US Dollar Outlook: USD/JPY

USD/JPY breaks out of the range bound price action from earlier this week as the US Non-Farm Payrolls (NFP) report shows a 139K expansion in May versus forecasts for a 130K print, with Average Hourly Earnings unexpectedly holding steady at 3.9% during the same period.

US Dollar Forecast: USD/JPY Breaks Out on Upbeat US NFP Report

USD/JPY seems to be bouncing back ahead of the May low (142.12) as it rallies to a fresh weekly high (145.09), and the exchange rate may stage a further recovery as the upbeat NFP report encourages the Federal Reserve to keep US interest rates on hold.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Recent remarks from Fed officials suggest the central bank will stick to a wait-and-see approach as Governor Adriana Kugler judges that ‘we might be seeing some moderation in the growth of economic activity but not yet a significant slowdown,’ with the official going onto say that ‘we are already seeing the effects of higher tariffs, which I expect will continue to raise inflation over 2025’ while speaking at the Economic Club of New York.

In turn, US data prints may continue to sway USD/JPY ahead of the next Fed rate decision on June 18 as households and businesses adjust to the shift in fiscal policy, but swings in the carry trade may also influence the exchange rate especially as the Bank of Japan (BoJ) sticks to the sidelines.

With that said, USD/JPY may attempt to retrace the decline from the May high (148.65) as it defends the rebound from the weekly low (142.38), but the US Dollar may face headwinds as US President Donald Trump argues that if ‘the Fed would cut, we would greatly reduce interest rates, long and short, on debt that is coming due.’

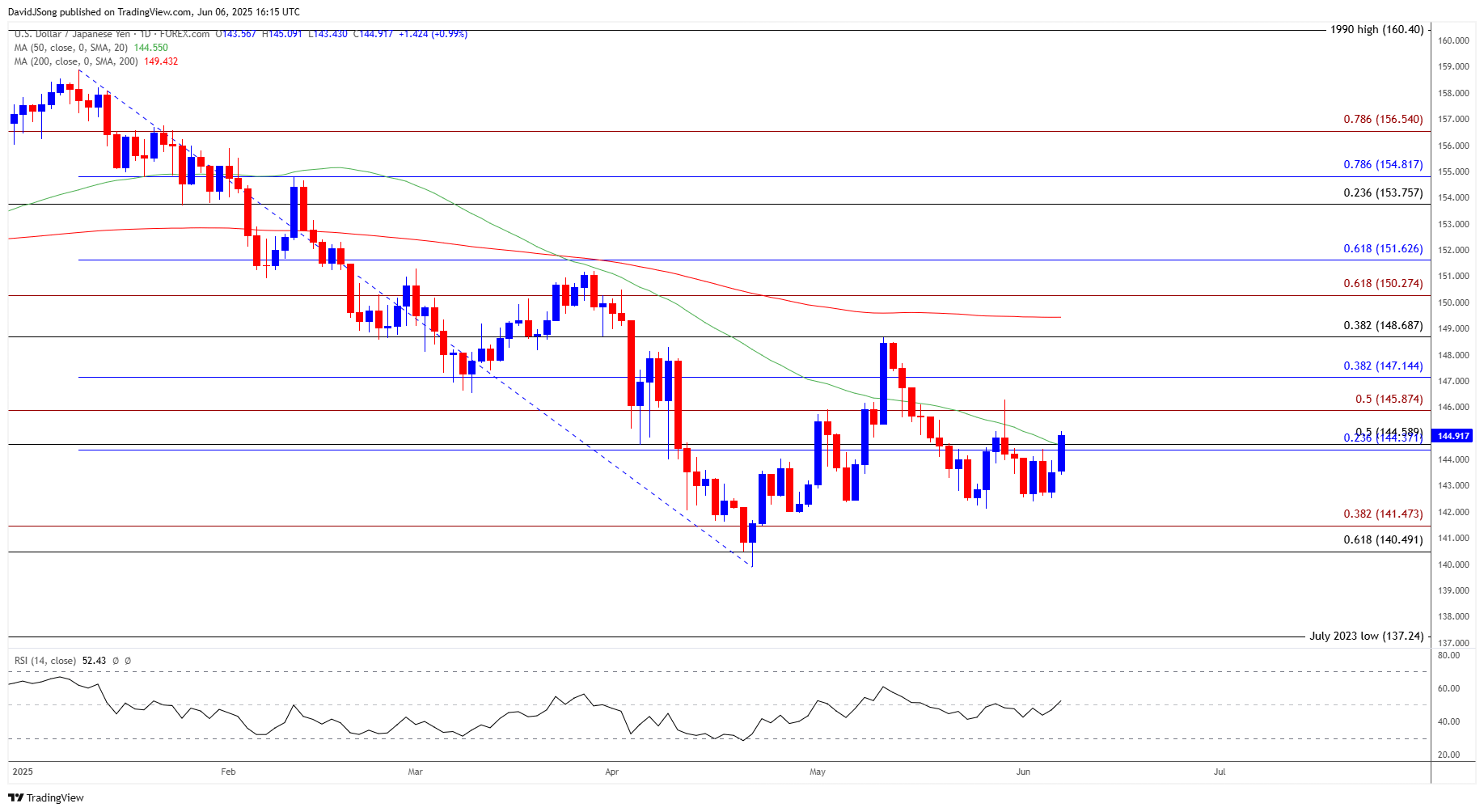

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY breaks out of the range bound price action from earlier this week to initiate a series of higher highs and lows, with a move/close above 145.90 (50% Fibonacci extension) bringing 147.10 (38.2% Fibonacci retracement) on the radar.

- Next area of interest comes in around the May high (148.65), with a break/close above 148.70 (38.2% Fibonacci retracement) opening up the 150.30 (61.8% Fibonacci extension) to 151.60 (61.8% Fibonacci retracement) zone.

- At the same time, lack of momentum to hold above the 144.40 (23.6% Fibonacci retracement) to 144.60 (50% Fibonacci extension) region may lead to a test of the weekly low (142.38), with a breach of the May low (142.12) raising the scope for a move toward the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) zone.

Additional Market Outlooks

Euro Forecast: EUR/USD Post-ECB Rally Eyes April High

Canadian Dollar Forecast: USD/CAD Drops as BoC Stays on Hold

GBP/USD Stuck in Narrow Range amid Failure to Test February 2022 High

US Dollar Forecast: USD/CHF Clears May Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong