- USD slides despite strong ISM services and rising Treasury yields

- USD/JPY breaks wedge and support near 144, risks turning lower

- AUD/USD closes above 200DMA, bulls eye further upside

- China reopening, yuan fix in focus Tuesday with Japan shut again

Summary

A resumption of U.S. dollar selling, despite more data contradicting fears of a looming U.S. recession helped deliver bullish breaks across numerous Asian currencies on Monday, including the Japanese yen and Australian dollar. If these breaks can be consolidated as we enter Tuesday’s session, it points to shifting directional risks for both USD/JPY and AUD/USD. Risk appetite and the performance of the Chinese yuan may prove influential for both pairs, with Japanese markets remaining closed for the Greenery Day public holiday.

Strong Data, Higher Yields Not Enough to Rescue USD

The U.S. dollar simply cannot take a trick in 2025, losing ground again at the start of the trading week despite a surprise lift in the U.S. services ISM PMI for April, including a sharp rise in the prices paid subindex—suggesting inflationary pressures are building across the largest and most important business sector in the United States.

The data helped lift longer-dated U.S. Treasury yields, extending Friday’s move following the April non-farm payrolls report, but not the greenback. Instead, with Donald Trump announcing fresh tariffs on movies made outside the United States and little evidence that trade deals elsewhere are close to being inked, the big dollar resumed its slide—especially against Asian currencies that had been under sustained pressure from USD strength in recent years.

The Japanese yen and Australian dollar were among the biggest movers, breaking key levels during the session.

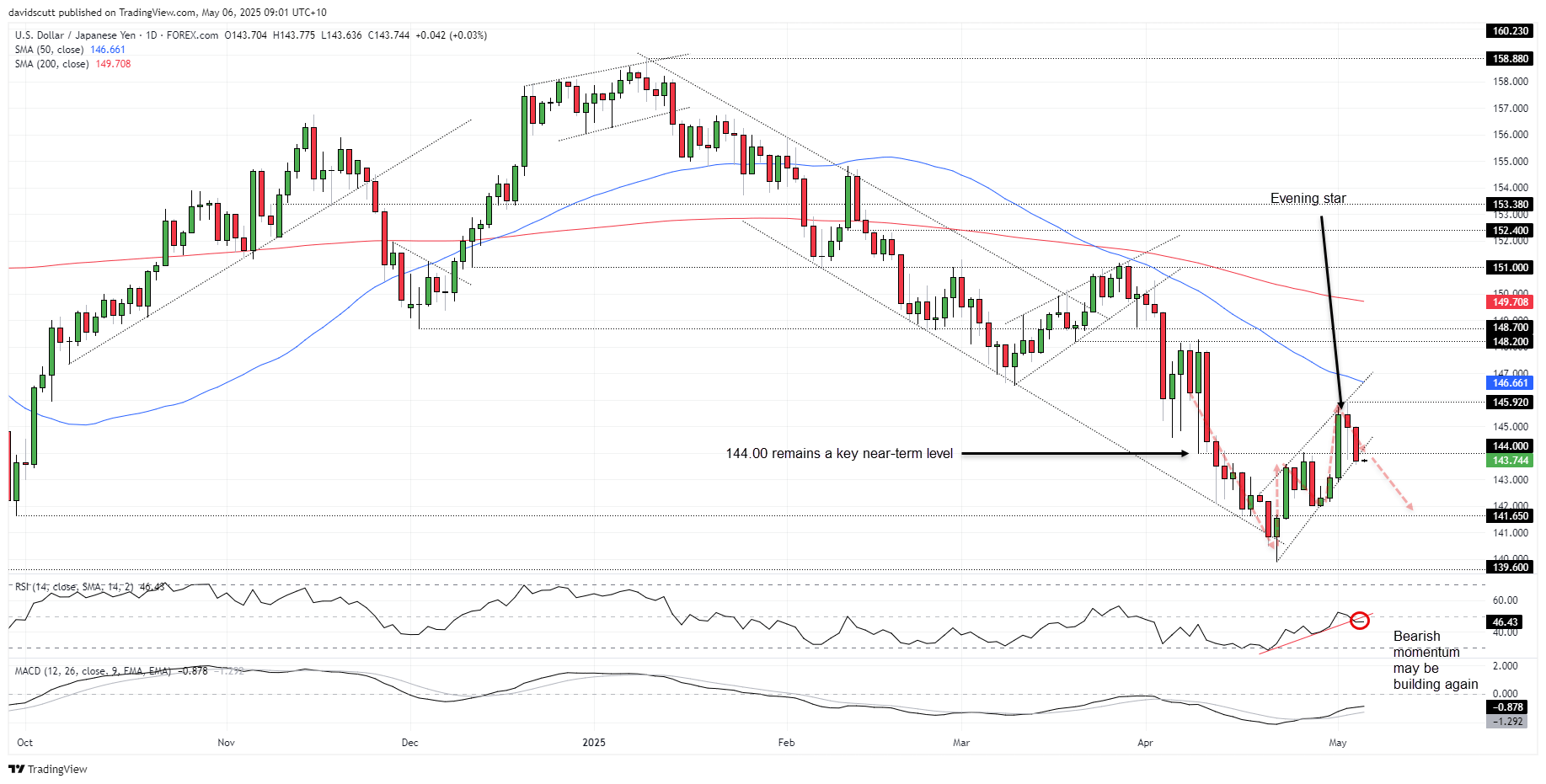

USD/JPY Directional Risks Skew Lower

Source: TradingView

USD/JPY not only broke beneath 144.00 horizontal support but also uptrend support dating back to when the pair bottomed on April 22, breaking out of the rising wedge it had been trading in since then. Combined with a three-candle evening star pattern completed Monday, it points to a growing risk of a resumption of the broader bearish trend established earlier in the year.

The weakening of bearish momentum seen recently may have also run its course, with RSI (14) breaking the uptrend it had been in since the April lows. While MACD continues to grind higher, it remains deeply negative, favouring selling rallies over buying dips.

If the bearish break sticks and price signals prove accurate, 142.75 screens as the first downside level of note, followed by 141.65, 139.80 and 139.60. On the topside, 144.00 may now act as resistance, making it a potential level to place stop-loss orders above for those considering bearish setups. A retest and rejection from the level would only reinforce that view.

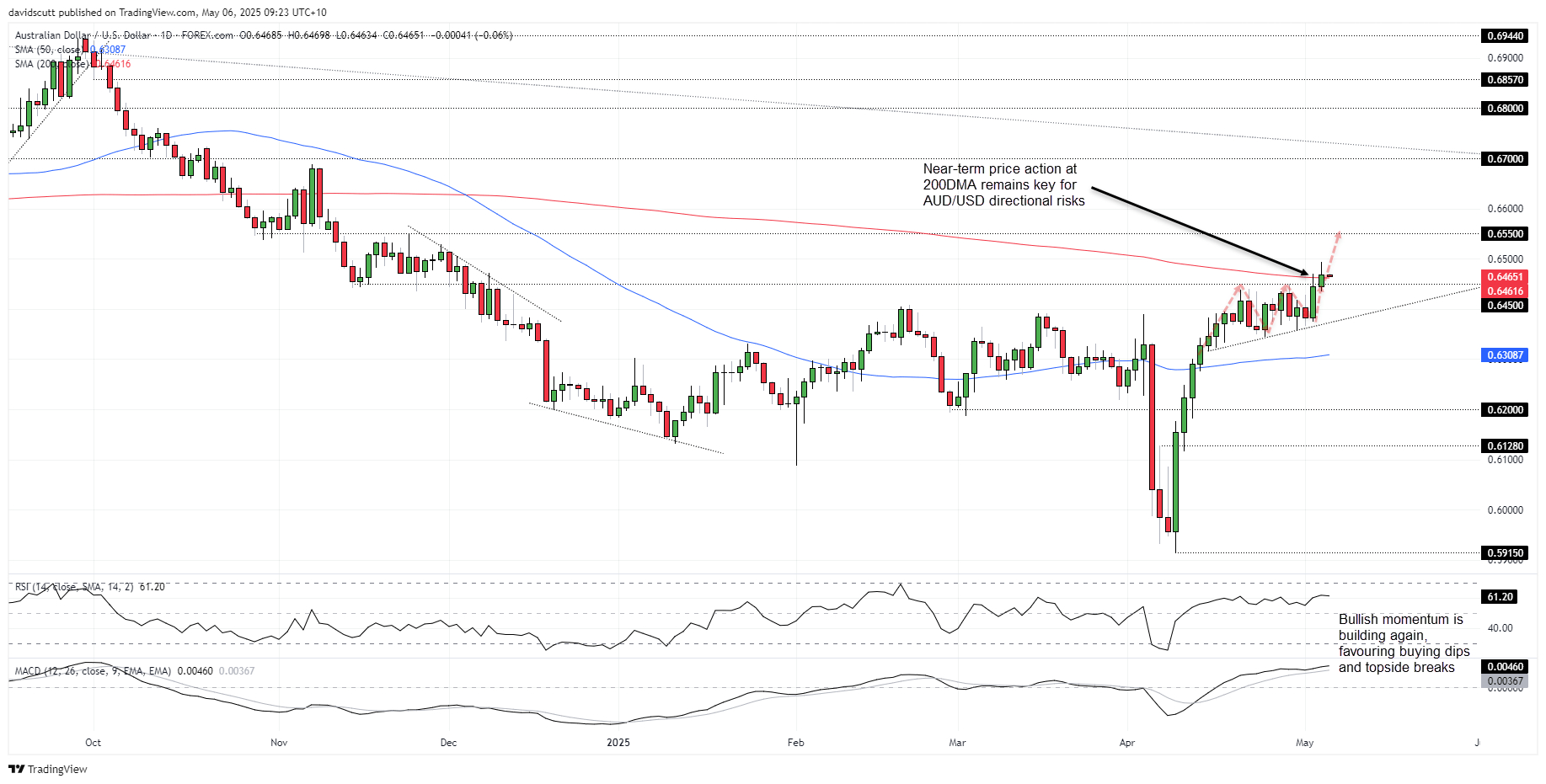

Can AUD/USD Sustain 200DMA Break?

Source: TradingView

After closing at 2025 highs on Friday, AUD/USD went on with the move Monday, breaking above the 200-day moving average for the first time since the U.S. election. Having staged a bullish break of the ascending triangle it had been trading in since mid-April, and after closing above the 200DMA, the ducks appear to be lining up for another run higher in AUD/USD.

Momentum indicators like RSI (14) and MACD are also strengthening, reinforcing a bullish bias that favours buying dips and topside breaks.

If AUD/USD can hold above the 200DMA, it creates a setup where longs could be established above the level with a stop beneath it or .6450 for protection. Monday’s session high of .6493 looms as the first hurdle for bulls, with a break above opening the path towards resistance at .6550. Beyond that, .6700 may offer a sterner test for longs.

Alternatively, if AUD/USD fails to hold the 200DMA or .6450, the near-term bullish bias would be invalidated, allowing for bearish setups looking for a move towards uptrend support near .6375 or even the 50DMA.

China Markets Key on Tuesday

With Japanese markets closed for a second session, the resumption of trade in Chinese markets may prove especially influential on movements in both the yen and Aussie on Tuesday. The PBOC onshore yuan fix around 9.15am in Beijing, along with the reopening of equities trade 15 minutes later, may prove instructive for directional risks during the session.

-- Written by David Scutt

Follow David on Twitter @scutty