US CPI Key Points

- US CPI came in a tick below expectations at 0.2% m/m (2.3% y/y) vs. 0.3% (2.4%) eyed.

- Core CPI was 0.2% m/m (2.8% y/y) vs. 0.3% m/m (2.8% y/y) anticipated.

- USD/JPY is showing near-term bullish consolidation, potentially setting the stage for a continuation above 149.00 in the coming days.

The just-released US CPI report showed that US consumer prices rose less than expected in April, marking the smallest annual increase since February 2021.

The Consumer Price Index (CPI) increased by 0.2% month-over-month and 2.3% year-over-year, slightly below forecasts. Core CPI, excluding volatile food and energy prices, also rose by 0.2% m/m and 2.8% y/y, aligning closely with expectations.

In terms of the details of the report, significant price declines were seen in several categories, particularly groceries, which dropped 0.4%, the largest decline since September 2020. Notably, egg prices plummeted by 12.7%, the steepest monthly decrease since 1984, reflecting relief from earlier avian flu-induced hikes. Airfares fell by 2.8%, and lodging prices dipped slightly by 0.1%, signaling a potential slowdown in travel demand. Apparel costs also saw a modest decrease of 0.2%.

However, shelter continued to drive overall inflation, rising 0.3% and accounting for more than half of the total CPI increase. Energy prices edged up 0.7%, despite a 0.1% adjusted drop in gasoline prices. Motor vehicle insurance increased notably by 0.6% month-over-month and 6.4% year-over-year.

The report suggests minimal immediate impact from April’s “Liberation Day” tariffs from the Trump administration, though inflationary effects could intensify in the coming months as pre-tariff inventories are depleted. Given the mostly as-expected reading and uncertainty around the impact of tariffs, the Federal Reserve is likely to leave interest rates unchanged in the near term, with the CME’s FedWatch tool suggesting less than 40% odds of an interest rate cut before September.

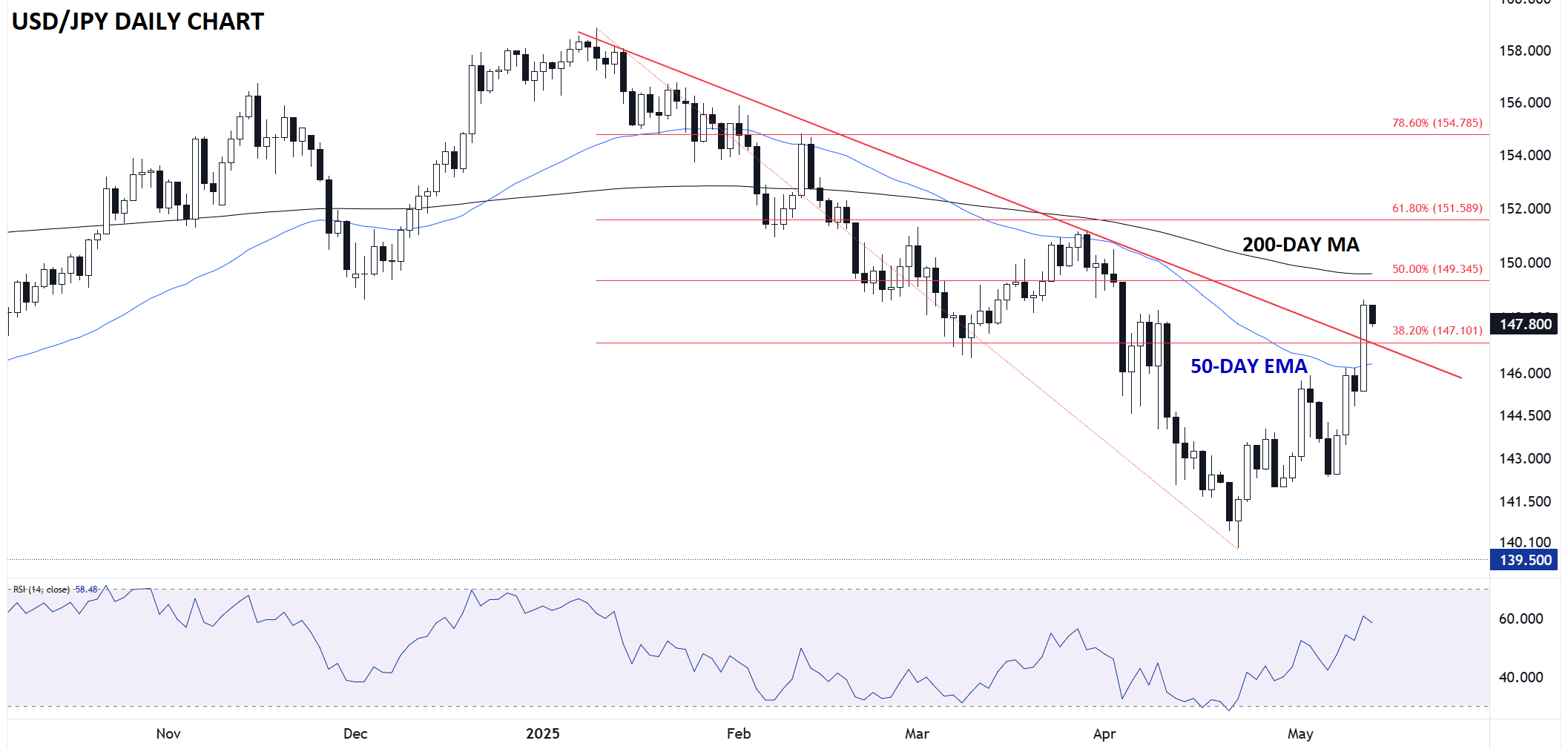

Japanese Yen Technical Analysis: USD/JPY Daily Chart

Source: TradingView, StoneX

Turning our attention to the forex market, USD/JPY is consolidating after yesterday’s big tariff truce surge through resistance at the 50-day EMA and 38.2% Fibonacci retracement. The (so far) small range near the top of yesterday’s big candle is sign of bullish consolidation from a near-term perspective, potentially setting the stage for a continuation higher in the latter half of the week.

To the topside, the next levels of resistance to watch are the 50% Fibonacci retracement near 149.35, followed by the 200-day MA closer to 150.00. Meanwhile, any pullbacks may find support on the topside of the broken bearish trend line near 147.00. Only a break below that area would erase the near-term bullish bias.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX