- Fed decision Wednesday, SNB follows Thursday

- Markets expect Fed to hold, signal two cuts in 2025

- SNB seen cutting 25bp, but risk of 50bp and negative rates lingers

- U.S. retail sales Tuesday; soft read could reinforce dovish Fed shift

USD/CHF Summary

With Swiss inflation now negative and the franc markedly stronger than when the SNB last met, the case for a larger rate cut—potentially 50bp—is building. A move of that magnitude would take the policy rate back below zero for the first time since 2022, yet markets are only pricing that risk at around one-in-four. For a deflation-hit, trade-exposed economy with just four meetings a year, that seems far too low. If the SNB surprises dovishly while the Fed sticks with two cuts, USD/CHF could find renewed support from recent lows.

Rates Correlation Strengthens Noticeably

The relationship between interest rate differentials between the U.S. and Switzerland with USD/CHF movements has strengthened recently, especially over the past week. You can see that with correlation coefficient scores for two, five and 10-year bond yield spreads sitting at 0.84, 0.90 and 0.93 respectively—that’s similar to levels seen prior to U.S. “Liberation Day,” when the link between U.S. Treasury yields and the dollar broke down noticeably.

Source: TradingView

If the correlation between rates and USD/CHF persists, it suggests monetary policy decisions from the Federal Reserve and Swiss National Bank (SNB) this week are likely to be highly influential on the franc’s performance.

Fed Guidance Key for Multiple Reasons

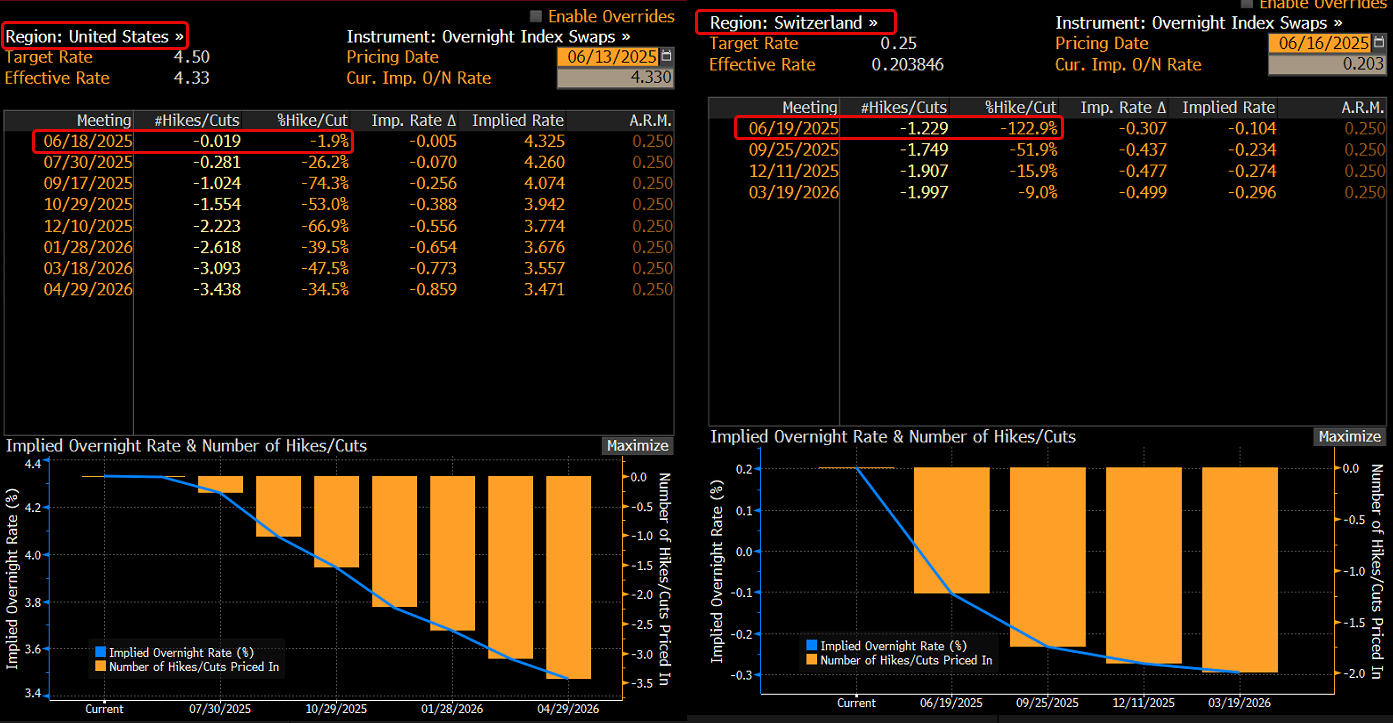

The graphic below looks at market pricing for both the Fed and SNB rate outlook over the remainder of the year.

Source: Bloomberg

This week, markets are confident the Fed will leave policy rates unchanged in a range between 4.25–4.50%, with two cuts priced by the end of the year. That means the performance of the USD post the FOMC decision will be driven by what Fed officials signal when it comes to the rates outlook.

Most recent market commentary has focused on hawkish risks that may see the median Fed forecast trimmed from two to one 25bp cut this year, citing the inflationary threat stemming from higher import tariffs and energy prices.

While such a view seems fundamentally sound, it ignores the wave of inflation undershoots seen in the United States recently, including in the period since higher tariffs were introduced. Sure, the influence on prices may be yet to be seen, but there was scant evidence in the latest producer price inflation report for May to suggest an imminent inflationary pulse is heading towards consumers.

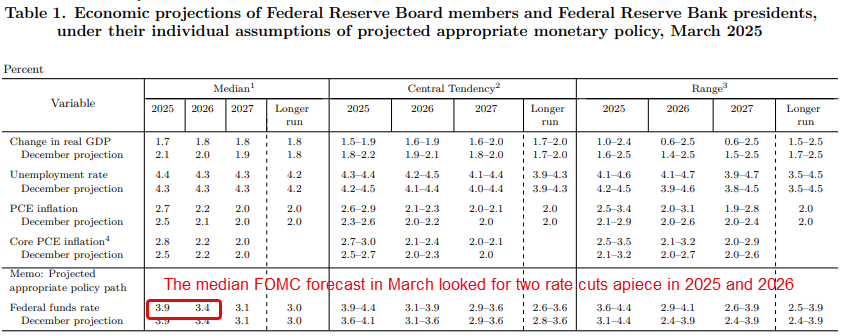

Source: Federal Reserve

With U.S. labour market conditions showing signs of softening, limiting the inflationary threat from accelerating wage pressures, rather than turning hawkish, it seems far more likely the Fed will continue to signal two cuts this year. The breakdown of individual forecasts will also be interesting—don’t be surprised to see a dispersion in views relative to three months ago, including a potential tilt towards an imminent resumption of the easing cycle given activity does not scream the need for restrictive policy settings right now.

SNB Negative Rates Risk Underpriced

If the FOMC median forecast does signal two or more cuts this year, it would likely soften the U.S. dollar. It may also influence the SNB decision given markets see a meaningful risk it will take interest rates back into negative territory for the first time since 2022, putting the implied probability at around one-in-four.

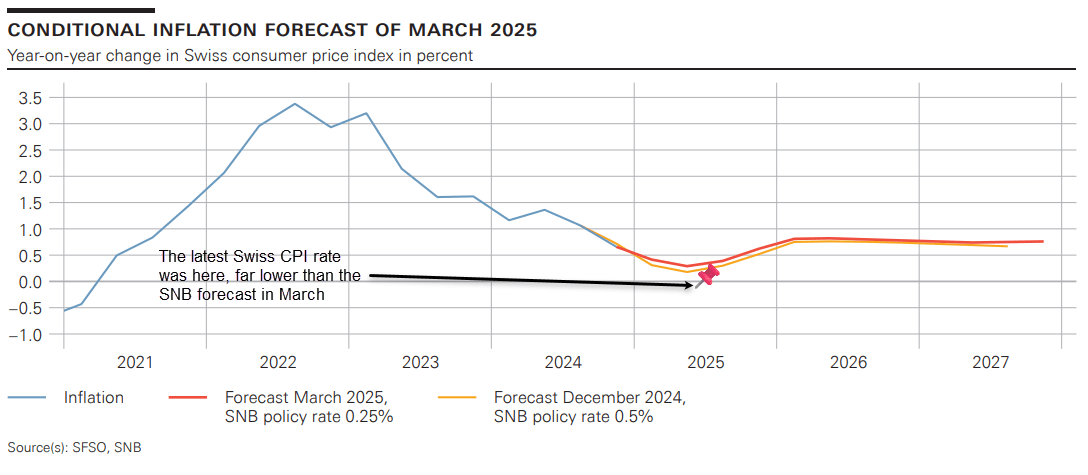

Considering recent Swiss inflation data and how far the CHF has appreciated against the USD since its last rates decision in March, you can easily make the argument that pricing for a 50bp cut this week is far too skinny. Just last month, the year-ended inflation rate in Switzerland turned negative, with prices down 0.1% relative to 12 months earlier. Importantly, the SNB three months ago saw the annual inflation rate troughing at 0.3% this quarter before gradually accelerating higher.

Source: SNB

Complicating matters, when the SNB forecasts were last released, USD/CHF and EUR/CHF were trading at 0.96 and 0.88 respectively. Fast forward to today and those rates sit at 0.94 and 0.8150 respectively, indicating just how much the franc has strengthened, especially against the dollar.

For a small trade-exposed economy already experiencing deflation, it points to a need to do more than just cut 25bps, especially as the SNB only meets four times a year. If it decides to cut only 25bps when the markets are pricing the risk of a 50, it would likely see the CHF strengthen further.

USD/CHF: April Lows Intact Despite Geopolitical Risks

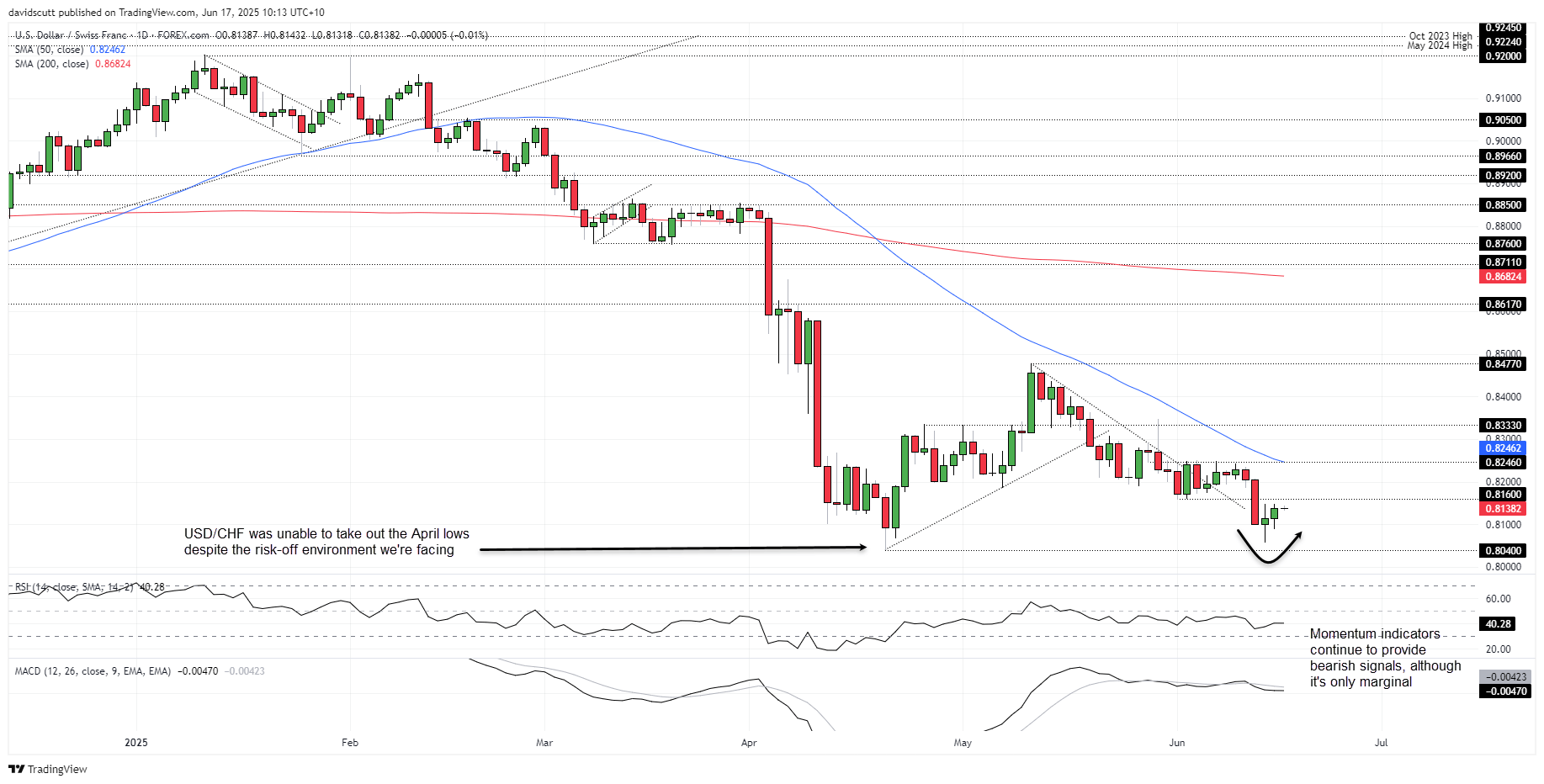

Source: TradingView

Looking at USD/CHF, the thing that immediately stands out is that it was unable to take out the April lows late last week despite a major risk-off episode, hinting further near-term downside may be hard won without a major catalyst to spark it.

Indeed, while not a textbook morning star, the last three candles prior to Tuesday’s hint that we may have seen the near-term lows, with Thursday’s bearish move post the U.S. PPI report for May followed up by a doji on Friday before a bullish rebound to start the week. Even though momentum indicators marginally favour a bearish bias, it suggests traders should keep an open mind on how to proceed as central bank decisions collide with geopolitical maneuvering.

If we have seen a near-term bottom, .8160 is a level worth watching given it provided support in early June. It may now flip to resistance. Above, .8246 capped gains for over a week earlier in the month. Coinciding with the 50-day moving average, it looms as a tough test for bulls before they can start thinking about a potential push towards .8333.

On the downside, a break of Friday’s low of .8056 would put a retest of April low of .8040 on the table. If that goes, there’s little meaningful technical support for multiple big figures, placing increased emphasis on price action for signals.

-- Written by David Scutt

Follow David on Twitter @scutty