View related analysis:

- AUD/USD weekly outlook: Bears Eye Sustainable Move to the 50s Amid Tariff Turmoil

- CHF Beats Yen for Safety as Tariffs Take Second Quarter to the Slaughter

- If Consumers Don’t Consume, a Recession Could be Presumed

- AUD/USD weekly outlook: RBA, ISMs and NFP in Focus

* Please note that this data is only accurate up to the daily close of 25th March 2025. Given the market in the second half of last week, market positioning is likely to have varied considerably for some markets from what has been reported.

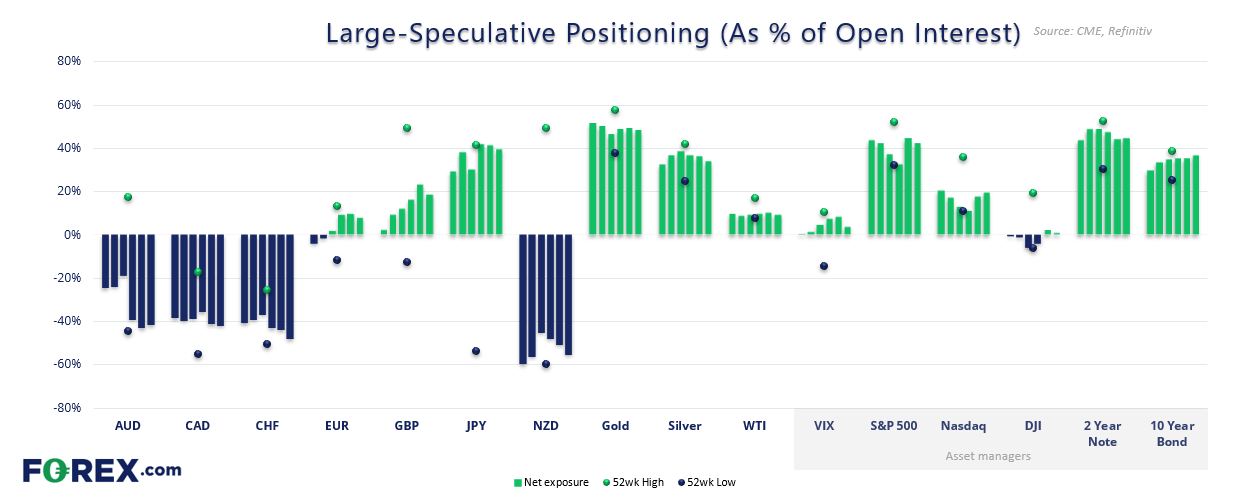

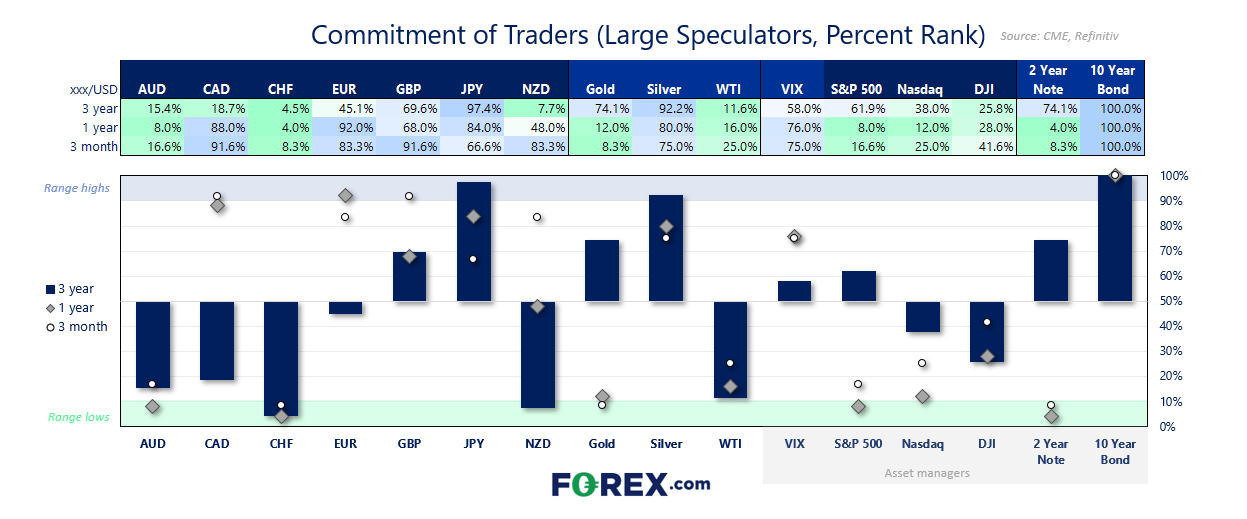

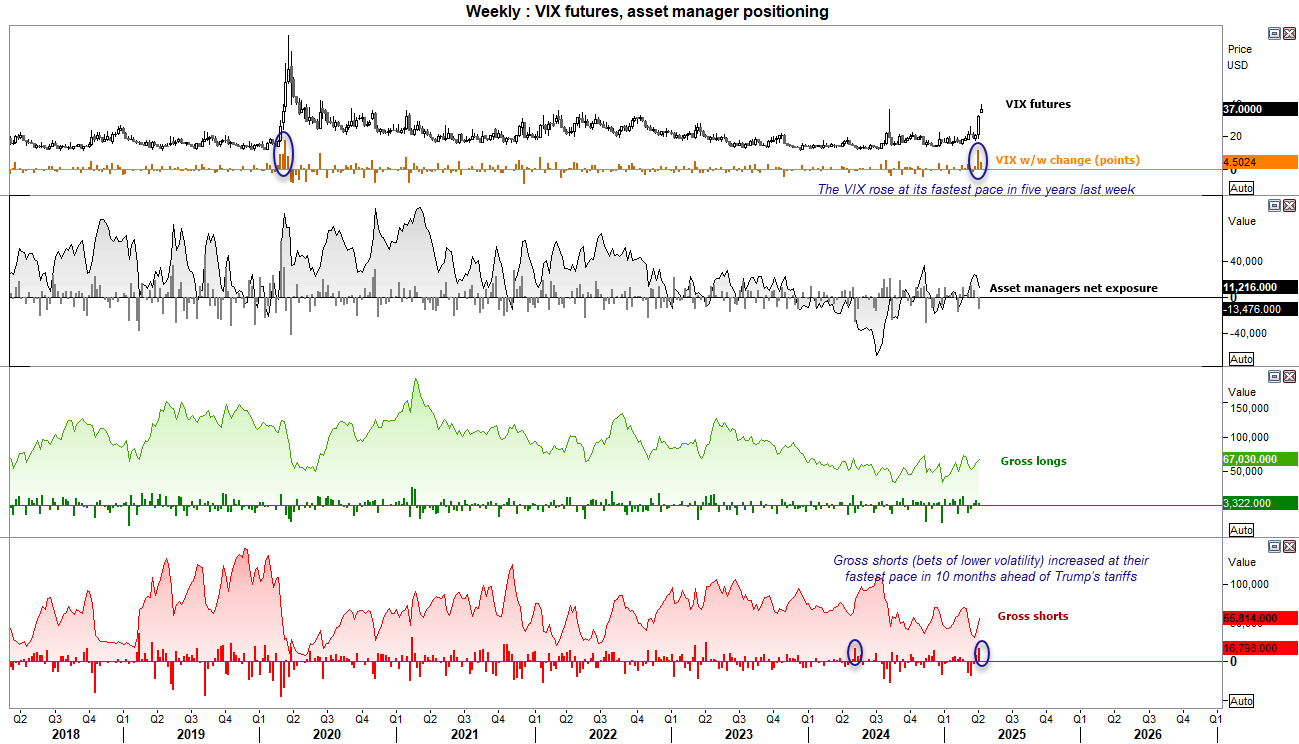

If there is anything to be gleaned from the recent COT data, it is how unprepared traders were for Trump’s tariffs. Not only did they increase bets of a lower volatility by shorting the VIX, but also shorted the Swiss franc – which turned out to be the best performing FX major last week. It is also interesting to note that asset managers decreased short bets against Nasda1 00 futures, which is unfortunate given it declined 15% last week (most of which was in the second half of the week).

Market positioning from the COT report – 25 March 2025:

- Large speculators increased their gross-short exposure to gold futures by -34% (-22.7k contracts)

- They also increased short by against silver futures by 14.5% (3.6k contracts)

- Gross-short exposure to WTI crude oil futures rose by 11% (15.8k contracts)

- Asset managers increased their gross-short exposure to VIX futures by 43.1% (16.8k contracts)

- They also increased gross-short exposure to S&P 500 futures by 2.1% (4.2k contracts) and trimmed longs by -2.3% (-25.7k contracts), which dragged net-long exposure by -30k contracts

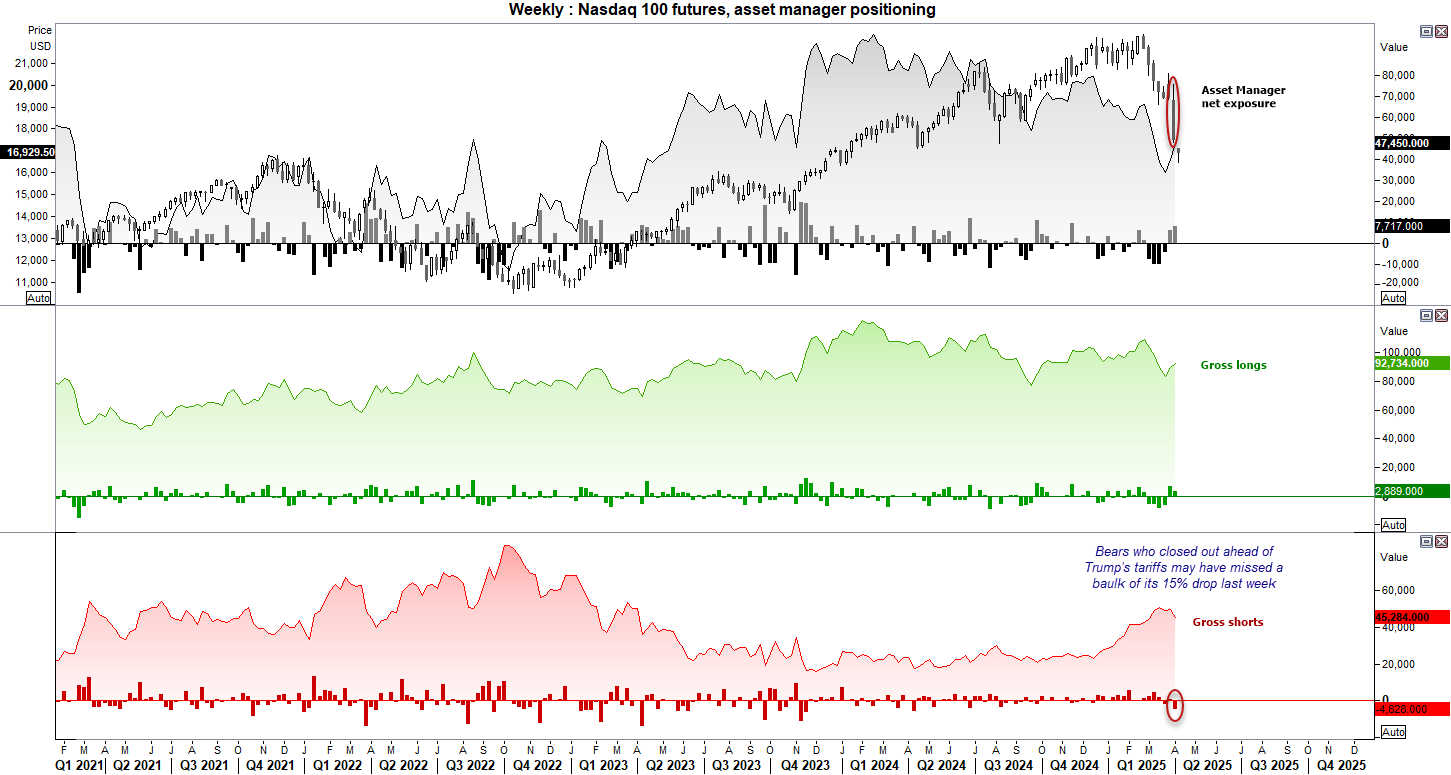

- Asset managed reduced gross-short exposure to Nasdaq 100 futures by -9.6% (-4.8k contracts)

- Large speculators increased gross-short exposure to Swiss franc futures by 12.3% (5.1k contracts)

VIX futures (VX) positioning – COT report:

Gross-shorts against the VIX rose at their fastest weekly pace in 10 months among asset managers, on the eve of Trump’s tariffs being fully unveiled. This means that traders were siding with lower volatility, and not the higher levels of volatility that were delivered.

The VIX went on the close the week at its highest level since October 2020, and has continued higher today in Asia to a near 5-year high. It was also the most bullish week for the VIX in five years by Friday’s close, which has surely burned a fear bearish fingers. I suspect we’ll see that asset managers increased long bets and reduced shorts quite considerably in the next COT report.

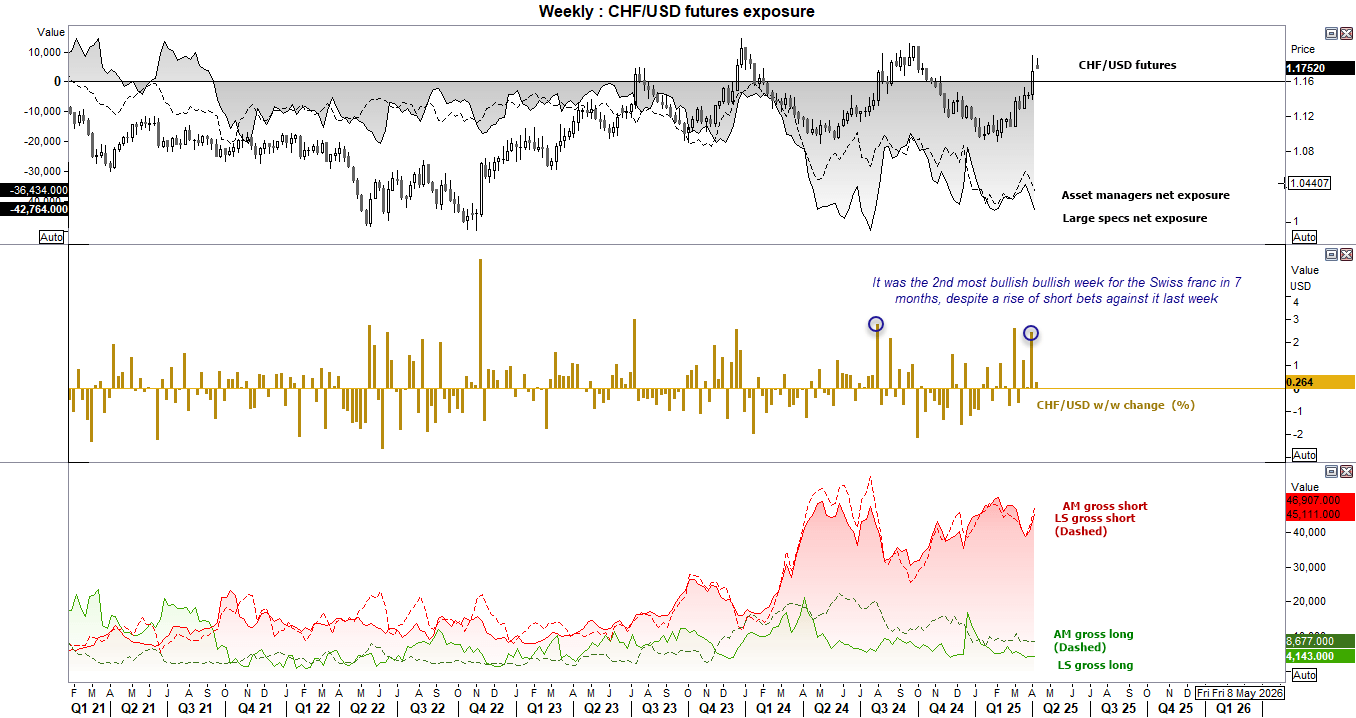

CHF/USD (Swiss franc futures) positioning – COT report:

If there were any concerns of tariffs last week, it cannot be seen on positioning of Swiss franc futures. Despite the Swiss franc going on to be the strongest FX major, large speculators and asset managers increased their net-short exposure against the safe-haven currency by around 10k contracts between them. Long bets were effectively flat, and gross-short were increased by 5.2k and 4.8k contracts respectively.

That the Swiss franc rose at its second fastest pace in seven months strongly suggest these bearish bets capitulated, and we likely will see a notable pickup of long bets in the next report.

Nasdaq 100 futures (NQ) positioning – COT report:

Bears who closed their bearish bets against the Nasdaq last week may be kicking themselves, given the market fell around -15% by Friday’s close. Asset managers reduced gross shorts by -4.8k contracts, which is their fastest pace of short covering since November. It was also the second week that net-short exposure fell.