US Consumer Price Index (CPI)

The US Consumer Price Index (CPI) unexpectedly widened to 3.0% in January from 2.9% per annum the month prior, with the core rate also rising to 3.3% from 3.2% during the same period.

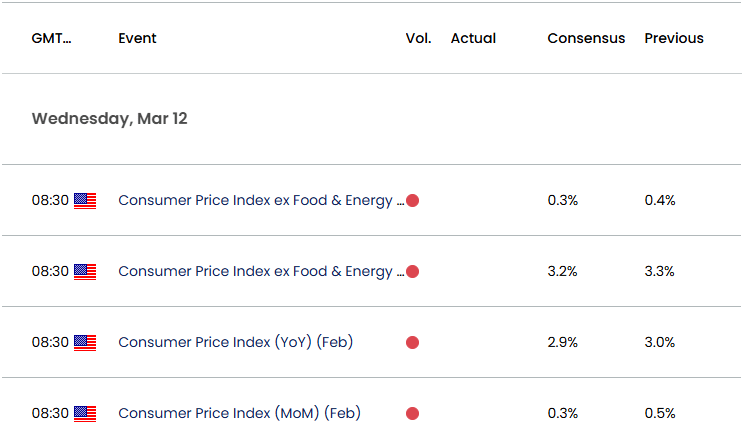

US Economic Calendar – February 12, 2025

A deeper look at the report showed the CPI increasing 0.5% in January following the 0.4% rise the month prior, with the Bureau of Labor Statistics (BLS) noting that ‘the index for shelter rose 0.4 percent in January, accounting for nearly 30 percent of the monthly all items increase.’

According to the BLS, ’the shelter index increased 4.4 percent over the last year, the smallest 12-month increase since January 2022,’ with the report going onto say that ‘other indexes with notable increases over the last year include motor vehicle insurance (+11.8 percent), medical care (+2.6 percent), education (+3.8 percent), and recreation (+1.6 percent).’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

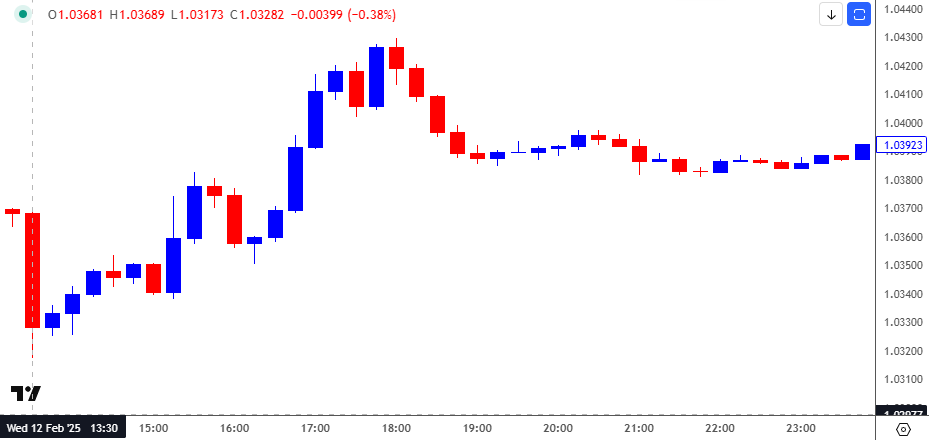

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

The US Dollar showed a bullish reaction to the stronger-than-expected CPI print, with EUR/USD slipping to a fresh daily low of 1.0317. However, the initial reaction was short-lived as EUR/USD ended the day at 1.0383, with the exchange rate appreciating throughout the remainder of the week to close at 1.0492.

Looking ahead, the US CPI is expected to narrow to 2.9% in February from 3.0% per annum the month prior, with the core rate also anticipated to fall to 3.2% from 3.3% during the same period.

With that said, indications of slowing inflation may drag on the US Dollar as it raises the Federal Reserve’s scope to further unwind its restrictive policy, but another higher-than-expected CPI print may spur a bullish reaction in the Greenback as it encourages the Fed to keep US interest rates on hold.

Additional Market Outlooks

Euro Forecast: EUR/USD on Cusp of Testing November High

Canadian Dollar Forecast: USD/CAD Faces BoC Rate Cut as Trump Tariffs Loom

Gold Price Outlook Hinges on Response to Positive Slope in 50-Day SMA

US Dollar Forecast: USD/JPY Weakness Pushes RSI Towards Oversold Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong