announcement on Sunday that he would impose tariffs on foreign-made movies.

Drugmakers Eli Lilly and Pfizer were slightly lower premarket following the latest developments, which offset optimism surrounding deregulation towards approval for opening pharmaceutical manufacturing plants.

Tariff-driven uncertainty is resulting in consumers, businesses, and the Federal Reserve adopting a wait-and-see approach to understand the outlook. While Trump said last week that potential deals with trading partners were making progress, the lack of concrete results is unnerving investors.

The Fed starts its two-day meeting on Tuesday, and the central bank is expected to leave interest rates unchanged. Policymakers' comments regarding any clues to their stance going forward will be closely monitored. With stable inflation and steady jobs data, the Fed will stay on the sidelines for now. The market is pricing in the first rate cut in July and 79 basis points of cuts by the end of the year.

Corporate news

Planatir Technologies is falling over 8% despite posting earnings and revenue in line with analysts' estimates. The defence technology stock also boosted full-year revenue guidance. However, the decline comes amid weakness in Europe, slowing customer growth rates, and trade tariff tensions.

Ford is falling over 2% after suspending its 2025 guidance owing to near-term risks surrounding supply chain disruptions. Q1 earnings and revenue were better than expected.

DoorDash falls over 3% after Q1 revenue missed estimates, but adjusted earnings beat expectations. DoorDash also reached a deal worth $2.9 billion for Deliveroo.

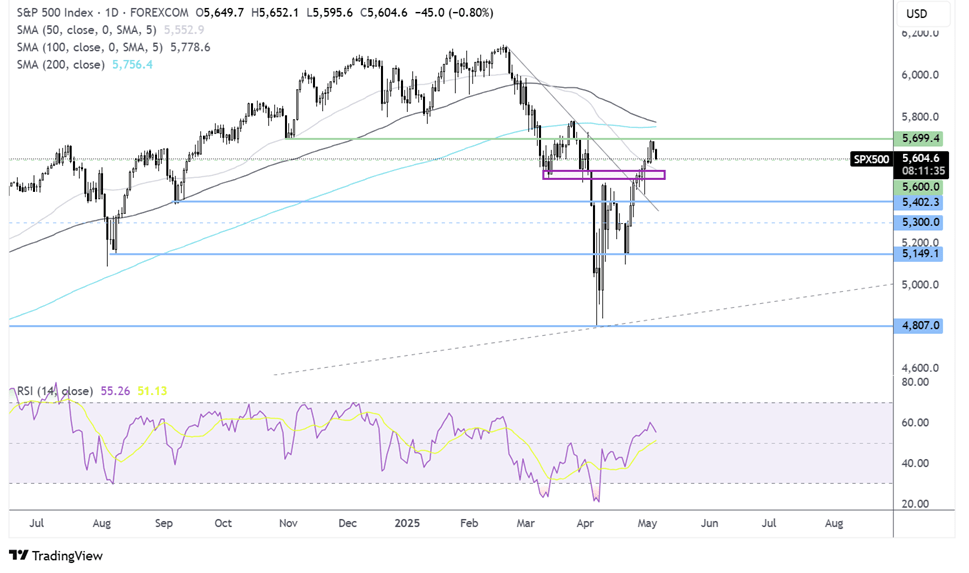

S&P 500 forecast – technical analysis.

The S&P 500’s recovery ran into resistance at 5700 before rebounding lower. The price is testing support at 5600 at the time of writing. Immediate support can be seen at the 5550-5500 zone and 5400 below. Buyers would need to rise above 5700 to create a higher high and expose the 200 SMA at 5760. Above here, buyers could gain momentum.

FX markets – USD falls, GBP/USD rises

The USD is falling as investors await news on trade deals. The lack of news is making investors nervous. Some of last week’s optimism has faded. Attention is turning to the FOMC decision tomorrow. Should the Fed push back on rate cuts, the USD could rise.

The EUR/USD is rising, capitalising on a weaker USD despite PMI data showing that business activity slowed in the eurozone in April. The composite PMI fell to 50.4 in April from 50.9 in March, and cost pressures eased, supporting the view that the ECB could cut rates again in June. Germany’s Merz also failed to secure enough votes to become Chancellor. Although a second vote will come soon.

GBP/USD is rising amid a weaker USD, despite UK service sector activity contracting at the steepest pace since 2023. The services PMI fell to 49 in April, down from 52.5 in March,, although it was slightly ahead of the forecast of 48.9. Meanwhile, input cost pressures rose at the fastest pace since July 2023. The data comes ahead of Thursday's Bank of England rate decision, where the central bank is expected to cut rates by 25 basis points.

Oil sees a technical rebound from a 4-year low

Oil is rebounding after hitting a four year low in the previous session after OPEC+ decided to boost output, although concerns about market oversupply persist.

Face benchmarks dropped to the lowest level since February 2021 on Monday after OPEC decided to ramp up oil production for a second straight month. Today's rebound is rather surprising given the potential for increased supply. The rise is most likely a technical increase in price rebound, WTI remains below the $60.00 psychological level.

Oil prices have lost over 10% in the past six sessions, dropping 20% since April, when Trump announced his Liberation Day tariffs.