US futures

Dow futures -0.35% at 39950

S&P futures 0.02% at 5574

Nasdaq futures 0.08% at 19185

In Europe

FTSE 0.03% at 8417

DAX 0.69% at 22222

- Contradictory US-China headlines keep the markets cautious

- Stocks struggle but rise across the week

- Alphabet rises after forecast-beating earnings

- Oil falls 3% across the week on supply, growth worries

Stocks struggle but rise across the week

U.S. stocks are broadly unchanged amid ongoing China-U.S. trade uncertainty. However, a slight softening of tone from both sides means stocks are set to rise across the week.

Traders remain cautious, with futures reversing earlier gains amid a lack of clarity over developments between the US and China. China granted some US imports exemptions from its 125% tariffs. However, China also denied that talks are taking place with the US despite President Trump saying his administration is talking with China to strike a deal.

The conflicting headlines keep the mood jittery and the markets in a wait and see mood to figure out what is happening and the possible impact. So whilst it appears the worst-case scenario won't be playing out, the actual outcome still remains unknown.

This week has been a relatively quiet week for data; however, next week will see plenty of releases, including US non-farm payrolls, core PCE, and US GDP, for investors to digest.

Corporate news

Alphabet is rising over 4% after the Google owner posted stronger-than-expected earnings for Q1 and announced a $70 billion buyback, reaffirming its ambitions for AI development plans.

Intel is falling 7% after the chipmaker's weak guidance offset consensus-beating earnings amid heightened concerns over macro headwinds stemming from the US-China trade war.

Apple is falling after reports in the FT that the tech giant plans to shift assembly of all iPhones sold to the US to India as soon as next year in a pivot away from China.

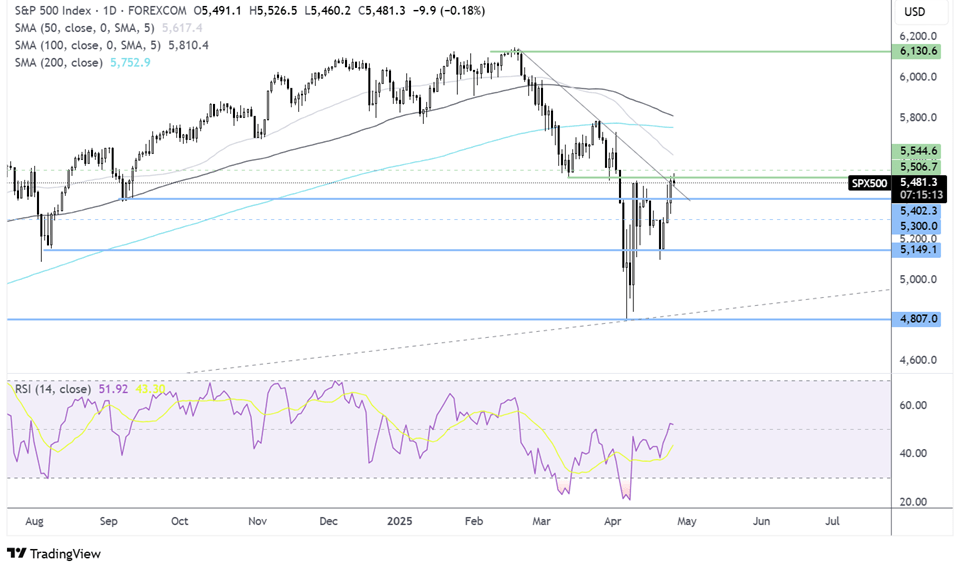

S&P500 forecast – technical analysis.

The S&P 500’s recovery from 5100 has stalled around the 5500 level, which buyers will need to rise above to extend the recovery towards the 200 SMA at 5750. Should the price face rejection at 5500, a retest of 5400 could be on the cards, and below here, 5300. A break below 5150 is needed to create a lower low.

FX markets – USD rises, EUR/USD falls

The USD is rising as trade war fears ease modestly. After four weeks of losses, the USD is on track to rise this week, a sign that the sell-America trade is easing.

The EUR/USD is falling towards 1.1350 amid renewed USD strength on growing optimism surrounding the US-China trade war. In recent weeks, the euro has been a key beneficiary of the weaker dollar, so a slight bullish reversal in the USD is pulling on the pair. Eurozone CPI data will be focused on next week.

GBP/USD is rising, falling towards 1.33 despite stronger-than-expected UK retail sales. Sales rose 0.4% MoM in March before Trump announced sweeping tariffs on US trading partners, and as the sunny weather lifted sales in clothing and outdoor shops. Economists had expected a fall of -0.4%

Oil rises after steep losses yesterday

Oil prices fell on Friday and are on track to book 3% losses across the week amid oversupply concerns and uncertainties surrounding trade tariffs between the US and China.

Speculation that OPEC+ could increase production hikes from June is weighing on oil prices after several members suggested the group accelerate output increases for a second month in June.

The US-China trade dispute remains a key focus. China said it is not in talks with the US, contradicting President Trump's earlier comments that talks were underway. A trade war between the two largest oil consumers is hurting the demand outlook.