US Dollar Forecast: EUR/USD

EUR/USD may continue to track the positive slope in the 50-Day SMA (1.1283) as it holds above the monthly low (1.1347), but the update to the US Consumer Price Index (CPI) may sway the exchange rate as the report is anticipated to show persistent inflation.

US Dollar Forecast: EUR/USD Holds Above Monthly Low Ahead of US CPI

The opening range for June in in focus for EUR/USD as it gives back the advance following the European Central Bank (ECB) meeting, and lack of momentum to push above the monthly high (1.1495) may indicate a potential change in trend as it still trades within the April range.

US Economic Calendar

At the same time, the US CPI may influence the near-term outlook for EUR/USD as both headline and core inflation are anticipated to increase in May, and the development may push the Federal Reserve to keep US interest rates on hold as Chairman Jerome Powell insists that ‘we’re well positioned to wait for greater clarity before considering any adjustments to our policy stance.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, evidence of sticky price growth may lead to a bullish reaction in the US Dollar as it curbs speculation for an imminent Fed rate-cut, but a softer-than-expected CPI report may drag on the Greenback as it raises the central bank’s scope to further unwind its restrictive policy.

With that said, EUR/USD may stage further attempts to test the April high (1.1573) should it break out of the monthly opening range, and the exchange rate may continue to track the positive slope in the 50-Day SMA (1.1283) as it still holds above the moving average.

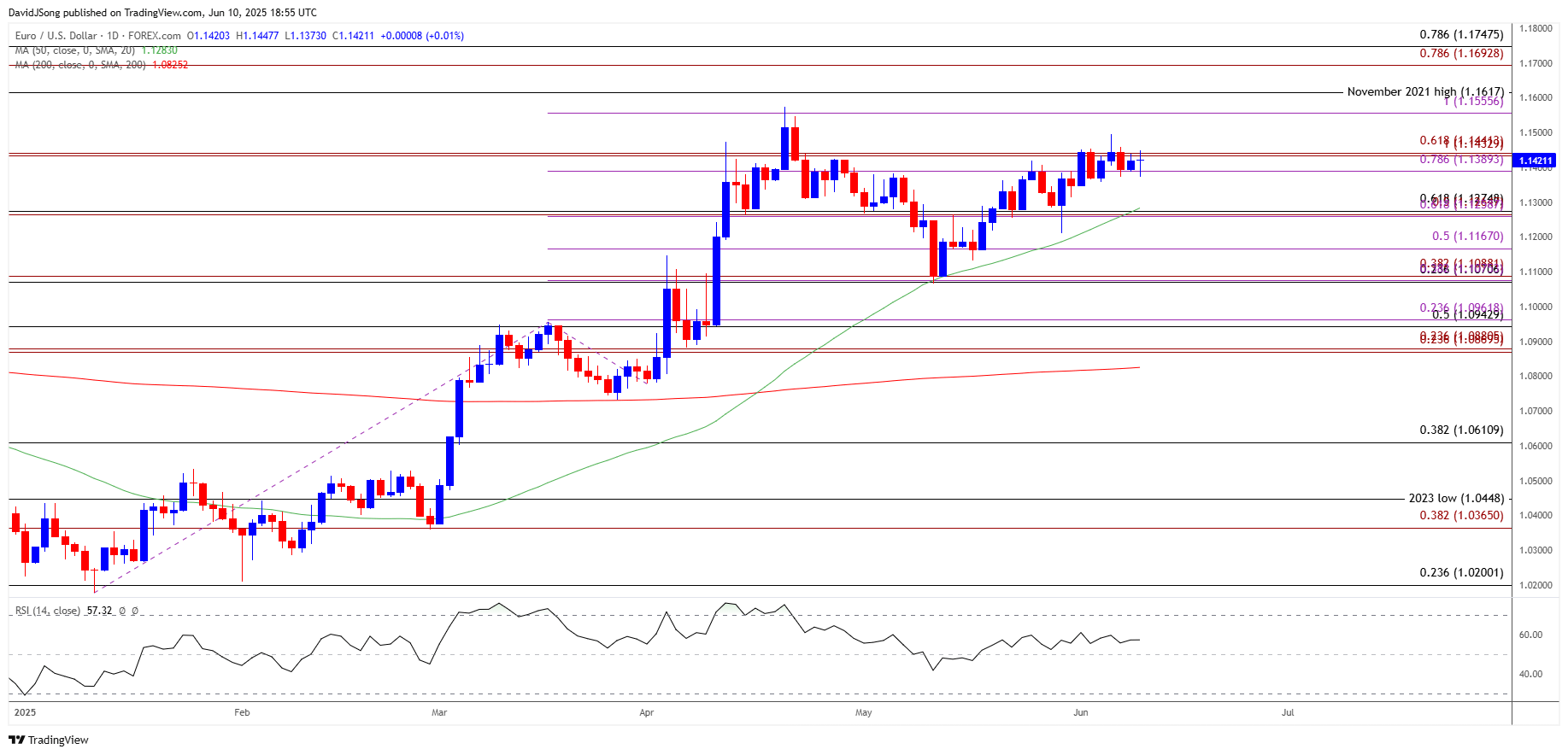

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD seems to be stuck within the opening range for June as it struggles to hold above the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region, and failure to defend the monthly low (1.1347) may push the exchange rate towards the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone.

- Next area of interest comes in around 1.1170 (50% Fibonacci retracement), but the range bound price action in EUR/USD may turn out to be temporary should it continue to hold/close above the 50-Day SMA (1.1283).

- Need a move above the monthly high (1.1495) to bring 1.1560 (100% Fibonacci extension) on the radar, with a breach above the April high (1.1573) opening up the November 2021 high (1.1617).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Coils Within June Opening Range

AUD/USD Climbs Toward Monthly High amid US-China Trade Talk

GBP/USD Vulnerable to Rise in UK Unemployment Rate

US Dollar Forecast: USD/CHF Clears May Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong