US Non-Farm Payrolls (NFP)

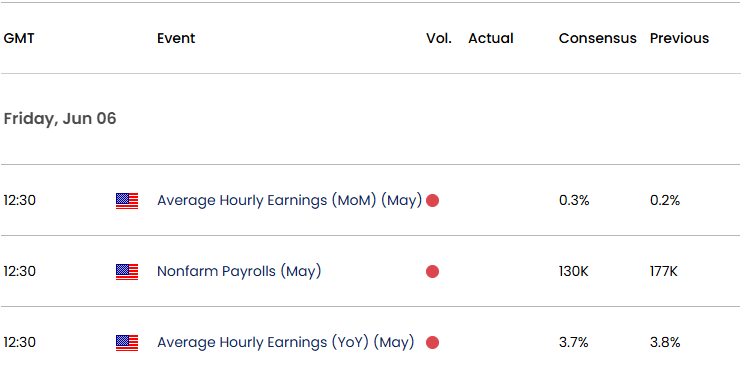

The US Non-Farm Payrolls (NFP) Report showed a 177K rise in April versus forecasts for a 130K print, while Average Hourly Earnings held steady at 3.8% amid projections for a 3.9% reading.

US Economic Calendar – May 2

A deeper look at the report showed the Unemployment Rate holding steady at 4.2% in April even as the Labor Force Participation Rate widened to 62.6% from 62.5% the month prior.

At the same time, the update from the Bureau of Labor Statistics (BLS) revealed that ‘employment continued to trend up in health care, transportation and warehousing, financial activities, and social assistance,’ with the report going onto say that ‘The change in total nonfarm payroll employment for February was revised down by 15,000, from +117,000 to +102,000, and the change for March was revised down by 43,000, from +228,000 to +185,000.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

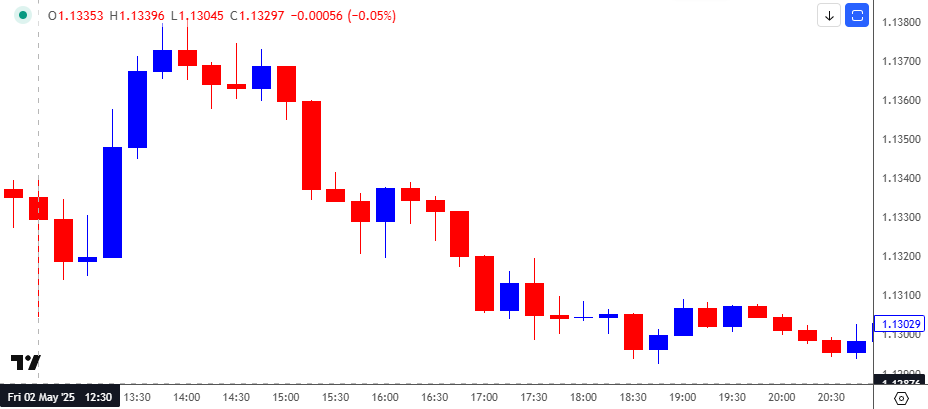

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

The US Dollar showed a limited reaction to the better-than-expected NFP report, with the exchange rate pullback from a fresh session high (1.1381) following the data print to close at 1.1298. EUR/USD continued to consolidate in the day ahead as it ended the first week of May at 1.1248.

Looking ahead, the US is expected to add 130K jobs in May, while the Unemployment Rate is seen holding steady at 4.2% during the same period.

With that said, signs of a strong labor market may generate a bullish reaction in the US Dollar as it raises the Federal Reserve’s scope to keep interest rates on hold, but a weaker-than-expected NFP report may produce headwinds for the Greenback as it puts pressure on the central bank to further unwind its restrictive policy.

Additional Market Outlooks

GBP/USD Stuck in Narrow Range amid Failure to Test February 2022 High

US Dollar Forecast: USD/CHF Clears May Low

Canadian Dollar Forecast: USD/CAD Selloff Persists Ahead of BoC Meeting

EUR/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong