Over the last two trading sessions, USD/CHF has shown a variation of just 0.4%, reflecting a clear neutral bias after the Swiss National Bank (SNB) rate decision. The central bank’s dovish stance has prevented the franc from stabilizing, and uncertainty now dominates short-term price action. If this pattern continues, the pair could enter a consolidation phase in the sessions ahead.

What Happened with the SNB Decision?

On June 19, 2025, the Swiss National Bank announced a 25-basis point rate cut, lowering its key rate to 0%, one of the lowest levels among major global central banks.

The SNB justified this move by pointing to ongoing declines in inflation and noting that the franc’s strength was weighing on the economy, opening the door for another rate reduction.

Swiss National Bank Interest Rate Trend Chart

Source: ForexFactory

This policy shift marks a clear divergence from the Federal Reserve’s narrative, which currently maintains rates at 4.5%. While the Fed continues with a restrictive monetary policy, Switzerland has stabilized its macro indicators enough to adopt a much more accommodative stance, even amid global economic and geopolitical uncertainty.

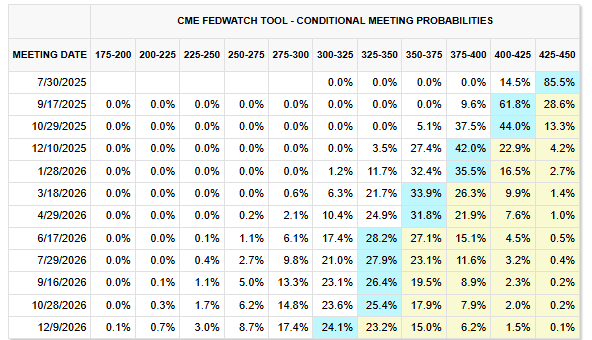

Although Switzerland has moved in this direction, the Federal Reserve does not appear ready to do the same. According to CME Group, there is an 85.5% chance that the rate will remain unchanged at the July 30 meeting. It’s only by September 17 that the probability of a rate cut to 4.25% increases to 61.8%.

Source: CME Group

This shows that the Fed is far less flexible than the SNB at the moment. U.S. officials have made it clear that inflation must be closely monitored, and a rate below 4% is not likely in the near term.

There is now a significant interest rate gap between the two countries: 0% in Switzerland vs. 4.5% in the U.S. This gap could have a major impact on capital flows, as U.S. fixed-income instruments become more attractive in terms of yield than their Swiss franc-denominated counterparts.

This disparity also affects currency demand, likely favoring the U.S. dollar over the Swiss franc. While USD/CHF remains neutral for now, a continued divergence in monetary policy could lead to sustained upward pressure on the pair in the near term.

USD/CHF Technical Outlook

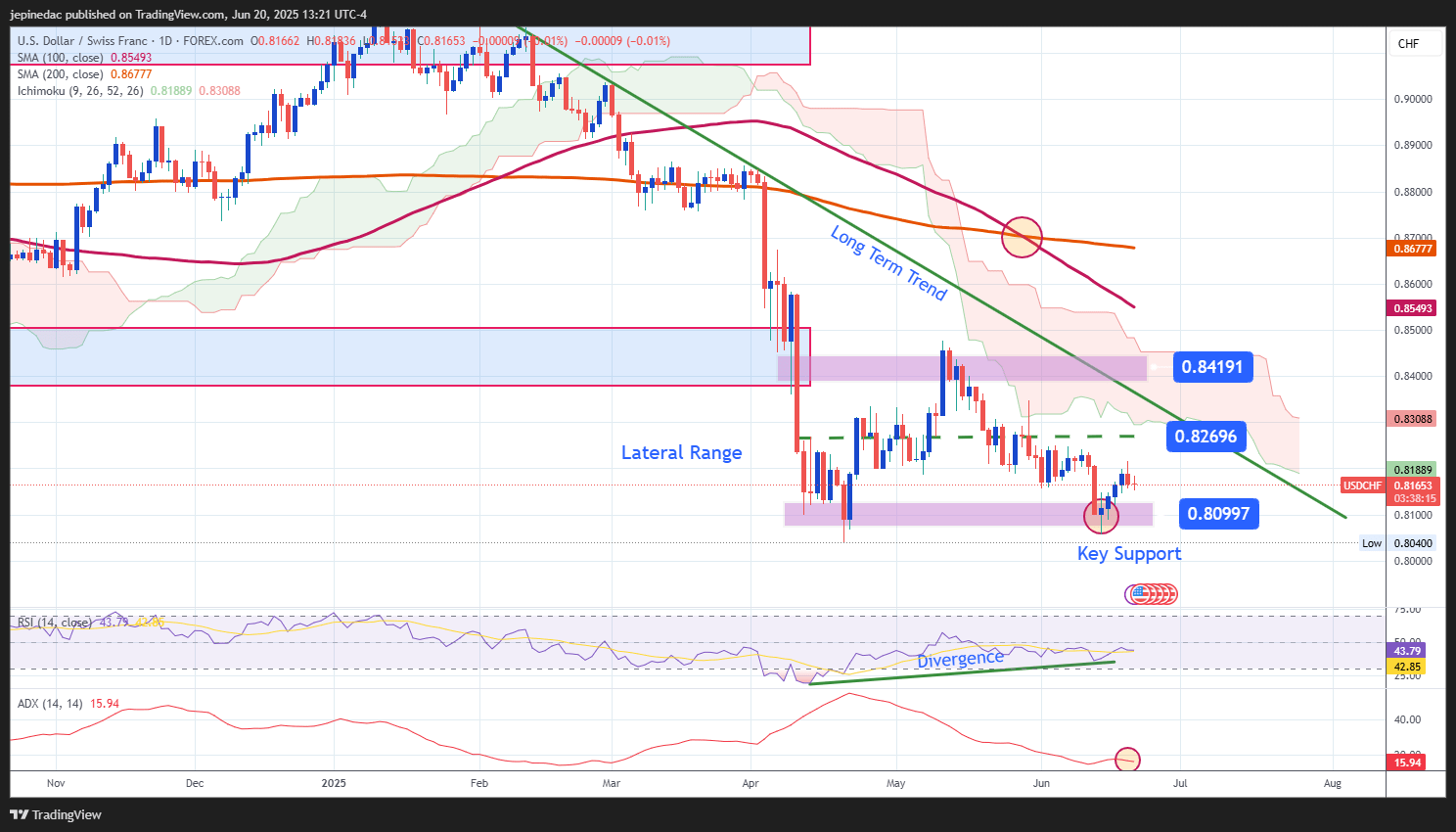

Source: StoneX, Tradingview

- Downtrend on Hold: Since early February, USD/CHF has been in a clear bearish trend, with no meaningful bullish attempts to reverse it. However, the pair has entered a consolidation phase, forming a sideways channel in recent weeks. If this continues, it could pose a technical challenge to the prevailing downtrend.

- RSI: The Relative Strength Index is showing higher lows, while price action holds at similar lows, signaling a bullish divergence. This may indicate waning bearish momentum and open room for short-term upward corrections.

- ADX: The ADX line remains below the 20 level, reflecting low average volatility over the last 14 sessions. This supports the idea of a well-defined consolidation range, with no clear directional momentum at present.

Key Levels to Watch:

- 0.80997 – Key Support: A recent multi-week low, respected on several occasions. A break below this level could reactivate the bearish bias and trigger a deeper downward move.

- 0.82696 – Nearby Barrier: An intermediate resistance zone, tied to a recent neutral phase. It may serve as a technical ceiling against short-term rebounds.

- 0.84191 – Critical Resistance: The multi-month high, marking a crucial level for bullish breakout attempts. A sustained move above this area could signal the end of the bearish trend and the beginning of a new upward cycle.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25