The US dollar has had a decent day so far today, especially against the Japanese yen. But it was higher event against the commodity dollars despite a sharp improvement in risk appetite. We had stronger consumer confidence data, while overnight news from Japan weighed heavily on the yen, supporting the USD/JPY and the Dollar Index (DXY). While higher for now, it may be too early to turn positive on the US dollar forecast. Indeed, the DXY was approaching a key resistance zone between 99.58 to 100.15, where the recovery may stall.

Trump’s U-Turn boosts risk appetite

President Trump’s decision to postpone the threatened 50% tariffs on the EU has led to a sharp bounce in risk trade, and this is one of the factors weighing on haven assets like gold and the yen. This shift came after what was described as a constructive call with the President of the European Commission. The announcement, which emerged over the weekend, has since sparked a rebound in risk assets, particularly in European stock markets. But the news has also boosted the appeal of the US dollar, which had been under pressure against almost all major currencies amid tariff uncertainty.

Japanese yen weakens on reports of reduction in long-dated bond issuance

More influential to the Japanese yen is a Reuters report overnight suggesting that Japan is weighing a reduction in long-dated bond issuance. Concerns have been mounting over rising yields, particularly at the long end of the JGB curve. The hope is that by reducing supply in this segment, this should lend support to bond prices and ease yield pressures, which is precisely what we’re seeing so far in today’s session. While the final debt issuance breakdown for the next fiscal year isn’t expected until June, the market has already responded. The yen has weakened broadly against its major counterparts, but it remains to be seen whether the move can hold.

US consumer confidences surprises

Turning to the US data, all eyes were on the Conference Board’s Consumer Confidence report. This was expected to show a modest rebound to 87.1, up from last month’s five-year low of 86.0. However, as it turned out, the data was actually quite strong at 98.0. This led to further dollar appreciation when it was released.

For the dollar to regain its footing, incoming data will need to soothe fears of a looming recession. That’s increasingly crucial, given that deficit anxieties are beginning to erode what little stability the currency still enjoys. The concern isn’t that Trump’s spending proposals will immediately blow the fiscal doors off. Rather, it's that Washington has, yet again, let a golden opportunity to address the deficit quietly slip away. Looking ahead, doubts around US creditworthiness could remain a persistent headwind, particularly if upcoming Treasury auctions reflect only tepid investor appetite.

Is it too soon to turn positive on US dollar forecast?

One wouldn’t be terribly surprised to see the dollar come under renewed pressure as the week unfolds—this, even after President Trump’s somewhat abrupt U-turn on the 50% EU tariff threat. May was meant to usher in a new phase of trade diplomacy, with tangible progress on agreements. Of course, no one expected Brussels to be straightforward, but the latest flare-up with the EU serves as a timely reminder: trade spats and tariff theatrics have a nasty habit of resurfacing with little warning. If recent events taught us anything, it’s that the dollar tends to suffer most when such sabre-rattling resumes.

The greenback, while modestly undervalued against a basket of key peers—an imbalance that’s lingered for some time—remains hemmed in by concerns around the long-term viability of US public finances. Investors, quite rightly, are now forced to account for a landscape shaped as much by erratic policy as by economic fundamentals.

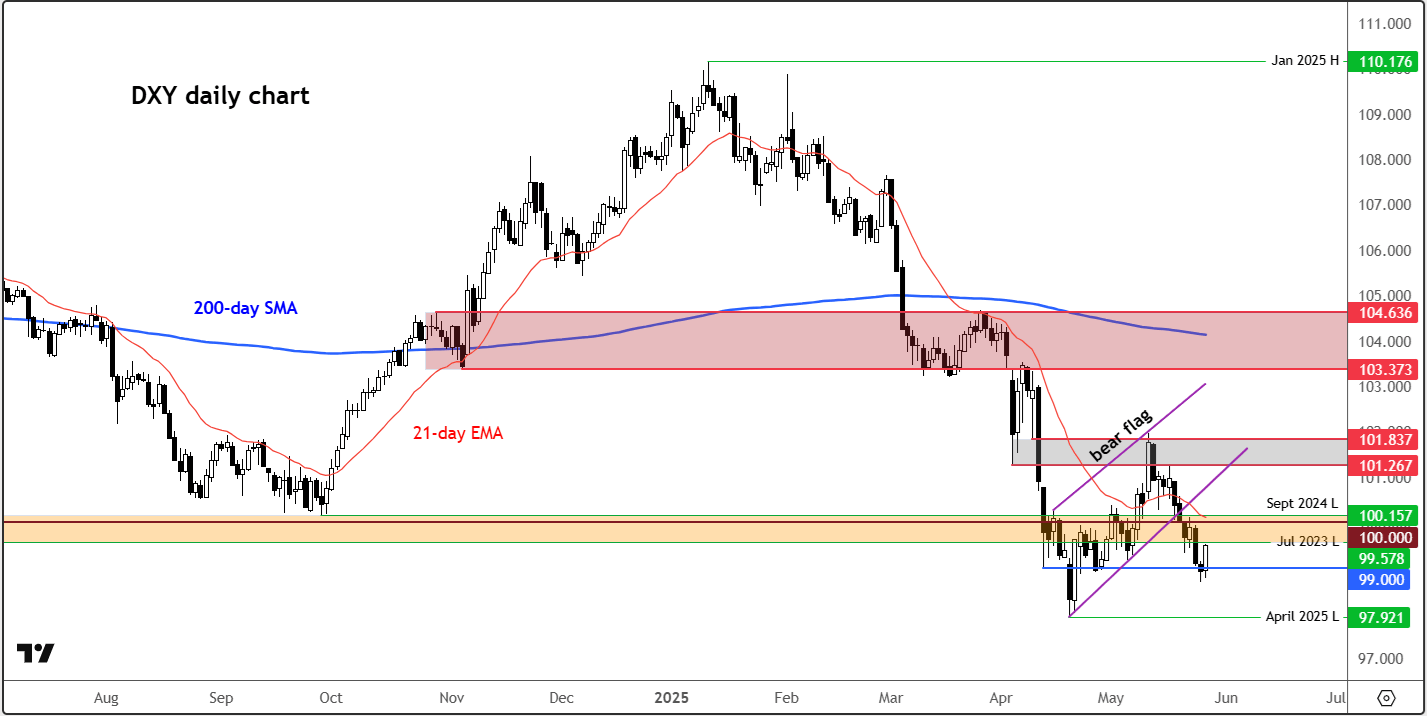

Technical US dollar forecast: DXY approaching key resistance

Source: TradingView.com

As can be seen on the chart, the dollar index was approaching a key area of potential resistance between 99.58 to 100.15. This zone was previous support and resistance. As long as this area holds as resistance now, the path of least resistance for the DXY remains tilted to the downside, despite today’s recovery. The US dollar forecast will only improve from a technical stand point if we were to see the DXY not only break back above this zone, but to then show upside follow-through. Support is seen around 99.00, then the April low of 97.92 comes into focus.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R