US Dollar Talking Points:

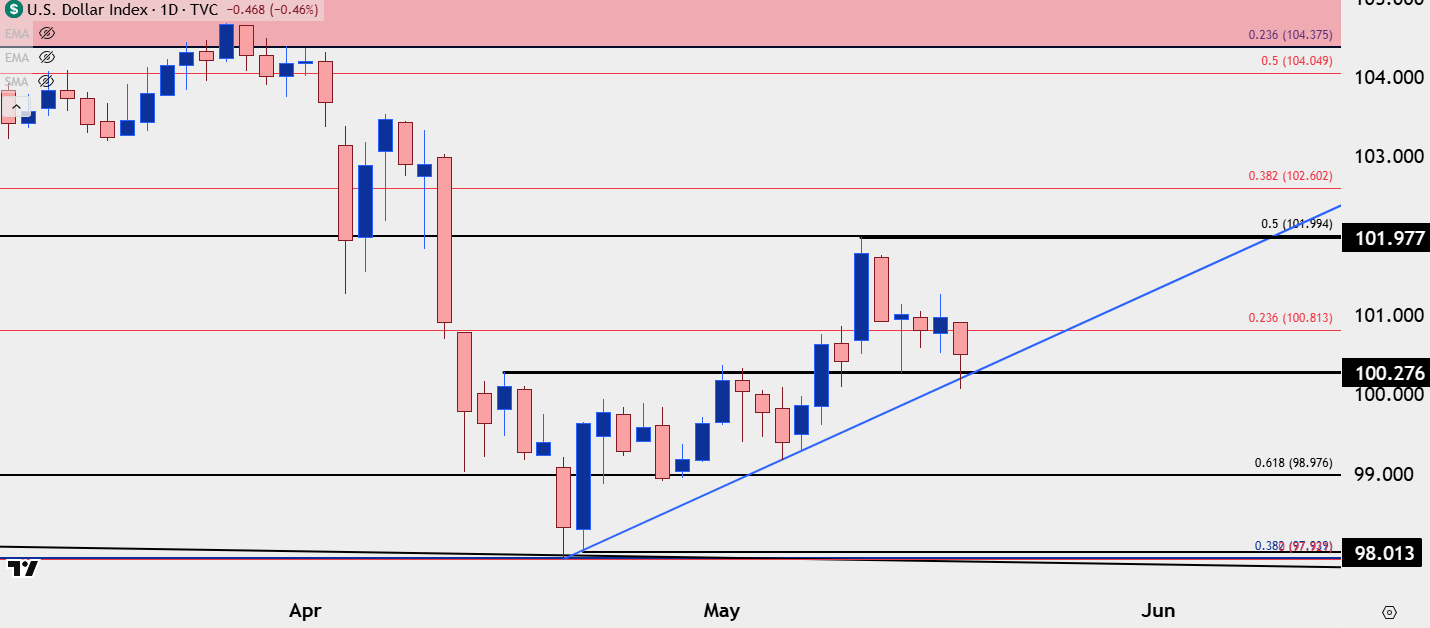

- USD pulled back to start the week and so far has held support at a key spot around 100.28.

- EUR/USD has held resistance and USD/JPY support. Meanwhile USD/CAD retains bearish trend structure after last week’s hold at the psychological level of 1.4000.

- I’ll be looking at setups across the US Dollar in the weekly webinar and you’re welcome to join. Click here to register.

The hit arrived after the market had already closed on Friday when Moody’s announced a downgrade of U.S. debt. On the open for this week there was bearish drive pricing in and this is one of those examples where Dollar bears have had ample motivation to push for short-side trends, but to this point, haven’t been able to take out prior support. Instead, this has been a re-load opportunity for bulls with support holding at both a prior point of resistance and a trendline projection.

The resistance from the inverse head and shoulders pattern plots at 100.28 and was initially broken through the week before last in the aftermath of the FOMC rate decision. That rally continued until DXY pushed very close to the 102.00 level, the same 102.00 level that I had noted ahead of the rate decision as a key spot for bears to defend for bigger picture trends.

At this point, the pullback from 102 has remained constrained with support holding at prior resistance, keeping the door open for USD bulls to make another push higher.

U.S. Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

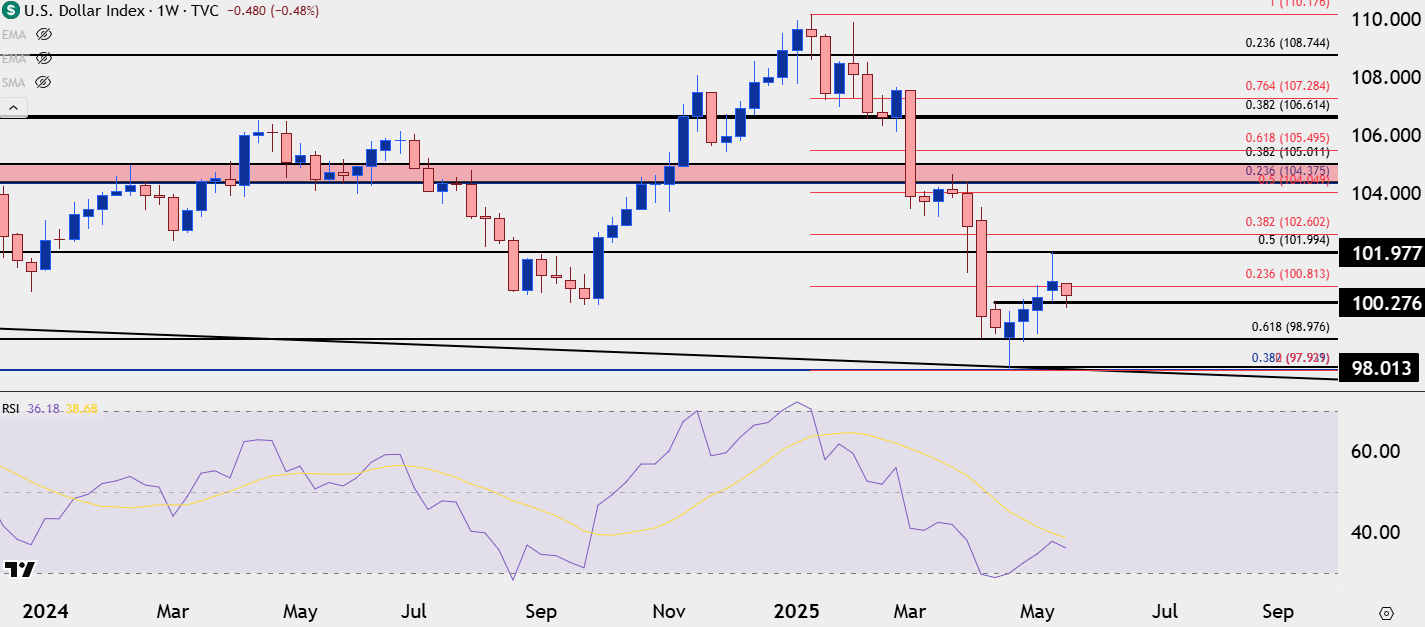

USD Bigger Picture

Taking a step back, this is an important week for the USD as there’s not much on the economic calendar, and the USD has rallied now for four consecutive weeks following the push into oversold territory in April.

Similar to what I had said above regarding trends – you find out what a trend is truly made of in counter-trend backdrops. Well, now that seller have been pushed back for four weeks with the 102 level on DXY coming into play, there’s some room for bears to work – if they can continue taking control of short-term trends.

I’m still leaning towards the bullish side, however, given the reaction to seemingly negative context taken from that downgrade. Sellers have had an open door to prod a larger move of USD-weakness and so far have failed to do so.

That said, whether this turn into something else will probably have something to do with the underlying currencies in the DXY basket, such as the Euro or Yen, which I’ll look at below.

U.S. Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

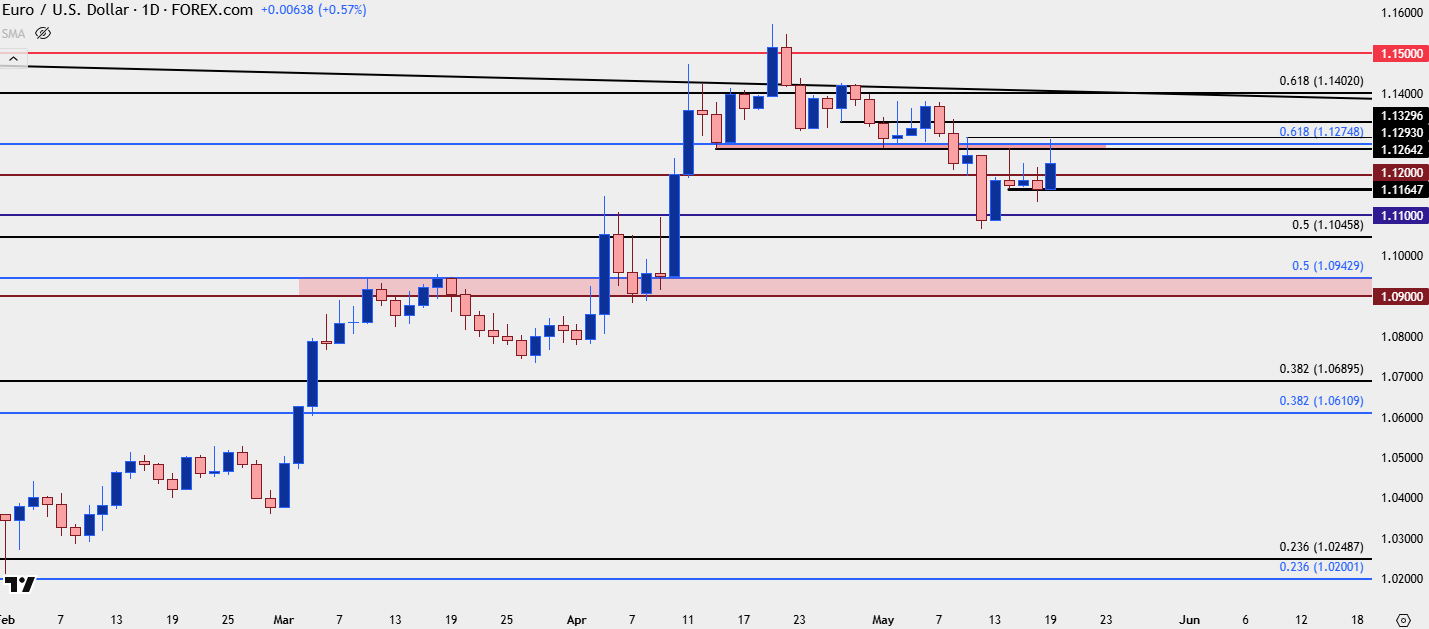

As of Friday bears had retained clean control of the short-side trend in EUR/USD and the backdrop had even remained very clean within the context of prior technicals.

The previous week saw a bounce from a lower-low at 1.12000, and then a resistance hold at the 1.1275 zone with a Friday high of 1.1293. The next week opened with breakdown as DXY pushed up to the 102.00 handle, and EUR/USD down to the 1.1100 level. The pullback from that held support inside of the prior swing high and just under that 1.1275 level, and into the end of last week, there was even a lower-high at 1.1200.

This week’s early rally upsets that sequencing a bit, although sellers aren’t entirely out of the matter at this point. They have defended the 1.1275 level as that zone is marking the daily high. But – there’s now a possible higher-low on the daily and bulls have an open door to run a deeper pullback.

Whether they can or not will depend on whether the USD runs a deeper sell-off below 100.28 and perhaps even 100.00; but at this point, for USD-strength, I think EUR/USD remains one of the more attractive major pairs.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD/JPY

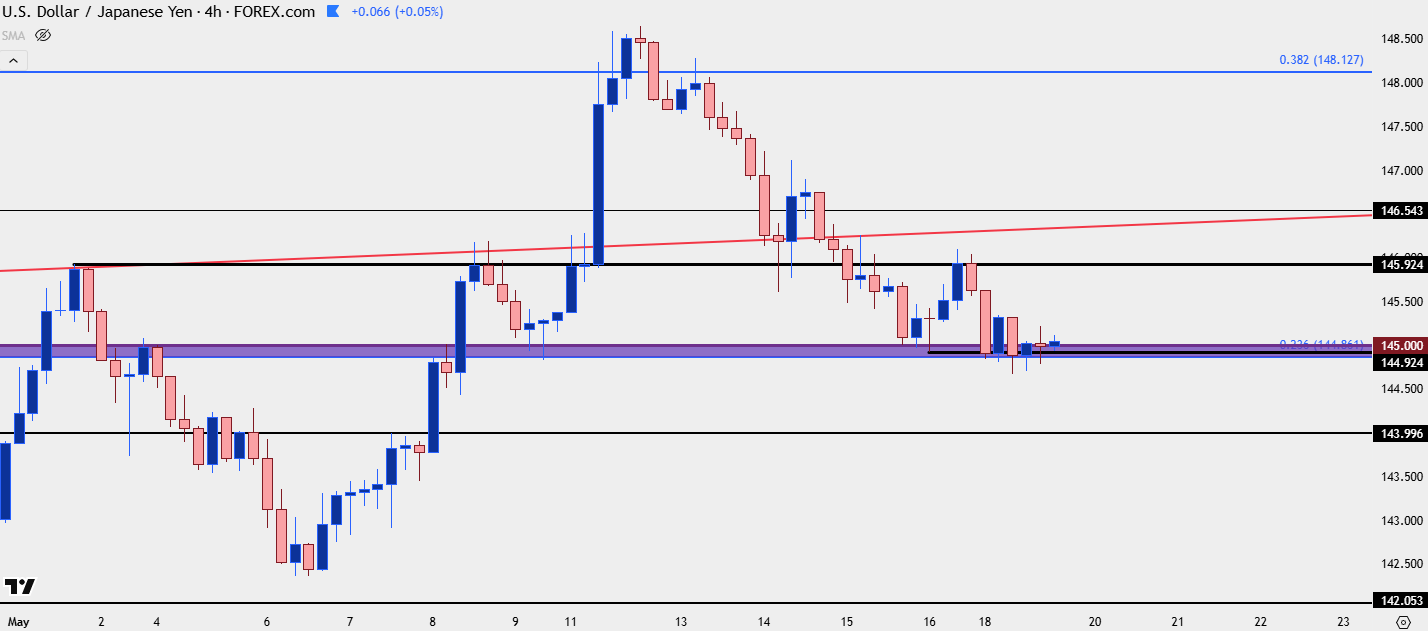

USD/JPY continued to test a major area on the chart at 145.00 after the Sunday open saw price hurriedly push from resistance at 145.92.

But, as you can see from the four hour chart below, bulls have been showing up to defend that line in the sand right around the big figure and this is something that I think would have to be chalked up as a positive for USD-bulls, at the moment.

USD/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD/CAD

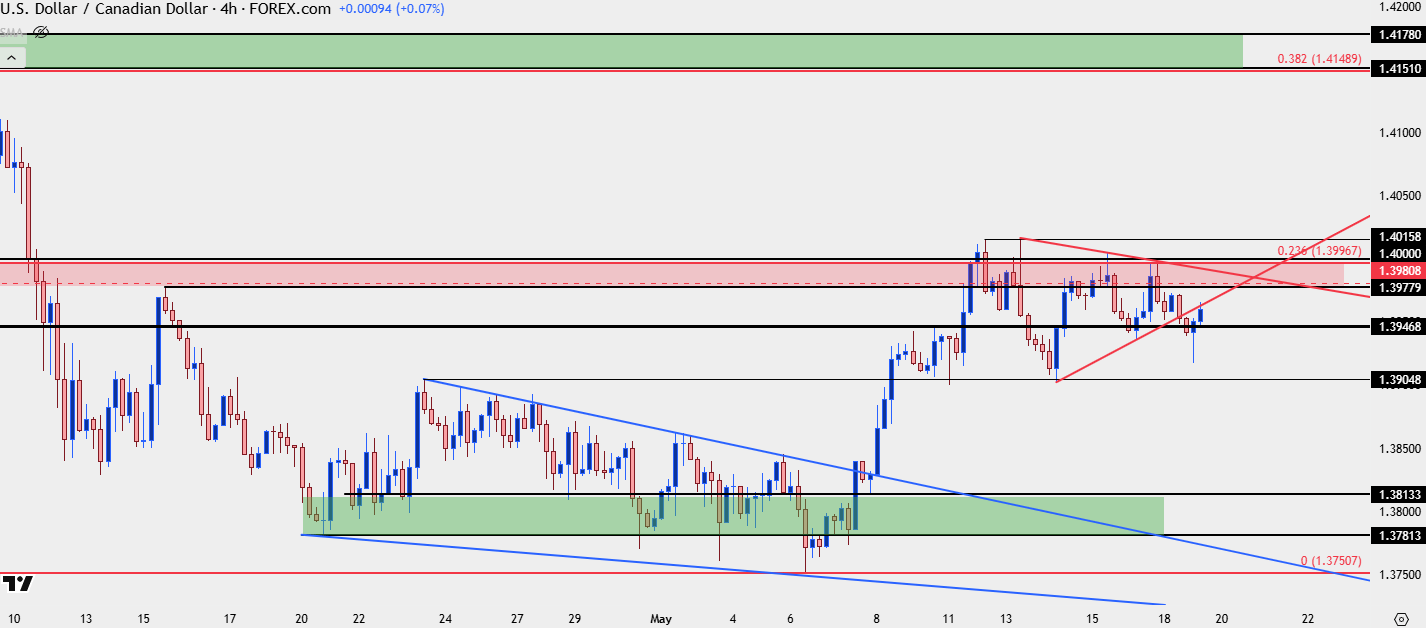

In the event that USD bears do take back over this week, I think USD/CAD is one of the more attractive major pairs for that theme. So far there’s been a build of lower-highs inside of the 1.4000 handle and as I wrote earlier today, bears didn’t even allow for a test of the big figure on Friday following a lower-high on Wednesday.

The main motive here would be the longer-term range in USD/CAD that came back to life with the March and April sell-offs in the pair. The 1.4000 handle remains a big part of that bigger picture context and, so far, it’s been defended by sellers multiple times on the pullback from the 2025 low earlier in May at the 1.3750 psychological level.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist