US Dollar Outlook: USD/CHF

USD/CHF continues to recover from a fresh yearly low (0.8040) to pull the Relative Strength Index (RSI) out of oversold territory, but the rebound in the exchange rate may turn out to be temporary as it no longer trades within the 2023 range.

US Dollar Forecast: USD/CHF Rebound Pulls RSI Out of Oversold Zone

USD/CHF trades to a fresh weekly high (0.8287) as it carves a series of higher highs and lows, and the move above 30 in the RSI is likely to be accompanied by a further rise in the exchange rate like the price action from last year.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, USD/CHF may further retrace the decline from the start of the month as the US Dollar rebounds against most of its major counterparts, but the exchange rate may continue to track the descending channel from earlier this year should the former-support zone around the 2023 low (0.8333) offer resistance.

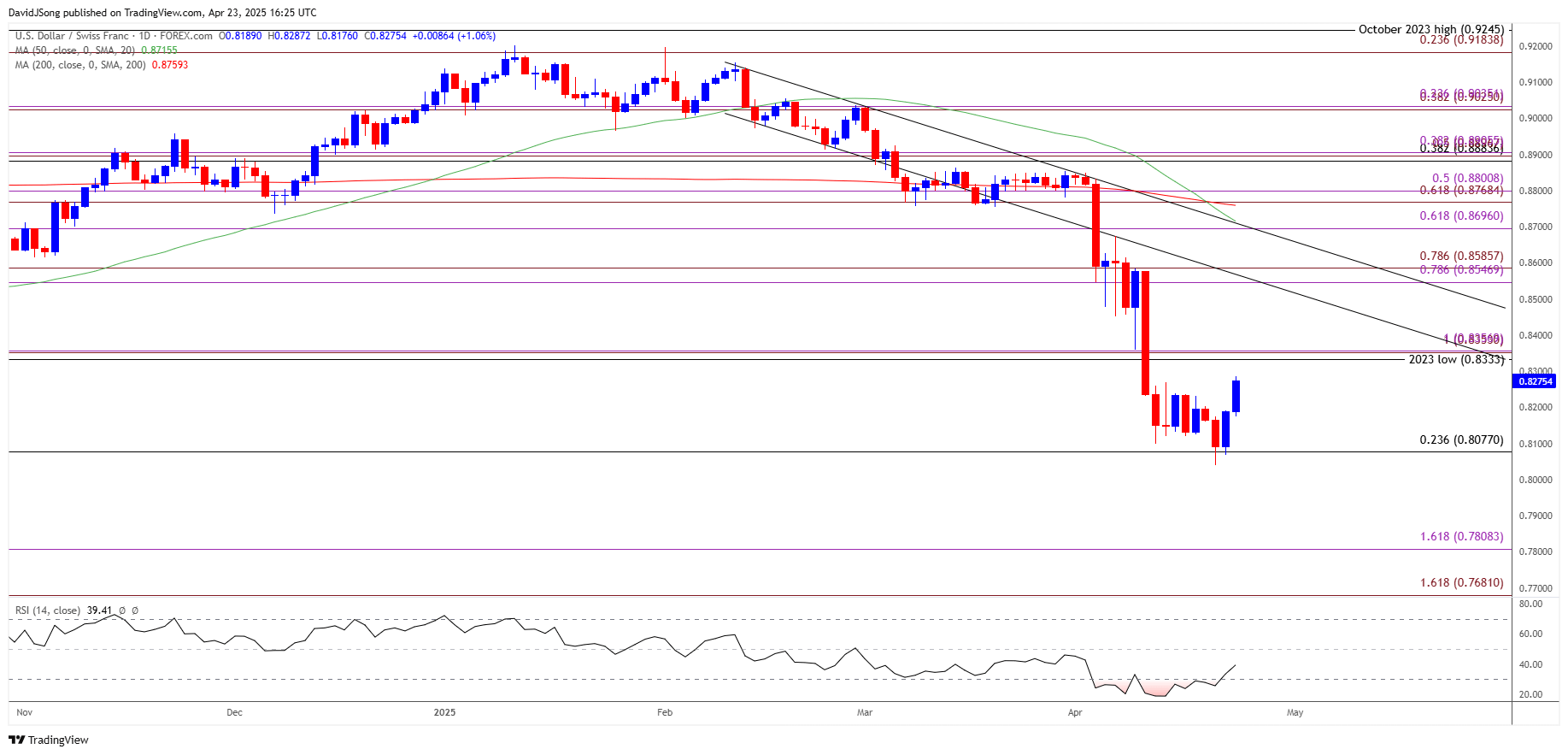

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- USD/CHF approaches the former-support zone around the 2023 low (0.8333) as it carves a series of higher highs and lows, with a break/close above 0.8360 (100% Fibonacci extension) bringing the 0.8550 (78.6% Fibonacci extension) to 0.8590 (78.6% Fibonacci extension) zone on the radar.

- Next area of interest comes in around 0.8700 (61.8% Fibonacci extension), but USD/CHF may continue to track the descending channel from earlier this year should it struggle to trade back above the former-support zone around the 2023 low (0.8333).

- In turn, USD/CHF may give back the advance from the weekly low (0.8040) should it snaps the bullish price series, with a close below 0.8080 (23.6% Fibonacci retracement) opening up 0.7810 (161.8% Fibonacci extension).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Cracks November Low Ahead of Election

GBP/USD Falls Ahead of 2024 High to Threaten Ten-Day Rally

AUD/USD Extends V-Shape Recovery to Push Above February High

USD/JPY Falls Toward 2024 Low to Push RSI into Oversold Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong