US Dollar Outlook: EUR/USD

EUR/USD declines for the sixth consecutive day as it extends the series of lower highs and lows from last week, and the bearish price action may persist as Federal Reserve officials show a greater willingness to keep US interest rates on hold.

US Dollar Forecast: Bearish EUR/USD Price Series Persists

EUR/USD trades to a fresh weekly low (1.0768) as St. Louis Fed President Alberto Musalem, who votes on the Federal Open Market Committee (FOMC) in 2025, argues that ‘there is more work to do to bring inflation down to our 2% target’ while speaking at an even held by the Paducah Area Chamber of Commerce.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Musalem goes onto say that ‘a patient and vigilant approach will help us as we seek maximum employment, price stability and a durable economic expansion for the American people,’ and the FOMC may keep US interest rates on hold for longer as US President Donald Trump pledges to impose reciprocal tariffs on April 2.

With that said, EUR/USD may depreciate over the remainder of the month amid waning expectations for an imminent Fed rate-cut, but the weakness in the exchange rate may turn out to be temporary as the 50-Day SMA (1.0558) establishes a positive slope.

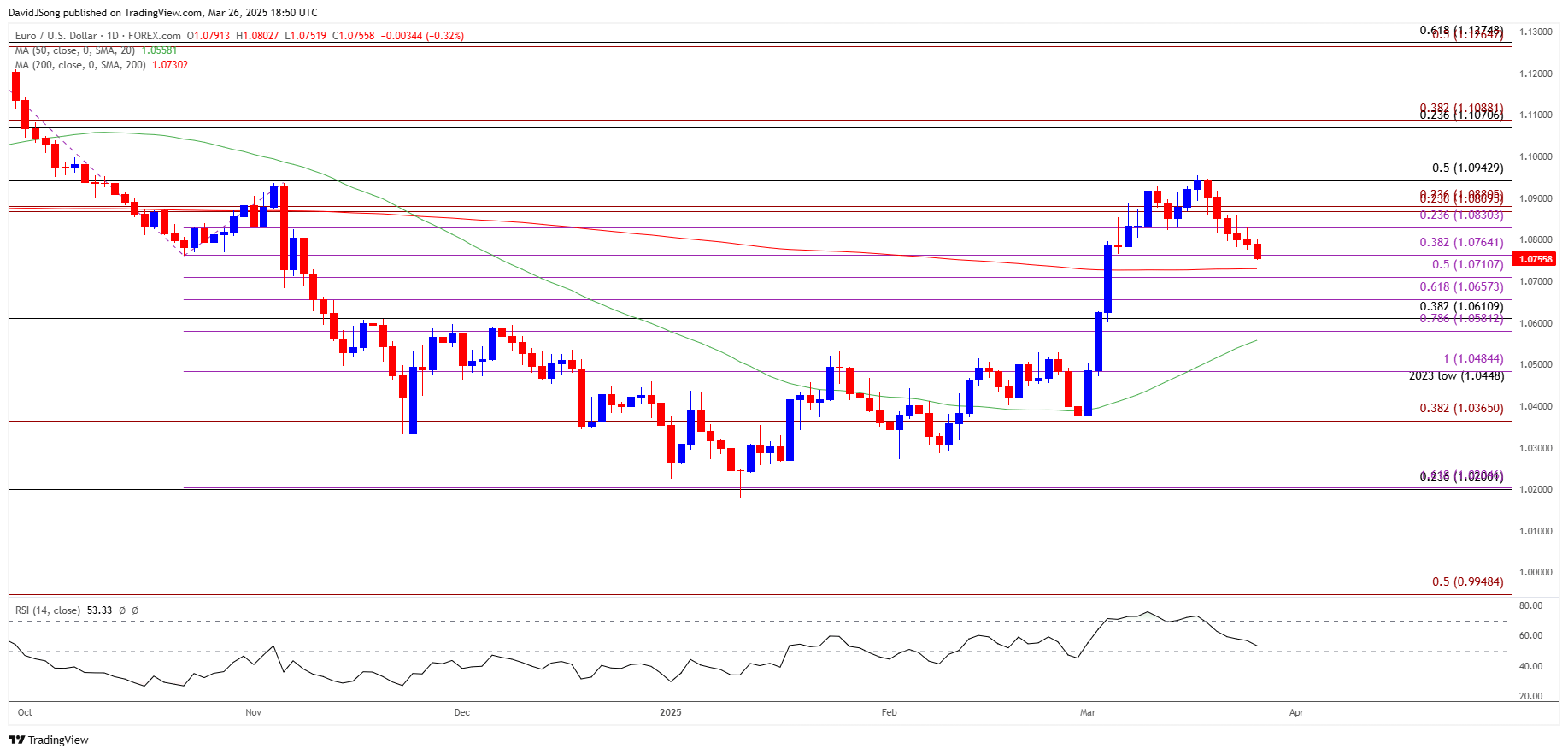

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD falls for the sixth consecutive day as it extends the decline from the monthly high (1.0955), with a break/close below the 1.0660 (61.8% Fibonacci extension) to 1.0710 (50% Fibonacci extension) region raising the scope for a test of the former-resistance zone around 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement).

- Next area of interest comes in around 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension), but EUR/USD may defend the advance from the monthly low (1.0377) should it struggle to hold below 1.0710 (50% Fibonacci extension).

- Need a move back towards the 1.0830 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region for EUR/USD to negate the recent series of lower highs and lows, with a breach above the month high (1.0955) bringing the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) zone on the radar.

Additional Market Outlooks

USD/JPY Pulls Back Ahead of Monthly High with US PCE in Focus

British Pound Forecast: GBP/USD Coils with UK CPI on Tap

AUD/USD Halts Four-Day Selloff Ahead of Australia CPI

Canadian Dollar Forecast: USD/CAD Breakout Looms on Trump Tariffs

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong