Tech stocks including Apple, Dell and ASML were higher on Monday after President Trump announced tariff exemptions on items such as smart phones, computers and some semiconductor devices. While this has been well received, Trump has warned that further tariffs are to arrive this week – namely imported chips. Wall Street futures gapped higher at the open on Monday but only etched out marginal gains after handing back most of the early profits.

The mild risk-on tone to the start of the week allowed NZD/USD, GBP/USD and AUD/USD to lead the way higher among FX majors. The Canadian dollar and USD were the weakest.

View related analysis:

- EUR/USD, AUD/USD, S&P 500 Analysis: COT Report

- AUD/USD weekly outlook: The Battler Stages a V-Bottom Recover

- AUD/USD, Nasdaq Soar as Trump Blinks First, Sparking Epic Market U-Turn

- AUD/USD Analysis: Eyes on China and the yuan Amid Trump’s 104% Tariff

Canadian inflation, BOC meeting in focus for CAD traders

The Bank of Canada (BOC) are likely to hold their cash rate at 2.75% on Wednesday. Their March statement outlined expectations for higher inflation due to the end of the sales tax break, alongside higher inflation expectations due to the trade war. And as the BOC have already slashed seven times this cycle, it remains debatable as to whether there is any appetite for further easing at all.

Besides, inflation has already been picking back up. Core CPI increased 0.7% in March, and rose to 2.7% y/y. And their preferred measures of CPI have also reflated to 2.9% for both trimmed mean and median CPI. If we see them rise above the BOC’s 3% band, it could even spark murmurs of a hike. Traders will keep a close eye on today’s inflation figures, as it could change the tone of the BOC’s statement on Thursday.

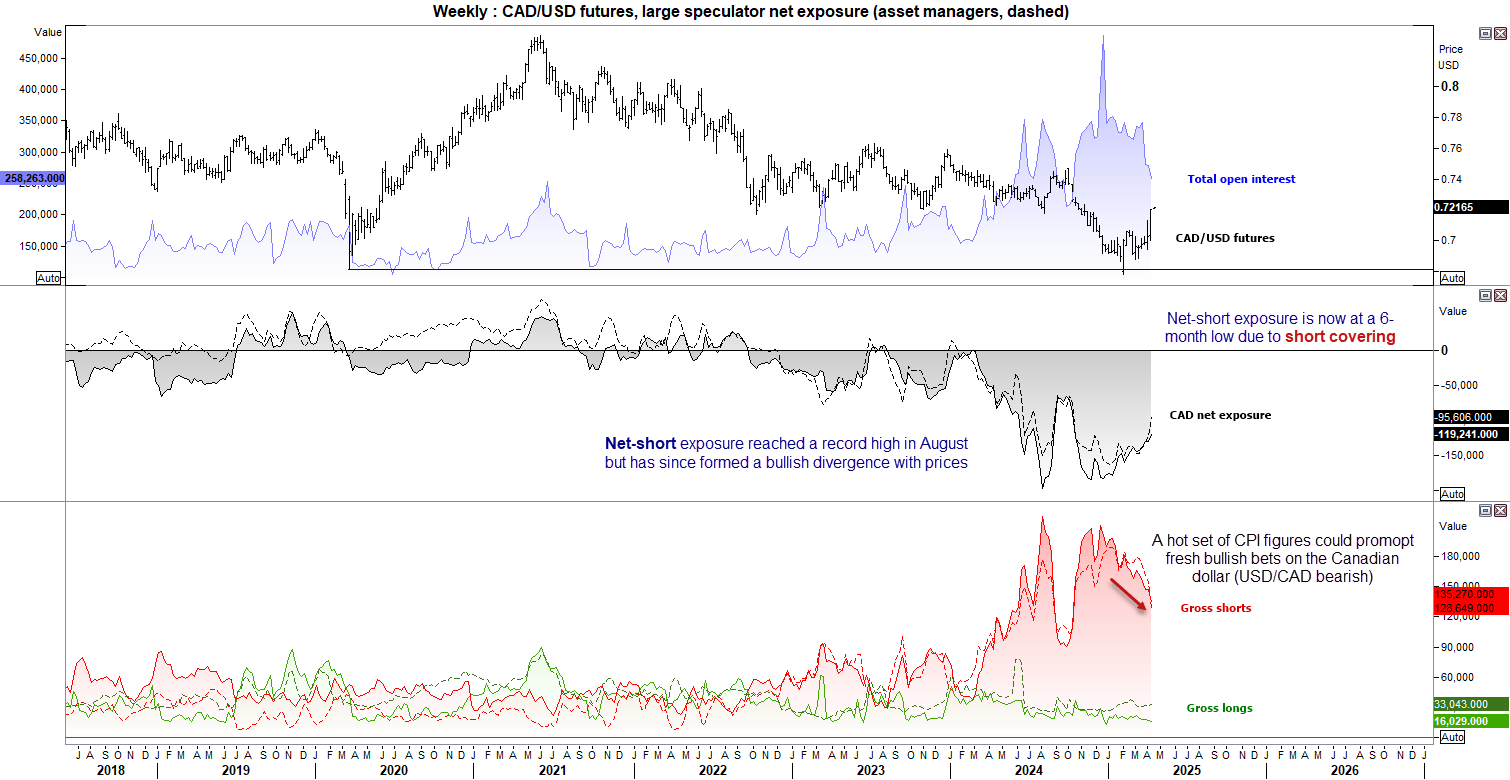

Canadian dollar (CAD) futures market positioning – COT report

Net short exposure to Canadian dollar futures peaked in August, and we have since seen a bullish divergence form compared with prices. Net-short exposure has since fallen to a 6-month low among asset managers and large speculators mostly due to short covering. But if inflation figures come in hotter than expected, it could spur a pickup of fresh longs and really get this rally started – which could be bearish for USD/CAD.

Economic events in focus (AEDT)

- 08:45 – NZ food price index

- 11:30 – RBA minutes

- 16:00 – UK average earnings, employment change, unemployment rate

- 16:45 – FR CPI

- 19:00 – DE ZEW Economic Sentiment, EU Industrial Production

- 22:30 – US Import Price Index, NY Empire State Manufacturing Index

- 22:30 – CA Core CPI

- 01:35 – FOMC member Barkin speaks

- 02:00 – ECB President Lagarde speaks

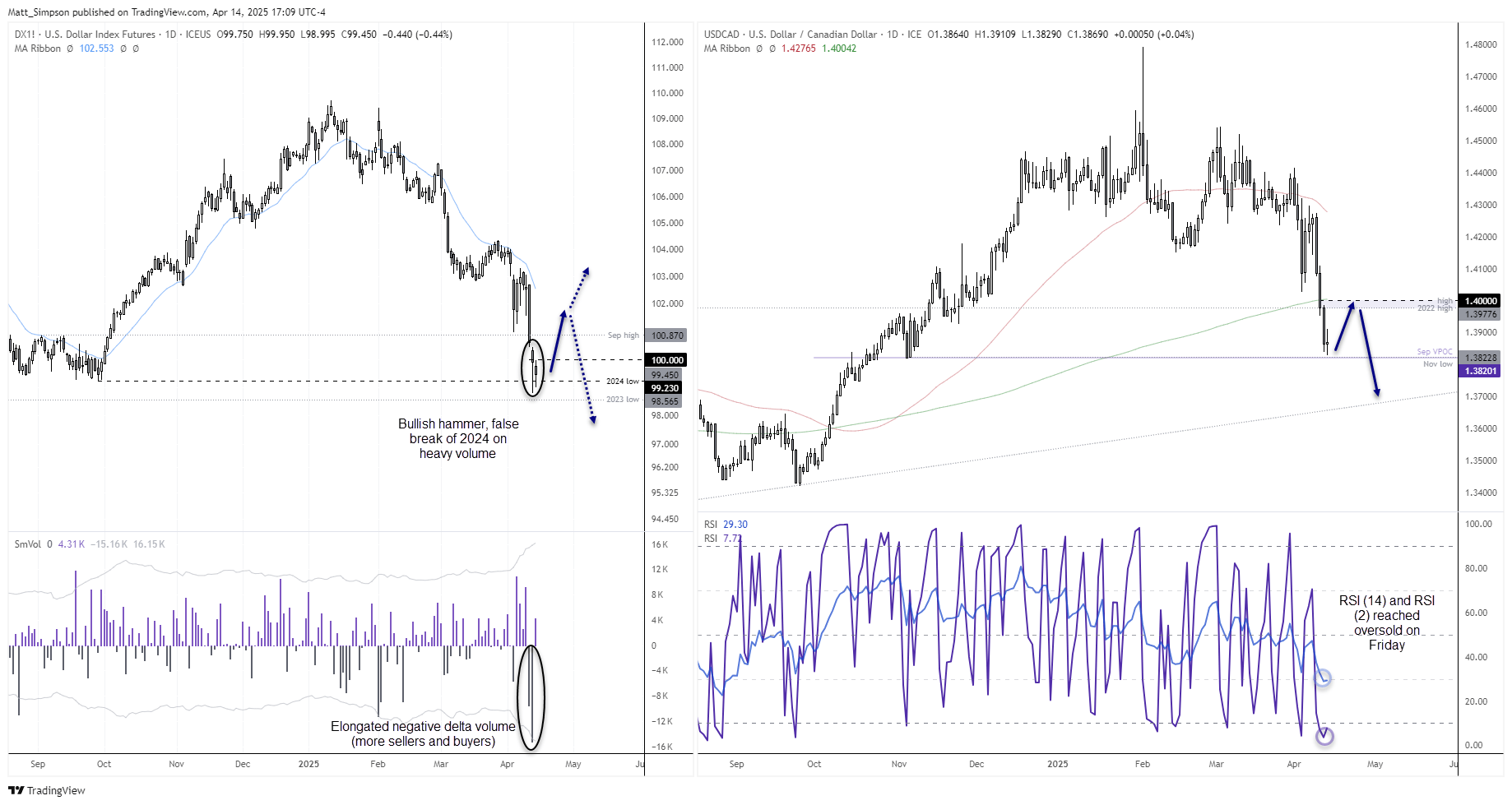

US dollar index, USD/CAD technical analysis

USD index

The US Dollar Index has fallen just under 10% from its April high and posted its first weekly close below 100 since September—a significant milestone for the bears. However, it's hard to say they’ve taken this level with much conviction.

Support appears to be forming around the 2024 low, and Friday’s bullish hammer candle was accompanied by a large negative volume delta bar. This suggests that bears were heavily selling into the lows, so the failure to break lower could be causing some discomfort. It may not take much of a bounce to shake them out and trigger a larger move higher.

A bullish mean reversion could be in play. A break back above 100 might bring the 100.87–101 area into focus, or perhaps even a move toward the 20-day EMA near 102.5.

Canadian dollar (USD/CAD)

If the US dollar bounces, there's a good chance USD/CAD will follow. Monday’s low found support around a tight cluster of technical levels, including the September VPOC and the November low at 1.3820/23. Additionally, both the daily RSI (14) and RSI (2) dipped into oversold territory on Friday.

My near-term bias for USD/CAD is for a modest bounce toward the 1.40 handle and the 200-day EMA, which aligns closely with the 2022 high. This move could potentially tempt bears to reload and target a move down toward the 1.37 handle, near trend support.

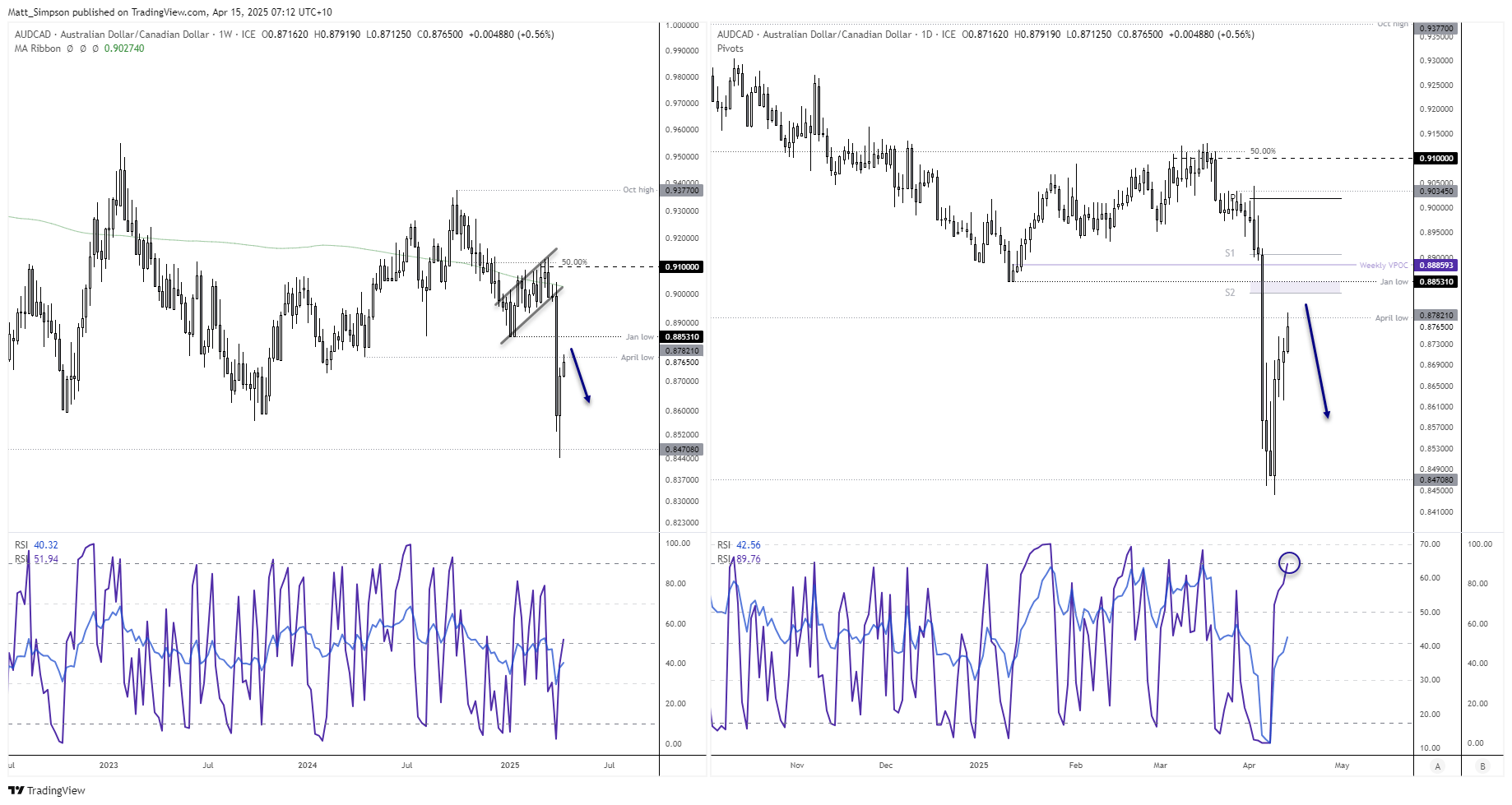

AUD/CAD technical analysis

The bearish flag pattern on the weekly AUD/CAD chart played out much better than expected. Prices are now retracing against that sharp bearish selloff, and I’m currently looking for signs of a swing high on the daily timeframe. I’m not expecting any move lower from here to match the magnitude of the previous drop, but we might get a near-term short opportunity lasting 2–3 days—especially if Canada’s inflation data comes in hot, setting the stage for a less-dovish BoC meeting later this week.

The 4-day rally in AUD/CAD has stalled around the April high, and the daily RSI (2) has reached overbought territory. I prefer to give some breathing room with crosses like AUD/CAD, so bears could look to fade into moves toward the monthly S2 pivot at 0.8831 or the January low at 0.8853, with an open downside target.

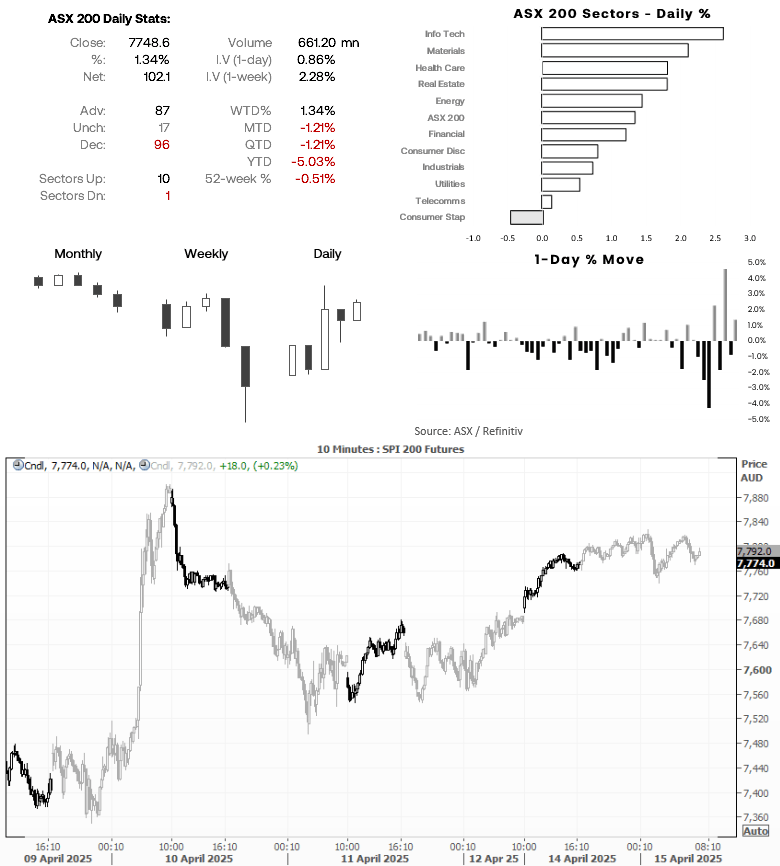

ASX 200 at a glance

- Last week was the most volatile range for the ASX 200 cash index since the pandemic, so for the ASX to only close lower by -0.3% could be seen as a victory for bulls

- The ASX 200 cash index also closed just above the 2021 and 2022 highs, suggesting near-term support resides around 7630

- ASX 200 futures (SPI 200) rose 0.23% overnight

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge