US Dollar Outlook: USD/JPY

USD/JPY seems to be unfazed by the slowdown in the US Consumer Price Index (CPI) as it continues to bounce back from a fresh yearly low (146.54), with the recent recovery in the exchange rate keeping the Relative Strength Index (RSI) out of oversold territory.

US Dollar Forecast: USD/JPY Rebound Keeps RSI Above Oversold Zone

USD/JPY trades to a fresh weekly high (149.20) even as the US CPI prints at 2.8% in February versus projections for a 2.9% reading, and the exchange rate may further retrace the decline from the monthly high (151.31) as it negates the series of lower highs and lows from last week.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, signs of slowing inflation may encourage the Federal Reserve to further unwind its restrictive policy as the core CPI also slows to 3.1% from 3.3% per annum in January, and the US Dollar may face headwinds ahead of the next Fed rate decision on March 19 as the ongoing shift in US trade policy clouds the outlook for global growth.

Nevertheless, swings in the carry trade may continue to influence USD/JPY as the Bank of Japan (BoJ) acknowledges that ‘if the outlook for economic activity and prices presented in the January Outlook Report will be realized, the Bank will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation,’ and the recent rebound in the exchange rate may turn out to be temporary as the Fed pursues a neutral stance.

With that said, USD/JPY may continue to give back the advance from the October low (142.97) as the 50-Day SMA (153.22) starts to establish a negative slope, but the exchange rate may stage a larger rebound as the RSI holds above 30.

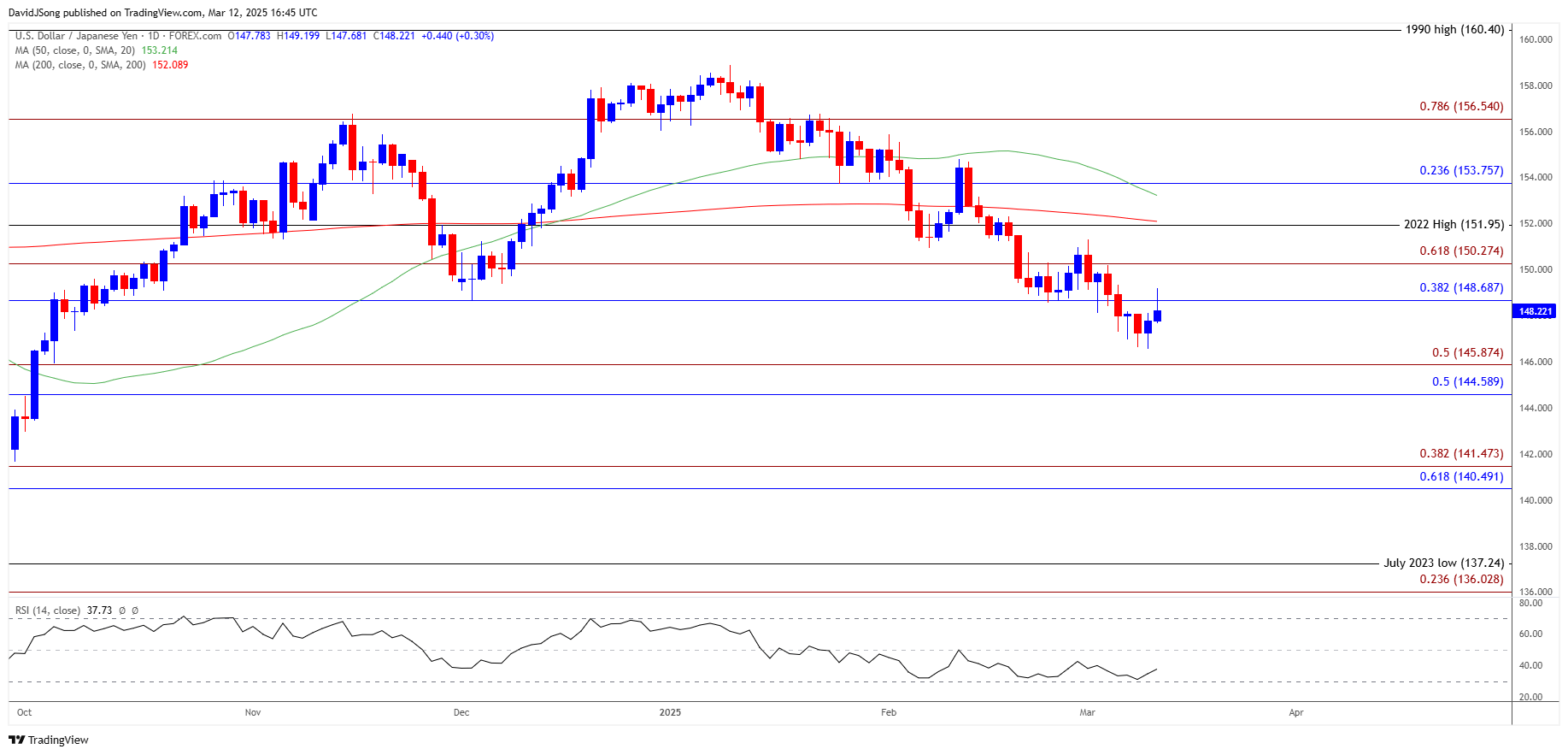

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY starts to carve a series of higher highs and lows as it continues to rebound from a fresh yearly low (146.54), with a break/close above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone raising the scope for a move towards the monthly high (151.31).

- Next area of interest comes in around 151.95 (2022 high), but the rebound in USD/JPY may turn out to be temporary if it struggles to trade back above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone.

- Need a break/close below the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region to open up the October low (142.97), with the next area of interest coming in around 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension).

Additional Market Outlooks

Euro Forecast: EUR/USD on Cusp of Testing November High

Canadian Dollar Forecast: USD/CAD Faces BoC Rate Cut as Trump Tariffs Loom

Gold Price Outlook Hinges on Response to Positive Slope in 50-Day SMA

US Dollar Forecast: USD/JPY Weakness Pushes RSI Towards Oversold Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong