Risk appetite took another big hit as China struck back with fresh tariffs of its own, following Trump’s big reciprocal tariffs announcement on Wednesday. The world’s second largest economy has just announced a sweeping 34% tariff on all US goods, effective 10 April, escalating trade tensions yet again. In response, stocks, crude oil, and Aussie dollar all plunged, while government bonds and haven currencies – Japanese yen and Swiss franc – soared, alongside a rebounding gold. With all these market tumbling, one has to wonder where it will all end. So far, risk appetite has been literally non-existent. But there is still lingering hope that there might be some deals that could be agreed on before the April 9 go-live date for US reciprocal tariffs. However, as we get closer to that date, it looks like the trade war is only intensifying with China – and soon to follow others – coming back with counter measures.

Source: TradingView.com

China retaliates aggressively: Trade War intensifies

So, the mood out there is rather bleak and deteriorating as markets brace for more volatility heading into the US session. Trump’s tariffs move a couple of days ago was big for volatility, but the retaliation phase could be even bigger, and Beijing’s response is among the most aggressive we have seen so far. If Trump is bluffing, well China is going all in and calling his bluff. If not, both sides will lose out as tariffs are not good for the global trade system. With just under a week until these measures kick in, uncertainty remains high.

How will Trump respond?

If Trump holds the line on his aggressive trade stance, the risk is clear: global growth could take a serious hit. Markets have already reacted. Traders are betting the Fed will have to step in, with money markets now pricing in as much as 100 basis points of rate cuts in the US this year.

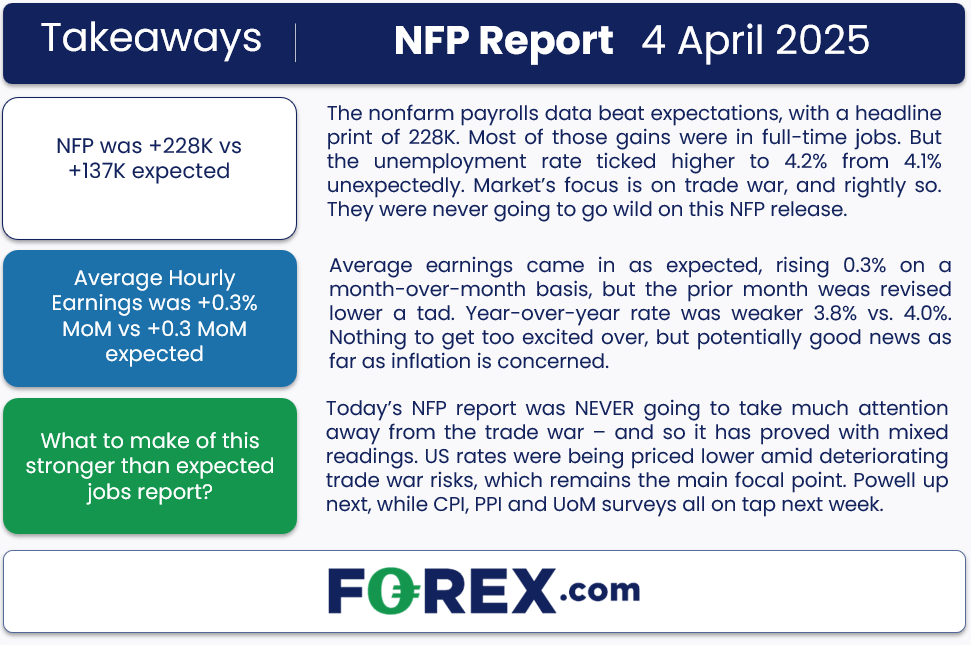

US non-farm jobs report beats, Powell up next

Today’s NFP report was NEVER going to take much attention away from the trade war – and so it has proved with mixed readings. US rates were being priced lower amid deteriorating trade war risks, which remains the main focal point. Powell up next, while CPI, PPI and UoM surveys all on tap next week.

The bigger event could be more tariffs news from other countries and economic regions, while the Fed chair Powell is also speaking later, who could potentially hint at some monetary support and thus help alleviate some of the pressure from risk assets.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R