US Non-Farm Payrolls (NFP)

The US Non-Farm Payrolls (NFP) report showed a 228K rise in March versus forecasts for a 135K print, while Average Hourly Earnings narrowed to 3.8% from 4.0% during the same period.

US Economic Calendar – April 4, 2025

A deeper look at the report showed the Unemployment Rate unexpectedly widening to 4.2% from 4.1% in February as the Labor Force Participation Rate widened to 62.5% from 62.4% during the same period.

At the same time, the update from the Bureau of Labor Statistics (BLS) revealed that ‘job gains occurred in health care, in social assistance, and in transportation and warehousing,’ with the report going onto say that ‘the change in total nonfarm payroll employment for January was revised down by 14,000, from +125,000 to +111,000, and the change for February was revised down by 34,000, from +151,000 to +117,000.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

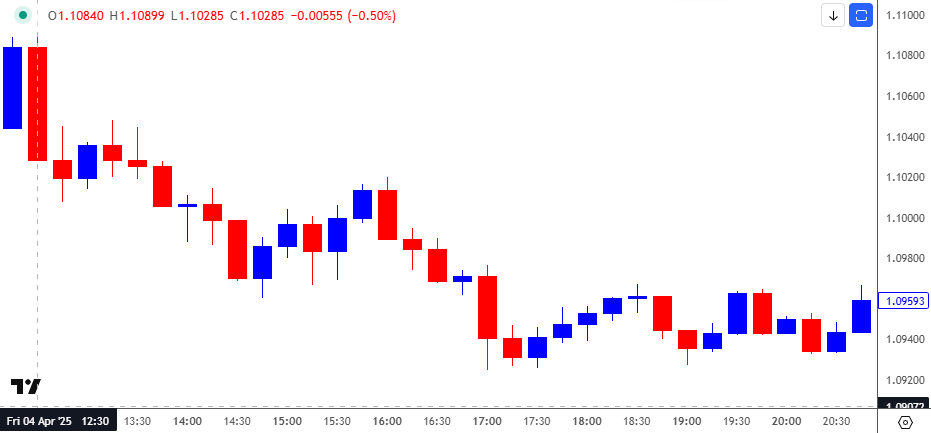

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

The US Dollar rallied following the better-than-expected NFP report, with EUR/USD trading lower throughout the day to close at 1.0959. Nevertheless, EUR/USD retraced the decline following the NFP report as it climbed to a fresh monthly high (1.1474) during the following week.

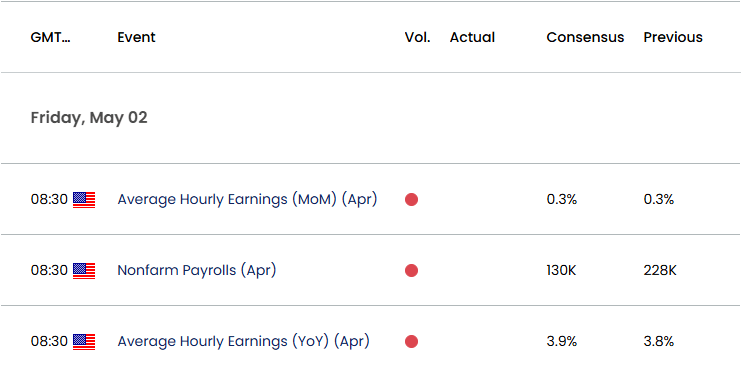

Looking ahead, the US is expected to add 130K jobs in April following the 228K expansion the month prior, while the Unemployment Rate is projected to hold steady at 4.2% during the same period.

With that said, signs of persistent job growth may generate a bullish reaction in the US Dollar as it encourages the Federal Reserve to keep US interest rates on hold, but a weaker-than-expected NFP report may drag on the Greenback as it puts pressure on the central bank to further unwind its restrictive policy.

Additional Market Outlooks

USD/JPY Defends Rebound from Monthly Low Ahead of BoJ Rate Decision

British Pound Forecast: GBP/USD on Cusp of Testing 2024 High

Euro Forecast: EUR/USD Defends Weekly Low Ahead of Euro Area GDP Report

AUD/USD V-Shape Recovery Stalls Ahead of December High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong