Jerome Powell Hits the Wires

Federal Reserve Chair Jerome Powell will speak on the U.S. economic outlook before the Economic Club of Chicago on Wednesday (local time), or 3:15 a.m. Thursday Sydney time. Traders are expected to pay close attention to his remarks for any clues on potential rate cuts. However, the Fed has remained consistent in its "wait and see" stance, preferring to assess the impact of tariffs before committing to cuts. Unless Powell strays from the established script, this could end up being a non-event. That said, market tensions are likely to remain elevated heading into his speech. A steady tone from Powell could allow the U.S. dollar to extend its tentative retracement higher in the near term.

View related analysis:

- US Dollar Index, USD/CAD, AUD/CAD Analysis

- EUR/USD, AUD/USD, S&P 500 Analysis: COT Report

- AUD/USD Stages a V-Bottom Recovery

- EUR/USD Surges in Asia as the USD Continues to Unravel

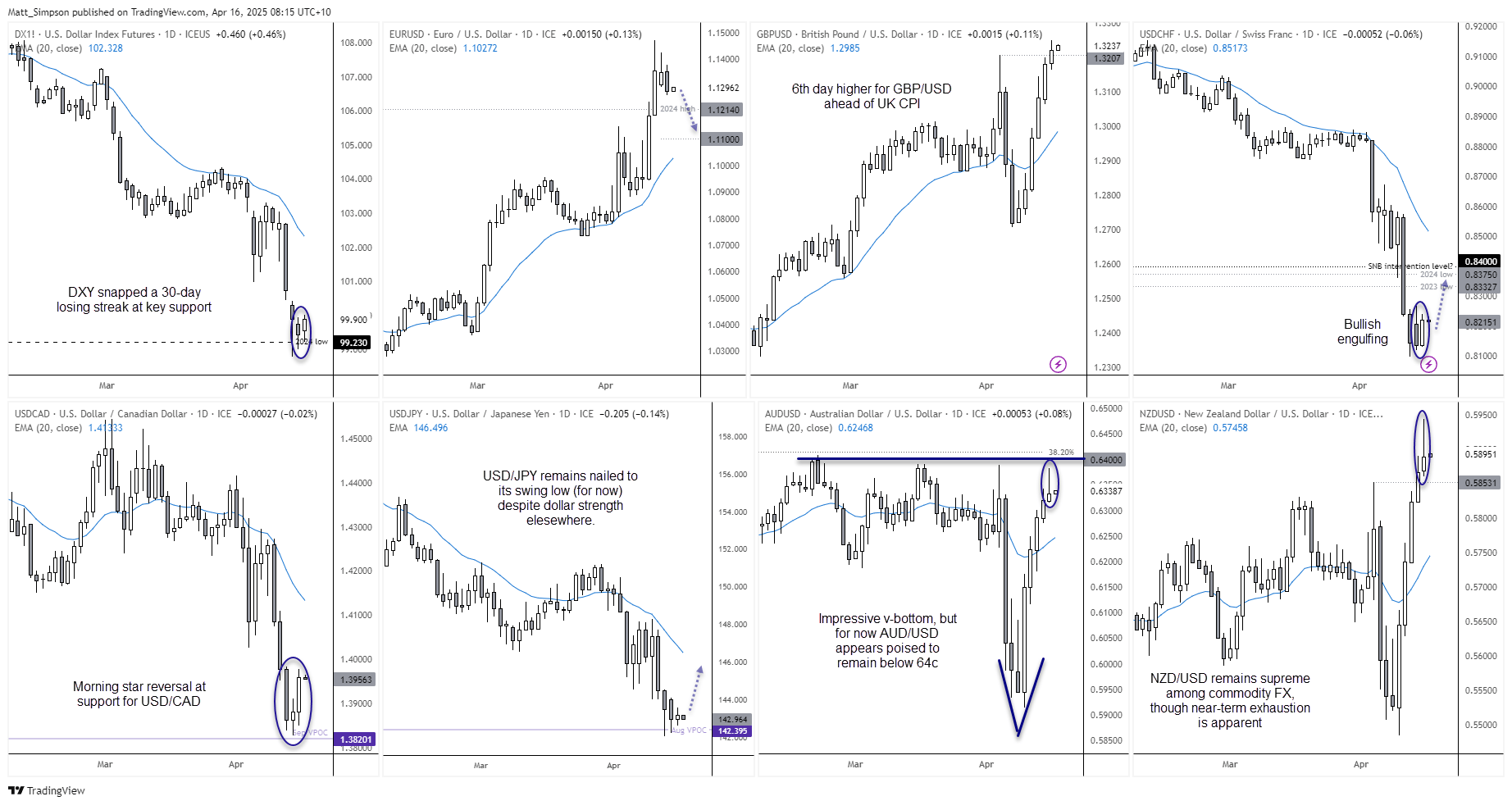

US Dollar Index Technical Analysis

The weekly chart of the U.S. Dollar Index closed just below the 100- and 200-week SMAs, though not with enough conviction to confirm a breakdown. This leaves room for a potential bounce. Notably, price action remains within the lower wick of last week's candle, highlighting hesitation among bears to push the dollar to new lows. The weekly and daily RSI (2) both dipped into oversold territory last week.

On the daily chart, the dollar snapped a three-day bearish streak with a modest bullish candle on Tuesday. Thursday and Friday both saw intraday dips below the 2024 low that failed to hold—hallmarks of a potential countertrend move.

Bulls may now eye a move toward the September high at 100.87 or the psychological 101 level. A break above that could open the door to 102–102.50.

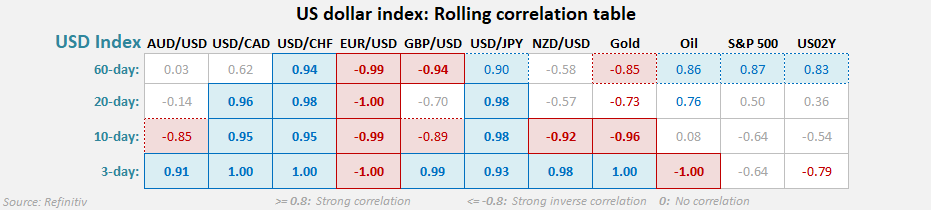

Mixed Response Against the U.S. Dollar

Euro (EUR/USD)

A rising dollar index typically spells weakness for EUR/USD, given the euro accounts for roughly 57% of the index’s weighting. The anticipated pullback in EUR/USD appears to be underway, and a break of the dollar index above 102 could drive the pair below 1.11.

Swiss franc (USD/CHF)

USD/CHF remains closely correlated with the dollar index and offers a strong alternative to express a bullish dollar view outside of EUR/USD. A bullish engulfing candle has formed, and with speculation that the SNB may intervene to weaken the franc, further upside looks increasingly likely—whether driven by fundamentals or sentiment.

Canadian dollar (USD/CAD)

Thanks to softer inflation data from Canada, a morning star reversal pattern has emerged on USD/CAD as bets of a BOC cut weakened the Canadian dollar. Bulls may look to buy dips within Tuesday’s range, targeting a potential break above 1.40.

Australian dollar (AUD/USD)

AUD/USD has risen for five straight sessions, yet there’s a lack of bullish momentum to decisively challenge the 0.64 level. This level has capped gains several times this year, and a bearish pinbar formed Tuesday with a high beneath recent cycle highs. Still, the formation of a prominent V-bottom hints that a significant low might be in place.

New Zealand dollar (NZD/USD)

The New Zealand dollar continues to outperform, climbing for a fifth day and reaching a 19-week high as it challenges the 0.59 level. A bearish pinbar has also formed, suggesting some loss of momentum. However, given AUD/USD’s struggle near resistance, NZD/USD may remain the stronger pair. This dynamic points to potential downside for AUD/NZD.

Japanese yen (USD/JPY)

The strength of the Japanese yen has kept USD/JPY nailed to cycle lows. This is the pair which may be the most vulnerable to how dovish (or not) Jerome Powell’s speech is deemed to be. But overall, this is not a preferred USD long when compared to other pairs such as USD/CAD, USD/CHF (or short EUR/USD).

EUR/GBP could be a pair to watch

With inflation reports released for the UK and EU within three hours, EUR/GBP is a prime candidate for volatility – especially if the two reports diverge.

Economic events in focus (AEDT)

- 09:10 – Fed Governor Cook speaks (US dollar, gold, crude oil, Wall Street indices)

- 09:50 – Japanese Core Machinery Orders (USD/JPY, AUD/JPY, Nikkei 225)

- 11:30 – Chinese GDP, retail sales, industrial production, NBS press conference (China A50, Hang Seng, USD/CNH)

- 16:00 – UK core CPI (GBP/USD, EUR/JPY, GBP/JPY, FTSE 100)

- 19:00 – EU core CPI (EUR/USD, EUR/GBP, EUR/JPY, EUR/CHF, DAX)

- 22:30 – US core retail sales (US dollar, gold, crude oil, Wall Street indices)

- 23:15 – US industrial production, capacity utilisation (US dollar, gold, crude oil, Wall Street indices)

- 23:45 – BOC interest rate decision (USD/CAD, CAD/JPY, AUD/CAD, WTI crude oil, brent)

- 00:30 – BOC press conference (USD/CAD, CAD/JPY, AUD/CAD, WTI crude oil, brent)

- 03:15 – Fed Chair Jerome Powell speaks (US dollar, gold, crude oil, Wall Street indices)

US Retail Sales

There is a reasonable chance we may see a dent in retail sales, given that consumer sentiment has nose dived alongside business sentiment, while inflation expectations have perked up. This could prompt a pullback in the US dollar over the near term, but I maintain my stance that Powell is not likely to be dovish and that leaves the dollar vulnerable to a bounce. Still, expectations are for a much hotter set of spending as consumers are expected to front load the impact of tariffs. In either case, my core bias remains being bullish the US dollar.

China’s growth figures in focus

China’s Q1 GDP figures are unlikely to reveal too much of Trump’s trade war, but that doesn’t mean risk might take a hit if it does come in softer than expected. Because if it undershoots before tariffs take effect, it is likely to once they do kick in. However, it also increases the urgency for China to switch to domestically-driven growth.

Bets are back on for a Bank of Canada (BOC) cut

Inflation data for March came in softer than expected across the board, boosting odds of an eight BOC cut of the cycle. A 25bp cut would take rates down to 2.5%, in a move that would be to fend off expectations of softer growth. The BOC’s February statement was littered with concerns of rising inflation and inflation expectations, and core CPI falling to 2.2% y/y and 0.1% m/m (while trimmed mean and median CPI remain within the 1-3% range) has tipped the odds into a BOC cut.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge